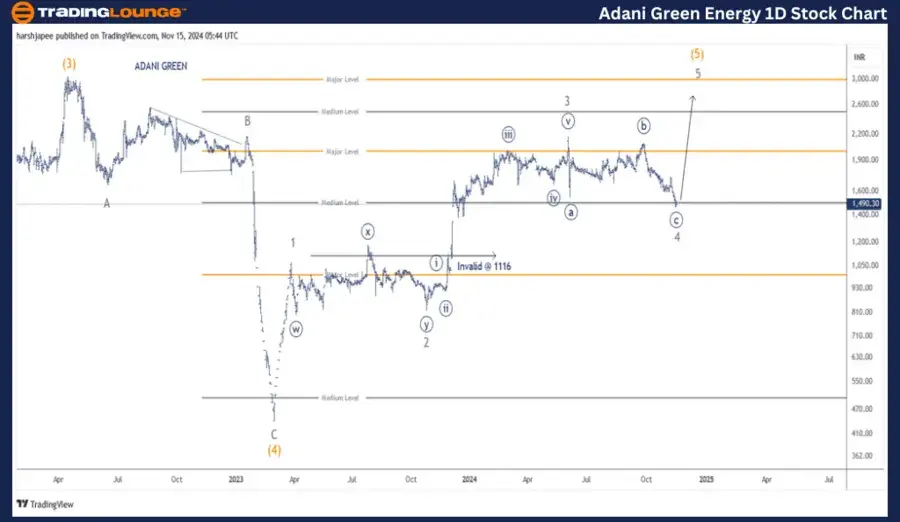

Adani Green Energy – Adanigreen (one-day chart) Elliott Wave technical analysis

Function: Larger Degree Trend Higher (Intermediate degree, orange).

Mode: Motive.

Structure: Impulse.

Position: Minor Wave 4 Grey.

Details: The counts have been adjusted with potential termination of Minor Wave 4 Grey 1485-90 zone. If correct, Minor Wave 5 Grey should resume higher soon, within Intermediate Wave (5). Alternatively, a continued drag lower would indicate a larger degree correction is underway.

Invalidation point: 1116.

ADANI GREEN ENERGY Daily Chart Technical Analysis and potential Elliott Wave Counts:

ADANI GREEN ENERGY daily chart indicating a progressive rally, which is within its last leg Minor Wave 5 Grey of Intermediate Wave (5) Orange against 1480 and broadly against 1116 low. Immediate resistance is seen around 1750 and a break higher would confirm a bottom in place.

The stock terminated Intermediate Wave (4) Orange around 435 mark on February 2023. Since then the rally has completed Minor Wave 1 (1075), Wave 2 (824), Wave 3 (2170) and potential Wave 4 around 1480 mark.

If the above is correct, bulls should be back in control soon from current price at 1490 levels as Minor Wave 5 unfolds.

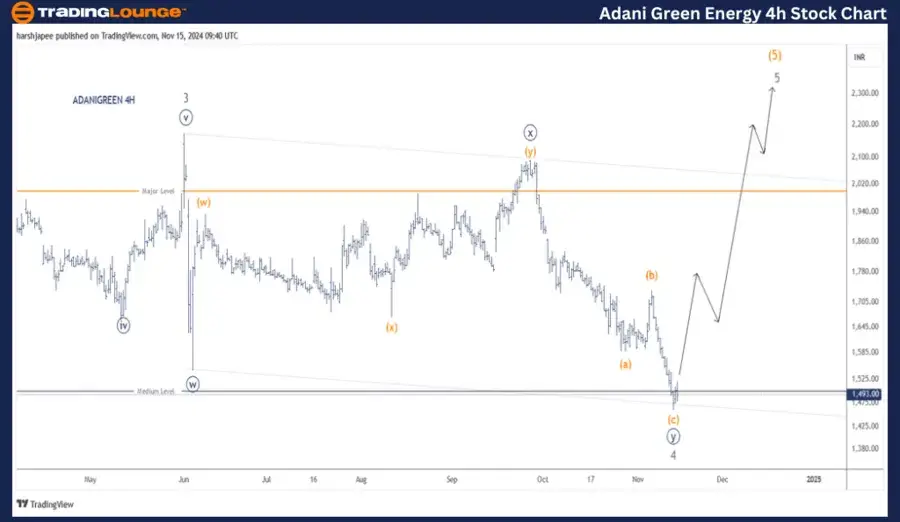

Adani Green Energy – Adanigreen (four-hour chart) Elliott Wave technical analysis

Function: Larger Degree Trend Higher (Intermediate degree, orange).

Mode: Motive.

Structure: Impulse.

Position: Minor Wave 4 Grey.

Details: The counts have been adjusted with potential termination of Minor Wave 4 Grey around 1485-90 zone. If correct, Minor Wave 5 Grey should resume higher soon, within Intermediate Wave (5). A break above 1735 will confirm bulls are back in control. Alternatively, a continued drag lower would indicate a larger degree correction is underway.

Invalidation point: 1116.

ADANI GREEN ENERGY 4H Chart Technical Analysis and potential Elliott Wave Counts:

ADANI GREEN ENERGY 4H chart is highlighting the sub waves between Minor Wave 3 and 4. The Minute Wave structure has been adjusted to ((w))-((x))-((y)), which looks complete around 1480-90 range. Also note the channel support has been tested.

If the above holds true, the stock should turn higher from here against 1480 low.

Conclusion:

ADANI GREEN ENERGY could be progressing higher from here (1490), as Minor Wave 5 begins to unfold within Intermediate Wave (5) Orange.

Elliott Wave analyst: Harsh Japee.

Adani Green Energy – Adanigreen Elliott Wave technical analysis [Video]

As with any investment opportunity there is a risk of making losses on investments that Trading Lounge expresses opinions on.

Historical results are no guarantee of future returns. Some investments are inherently riskier than others. At worst, you could lose your entire investment. TradingLounge™ uses a range of technical analysis tools, software and basic fundamental analysis as well as economic forecasts aimed at minimizing the potential for loss.

The advice we provide through our TradingLounge™ websites and our TradingLounge™ Membership has been prepared without considering your objectives, financial situation or needs. Reliance on such advice, information or data is at your own risk. The decision to trade and the method of trading is for you alone to decide. This information is of a general nature only, so you should, before acting upon any of the information or advice provided by us, consider the appropriateness of the advice considering your own objectives, financial situation or needs. Therefore, you should consult your financial advisor or accountant to determine whether trading in securities and derivatives products is appropriate for you considering your financial circumstances.

Recommended content

Editors’ Picks

EUR/USD stabilizes near 1.0400 after upbeat US data

EUR/USD consolidates daily recovery gains near 1.0400 following the release of upbeat United States data. Q3 GDP was upwardly revised to 3.1% from 2.8% previously, while weekly unemployment claims improved to 220K in the week ending December 13.

GBP/USD drops toward 1.2550 after BoE rate decision

GBP/USD stays on the back foot and declines toward 1.2550 following the Bank of England (BoE) monetary policy decisions. The BoE maintained the bank rate at 4.75% as expected, but the accompanying statement leaned to dovish, while three out of nine MPC members opted for a cut.

Gold price resumes slide, pierces the $2,600 level

Gold resumes its decline after the early advance and trades below $2,600 early in the American session. Stronger than anticipated US data and recent central banks' outcomes fuel demand for the US Dollar. XAU/USD nears its weekly low at $2,582.93.

Bitcoin slightly recovers after sharp sell-off following Fed rate cut decision

Bitcoin (BTC) recovers slightly, trading around $102,000 on Thursday after dropping 5.5% the previous day. Whales, corporations, and institutional investors saw an opportunity to take advantage of the recent dips and added more BTC to their holdings.

Bank of England stays on hold, but a dovish front is building

Bank of England rates were maintained at 4.75% today, in line with expectations. However, the 6-3 vote split sent a moderately dovish signal to markets, prompting some dovish repricing and a weaker pound. We remain more dovish than market pricing for 2025.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.