Adani Enterprises Ltd Elliott Wave technical analysis [Video]

![Adani Enterprises Ltd Elliott Wave technical analysis [Video]](https://editorial.fxstreet.com/images/TechnicalAnalysis/ChartPatterns/Candlesticks/high-resolution-stock-exchange-evolution-panel-55741904_XtraLarge.jpg)

Adani Enterprises Ltd Elliott Wave technical analysis

Function: Counter Trend (Intermediate degree, orange).

Mode: Corrective.

Structure: Flat (3-3-5).

Position: Minor Wave 2 Grey within Wave (C) Orange.

Details: The larger degree impulse Wave ((5)) looks complete. The stock is likely correcting as a flat since then. Wave (A) and (B) look complete and (C) could be underway now. Furthermore, Minor Waves 1 and 2 Grey also look complete. If correct, Wave 3 should be underway lower from here.

Invalidation point: 4230-40.

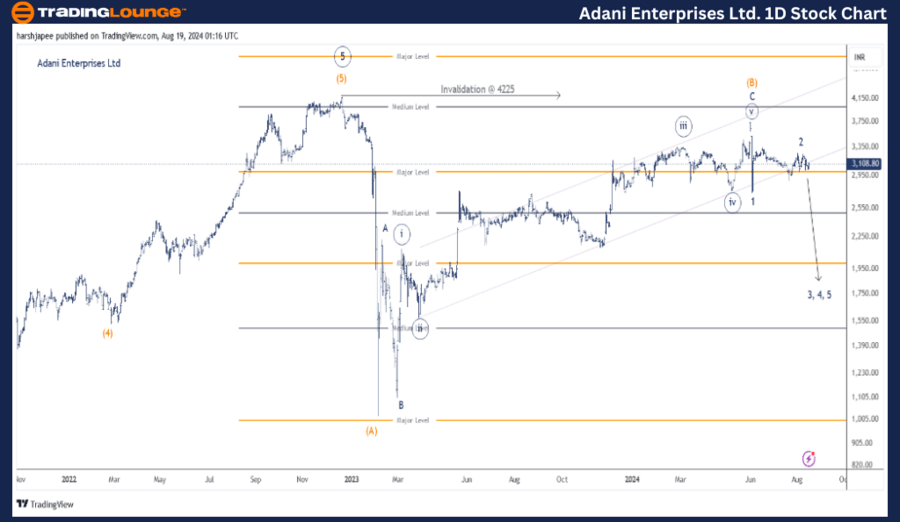

Adani Enterprises Daily Chart Technical Analysis and potential Elliott Wave Counts:

Adani Enterprises Daily chart indicates a larger degree uptrend potentially complete around 4225 or near to complete. The stock has been marked with Primary Wave ((5)) complete around 4225. Furthermore, an intermediate corrective Wave (A)-(B)-(C) could be underway against 4225.

The stock peaked in December 2023 at 4225, which was followed by a sharp drop through 1019 levels potentially marking intermediate Wave (A) of the larger correction. Wave (B) has unfolded as a flat (3-3-5) looking complete around 3750-80 in June 2024.

If the above potential wave counts hold well, the stock could be heading lower from here as intermediate Wave (C) begins to unfold. Alternatively, if prices push higher through 3750 mark, it imply that Intermediate Wave (5) is still unfolding and could print above 4225.

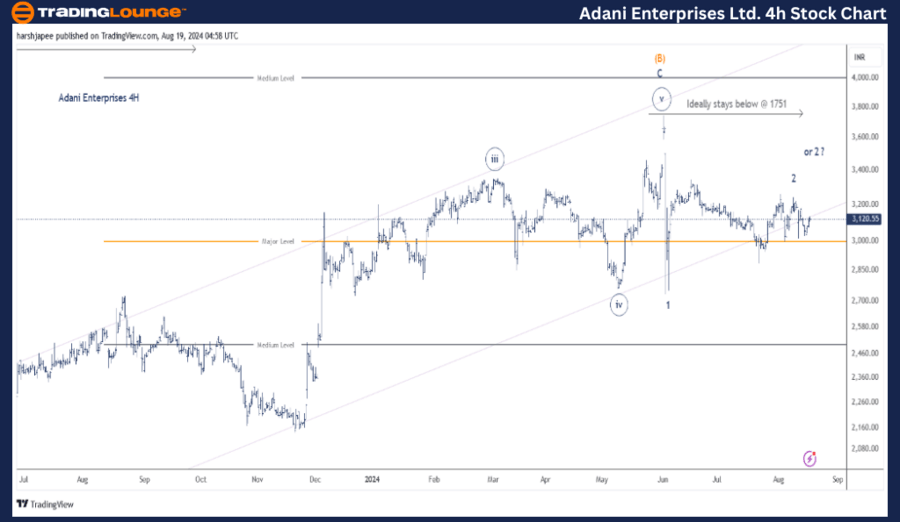

Adani Enterprises four-hour chart Technical Analysis and potential Elliott Wave counts:

Adani Enterprises 4H chart highlights price action through 3750-80 zone, potential Wave (B) termination and thereafter. The stock is trading around 3121 at the time of writing, just below Minor Wave 2. If correct, prices should turn sharply lower as Wave 3 begins to unfold.

The stock has rallied for the past 15 months to unfold Intermediate Wave (B) around 3750. The structure has unfolded as a flat with Wave C unfolding as an impulse. Furthermore, prices dropped through 2775 on June 04, marked as Minor Wave 1 here.

Minor Wave 2 potentially unfolded as a contracting triangle and terminated around 3240-50 zone. If the above holds, prices would ideally stay below 3240-50 and turn lower towards as Wave 3 begins to unfold. Alternatively, the drop through 2775 could be Minute Wave ((iv)) and Wave ((v)) is progressing higher.

Conclusion

Adani Enterprises is potentially set for a larger degree (Intermediate) corrective Wave (A)-(B)-(C) Orange, against 4225 broadly.

Adani Enterprises Ltd Elliott Wave technical analysis [Video]

Author

Peter Mathers

TradingLounge

Peter Mathers started actively trading in 1982. He began his career at Hoei and Shoin, a Japanese futures trading company.