Actinium Pharmaceuticals Stock News and Forecast: ATNM could be in for some downside mitigation of the impulse

- ATNM is a pharma stock involved in treatments for leukemia.

- Actinium Pharmaceuticals stock has soared on Tuesday as it announces a commercialization deal.

- ATNM is to receive $35 million upfront from Immedica.

Update: ATNM stock gapped and is yet to mitigate the closing levels of the prior day which makes for a highly unpredictable technical outlook for the remainder of the week. The daily chart has left an incredibly wide-ranged doji on the chart of some 172 ticks.

However, the bias might be with the bears at this juncture considering the mitigation that has taken place to the upside and the fact that the price closed around a well-defined structure as per the weekly chart. On the monthly chart, this is a 50% mean reversion of the monthly bearish impulse. Some deceleration might be in order for the rest of the week and that puts a focus back on the old daily resistance of 5.65.

Update: ATNM stock is encountering some profit-taking after the huge spike seen in Tuesday's premarket on the breakout news of leukemia treatment deal. Actinium Pharma, like most pharma companies, trades mainly on medical advances and applications, and once these happen, the bulls are in for a field day. This has been the story behind the current move, but it seems bulls have started to capitalize, with the stock easing from a $6.60 swing high to the $6.30 mark where it is trading at the time of writing. ATNM stock already spiked from below $6 to almost $10 on other medical improvements last September.

Also read: MULN stock looks higher on Tuesday as equities are risk back on

Actinium Pharma (ATNM) is making headlines amongst retail traders on Tuesday as they look for the next multi-bagger stocks. Newsflow from ATNM stock this morning has sent it spiking over 20% and this naturally has drawn in retail traders looking for some volatility and the next quick buck. This can work well just please use stops or risk management of some sort.

Now, most of you may not be familiar with this company as it is relatively small scale with a market cap of just $117 million.

"Actinium Pharmaceuticals, Inc. is a clinical-stage biopharmaceutical company developing targeted radiotherapies to deliver cancer-killing radiation with cellular-level precision to treat patients with high unmet needs not addressed by traditional cancer therapies. Actinium's current clinical pipeline is led by ARCs or Antibody Radiation-Conjugates that are being applied to targeted conditioning, which is intended to selectively deplete a patient's disease or cancer cells and certain immune cells before a BMT or Bone Marrow Transplant, Gene Therapy, or Adoptive Cell Therapy (ACT) such as CAR-T to enable engraftment of these transplanted cells with minimal toxicities".

This is from the press release so it gives us an idea of the company. Pharma investments are notoriously speculative.

ATNM stock news: Significant deal on bone marrow transplant treatment

ATNM stock as mentioned has a market cap of just over $100 million so a deal with an upfront payment of $35 million is certainly significant. Also, follow-on payments totaling $417 million could be forthcoming.

The deal between ATNM and Swedish company Immedica relates to an ATNM drug called Iomab-B, a drug combination treatment for development in bone marrow transplant and gene therapies. Iomab-B is an anti-radiation conjugate. As part of the deal, Actinium receives $35 million upfront from Immedica and potentially another $417 million in regulatory and commercial milestones. It will also receive royalties in the mid-twenty percent range on sales of Iomab-B. Immedica receives commercialization rights for Iomab-B in Europe, the Middle East, and North Africa while Actinium keeps the rights for the US.

We should point out that Iomab-B is currently in Phase 3 trials and topline data is expected in Q3 of this year.

ATNM stock forecast: Big volatility triggered by newsflow

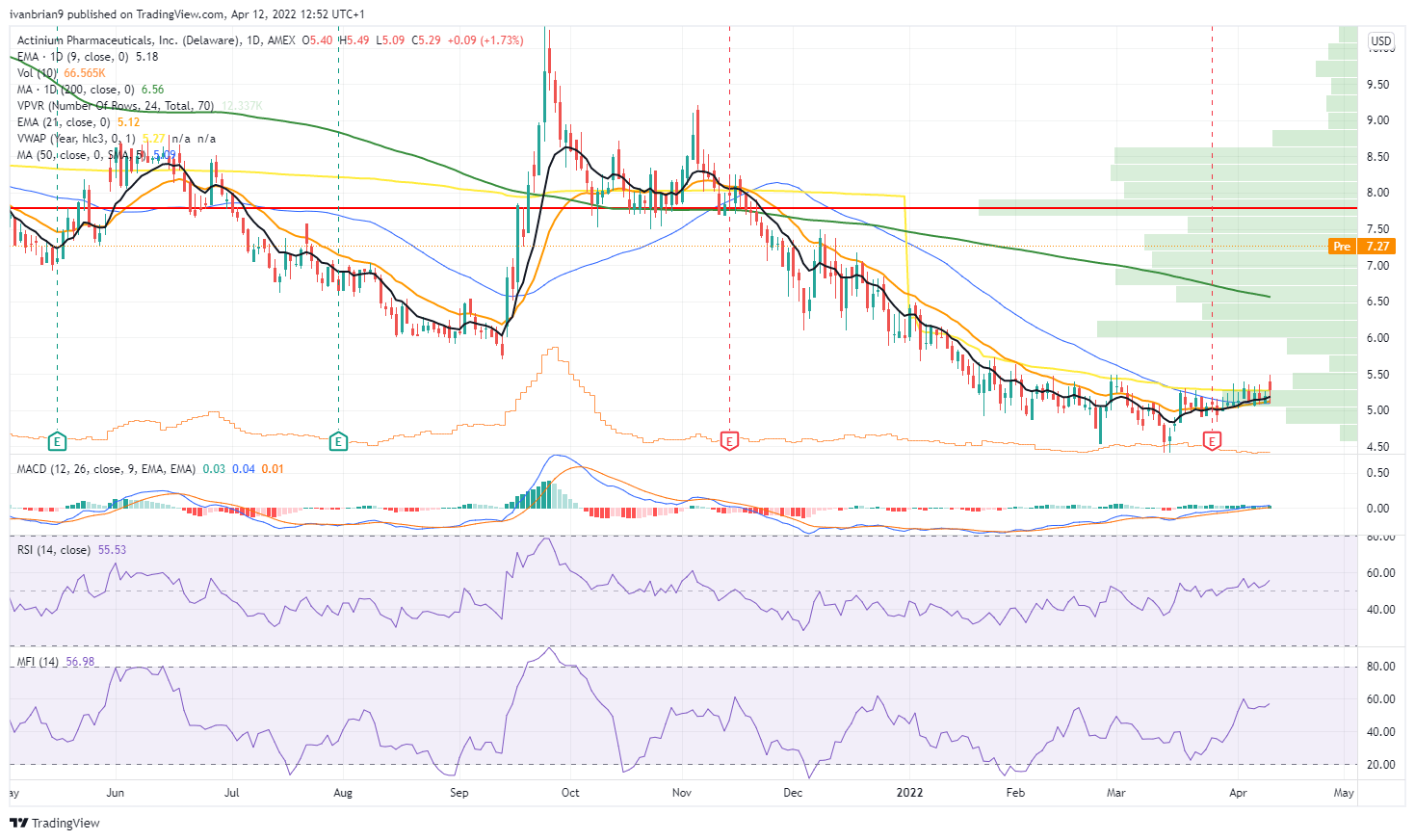

ATNM stock is volatile like most early-stage pharma names. Notice the massive spike in September 2021. ATNM stock spiked from $6 to $10. This was on the news that ATNM had completed enrollment for the Phase 3 trial. The latest news is certainly positive but the Phase 3 trial results will be key, due as mentioned in Q3 2022.

ATNM stock chart, daily

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Ivan Brian

FXStreet

Ivan Brian started his career with AIB Bank in corporate finance and then worked for seven years at Baxter. He started as a macro analyst before becoming Head of Research and then CFO.