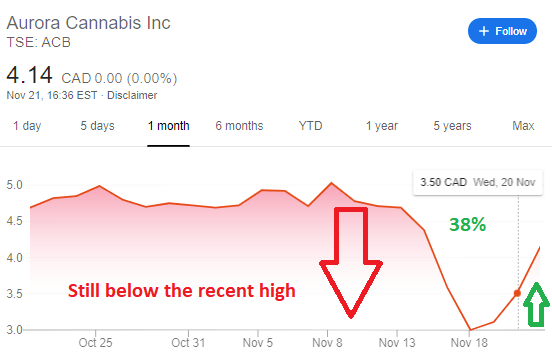

- Aurora's stock price has rallied 38% in three days, escaping the abyss.

- The November high of $5.03 is eyed as the next target.

- The US House of Representatives is advancing a legalization bill on the federal level.

Aurora Cannabis Inc. (ACB) has been a star performer. Shares of the Edmonton-based firm have soared 38% in three days amid a euphoric melt-up of pot stocks.

Sellers that have feared Aurora's dilutive debentures scheme have been weeded out. The equity bottomed out at $3.00 on Monday before shooting for the highs. Despite the unattractive financial offer, it was taken up by 94% of buyers, well ahead of the March 2020 deadline. The robust participation shows a high level of trust in the company.

Aurora Cannabis Stock Price

ACB shares closed at $4.14 on Thursday, which is more than half the drop from the November 13 peak of $5.03 to the trough of $3.00. However, at an increase of 56%, the recovery falls short of the Fibonacci 61.8% that would convince technical traders to join in.

It is also essential to note that Aurora Cannabis' price peaked at $13.67 in the past 52 weeks – and at current prices, it is nearly 70% down, albeit substantially above the bottom of $2.82.

Investing in Marijuana Stocks

Marijuana stocks have experienced considerable volatility, and the recent upswing for the whole sector may be attributed to Jerrod Nadler, Chairman of the House Judiciary Committee. The New York Democrat oversaw the passage of a bill that aims to legalize cannabis on the federal level. The promising 24 to 10 vote indicates that broad support. However, members of the lower chamber were warned that the upper one is unlikely to take it up.

Senate majority leader, Mitch McConnell, is a life-long opponent of legalizing marijuana. The Kentucky Republican may particularly be opposed to provisions to expunge past criminal records. The right-wing party has a tough stance on crime.

Regulation may have a further impact on cannabis stocks. ACB's shares remain at the forefront of weed stocks.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD clings to gains above 1.0400 ahead of US data

EUR/USD stays in positive territory above 1.0400 in the second half of the day on Tuesday. The data from the Euro area showed that the annual HICP inflation rose to 2.4% in December, as expected. Investors await ISM Services PMI and Job Openings data from the US.

GBP/USD retreats from weekly highs, trades below 1.2550

GBP/USD loses its traction and trades below 1.2550 after rising toward 1.2600 earlier in the day. The cautious market stance helps the US Dollar (USD) limit its losses and caps the pair's upside as focus shifts to key macroeconomic data releases from the US.

Gold extends recovery beyond $2,650 amid increased caution

Following Monday's indecisive action, Gold gains traction and rises to the $2,660 area. XAU/USD benefits from mounting caution ahead of critical United States data, with the December ISM Services PMI next on the docket.

Bitcoin Price Forecast: BTC holds above $100K following Fed’s Michael Barr resign

Bitcoin edges slightly down to around $101,300 on Tuesday after rallying almost 4% the previous day. The announcement of Michael S. Barr’s resignation as Federal Reserve Vice Chair for Supervision on Monday has pushed BTC above the $100K mark.

Five fundamentals for the week: Nonfarm Payrolls to keep traders on edge in first full week of 2025 Premium

Did the US economy enjoy a strong finish to 2024? That is the question in the first full week of trading in 2025. The all-important NFP stand out, but a look at the Federal Reserve and the Chinese economy is also of interest.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.