ACB Stock Price: Aurora Cannabis inc recovers as analysts back the firm

- Aurora Cannabis is rising and distancing itself from the $2 level.

- An analyst at Cowen has said financial changes may help the company.

- Some investors are still reeling from the drop to $1.50.

Shares of Aurora Cannabis Inc (ACB) are rising around 6% at the time of writing and trading around $2.18. The price is on the rise after as an analyst at Cowen said that the firm will likely focus on controlling its spending and will also restructure its debt.

The new estimate may have provided bargain seekers an opportunity to purchase the stock at a low price. High volatility is set to persist.

Other experts had previously brought the price down. Bank of America and Piper Sandler both downgraded the stock due to its financial issues. PS set a target of $1 with an "underweight" recommendation.

Aurora Cannabis Stock Price

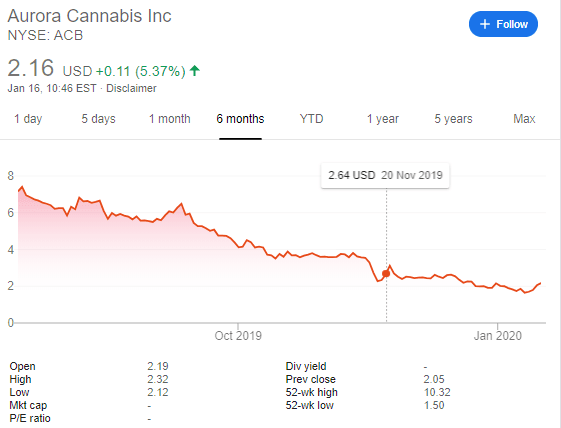

In the bigger picture, the marijuana stock has been sliding from a peak of over $7 in the past six months. While the fresh recovery erases losses incurred early this year, there is a long way to go to recover previous levels.

On the business-level, the Edmonton-based firm received a blow from German authorities, that suspended selling of the company's products in the country. Even in Canada, where marijuana is legal, regulatory bottlenecks have undermined Aurora's position.

ACB is reportedly considering issuing more shares, but it has previously struggled with the dilution of existing shareholders.

The buzz around pot stocks fizzled out during 2019 as investors demanded financial results and not only pipe dreams. Nevertheless, growing weed markets provide opportunities for companies that get their act together.

Optimism about legalizing pot on the federal level in the US boosted stocks in late 2019, but the path to fully opening the vast American market to Canadian companies is still long. Moreover, such firms may face competition from US ones.

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.