- Aurora Cannabis stocks trade below one dollar in New York.

- The massive sell-off in equities, fueled by coronavirus fears, is the latest trigger.

- The NY delisting risk adds to previous issues.

Aurora Cannabis Inc is trading at around 95 cents on the New York Stock Exchange. While ACB's Toronto-traded shares are above C$1, the marijuana firm is now ta penny stock territory. If this situation persists for 30 days and if other conditions are satisfied, NYSE may delist Aurora.

Confined to trading at the TSX, Aurora would attract fewer investors, and that would further exacerbate its situation. The latest trigger for the downfall is the broad stock market sell-off, which is related to the coronavirus health crisis. Rising anxiety and home quarantine may eventually increase cannabis consumption, but markets are tumbling worldwide, and almost no stock is spared.

Aurora's management – which has been reshuffled in February – may opt for a "reverse split." Companies that are seeing a plunge in the value of their stocks can merge two or more shares into one, making the new equity worth more than one dollar and thus averting the dreaded delisting. However, such a move tells investors that the firm does not foresee growth in the near future.

It seems that the weed firm has limited options when it comes to its stock price, However, if it announces new products, rising revenues, new partnerships, etc.it would have its own reasons to rise – regardless of broader markets.

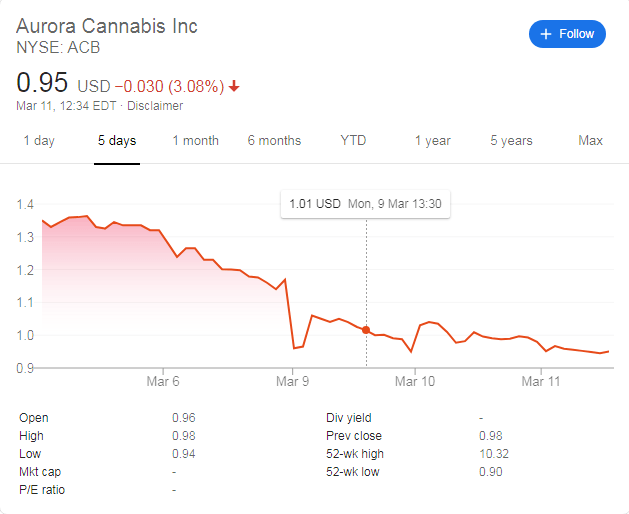

Aurora Cannabis Stock Price

As the chart shows, ACB has been on a downtrend in recent days, extending its fall. It has fallen below $1 and fails to recover.

See ACB Stock Price: Aurora Cannabis inc has three (mostly coronavirus-related) reasons rise

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD clings to daily gains near 1.0300 after US PMI data

EUR/USD trades in positive territory at around 1.0300 on Friday. The pair breathes a sigh of relief as the US Dollar rally stalls, even as markets stay cautious amid geopolitical risks and Trump's tariff plans. US ISM PMI improved to 49.3 in December, beating expectations.

GBP/USD holds around 1.2400 as the mood improves

GBP/USD preserves its recovery momentum and trades around 1.2400 in the American session on Friday. A broad pullback in the US Dollar allows the pair to find some respite after losing over 1% on Thursday. A better mood limits US Dollar gains.

Gold retreats below $2,650 in quiet end to the week

Gold shed some ground on Friday after rising more than 1% on Thursday. The benchmark 10-year US Treasury bond yield trimmed pre-opening losses and stands at around 4.57%, undermining demand for the bright metal. Market players await next week's first-tier data.

Stellar bulls aim for double-digit rally ahead

Stellar extends its gains, trading above $0.45 on Friday after rallying more than 32% this week. On-chain data indicates further rally as XLM’s Open Interest and Total Value Locked rise. Additionally, the technical outlook suggests a rally continuation projection of further 40% gains.

Week ahead – US NFP to test the markets, Eurozone CPI data also in focus

King Dollar flexes its muscles ahead of Friday’s NFP. Eurozone flash CPI numbers awaited as euro bleeds. Canada’s jobs data to impact bets of a January BoC cut. Australia’s CPI and Japan’s wages also on tap.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.