ACB Stock Price: Aurora Cannabis inc earnings send shares to record lows before bouncing

- Aurora Cannabis reports earnings amid downbeat expectations.

- Investors are eyeing ACB's recovery plan in addition to raw numbers.

- Bargain-seekers are yet to appear for the marijuana stock.

Aurora Cannabis inc. has published its earnings report for its second fiscal quarter that ended in December, and the figures are dismal. The adjusted EBITDA losses nearly doubled from C$39.7 million to C$80.2 million. The marijuana firm did not detail its losses.

Cannabis sales came out at C$52.7 million, within estimates but down 26% from the previous quarter.

Its output fell by the same percentage, 26% to just under 31 tons while sales declines by 25% to around 9.5 tons. The price that ACB fetches for its cannabis slid to C$4.76, a decrease of 10%.

While these results are dismal, they have come one week after the Aurora replaced its CEO, announced impairment charges, reduced its market activity – and all but hinted at these results. The pot company is taking a hit for goodwill losses and is also scaling back operations outside its core Canadian market.

Aurora Cannabis Stock Price

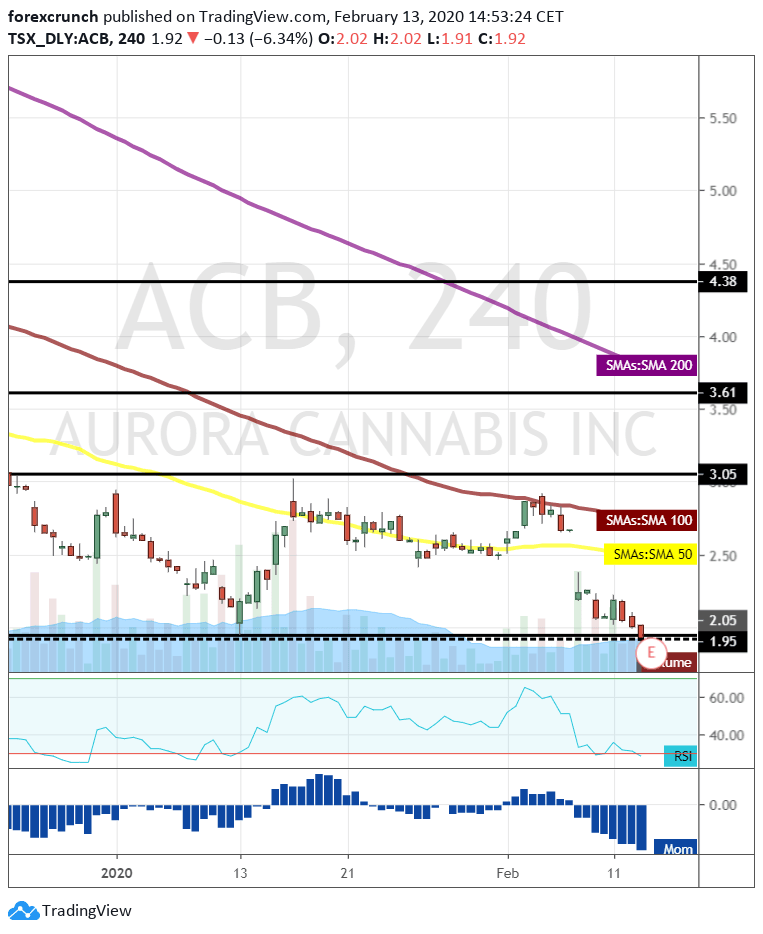

Ahead of the news, ACB's share price on the Toronto Stock Exchange fell to the all-time lows of C$1.92, a figure already touched beforehand. These results may further weigh on the Edmonton based company's equity price.

Premarket trading is showing a drop of over 4%.

Update: After the initial drop, ACB's stock price is rising from the abyss. In New York, NYSE:ACB has hit a high of US$1.53, up from a low of $1.43.

Are bargain-seekers in play?

The Relative Strength Index on the four-hour chart is below 30 – reflecting oversold conditions that may lead to a correction. The round levels of 1.75 and 1.50 serve as support lines in the uncharted territory while 2.50 and 3.05 are resistance lines.

Marijuana stocks have been under pressure to deliver results and not only promises. The legalization of weed in Canada back in October 2018 has brought opportunities but also regulatory hurdles. While many US states have embraced weed, the absence of legalization at the Federal level is another hurdle.

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.