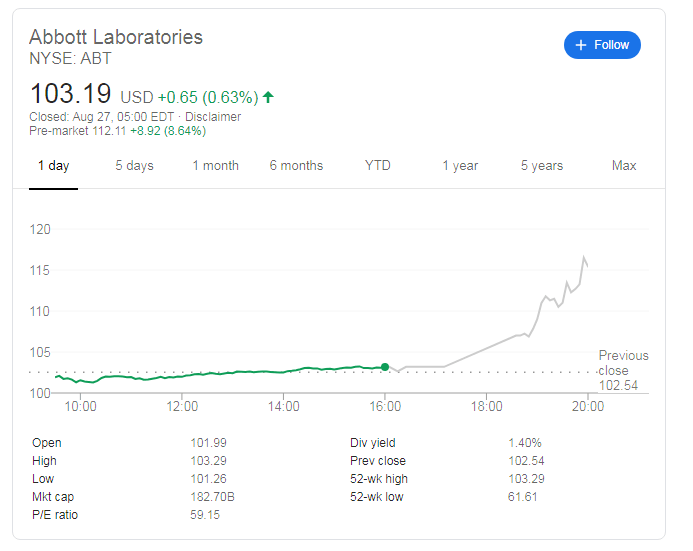

- NYSE: ABT is on course to leap by around 10% on Thursday.

- Abbott Laboratories has received an FDA approval for its BinaxNOW COVID-19 Card test.

- The rapid, cheap, and instrument-free probe is touted as a game-changer.

A game-changer in fighting coronavirus – and this time it is not a vaccine or a cure, but a rapid test coming from a well-established company. Abbott Laboratories (NYSE: ABT) may now begin selling its Aboott BinaxNow COVID-19 Ag Card Test. The Food and Drug Administration (FDA) has given its emergency authorization, allowing mass production of the test.

Abbott expects to manufacture around ten million units in September, 50 million in October, and continue ramping up output later on. The Chicago-based firm – which is in businesses since the 19th century – said that results of the test are out after 15 minutes – far faster than the standard PCR ones.

Abbott Laboratories also said that the tests have a demonstrated sensitivity of 97.1% and specificity of 98.5% in a clinical study. The tests are also cheap – only $5, and do not necessitate any labs or instruments.

Using such rapid tests could help capture asymptomatic COVID-19 carriers and isolate them before they infect others. Moreover, it could allow a quick resumption of normal life. Air passengers can undergo these quick tests, assuring with a high degree of certainty that no coronavirus-carrying patient is on board.

Overall, the product is promising.

ABT Stock Dividend

NYSE: ABT is changing hands at over $112 in pre-market trading on Thursday, an increase of nearly 10%. It is critical to note that Abbott Laboratories is a large pharmaceutical firm worth over $180 billion, and such a move is substantial.

Moreover, sales of BinaxNOW could boost income and the bottom line, leading to a higher dividend. The mere prospects of topping its 2019 revenue of $31.9 billion could also trigger an increase in Abbott's payout to shareholders.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

Gold trades near record-high, stays within a touching distance of $3,100

Gold clings to daily gains and trades near the record-high it set above $3,080 earlier in the day. Although the data from the US showed that core PCE inflation rose at a stronger pace than expected in February, it failed to boost the USD.

EUR/USD turns positive above 1.0800

The loss of momentum in the US Dollar allows some recovery in the risk-associated universe on Friday, encouraging EUR/USD to regain the 1.0800 barrier and beyond, or daily tops.

GBP/USD picks up pace and retests 1.2960

GBP/USD now capitalises on the Greenback's knee-jerk and advances to the area of daily peaks in the 1.2960-1.2970 band, helped at the same time by auspicious results from UK Retail Sales.

Donald Trump’s tariff policies set to increase market uncertainty and risk-off sentiment

US President Donald Trump’s tariff policies are expected to escalate market uncertainty and risk-off sentiment, with the Kobeissi Letter’s post on X this week cautioning that while markets may view the April 2 tariffs as the "end of uncertainty," it anticipates increased volatility.

US: Trump's 'Liberation day' – What to expect?

Trump has so far enacted tariff changes that have lifted the trade-weighted average tariff rate on all US imports by around 5.5-6.0%-points. While re-rerouting of trade will decrease the effectiveness of tariffs over time, the current level is already close to the highest since the second world war.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.