AAPL: Impulse hints at bullish correction

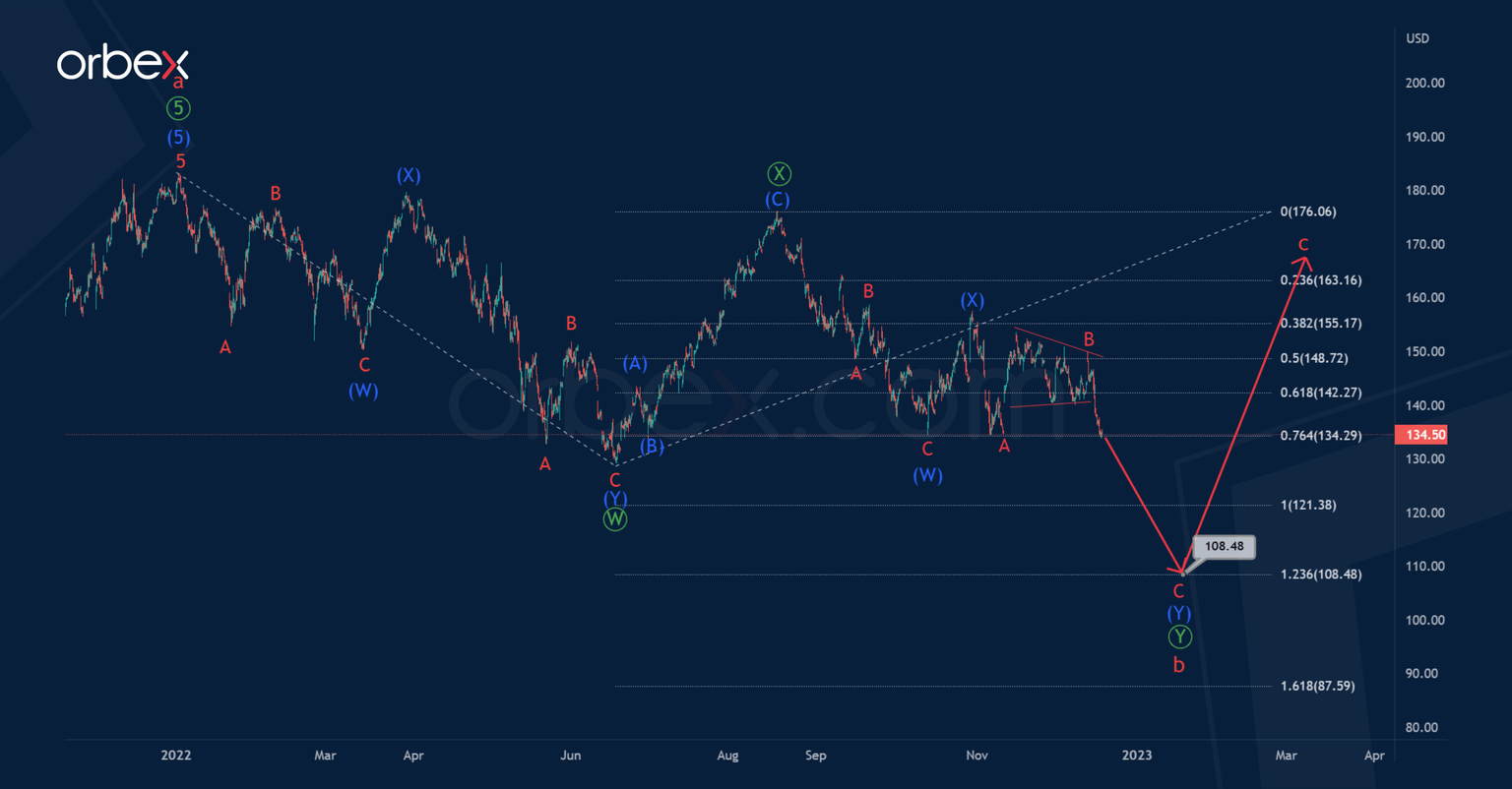

According to the current AAPL stock chart, it is possible to assume the formation of a corrective trend, which takes the form of a 3-wave zigzag of the cycle degree a-b-c.

The first impulse wave a looks fully completed. A complex correction b is currently under development, the structure of which hints at the primary double zigzag Ⓦ-Ⓧ-Ⓨ. The actionary leg Ⓦ and the zigzag intervening wave Ⓧ look complete. That is, the last sub-wave Ⓨ is being built now.

The primary wave Ⓨ most likely takes the form of an intermediate zigzag (A)-(B)-(C), where the impulse (A) is formed.

The price may rise to 155.26 in the near future. At that level, intermediate correction (B) will be at 50% of wave (A).

Let's consider an alternative scenario in which the bearish primary wave Ⓨ is more complex in structure and takes the form of an intermediate double zigzag (W)-(X)-(Y). Intermediate waves (W) and (X) may already be completed.

Thus, the market is currently in the last sub–wave (Y), or rather in its last part - impulse C.

It is assumed that the price in impulse C may fall to 108.48. At that level, wave Ⓨ will be at 123.6% of wave Ⓦ.

Author

Jing Ren

Orbex

Jing-Ren has extensive experience in currency and commodities trading. He began his career in metal sales and trading at Societe Generale in London.

-638070299826352442.png&w=1536&q=95)