AAL Stock Price: American Airlines Group inc still from touchdown after Buffet's blow

- American Airlines' share prices are declining while broader stock markets are on the rise.

- Warren Buffet's depressing words about AAL and the airline industry are weighing.

- The industry will need more time to take off after the coronavirus crisis.

"I wish them luck" – the words of legendary investor Warren Buffet, owner of Berkshire Hathaway on the airline industry, are taking their toll. Buffet said he is selling stocks of airlines in a changing world, during his annual investor gathering, held online.

He also said that his firm is sitting on cash, and stock markets are recovering anyway. Yet for airlines, his words resonate with many investors. Government across the world have slapped travel bans and forced people to stay indoors in order to curb the outbreak of coronavirus. Flights have been canceled and people are not traveling.

These measures have had success in several countries reporting drops in deaths from COVID-19 and fewer cases. That has prompted some to lift restrictions. Gavin Newsom, Governor of California, announced such easing and contributed to boosting markets. In Texas, where American Airlines is based, the state never endured a strict order and has let it lapse.

Nevertheless, airports are seen as no-go zones, and AAL, one of the largest carriers in the world has limited room to rise.

Will the federal government bail out the company? THat cannot be ruled out, but fatigue from helping struggling companies – a scar from the financial crisis – will likely prevent any imminent action.

All in all, the failure of America Airlines Group to advance while the broader NASDAQ and S&P indexes are rising is a warning sign.

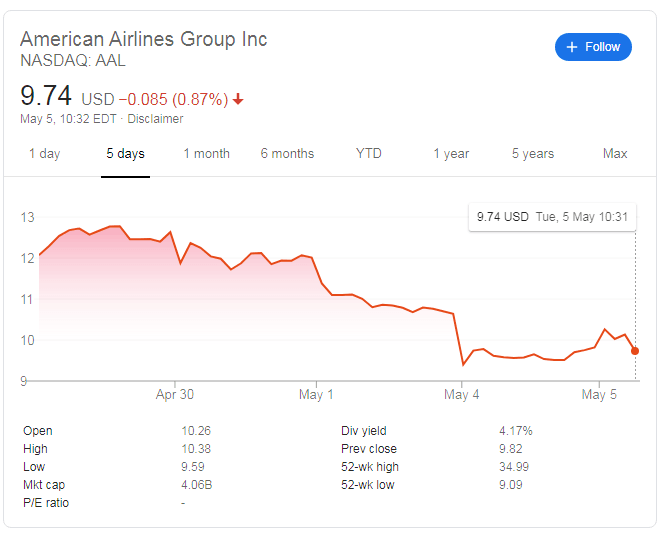

AAL Stock Chart

AAL's stock price is hovering above the yearly lows and seems vulnerable to further falls. The $9.50 level is critical, and falling below that line would place the stock price at the lowest since 2013. Significant resistance awaits at $11 and at $12.50, which have capped the share 's price recently.

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.