Emini S&P December made it as far as 5918 but has hit profit taking in overbought conditions as we wipe out Monday's strong gains.

There is a good chance we will consolidate & trade sideways for a short period to ease overbought conditions.

Definitely no sell signal though!!!

The low & high for the last session were 5853 - 5892

Emini Nasdaq December should find support at 20250/200 & longs need stops below 20150.

Last session high & low for the last session were: 20206 - 20398.

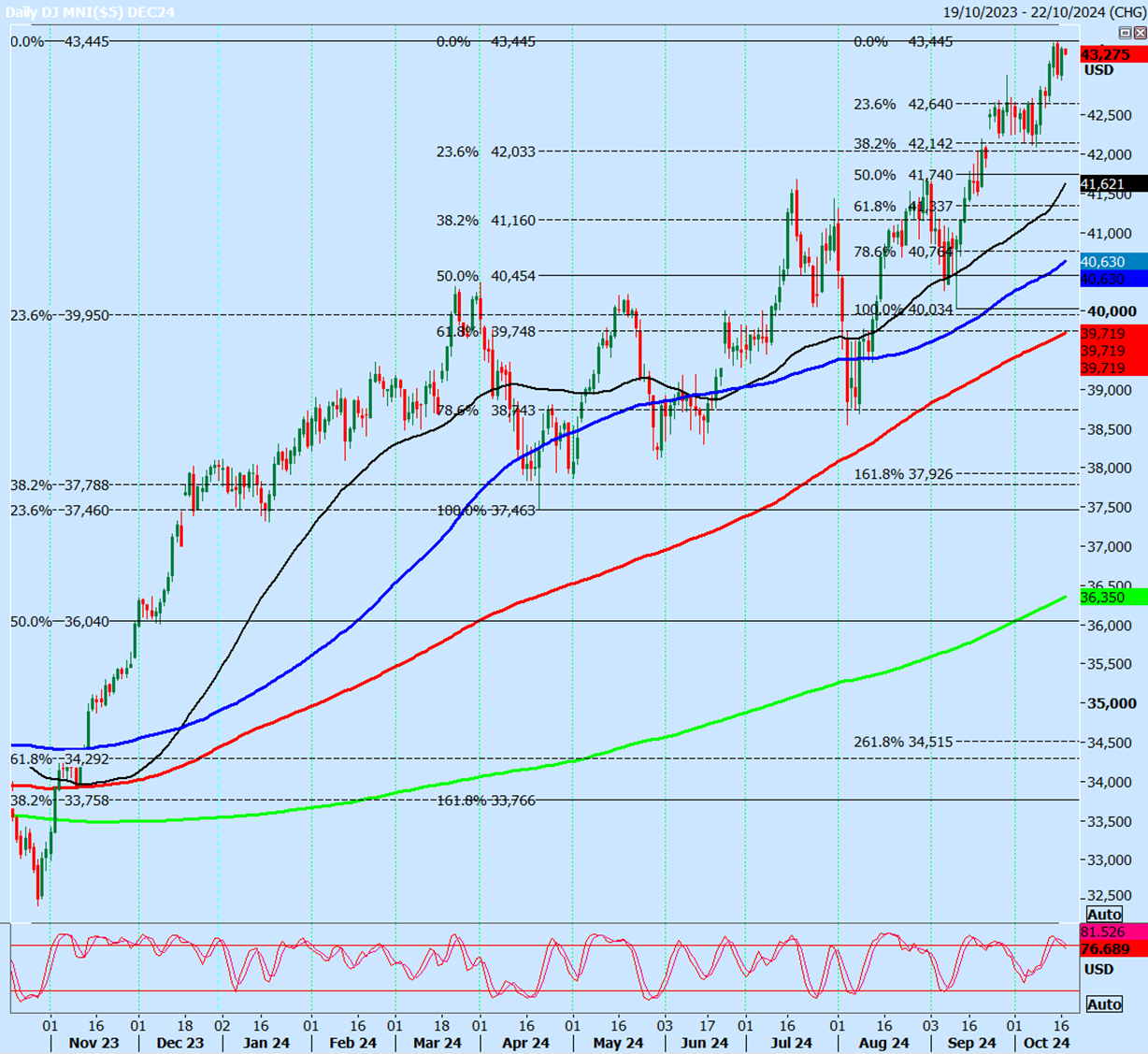

Emini Dow Jones December collapsed from a new all time high at 43445 leaving a bearish engulfing candle on the daily chart on Tuesday but we recovered yesterday.

Last session high & low for the last session were: 42937 - 43369.

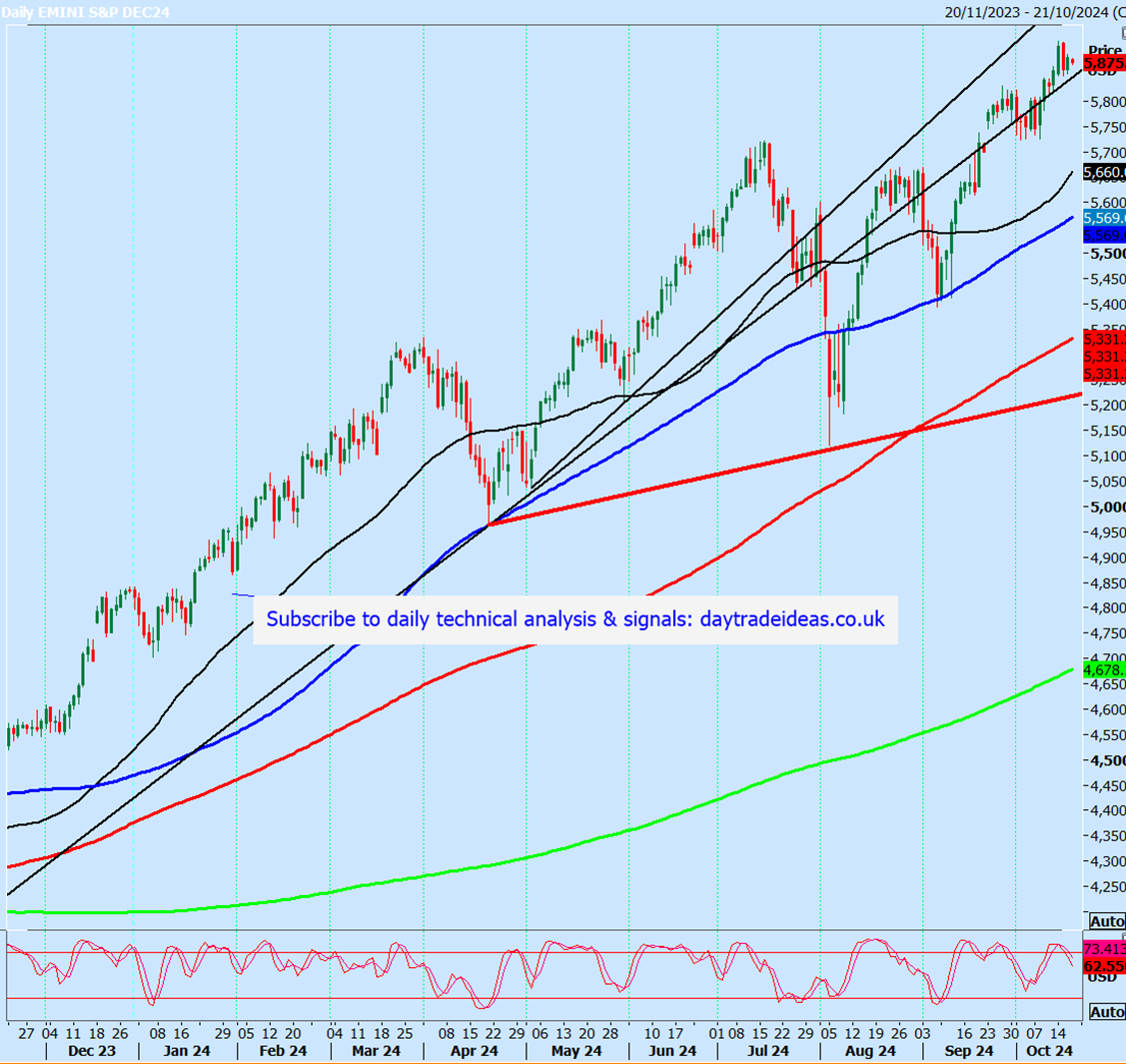

Emini S&P December futures

Emini S&P managed to bounce from support at 5850/40 (I wasn't sure it would).

We reached 5892 & obviously bulls want to retest this week's all time high at 5918.

On a break higher look for 5935/40.

A break below 5840 targets a buying opportunity at 5810/5790. Longs need stops below 5780.

Targets: 5830, 5850, perhaps as far as 5870.

I cannot think about short positions in the strong longer-term bull trend on any recovery, despite overbought conditions. But it is possible that we trade in a sideways range for a while to consolidate gains, so I will be watching for a pattern to form.

Nasdaq December futures

Key support at 20250/200 today from short term moving averages & a 5 week ascending trend line.

Longs need stops below 20150.

A break lower risks a slide to a buying opportunity at 19950/850 & longs need stops below 19700.

Emini Dow Jones December futures

Bearish engulfing candle formed on the daily chart on Tuesday but we bounced from support at 43000/42900 to 43369.

Longs on a retest of support at 43000/42900 today need stops below 42800.

A break lower should target a better buying opportunity at 42660/620.

A good chance of a low for the day but longs need stops below 42500.

The contents of our reports are intended to be understood by professional users who are fully aware of the inherent risks in Forex, Futures, Options, Stocks and Bonds trading. INFORMATION PROVIDED WITHIN THIS MATERIAL SHOULD NOT BE CONSTRUED AS ADVICE AND IS PROVIDED FOR INFORMATION AND EDUCATION PURPOSES ONLY.

Recommended content

Editors’ Picks

EUR/USD treads water just above 1.0400 post-US data

Another sign of the good health of the US economy came in response to firm flash US Manufacturing and Services PMIs, which in turn reinforced further the already strong performance of the US Dollar, relegating EUR/USD to the 1.0400 neighbourhood on Friday.

GBP/USD remains depressed near 1.2520 on stronger Dollar

Poor results from the UK docket kept the British pound on the back foot on Thursday, hovering around the low-1.2500s in a context of generalized weakness in the risk-linked galaxy vs. another outstanding day in the Greenback.

Gold keeps the bid bias unchanged near $2,700

Persistent safe haven demand continues to prop up the march north in Gold prices so far on Friday, hitting new two-week tops past the key $2,700 mark per troy ounce despite extra strength in the Greenback and mixed US yields.

Geopolitics back on the radar

Rising tensions between Russia and Ukraine caused renewed unease in the markets this week. Putin signed an amendment to Russian nuclear doctrine, which allows Russia to use nuclear weapons for retaliating against strikes carried out with conventional weapons.

Eurozone PMI sounds the alarm about growth once more

The composite PMI dropped from 50 to 48.1, once more stressing growth concerns for the eurozone. Hard data has actually come in better than expected recently – so ahead of the December meeting, the ECB has to figure out whether this is the PMI crying wolf or whether it should take this signal seriously. We think it’s the latter.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.