4 top biotech stocks to watch in October 2021

The ongoing COVID-19 crisis has highlighted the growing importance of biopharma and biotech companies to our world-wide healthcare systems. The products and services these companies provide, some of them established industry giants while others relatively new startups, will have impact on global healthcare delivery for years, if not decades, to come. It makes sense, therefore, for investors to consider adding biotech exposure to their portfolios.

We’ll highlight four biotech stocks to watch in the coming months.

MOUNTAIN VALLEY MD (MVMD)

The ongoing worldwide health crisis, and the global vaccine-based response to it, clearly demonstrated that there is a dearth of alternate approaches to deliver critically necessary medication to world-wide audiences. Vaughan, Canada-based Mountain Valley MD has developed a patented oral delivery technology called Quicksome™. This unique approach has wide-spread relevance to nutraceutical, vaccine, and pharmaceutical drug applications.

Established in 2005, MVMD’s ground-breaking innovation is especially relevant now (and in the foreseeable future) considering many patients that have showed aversion to needle-based drug delivery. Quicksome™ now allows drug manufacturers to formulate and encapsulate new approaches to traditional drugs that are capable of oral delivery into the body.

This breakthrough offers a great opportunity for the company to address the growing global challenge of needle-based vaccine hesitancy. In recent tests, Quicksome™ has proved highly resilient in a vial for five days of exposure at 40 degrees Celsius. The results far exceed World Health Organization’s (WHO) guidelines, and gives MVMD a competitive edge over some of its peers when it comes to transporting and storing vaccines.

MVMD’s CEO, Dennis Hancock, recently noted in a Forbes interview, that the company is seeking to address the $35 billion in vaccines wasted annually. MVMD’s technology eliminates the need for traditional cold chain transport and thus allows for those in underserved and/or hot climates, to gain access.

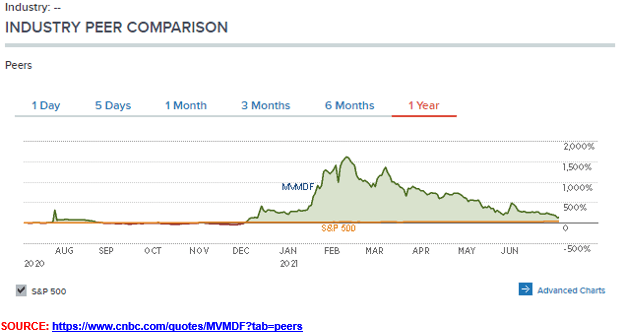

Investors should note that MVMD has largely performed in lock-step with its peers, or outperformed them over the past one year. Additionally, the company is also involved in other products and therapies, including for pain management, weight loss, energy, focus, sleep, and anxiety. This adds a level of product diversification upside for portfolios holding MVMD.

JOHNSON & JOHNSON (JNJ)

If you are in the camp that believes only owning the giants in a space is right for you, then JNJ may be the perfect pick for your portfolio. Johnson & Johnson’s Janssen is one of three (others being Pfizer-BioNTech and Moderna) approved in the United States. The New Brunswick, New Jersey-based biotech/pharma giant supports a vast global network of facilities, and operates through three segments - Consumer Health, Pharmaceutical, and Medical Devices – each of which has a claim to fame in its own right.

Like MVMD discussed earlier, JNJ’s relevance to a biotech-focused portfolio has heightened interest, given the recent move by several EU countries to order 40-million additional COVID-19 vaccines from the company. This is in addition to the 200-million doses already ordered by the EU. The icing on the cake, for any biotech portfolio containing JNJ, is the fact that the company is among the few to also support a single-dose COVID-19 vaccine. Given the logistic challenges the world has experienced with multiple-dose vaccines – especially in underserved and remote communities – having a single-dose solution bodes well for long-term holders of this stock.

ADIAL PHARMACEUTICALS, INC. (ADIL)

ADIL is a clinical-stage biopharmaceutical company that’s entirely focused on the development of treatments for addictions. It’s place in a biotech portfolio is a play on drug treatments for prevention of substance abuse and addiction. According to one estimate, substance abuse treatments are expected to grow to a $27-billion market by 2027. That’s an impressive 7.3% Compound Annual Growth Rate (CAGR) over a 7-year period between 2000 and 2027.

And with its ONWARDTM product line aimed at that market, the company has potential to gain significant share of that global market. However, ADIL is evaluating AD04 as a therapeutic agent for the treatment of Alcohol Use Disorder (AUD). And data suggests that segment of addiction treatment is a $36-billion market that continues to grow.

The Charlottesville, VA-based company recently announced that ONWARDTM had met 100% of its targeted screening for enrollment of patients to its Phase 3 trials, with 33% of them testing positive for AD04-associated genotype. Holders of the stock should also note that the company has reported an 84% retention rate for its trials. That’s significantly higher than the initially expected 70%. Trial data is expected to be released by Q1-2022, which, if it delivers expected results, should send the stock higher.

ONCOLYTICS BIOTECH, INC (ONCY)

Cancer is a leading cause of deaths globally. According to the World Health Organization (WHO), breast cancer accounted for the greatest numbers of new cancer cases added in 2020 – 2.26 million. Compare that to other forms of cancer, such as colon and rectum cancer (1.93 million), prostrate (1.41M) and stomach cancer (1.09M), and once can appreciate why breast cancer is a serious cause for concern.

Calgary, ON Canada-based ONCY (which also trades on the Toronto Stock Exchange - ONC), a development stage biopharmaceutical company, focuses on the discovery and development of pharmaceutical products for the treatment of cancer. Incorporated in 1998, the company’s lead product is Pelareorep, an immuno-oncology viral-agent for the treatment of solid tumors and hematological malignancies, and targeted for use in a variety of cancers, including multiple myeloma, gastrointestinal cancers and breast cancer.

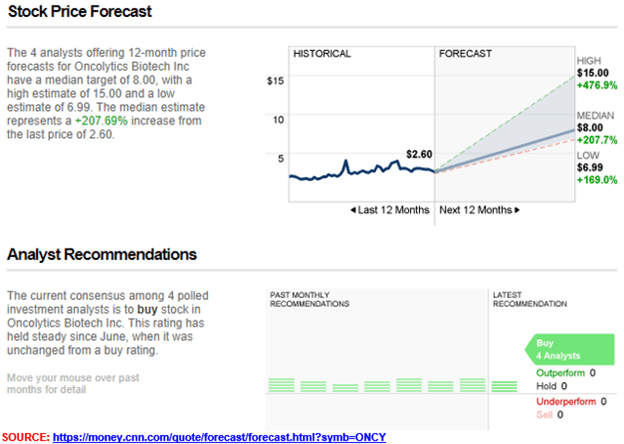

Analysts tracking the company are extremely bullish on the 12-month outlook for the stock, projecting a medium stock price of $8, with a high of $15. The fact that ONCY partners with global bio-pharma giants, like Merck KGaA and Pfizer Inc., in the development of Pelareorep for cancer treatments - specifically for breast cancer applications – also bodes well for portfolios holding the name.

A Winning Portfolio

Given that the demand on biopharma and biotech products and services is likely to continue over the foreseeable future, these 4 stocks offer investors a great risk-reward proposition, and fair up-side potential over the coming months.

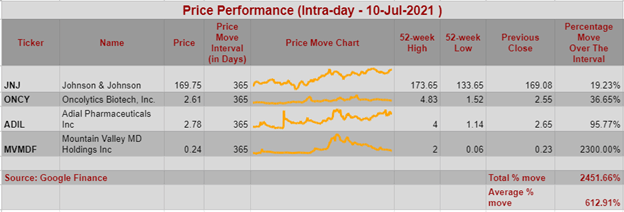

A hypothetical portfolio, containing these names, would have delivered exceptional price appreciation over a one-year period.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Ivan Serrano

Ivan Serrano Writes

Ivan Serrano was a financial analyst turned entrepreneur. His work has been featured in key publications such as Zerohedge.com, SeekingAlpha, Entrepreneur, Forbes, Benzinga and more.