How I’m Preparing For The Next Market Crash

If you’ve ever read Douglas Adam’s Hitchhiker’s Guide To The Galaxy, you’re familiar with the term “DON’T PANIC!”

After the recent drop in the market, you may have been asking yourself, “what am I going to do?” or “what if it happens again?”

What should you do when and if the stock market crashes… again?

There’s one incredibly important thing to remember:

Always follow your plan!

What am I doing now to prepare for the next crash?

Let’s talk about what happened this week in my 20k account.

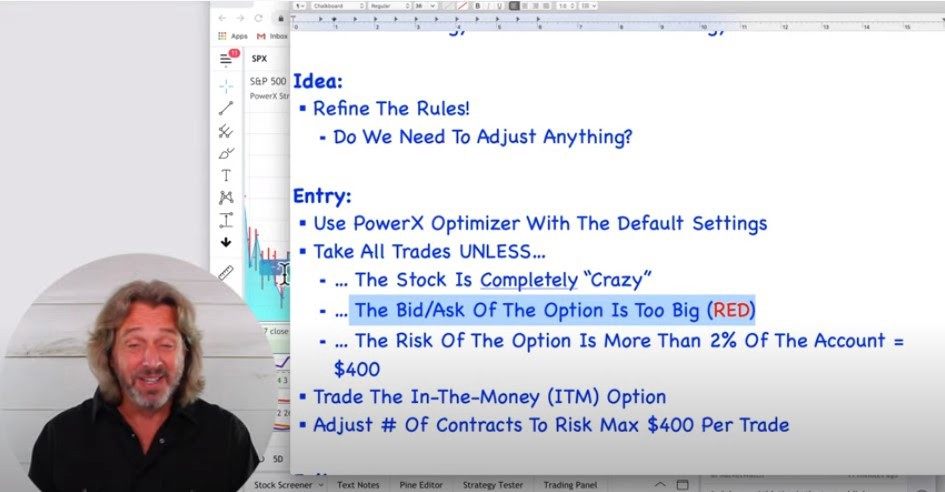

In this account, I’m using my PowerX Strategy to find my trades.

Using my trading plan, I take the trades that the PowerX software recommends.

Out of those trade recommendations, I ONLY take the trades that fit my plan.

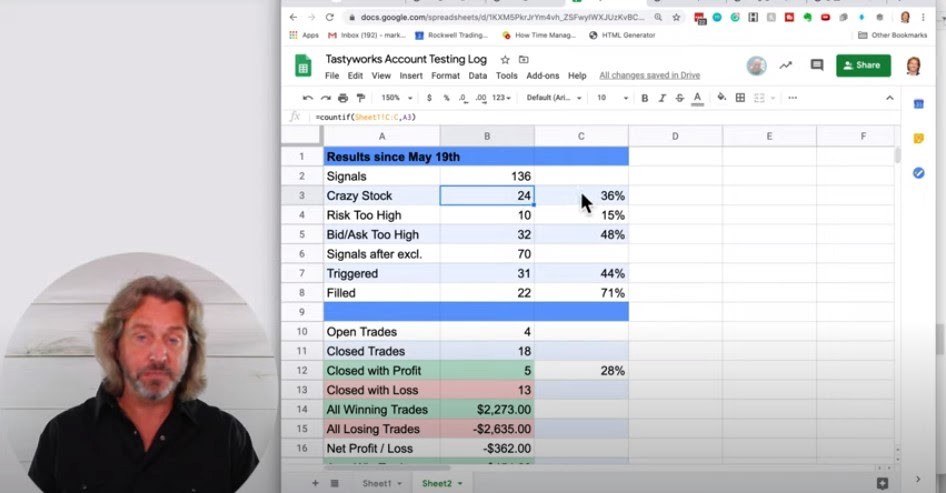

As of today, the PowerX Software recommended 70 trades total. 31 of these trades matched my plan and 22 had order fills, or were executed.

After Thursday’s (June 11th) huge drop in the market, I had to exit a LOT of those positions.

Out of all those trades, only 5 were profitable… but I still have 4 positions on.

Wait a minute… this means I only had a 28% winning rate, right!?

Or after the crash, I lost 72% of my trades?! That sounds pretty bad.

Don’t traders always want to have high winning rates?

Yes! But even when we can’t win 80% or 90% of the time, we still practice trade management.

What is trade management?

We can limit the downside potential to any losing trade by sticking to our trading plan. What does this mean exactly?

In this particular instance, I am referencing your entry and exit point.

Before any trade is taken, you should have an entry and exit point already defined. Meaning you know exactly when to buy and sell the stock or option.

If the trade goes against you, you always stick to your plan and use your exit strategy.

Too often I see traders that hold onto losing trades way longer than they should, just hoping things will turn around… and let me tell you, they rarely do.

That’s why it’s important to STICK TO YOUR PLAN!

How did I do after Thursday’s drop?

So… after I closed out the losing trades totaling $2,365, and the winning trades of $2,273, I am only down a total of $362 dollars.

This means the average value of my winning trades is more than DOUBLEthe value of my losing trades…

So after the huge drop in the market, I managed the losing trades by sticking to my trading plan. What’s the good news?

I still have 4 remaining trades left… and all I need is one of them to be profitable!

How to manage your emotions during a losing week

You may have seen the awesome coffee cup that I use during my “Coffee With Markus” YouTube Series? I use this mug every day.

It says, “Trade what you SEE, not what you THINK.” It reminds me every day to be objective when trading the markets.

It reminds me to trade what I see, not what I feel.

It’s important after a week of losses to remember this: You MUST prevent your emotions from getting the best of you.

It’s perfectly fine to have emotions. Scream. Yell at your computer! Let your dog know how frustrated you are… just don’t let your emotions influence your trading.

Many traders will take their frustrations from a losing trade and chase after the market. This is called revenge trading, and it’s a spectacular way to lose even more money.

Never let your emotions get the best of you.

What’s the secret to winning during a stock market crash?

Keeping your losses smaller than your wins and sticking to your trading plan. It’s really that simple.

So if the news (that has been nothing but BAD lately) has you asking, “When Is the next crash coming?!”

Or…”Is the next crash already here?”

I have news for you! It does NOT matter..

I do not care what the markets are doing!

I only trade what I see, not what I think.

Follow your plan and remember… hope is not a strategy.

So, if the markets turn and your trade is no longer profitable, stick to your trading plan and get out.

This will always keep your losses smaller than your wins. This is really the key to consistency and success in trading, no matter the market conditions.

Trading Futures, options on futures and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. The lower the day trade margin, the higher the leverage and riskier the trade. Leverage can work for you as well as against you; it magnifies gains as well as losses. Past performance is not necessarily indicative of future results.

Editors’ Picks

EUR/USD bounces off lows, back to 1.1860

EUR/USD now manages to regain some balance, retesting the 1.1860-1.1870 band after bottoming out near 1.1830 following the US NFP data on Wednesday. The pair, in the meantime, remains on the defensive amid fresh upside traction surrounding the US Dollar.

GBP/USD rebounds to 1.3660, USD loses momentum

GBP/USD trades with decent gains in the 1.3660 region, regaining composure following the post-NFP knee-jerk toward the 1.3600 zone on Wednesday. Cable, in the meantime, should now shift its attention to key UK data due on Thursday, including preliminary GDP gauges.

Gold stays bid, still below $5,100

Gold keeps the bid tone well in place on Wednesday, retargeting the $5,100 zone per troy ounce on the back of humble gains in the US Dollar and firm US Treasury yields across the curve. Moving forward, the yellow metal’s next test will come from the release of US CPI figures on Friday.

Ripple Price Forecast: XRP sell-side pressure intensifies despite surge in addresses transacting on-chain

Ripple (XRP) is edging lower around $1.36 at the time of writing on Wednesday, weighed down by low retail interest and macroeconomic uncertainty, which is accelerating risk-off sentiment.

US jobs data surprises to the upside, boosts stocks but pushes back Fed rate cut expectations

This was an unusual payrolls report for two reasons. Firstly, because it was released on Wednesday, and secondly, because it included the 2025 revisions alongside the January NFP figure.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a Chief trader its second knowledge how to extract cash out of the market.

5 Forex News Events You Need To Know

In the fast moving world of currency markets where huge moves can seemingly come from nowhere, it is extremely important for new traders to learn about the various economic indicators and forex news events and releases that shape the markets. Indeed, quickly getting a handle on which data to look out for, what it means, and how to trade it can see new traders quickly become far more profitable and sets up the road to long term success.

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and selling pressure. Chart patterns have a proven track-record, and traders use them to identify continuation or reversal signals, to open positions and identify price targets.

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

The challenge: Timing the market and trader psychology

Successful trading often comes down to timing – entering and exiting trades at the right moments. Yet timing the market is notoriously difficult, largely because human psychology can derail even the best plans. Two powerful emotions in particular – fear and greed – tend to drive trading decisions off course.