Looking for potential Market Turns in FX markets?

Many traders had come to me saying that the FX market is so unpredictable and that not only does the release of economic data move the currencies’ prices, the FX market seems to be affected by many other factors like central banks’ speeches and their intentions of raising or reducing its currency interest rates. And yet, putting aside all these news-related price movements, the currencies also seems to have a kind of rhythm to dance with themselves.

Yes, FX markets do response to a lot to expected news (such as economic data release) and unexpected news (such as earthquakes/ missile tests from Korea etc) as it pretty much runs 24 hours a day. But this is also the reason why I like to trade with FX a lot – that is, the planets in our solar system are also moving in the sky 24 hours a day as well. And they keep on giving signals to our investment markets – Don’t understand what I mean? Let’s see a few examples on how I read the markets from an astrological point of view!

How to trade with the Astrology Timing

Spot for set ups

- Mid to Long Term

First, I would like to raise a non-FX example so as to explain the theory that I am introducing to you is universal to all investment products, and that it does not only confine within the FX market.

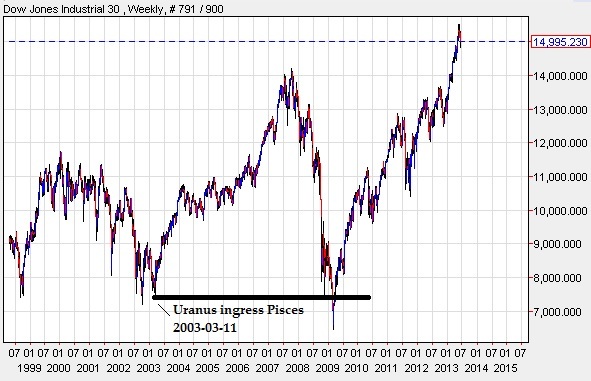

For example, on 2010-May-28 is the Uranus ingress date, and let us take a look on its interaction with the Dow Jones Industrial Index. (Shock!) See that Uranus ingress served as a ‘base’ for market to advance as time goes by.

The good news is: this price pattern is not a single-time incident, and now, all of a sudden, the market becomes predictable. Let us now trace back one earlier ingress date of Uranus –

This is what had happened when Uranus ingressed Pisces on 2003 March 11.

It (ingress of Pisces) served as a ‘base’ for the bull market in 2003 – 2007, and it worked nicely with the 2008/ 2009 financial crisis which it served as a mysterious support at the same price level.

Do you see same interaction/ price pattern going on, in both of the DJI charts?

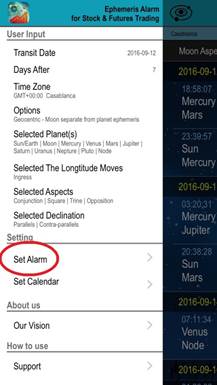

How “Eph Alarm” will able to help you

Assuming you have already downloaded the iOS app “Eph Alarm” and have watched the video which introduces basic functions of the app on "Trineaspect".

Now you can import all these ingresses date onto your apple calendar, and set an alarm from 120minutes to 3 days ‘after’ they occurred in the sky and check if they had served as ‘ bases’ in the market when the alarm reminds you of their occurrence.

Set a tight stop loss a bit below (if it serves as a bottom) or above (if it serve as a top) the ‘base’, and then you can ride with the trend together with your analysis derived from fundamental analysis or technical indicators.

You can also treat the ‘base’ as an alert that a certain trend might have changed whenever the market breaks these ingress ‘bases’!

How to import the ingress dates onto the calendar

Below are the screen shot from the app, Just click on the solar button on the Top left corner and choose Set Alarm

And clicking the right top hand Calendar button will allow you to import all these astro phenomena dates into your apple calendar.

- Short Term & Intraday Trade

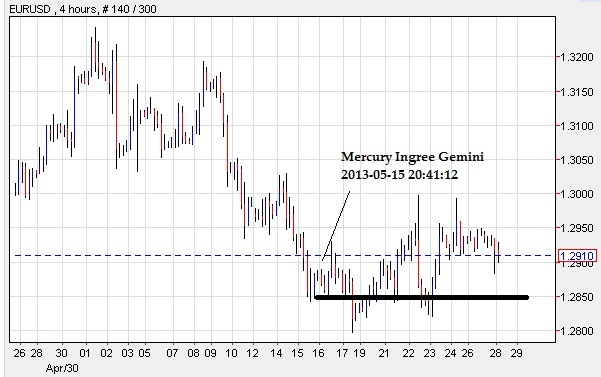

The same theory actually also applies to other faster moving planets like mercury. And now let us do another example here:

You may see when Mercury ingress Gemini, it serves another nice bottom for the Euro in May, 2013.

And for intraday traders, I personally use moon ingresses to trade with a tight stop loss around 25 pips on volatile market like JPY/ EUR/ GBP. I have traded on this strategy around 2 years now and so far it works ok

As you can see, the market usually stay near the ingress point and not moving exceed more than 25pips. and then *boom!*, and this chart showed I can easily get the 50 pips profit with little drawdown in my position. Risk Reward Ratio is 1:2.0+

Khit Wong and all members of Gann Explained LLC are NOT financial advisors, and nothing they say is meant to be a recommendation to buy or sell any financial instrument. All information is strictly educational and/or opinion. By reading this, you agree to all of the following: You understand this to be an expression of opinions and not professional advice. Any opinions, news, research, analysis, prices, or other information contained on this website is provided as general market commentary and education and does not constitute advice. The brand name of Gann Explained LLC will not accept liability for any loss or damage, including without limitation any loss of profit, which may arise directly or indirectly from the use of or reliance on such information. You are solely responsible for the use of any content and hold Khit Wong, Gann Explained LLC all members harmless in any event or claim. FTC DISCLOSURE: Any income claims shared by myself, students, friends, or clients are understood to be true and accurate but are not verified in any way. Always do your own due diligence and use your own judgment when making buying decisions and investments in your business.

Editors’ Picks

AUD/USD now targets the 0.7150 zone

AUD/USD has rapidly left behind Tuesday’s pullback, advancing sharply to three-year highs past the 0.7100 barrier on Wednesday. The pair’s strong performance follows investors’ assessment of the RBA’s hawkish message and the likelihood of further tightening down the road.

EUR/USD faces next resistance near 1.1930

EUR/USD continues to build on its recovery in the latter part of Wednesday’s session, with upside momentum accelerating as the pair retargets the key 1.1900 barrier amid a further loss of traction in the US Dollar. Attention now shifts squarely to the US data docket, with labour market figures and the always influential CPI releases due on Thursday and Friday, respectively.

Gold holds on to higher ground ahead of the next catalyst

Gold keeps the bid tone well in place on Wednesday, retargeting the $5,100 zone per troy ounce on the back of modest losses in the US Dollar and despite firm US Treasury yields across the curve. Moving forward, the yellow metal’s next test will come from the release of US CPI figures on Friday.

UNI faces resistance at 20-day EMA following BlackRock's purchase and launch of BUIDL fund on Uniswap

Decentralized exchange Uniswap (UNI) announced on Wednesday that it has integrated asset manager BlackRock's tokenized Treasury product on its trading platform via a partnership with tokenization firm Securitize.

US jobs data surprises to the upside, boosts stocks but pushes back Fed rate cut expectations

This was an unusual payrolls report for two reasons. Firstly, because it was released on Wednesday, and secondly, because it included the 2025 revisions alongside the January NFP figure.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a Chief trader its second knowledge how to extract cash out of the market.

5 Forex News Events You Need To Know

In the fast moving world of currency markets where huge moves can seemingly come from nowhere, it is extremely important for new traders to learn about the various economic indicators and forex news events and releases that shape the markets. Indeed, quickly getting a handle on which data to look out for, what it means, and how to trade it can see new traders quickly become far more profitable and sets up the road to long term success.

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and selling pressure. Chart patterns have a proven track-record, and traders use them to identify continuation or reversal signals, to open positions and identify price targets.

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

The challenge: Timing the market and trader psychology

Successful trading often comes down to timing – entering and exiting trades at the right moments. Yet timing the market is notoriously difficult, largely because human psychology can derail even the best plans. Two powerful emotions in particular – fear and greed – tend to drive trading decisions off course.