A few years ago, I met with a new coaching client at a hedge fund. This individual defied every stereotype of how one might assume a hedge fund portfolio manager may be. Despite a 20-year history in the markets and a stellar track record, he was a very nervous and anxious individual. Unlike many of his colleagues at the fund, who mostly took medium- term relative-value type trades, this individual day-traded FX, something generally assumed the domain of the home retail trader. What was all the more remarkable was his incredible track record. In a typical year he made around USD 40-50 mio of profit, this year he had made around USD 100 mio, a large chunk of it in the space of a few moments when the Swiss pulled their peg against the Euro. What really stood out for me though, was that he never traded after 1 pm.

I asked him, “What if you have a strong signal in the afternoon which suggests taking action, wouldn’t it mean that you will be leaving a lot of money on the table by not doing anything?” He replied that that was often the case, however he was still better not to act, he said overall he believes that historically his afternoon trading provides him with a net loss, even if you included these trades.

This fascinated me because it was a live example of a theory that I had about afternoon trading. This theory was formed from research I had read about our how our ability to make effective decisions and to exert self-control in our actions diminished the longer the day went on. In a trading sense, this could mean that whilst a trader may have an edge in early in the day, as the day wore on, that edge was eroded to the point where it became a negative edge.

Decision fatigue, mental bandwidth and trading

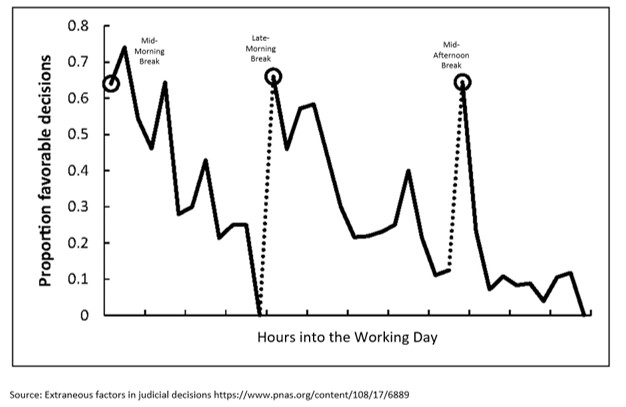

The research which led me to this belief was produced by a group of psychologists who had analysed the decision-making performance of judges. The research analysed the decision-making capabilities of a group of parole board judges when it came to granting or denying parole of over 1000 cases over a period of nearly a year. Their decisions were aggregated and placed into a single time of day chart. This chart can be seen below:

A positive or good choice was given a score of 1, a sub-par choice ‘denying parole’ was given a score of 0. The quality of the choices can be seen to deteriorate as the day wears on, only improving for a short period after intraday breaks.

This chart and their research highlight the role of ‘Decision Fatigue’ in people’s decision-making. The mental work of ruling on case after case, whatever the individual merits, wore the judges down leading to lower quality decisions as the day moved on. This sort of decision fatigue makes people involved in repetitive high stakes decision-making prone to dubious choices as the day progresses.

This sort of fatigue differs from ordinary physical fatigue where you are conscious of your tiredness. With decision-fatigue, your mental bandwidth is stretched, but you are not conscious of it and do not feel it. Thus, you carry you carry on making decisions and choices regardless, though you do become more irritable, and do make progressively lower quality choices.

Decision fatigue usually manifests in one of two ways.

The first of these is poor quality or even reckless decisions where one acts impulsively instead of expending the energy to first think through the consequences. We see these in knee-jerk trading responses, and unplanned reactive trades. The other manifestation is ‘Decision Avoidance’, not taking an action but procrastinating or hesitating.

Time of day quality in FX trading markets

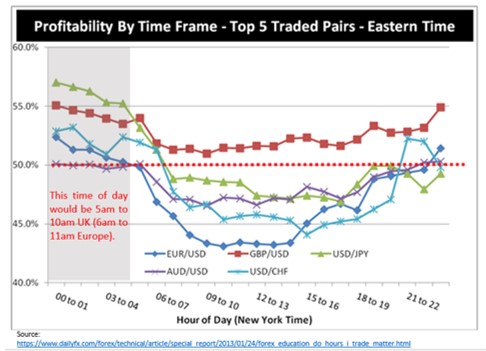

The following chart looks at the percentage of trades in five currency pairs that closed with a profit at broker FXCM from 10/01/2009 to 09/30/2010. I have assumed that most of these trades refer to day trading clients.

The most profitable period of the day was from midnight to around 5am NY Time. This is around 6am to 11am Central European Time. Since by far the highest proportion of Forex trading occurs in the European time-zone, this suggests that most Forex traders were profitable in the first few hours of their trading day. However, as the day goes progressed the trader’s profitability levels drop.

Levels of profitability appear to return to balance late in the evening, which one presumes coincides with much lower activity levels post-US markets and into the Asian/Pacific time-zone.

We cannot know the reason for this with any certainty, but this does seem to lend some credence to the possibility that ‘Decision-Fatigue’ could be at play.

Returning to the story of the Fund trader. Seen in this light, his practice of not trading into the afternoon seems a wise one. He is a seasoned trader; he knows when he is strong and when he is compromised. He knows he has no edge in the afternoon, why play when you have no edge, for him it is just playing to lose.

AlphaMind do not offer trading or investment advice and do not take responsibility for any investment or trading actions or decisions taken by clients or any observers of our material in any form of media, either now or in future.

Editors’ Picks

EUR/USD extends recovery beyond 1.0400 amid Wall Street's turnaround

EUR/USD extends its recovery beyond 1.0400, helped by the better performance of Wall Street and softer-than-anticipated United States PCE inflation. Profit-taking ahead of the winter holidays also takes its toll.

GBP/USD nears 1.2600 on renewed USD weakness

GBP/USD extends its rebound from multi-month lows and approaches 1.2600. The US Dollar stays on the back foot after softer-than-expected PCE inflation data, helping the pair edge higher. Nevertheless, GBP/USD remains on track to end the week in negative territory.

Gold rises above $2,620 as US yields edge lower

Gold extends its daily rebound and trades above $2,620 on Friday. The benchmark 10-year US Treasury bond yield declines toward 4.5% following the PCE inflation data for November, helping XAU/USD stretch higher in the American session.

Bitcoin crashes to $96,000, altcoins bleed: Top trades for sidelined buyers

Bitcoin (BTC) slipped under the $100,000 milestone and touched the $96,000 level briefly on Friday, a sharp decline that has also hit hard prices of other altcoins and particularly meme coins.

Bank of England stays on hold, but a dovish front is building

Bank of England rates were maintained at 4.75% today, in line with expectations. However, the 6-3 vote split sent a moderately dovish signal to markets, prompting some dovish repricing and a weaker pound. We remain more dovish than market pricing for 2025.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

Discover how to make money in forex is easy if you know how the bankers trade!

5 Forex News Events You Need To Know

In the fast moving world of currency markets, it is extremely important for new traders to know the list of important forex news...

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and...

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.