The arch-nemesis of the directional trader?

Efficiency. Periods when all known information is reflected in the price. It's unlikely price will move meaningfully to profit from.

The trouble is, without an awareness of when market efficiency falters, most traders are firing shots in the dark, hoping to catch these lucrative trades.

However, their shots are aimless. Catching a 'one-way traffic' trade is mostly a matter of luck and doesn't compensate for the losses incurred for missing. Hence the saying, "You win some—you lose more."

Instead, you're looking for the rare occasion when market efficiency breaks—resembling a broken ATM spitting out a continuous stream of 100-dollar bills to those who know what to look for—a frenzy of aggressive buying or selling activity that dominates the market. Described as a 'strong move', price is 'one-way traffic' only.

But here's the kicker

Market opportunities frequently resemble the deceptive tactics of chess. Often, the winner purposely disguises the outcome (checkmate) by allowing the opponent 'small victories'—taking a bishop, knight, pawns, or rook (castle)—on the journey to their ultimate demise.

Like chess, the element of surprise is the catalyst for the outcome—checkmate in chess, broken ATM in trading.

I refer to the period leading up to the broken ATM trade erupting as 'before the outcome is known'.

It's a critical part of your strategy because if you wait until the outcome has taken place, you'll miss out. Make sense?

It requires knowing the deceptive moves and which market participants will fall for them. As Michael Marcus, who turned 30K into 80M, said, "Successful trading is anticipating the anticipations of others."

Once you're aware deceptive tactics have ensnared enough competitors to fuel the broken ATM trade, the next challenge is knowing the exact timing of the trade erupting.

It's a challenge because you're not pulling the strings; you'll ride along on the coattails.

Take Monday

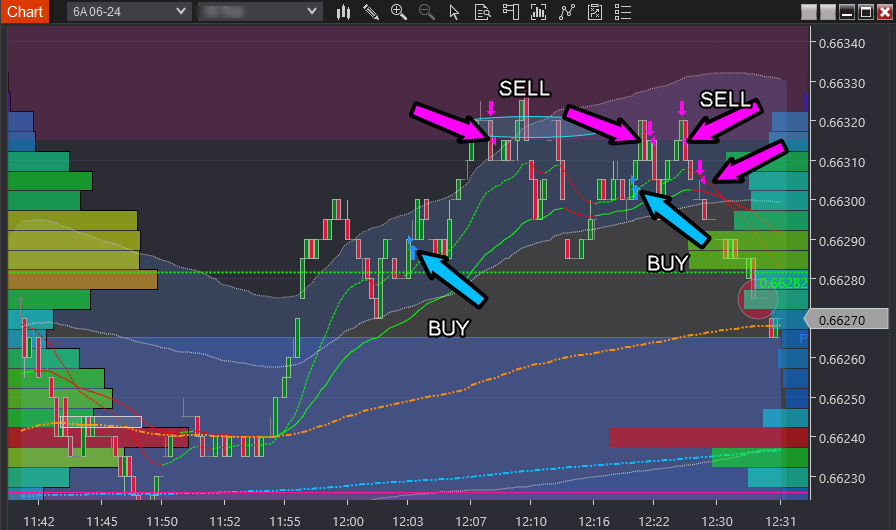

The first attempts to enter a trade to erupt to the upside were in vain. You can see the buy entries and subsequent exits in the chart below.

What happens next?

They highlight the need for precision and timing skills. The reason to exit is not a 'gut feel'; it's market evidence-driven. But without these skills, trades are entered only to quash hopes and dreams as the price moves further and further against you until you're facing an outsized loss. Sound familiar?

What do you know about it being by design?

If too many of us try to ride the coattails, the market will flush many out. Why? Because this business is about the majority paying the minority. Like poker, there's no such thing as an even distribution of winnings in trading. Correct?

Shortly after the above trades, the market moved significantly lower, and hangers-on were washed out of the market for a loss.

One of the 'easiest' trading edges is outlasting the competition. But it's only accessible if you know how the game works. If not, you fall victim to what I refer to as the 'time-trap'.

The broken ATM trades occurred hours later. The last of which was 6 hours after the initial trade above.

The reason for showing one of the trades is to illustrate how the price was one-way traffic, an example of when trading takes on the appearance of seeming effortless.

Notice in both charts the buying was in the same pricing area?

If held, the first attempt would have resulted in an epic fail (and loss), while the second time was successful. As mentioned, this is by design.

Why else do broken ATM trades transform your trading?

I've already touched on it: Winnings aren't evenly distributed—the majority pay for the few to win.

When you shift your focus to broken ATM trades, you join the prosperous few and remove yourself from the majority who are net losers.

It's a powerful reason to focus on inefficiency in the market. Agree?

Forex and derivatives trading is a highly competitive and often extremely fast-paced environment. It only rewards individuals who attain the required level of skill and expertise to compete. Past performance is not indicative of future results. There is a substantial risk of loss to unskilled and inexperienced players. The high degree of leverage can work against you as well as for you. Before deciding to trade any such leveraged products you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with trading on margin, and seek advice from an independent

Editors’ Picks

EUR/USD holds on to intraday gains after upbeat US data

EUR/USD remains in positive ground on Friday, as profit-taking hit the US Dollar ahead of the weekend. Still, Powell's hawkish shift and upbeat United States data keeps the Greenback on the bullish path.

GBP/USD pressured near weekly lows

GBP/USD failed to retain UK data-inspired gains and trades near its weekly low of 1.2629 heading into the weekend. The US Dollar resumes its advance after correcting extreme overbought conditions against major rivals.

Gold stabilizes after bouncing off 100-day moving average

Gold trades little changed on Friday, holding steady in the $2,560s after making a slight recovery from the two-month lows reached on the previous day. A stronger US Dollar continues to put pressure on Gold since it is mainly priced and traded in the US currency.

Bitcoin to 100k or pullback to 78k?

Bitcoin and Ethereum showed a modest recovery on Friday following Thursday's downturn, yet momentum indicators suggest continuing the decline as signs of bull exhaustion emerge. Ripple is approaching a key resistance level, with a potential rejection likely leading to a decline ahead.

Week ahead: Preliminary November PMIs to catch the market’s attention

With the dust from the US elections slowly settling down, the week is about to reach its end and we have a look at what next week’s calendar has in store for the markets. On the monetary front, a number of policymakers from various central banks are scheduled to speak.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

Discover how to make money in forex is easy if you know how the bankers trade!

5 Forex News Events You Need To Know

In the fast moving world of currency markets, it is extremely important for new traders to know the list of important forex news...

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and...

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.