- This article is co-authored by Geoff Trickey, Managing Director at Psychological Consultancy Ltd (PCL), and Steven Goldstein, Trader Performance Coach, Alpha R Cubed

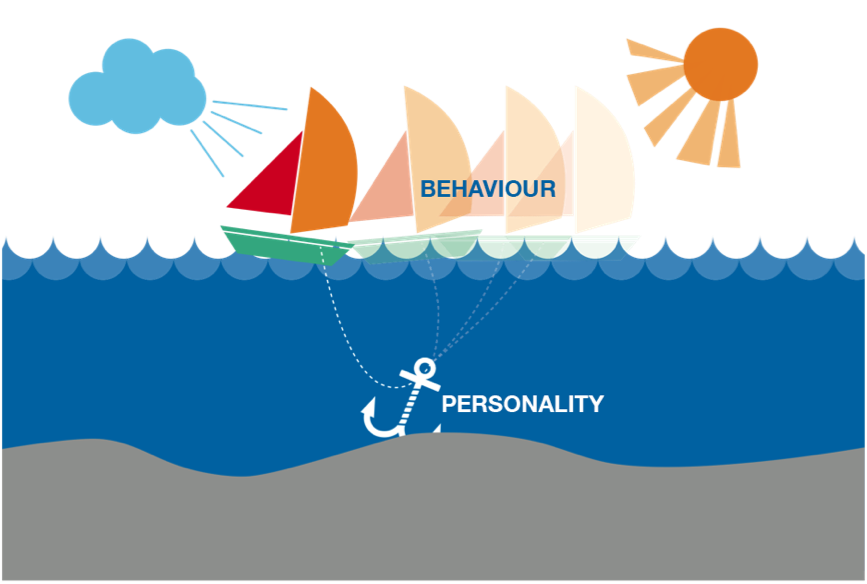

Let’s first draw on a powerful analogy. Consider a boat on the sea with its anchor down. The boat moves around on the surface as it gets pushed, pulled and buffeted by the tides, wind, and waves. However, there is a defined point around which these movements are constrained. This analogy parallels the relationship between Risk Type and behavior. Risk Type, like the anchor, has a persistent and continuous influence. In effect, a person's Risk Type establishes a consistent bias that influences all risk-related decisions.

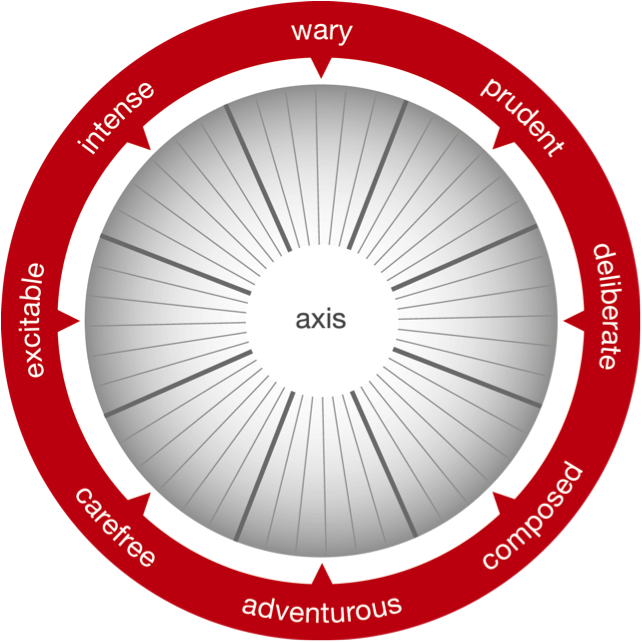

The mistake in the past has been to think of risk-taking behavior as something that falls somewhere on a scale between risk aversion and gung-ho recklessness. In fact, risk-taking relates to many different aspects of personality such as distractibility, impulsiveness, pessimism, uncertainty, over confidence, inflexibility, fearlessness, or a tendency to overreact or be unresponsive. These and many other risk-related characteristics from the personality domain have been factor analyzed and regrouped to build the Risk Type Compass.

The Risk Type Compass

The 'Risk Type Compass' helps people to gain deeper insights into their risk personality and how it impacts their decision-making in high-risk situations.

One pole on the Compass defines a personality disposition that is extremely alert to risk and emotionally aroused to action by it. If you are predisposed this way you are likely to be anxious, apprehensive, and fundamentally pessimistic so that anything unfamiliar or ambiguous will be perceived as a threat until proven otherwise. Your reaction to risk is visceral, strong, passionate, and expressed physically as high arousal and avoidance, more tuned for flight than for fight.

If you fall at the other pole of this first scale you would have opposite characteristics: an unusually high threshold for perceiving risk, an unemotional response to it, and a greater readiness to take risks. Your optimism leads to anticipation of positive outcomes, new possibilities, and opportunities. Consequently, you may be the last to appreciate the danger. Disappointments, upsets, or failures arouse little emotion, no regrets, disparagement, or remorse. Your willingness to take it down to the wire before bailing out will open doors to opportunities that would otherwise have been missed.

The second of the two bi-polar scales is concerned broadly with restraint at one end and impulsivity at the other.

The first pole is characterized by the need to understand, to make sense of things, and to prepare appropriate and suitable actions, carefully and in detail. If you are predisposed this way you will be reluctant to do anything until you see good reason to do so and unless you have a clear and well-prepared plan of action. You are likely to be conservative, conventional and respectful of tradition and would ideally organize risk out of the equation.

The opposite pole of this second scale is concerned with excitement seeking and impulsivity. If you score at this extreme you will be easily bored, preferring the new to the familiar and the unconventional to the traditional. Because you enjoy and embrace uncertainty you are more comfortable about doing things ‘on the fly’ than planning events carefully or in plenty of time. Restless and easily bored you seek action, welcome change, and may be frustrated by traditions and conventions that stand in your way.

The Risk Type Compass places people into one of eight different Risk Types based on their scores on these two underlying scales.

Risk Behavior Change Requires an Understanding of Risk Type

From a trading perspective, understanding your Risk Type helps you make sense of the positive and negative behaviors you display in your trading activities. For example, individuals identified as extreme ‘Wary’ types tend to be highly risk-averse. They are usually very detailed orientated and highly analytical, and are therefore more likely to succeed taking a tactical approach to trading. On the other-hand, Wary types may display high levels of anxiety and find ambiguity challenging.Diametrically opposed to the Wary type is the 'Adventurous’ type. These individuals have a high-risk tolerance and are more likely to succeed adopting a strategic perspective. They are comfortable holding risk without becoming too flustered. However, they lack detail orientation and can get caught out being over-confident and under-appreciating the level of risk they take.

What matters for success is not which Risk Type you are, but whether you apply yourself in the correct way for your Type. The most profitable trader assessed by Alpha R Cubed so far was an extreme version of the Wary type. This individual was from a large and very successful hedge fund. He was very anxious and nervous when trading yet he produced profits well in excess of $100 million over each of the past two years. His method, which is purely discretionary, plays very much to the strengths of his Wary characteristics.

The Risk Type Compass has many applications beyond improving trader and investment manager performance. It is increasingly being applied to help increase team, leadership, and management performance, as well as to support cultural initiatives and change projects in banks and investment firms. The tool is also being used with boards and strategic decision-makers by consultants and coaches, as well as in the world of high-performance sport.

While various factors influence our behavior, they are intermittent and will vary. We have goals and aspirations, as well as free will in dealing with an infinite variety of situations, but our risk-taking is anchored by personality dispositions that underpin our unique personal preferences and limits. Understanding your Risk Type helps you to maximize your strengths in your trading strategies rather than working against the tide of your natural risk disposition.

N/A

Editors’ Picks

AUD/USD gets ready to punch through 0.7100

The intense sell-off in the Greenback underpins the solid performance of the Aussie Dollar on Monday, motivating AUD/USD to add to recent gains while challenging the key 0.7100 barrier, or fresh YTD highs, at the same time.

EUR/USD extends its optimism past 1.1900

EUR/USD retains a firm underlying bid, surpassing the 1.1900 mark as the NA session draws to a close on Monday. The pair’s persistent uptrend comes as the US Dollar remains on the defensive, with traders staying cautious ahead of upcoming US NFP prints and CPI data.

Gold picks up pace, retargets $5,100

Gold gathers fresh steam, challenging daily highs en route to the $5,100 mark per troy ounce in the latter part of Monday’s session. The precious metal finds support from fresh signs of continued buying by the PBoC, while expectations that the Fed could lean more dovish also collaborate with the uptick.

XRP struggles around $1.40 despite institutional inflows

Ripple (XRP) is extending its intraday decline to around $1.40 at the time of writing on Monday amid growing pressure from the retail market and risk-off sentiment that continues to keep investors on the sidelines.

Japanese PM Takaichi nabs unprecedented victory – US data eyed this week

I do not think I would be exaggerating to say that Japanese Prime Minister Sanae Takaichi’s snap general election gamble paid off over the weekend – and then some. This secured the Liberal Democratic Party (LDP) an unprecedented mandate just three months into her tenure.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a Chief trader its second knowledge how to extract cash out of the market.

5 Forex News Events You Need To Know

In the fast moving world of currency markets where huge moves can seemingly come from nowhere, it is extremely important for new traders to learn about the various economic indicators and forex news events and releases that shape the markets. Indeed, quickly getting a handle on which data to look out for, what it means, and how to trade it can see new traders quickly become far more profitable and sets up the road to long term success.

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and selling pressure. Chart patterns have a proven track-record, and traders use them to identify continuation or reversal signals, to open positions and identify price targets.

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

The challenge: Timing the market and trader psychology

Successful trading often comes down to timing – entering and exiting trades at the right moments. Yet timing the market is notoriously difficult, largely because human psychology can derail even the best plans. Two powerful emotions in particular – fear and greed – tend to drive trading decisions off course.