What Is “Theta” In Options?

When you are BUYING options, time decay in options can suck the life out of you.

But when you are SELLING options, you should forget everything you learned about time decay, because now suddenly THETA is your best friend!

In this article, I’ll show you 3 amazing facts about time decay in options.

Let’s review: In my last article Short Selling Put Options, I talked about Option Premium. And we talked about “real value” and “time value.”

If you need a refresher on this concept, check out the last article that I did on “option premium.”

In a nutshell:

If an option is out of the money, then there’s no “real value” in this option, and the premium you see on your trading platform is only TIME value.

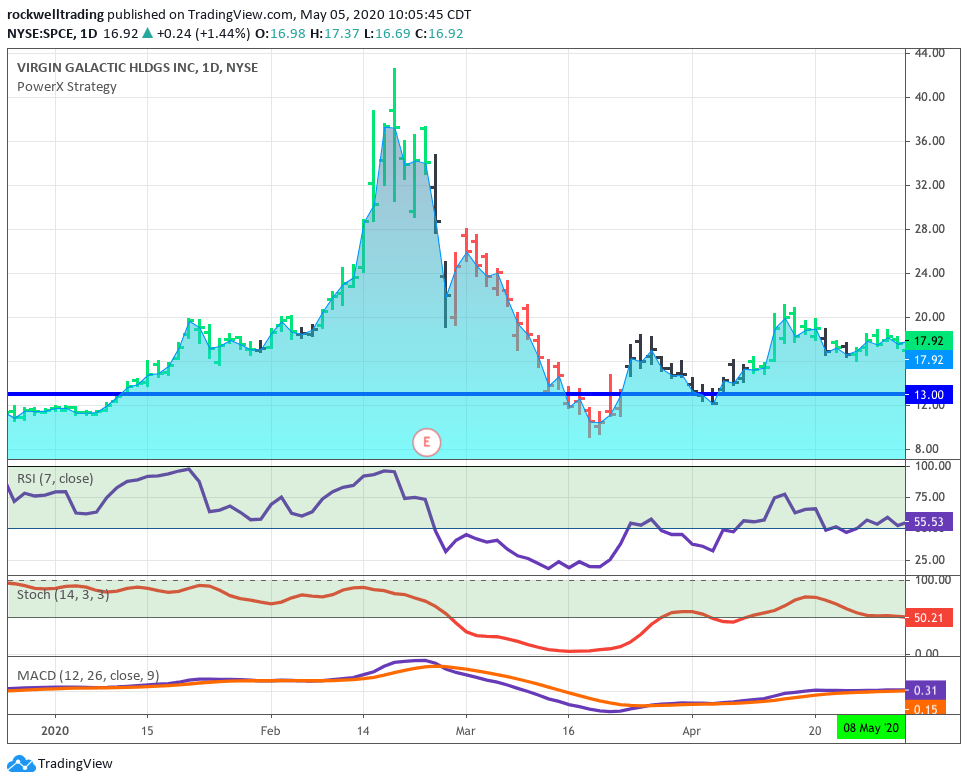

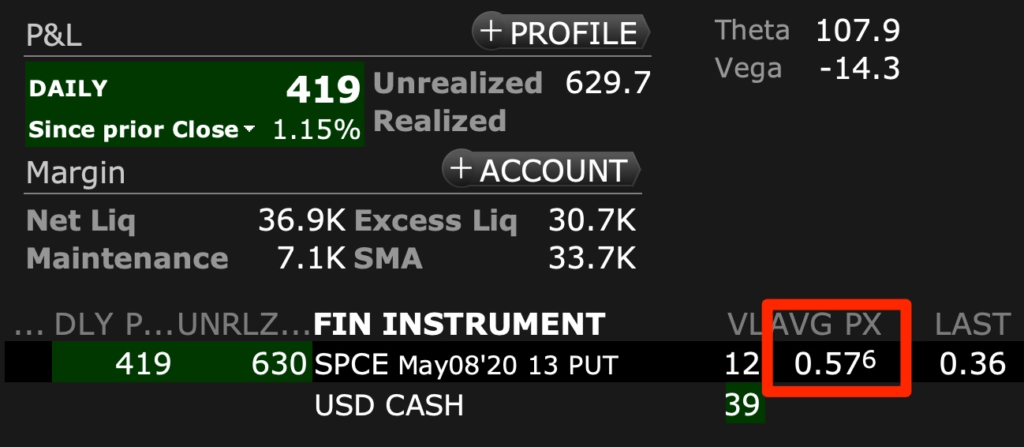

So let’s take a look at a very specific example. THIS is a trade that I currently have in my account: SPCE.

Right now, the stock is trading at 17.71.

So let’s talk about the PUT option that I traded:

A PUT option means that you are allowed to SELL the stock at a certain strike price.

I traded the 13 PUT, which means that somebody who owns the put option is allowed to sell it at $13.00:

Right now, the price of SPCE is at 17.71. So why would anybody exercise the option and sell the stock for $13, if you can sell it right now for more than $4.5 higher at 17.71?

It doesn’t make sense, right? So there’s no “real value” in this option UNLESS the price drops below $13.

This means, that the price the option is trading for right now is only “time value.” (see last article on options premium)

So let’s take a look at the option price right now:

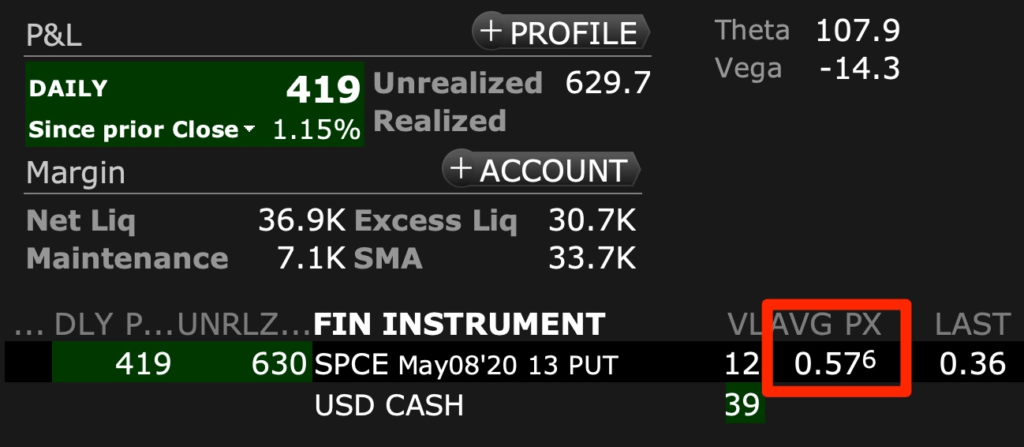

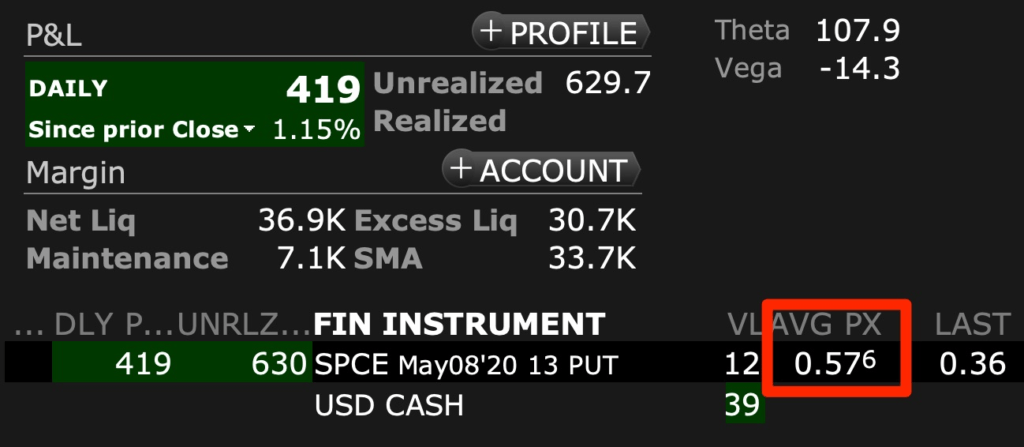

The 13 PUT Option with an expiration of May 8 is trading at $0.35 x $0.37, so let’s use the midpoint: $0.36.

Options are trading in “100 packs,” so this means that there’s $36 in time value in this option.

What Is “Theta” In Options?

Theta shows you how much the option loses in time value per day.

As you can see in the image above, right now, the Theta of the 13 Put for May 8 is 4.6 cents.

And since options are trading in 100 packs, this translates into a so-called “time decay” of $4.60 per day.

Here are 3 Amazing Facts About Time Decay In Options

Fact 1: It’s the ONLY thing that’s guaranteed:

Every day, the time value of an option is getting smaller.

This is also called “time decay in options.”

As you know, usually there’s NOTHING guaranteed when it comes to trading, but time decay is!

This is GREAT when we’re selling options, and that’s what I like to do right now — since the markets are still crazy!

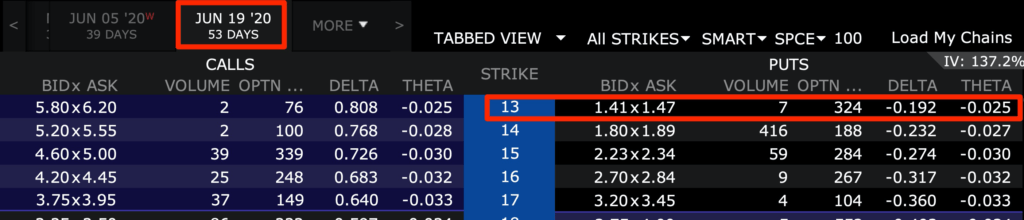

Fact 2: The sooner the option expires, the higher the time decay!

The “theta” of the 13 Put that expires on May 8th with 11 days to expiration is 4.6 cents.

Take a look at this:

The theta of the 13 Put that expires on May 15th with 18 days to expiration is only 4 cents.

And the Theta of the 13 Put that expires on June 19th with 53 days to expiration is only 2.5 cents.

This is important, because here’s what this means:

- If you are an options BUYER, then time decay is your enemy! So as a buyer, you want to choose MORE days to expiration so that Time Decay doesn’t hit you.

- If you are an options SELLER, then time decay is your friend! So as a seller, you want to choose as few days to expiration as possible.

Fact 3: Since time decay decreases every day, you can make money even if the stock does NOT do what you want!

Let’s talk about my trade:

I was SELLING the 13 Put. This means that I want the stock price to stay ABOVE 13. Ideally, I want the stock price to go up.

I sold this Put Option on April 20th, when the stock price was at $19.0.

And now it is trading at $17.71. This means that SPCE dropped almost 7%!

But here’s what happened: I sold this option for $0.58.

And right now, one week later, it’s trading at $0.36.

That’s a profit of $22 per option.

And since I traded 25 options, that a profit of $550:

So even though the stock did NOT do what it was supposed to do, I still made money.

SPCE was supposed to go up, but it went down by 7%, and I still made $550.

That’s why I love selling options during times of high volatility

Now you understand was theta in options is and how time decay in options work.

Trading Futures, options on futures and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. The lower the day trade margin, the higher the leverage and riskier the trade. Leverage can work for you as well as against you; it magnifies gains as well as losses. Past performance is not necessarily indicative of future results.

Editors’ Picks

US Dollar struggles as Trump tariff uncertainty grows

The US Dollar struggles to stay resilient against its rivals to start the new week as investors assess the headlines surrounding the US trade regime. After the Supreme Court ruled against US President Trump's tariffs, Trump announced that he will hike global tariff rates to 15%.

Gold advances to four-week highs, focus is on $5,200

Gold is holding onto its bullish tone on Monday, hovering near monthly highs well above the $5,100 mark per troy ounce. Fresh trade-war concerns, coupled with rising geopolitical tensions in the Middle East, are keeping demand for the yellow metal well on the rise.

EUR/USD regains balance, targets 1.1800

EUR/USD has lost a bit of momentum after its earlier push higher and is now attempting to reclaim the key 1.1800 barrier on Monday. In the meantime, investors remain focused on the evolving US–EU trade relationship after President Trump’s announcement of sweeping global tariff hikes.

Crypto Today: Bitcoin, Ethereum, XRP intensify sell-off as tariff uncertainty weighs

Bitcoin, Ethereum and Ripple are trading amid increasing selling pressure at the time of writing on Monday, as investors react to fresh trade uncertainty over US President Donald Trump’s push for more tariffs.

Supreme Court nixes tariffs, Trump teases 15% global tariff

On February 20th, the Supreme Court ruled that Trump’s global tariffs under IEEPA authority were unconstitutional, effectively nullifying the framework. However, the relief was short-lived. Within hours, Trump floated a 15% blanket tariff under an alternative legal authority.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a Chief trader its second knowledge how to extract cash out of the market.

5 Forex News Events You Need To Know

In the fast moving world of currency markets where huge moves can seemingly come from nowhere, it is extremely important for new traders to learn about the various economic indicators and forex news events and releases that shape the markets. Indeed, quickly getting a handle on which data to look out for, what it means, and how to trade it can see new traders quickly become far more profitable and sets up the road to long term success.

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and selling pressure. Chart patterns have a proven track-record, and traders use them to identify continuation or reversal signals, to open positions and identify price targets.

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

The challenge: Timing the market and trader psychology

Successful trading often comes down to timing – entering and exiting trades at the right moments. Yet timing the market is notoriously difficult, largely because human psychology can derail even the best plans. Two powerful emotions in particular – fear and greed – tend to drive trading decisions off course.