As the financial world embraces innovation, copy trading emerges as the latest transformative strategy, allowing traders to leverage the expertise of others for profitable outcomes. This article will be exploring the unique offerings of FTMO, IC Markets, and ECG Brokers, shedding light on how these platforms enable users to capitalize on the potential of copy trading and carve a path to financial success.

What Is Copy Trading?

Copy trading automates the replication of successful traders' actions. Investors choose providers based on performance. The investor's account mirrors the chosen trader's real-time actions, democratizing market access. It emphasizes transparency, risk management, and portfolio flexibility, allowing investors to monitor and adjust portfolios as needed.

ECG Brokers: Holistic Copy Trading Experience

Experience, Transparency, and Copy Trading

ECG Brokers, a paragon of experience and transparency, redefines the copy trading landscape as a comprehensive and client-centric brokerage firm. With over seven years in the industry, ECG Brokers provides an extensive range of trading instruments, including forex, commodities, indices, and cryptocurrencies. The commitment to regulatory compliance ensures a secure trading environment for users engaging in the dynamic realm of global financial markets.

Empowering Traders through Education and Support

Beyond conventional brokerage services, ECG Brokers places education and support at the core of its offerings. Collaborating with the Global Trade Academy, the platform provides traders with access to award-winning educational resources. Workshops and podcasts, facilitated by industry experts, trading coaches, and professional speakers, enhance the learning experiences of traders at every level, cultivating a community of informed and empowered traders ready for the challenges and opportunities of copy trading.

User-friendly Platform for Copy Trading Success

The user-friendly trading platform at ECG Brokers underscores the platform's commitment to a seamless copy trading experience. Engineered for efficiency, smooth operation, and rapid trading, the platform prioritizes secure fund segregation and compliance. It's not just about executing trades; it's about providing traders with confidence and peace of mind as they navigate the complexities of the financial markets through the powerful strategy of copy trading.

Holistic Copy Trading Journey

ECG Brokers offers a holistic approach that encompasses education, diverse trading opportunities, and unwavering client satisfaction. Whether you're a novice trader embarking on your copy trading journey or a seasoned professional seeking a reliable partner, ECG Brokers presents a compelling platform to meet your evolving trading needs and maximize profits by utilizing one of the most powerful tools in recent years, copy trading.

Check out the reviews on Trustpilot!

FTMO: Transforming Skills into Capital

Innovative Funding through FTMO Challenge

FTMO pioneers a distinctive approach, providing traders with a novel pathway to convert their trading skills into tangible capital. Through the FTMO Challenge, participants showcase their mastery in risk management and strategic execution. Unlike traditional brokers such as IC Markets, FTMO introduces a paradigm where traders seek not only market success but also validation to secure capital based on their simulated performance.

Simulated Success, Real-world Rewards

The FTMO journey emphasizes securing funding through simulated environments. This unique model sets FTMO apart, offering a fresh perspective on how traders can amplify their financial potential. By participating in the FTMO Challenge, traders not only refine their skills but also open doors to real-world capitalization on their demonstrated expertise.

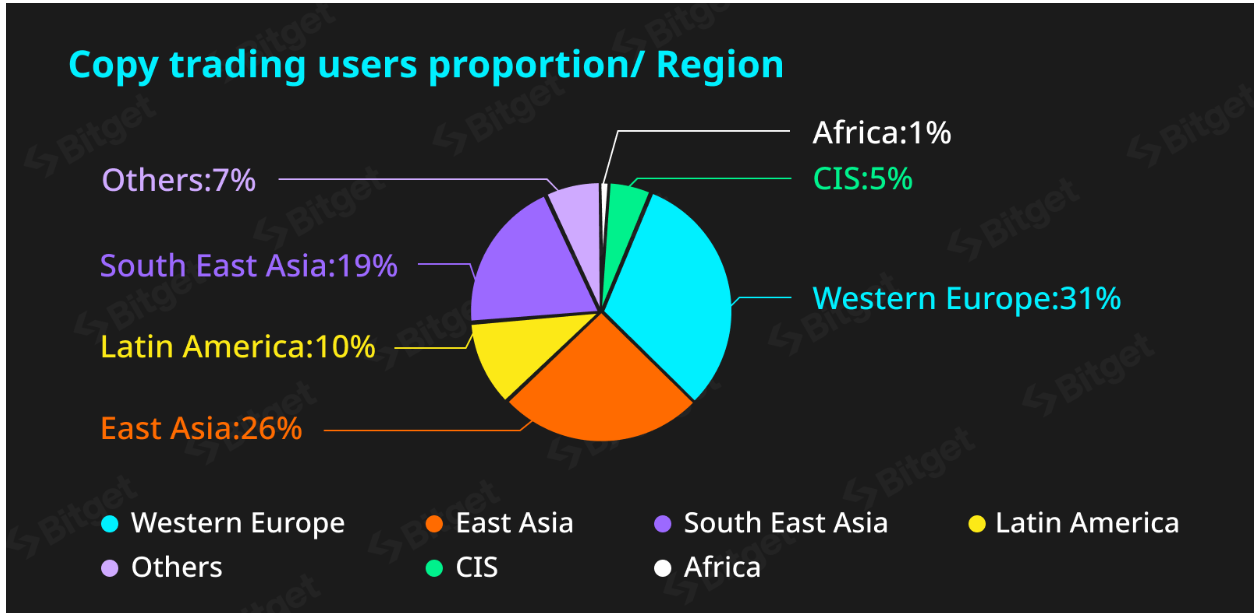

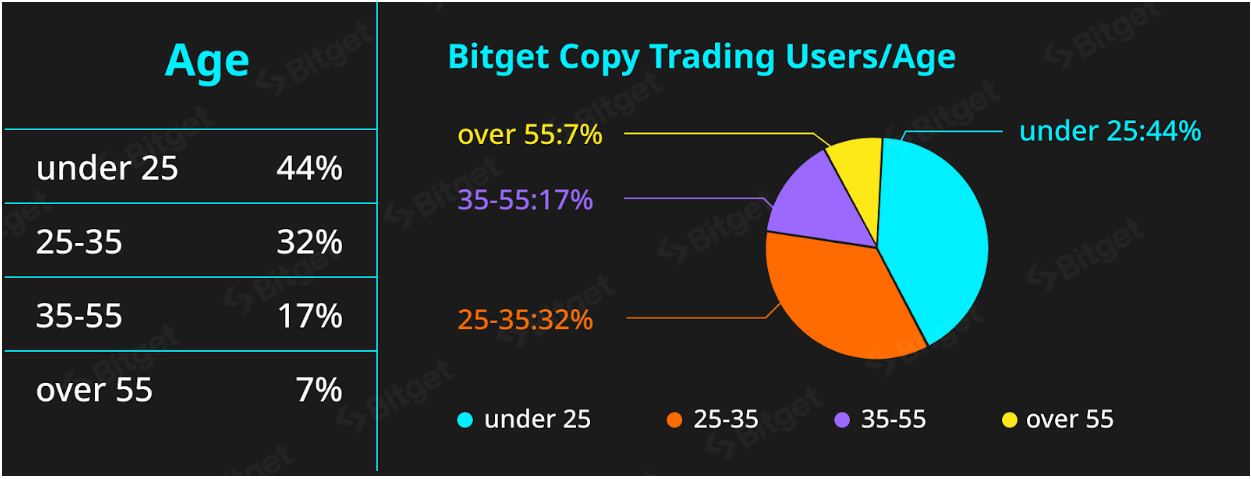

Source: Bitget

IC Markets: Harnessing Traditional Excellence for Copy Trading

Confident Navigation through Diverse Markets

IC Markets, a cornerstone in forex and CFD brokerage, melds traditional excellence with the innovative potential of copy trading. Renowned for low spreads, rapid execution, and a diverse array of trading instruments, IC Markets provides traders access to forex, commodities, indices, and cryptocurrencies. The platform caters to those seeking stability, diverse instruments, and efficient execution in their copy trading endeavors.

Regulated Stability for Copy Trading Success

Under ASIC regulation, IC Markets stands as a reliable choice for traders embracing the copy trading strategy. In an ever-evolving financial landscape, IC Markets continues to offer a steadfast foundation, ensuring traders can confidently explore diverse asset classes and maximize profits through copy trading.

Source: Bitget

Where Should You Begin Copy Trading?

Copy trading emerges as an incredible strategy for profit maximization, and each platform adds a unique layer to this ever-evolving landscape. FTMO's innovative funding model, IC Markets' stalwart presence in traditional brokerage with a copy trading twist, and ECG Brokers' holistic approach create a diverse tapestry, providing traders with a myriad of options to explore and profit from in their copy trading journey.

Given ECG Brokers’ investment into optimizing the user experience from all angles in conjunction with its vast library of trading tools, it could be the best experience for traders regardless of their expertise. ECG Brokers have simplified the process and with over 150 years of experience between their team, it comes as no surprise why people are using their trading platform.

Trading derivatives carries significant risks. It is not suitable for all investors and if you are a professional client, you could lose substantially more than your initial investment. When acquiring our derivative products, you have no entitlement, right or obligation to the underlying financial assets. Past performance is no indication of future performance and tax laws are subject to change. The information on this website is general in nature and doesnt take into account your personal objectives, financial circumstances, or needs. Accordingly, before acting on the advice, you should consider whether the advice is suitable for you having regard to your objectives, financial situation and needs. We encourage you to seek independent advice if necessary. Please read our legal documents and ensure that you fully understand the risks before you make any trading decisions. Regional Restrictions: We do not offer our services to residents of certain jurisdictions such as United States and to jurisdictions on the FATF and EU/UN sanctions lists. For more information please refer to our FAQ page.

Editors’ Picks

AUD/USD retargets 0.7100 ahead of RBA Minutes

AUD/USD keeps the slightly bid bias around 0.7070 ahead of the opening bell in Asia. Indeed, the pair reverses two daily pullbacks in a row, meeting some initial contention around 0.7050 while investors gear up for the release of the RBA Minutes early on Tuesday.

EUR/USD keeps the rangebound trade near 1.1850

EUR/USD is still under pressure, drifting back towards the 1.1850 area as Monday’s session draws to a close. The modest decline in spot comes as the US Dollar picks up a bit of support, while thin liquidity and muted volatility, thanks to the US market holiday, are exaggerating price swings and keeping trading conditions choppy.

Gold battle around $5,000 continues

Gold is giving back part of Friday’s sharp rebound, deflating below the key $5,000 mark per troy ounce as the new week gets underway. Modest gains in the US Dollar are keeping the metal in check, while thin trading conditions, due to the Presidents Day holiday in the US, are adding to the choppy and hesitant tone across markets.

AI Crypto Update: Bittensor eyes breakout as AI tokens falter

The artificial intelligence (AI) cryptocurrency segment is witnessing heightened volatility, with top tokens such as Near Protocol (NEAR) struggling to gain traction amid the persistent decline in January and February.

The week ahead: Key inflation readings and why the AI trade could be overdone

It is likely to be a quiet start to the week, with US markets closed on Monday for Presidents Day. European markets are higher across the board and gold is clinging to the $5,000 level after the tamer than expected CPI report in the US reduced haven flows to precious metals.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a Chief trader its second knowledge how to extract cash out of the market.

5 Forex News Events You Need To Know

In the fast moving world of currency markets where huge moves can seemingly come from nowhere, it is extremely important for new traders to learn about the various economic indicators and forex news events and releases that shape the markets. Indeed, quickly getting a handle on which data to look out for, what it means, and how to trade it can see new traders quickly become far more profitable and sets up the road to long term success.

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and selling pressure. Chart patterns have a proven track-record, and traders use them to identify continuation or reversal signals, to open positions and identify price targets.

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

The challenge: Timing the market and trader psychology

Successful trading often comes down to timing – entering and exiting trades at the right moments. Yet timing the market is notoriously difficult, largely because human psychology can derail even the best plans. Two powerful emotions in particular – fear and greed – tend to drive trading decisions off course.