A trader’s journey is typically a long and painful route. Usually, to survive through this process a trader must be very patient with their studying of the market and strategy but simultaneously understand the process and most importantly survive through the journal i.e. not get burnt out, emotionally and monetary.

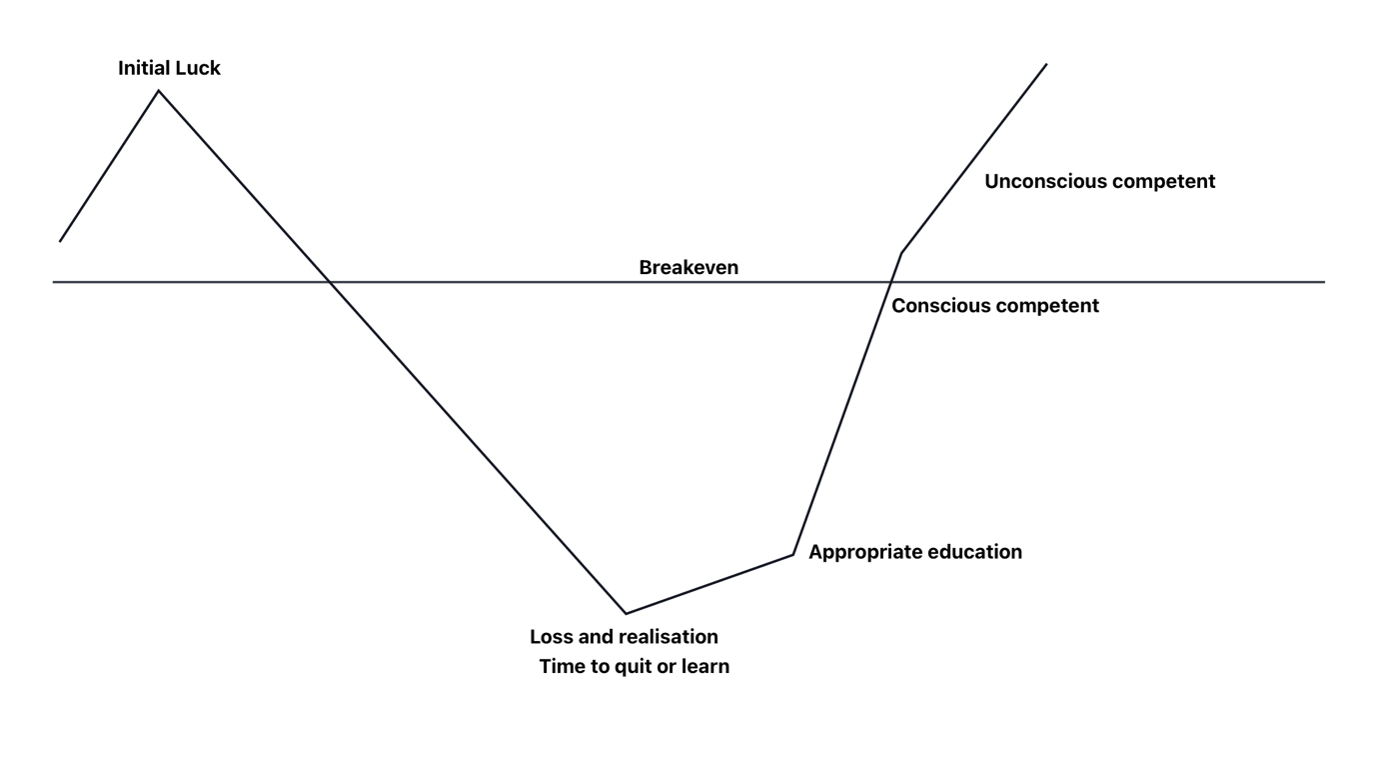

Here is a visual representation on how I see a trader’s journey:

Initial luck

When traders start, typically they do not want to learn and apply a strategy appropriately. They think they know what they are doing, make a bit of profit but this is purely based on luck. A trader without an edge and mature trading psychology. But the next step proves them a realization.

Loss and realisation

This is where they keep applying the same luck, but it eventually runs out the market tends to humble this trader at this stage. They either burn their account or realise that the market is not based on beginner’s luck. At this stage, it’s either a make it or break it. The trader either realises that this is not the game for them, or they stick to it and education themselves the right now. This means, by learning a strategy such as the Elliott Wave Theory and learning how to apply it to the market.

Appropriate education

This is the main and first stage to success. It sounds like common sense, but you would be surprised how this stage is highly ignored. Even those who are aware of this but not everyone is willing to do things properly without shortcuts. A trader must educate themselves by understanding the market, so you build an edge as an analyst like for example one of the most reputable strategies is the Elliott Wave Theory. However, this is not enough, as you are then just an analyst. In order to be a trader, i.e. capitalise from the financial markets, you must be able to have a trading strategy that you can apply to your analysis. Risk management is extremely crucial when it comes to managing positions and your portfolio. Finally, the most ignored, again it is to do with the human mind, trading psychology.

The human is not naturally engineered to be a successful trader therefore there is a whole process for you as an individual to go through prior to seeing any positive results. You could have FOMO, fear of entering the market, gambling tendencies, greedy or lack confidence. Even one of them can jeopardise your account.

Here are Elliott Wave Forecast, we have courses conduct by not only successful but professional analysts and traders you can start that stage here: Educational Products

Conscious competent

You consciously know what you need to do but it is not in auto-pilot mode. Therefore, you have to work a little extra hard to get things right, but the end result is good. This is where you are reaching breakeven. You make mistakes but you rectify them.

Unconscious competent

Analysis and trading are second nature to you. You are confident with making decisions and you are very sensible with your emotions. You pull the trigger at the right time and know when to get out at the right time.

Losses do not affect you as you know this is part of the business! And you have understood the market and your positions really well. You do not marry your positions and you adjust to the market accordingly. This trader sounds boring as he or she does not work on luck but instead on logic, intelligence, and experience.

FURTHER DISCLOSURES AND DISCLAIMER CONCERNING RISK, RESPONSIBILITY AND LIABILITY Trading in the Foreign Exchange market is a challenging opportunity where above average returns are available for educated and experienced investors who are willing to take above average risk. However, before deciding to participate in Foreign Exchange (FX) trading, you should carefully consider your investment objectives, level of xperience and risk appetite. Do not invest or trade capital you cannot afford to lose. EME PROCESSING AND CONSULTING, LLC, THEIR REPRESENTATIVES, AND ANYONE WORKING FOR OR WITHIN WWW.ELLIOTTWAVE- FORECAST.COM is not responsible for any loss from any form of distributed advice, signal, analysis, or content. Again, we fully DISCLOSE to the Subscriber base that the Service as a whole, the individual Parties, Representatives, or owners shall not be liable to any and all Subscribers for any losses or damages as a result of any action taken by the Subscriber from any trade idea or signal posted on the website(s) distributed through any form of social-media, email, the website, and/or any other electronic, written, verbal, or future form of communication . All analysis, trading signals, trading recommendations, all charts, communicated interpretations of the wave counts, and all content from any media form produced by www.Elliottwave-forecast.com and/or the Representatives are solely the opinions and best efforts of the respective author(s). In general Forex instruments are highly leveraged, and traders can lose some or all of their initial margin funds. All content provided by www.Elliottwave-forecast.com is expressed in good faith and is intended to help Subscribers succeed in the marketplace, but it is never guaranteed. There is no “holy grail” to trading or forecasting the market and we are wrong sometimes like everyone else. Please understand and accept the risk involved when making any trading and/or investment decision. UNDERSTAND that all the content we provide is protected through copyright of EME PROCESSING AND CONSULTING, LLC. It is illegal to disseminate in any form of communication any part or all of our proprietary information without specific authorization. UNDERSTAND that you also agree to not allow persons that are not PAID SUBSCRIBERS to view any of the content not released publicly. IF YOU ARE FOUND TO BE IN VIOLATION OF THESE RESTRICTIONS you or your firm (as the Subscriber) will be charged fully with no discount for one year subscription to our Premium Plus Plan at $1,799.88 for EACH person or firm who received any of our content illegally through the respected intermediary’s (Subscriber in violation of terms) channel(s) of communication.

Editors’ Picks

EUR/USD bounces off lows, back to 1.1860

EUR/USD now manages to regain some balance, retesting the 1.1860-1.1870 band after bottoming out near 1.1830 following the US NFP data on Wednesday. The pair, in the meantime, remains on the defensive amid fresh upside traction surrounding the US Dollar.

GBP/USD rebounds to 1.3660, USD loses momentum

GBP/USD trades with decent gains in the 1.3660 region, regaining composure following the post-NFP knee-jerk toward the 1.3600 zone on Wednesday. Cable, in the meantime, should now shift its attention to key UK data due on Thursday, including preliminary GDP gauges.

Gold stays bid, still below $5,100

Gold keeps the bid tone well in place on Wednesday, retargeting the $5,100 zone per troy ounce on the back of humble gains in the US Dollar and firm US Treasury yields across the curve. Moving forward, the yellow metal’s next test will come from the release of US CPI figures on Friday.

Ripple Price Forecast: XRP sell-side pressure intensifies despite surge in addresses transacting on-chain

Ripple (XRP) is edging lower around $1.36 at the time of writing on Wednesday, weighed down by low retail interest and macroeconomic uncertainty, which is accelerating risk-off sentiment.

US jobs data surprises to the upside, boosts stocks but pushes back Fed rate cut expectations

This was an unusual payrolls report for two reasons. Firstly, because it was released on Wednesday, and secondly, because it included the 2025 revisions alongside the January NFP figure.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a Chief trader its second knowledge how to extract cash out of the market.

5 Forex News Events You Need To Know

In the fast moving world of currency markets where huge moves can seemingly come from nowhere, it is extremely important for new traders to learn about the various economic indicators and forex news events and releases that shape the markets. Indeed, quickly getting a handle on which data to look out for, what it means, and how to trade it can see new traders quickly become far more profitable and sets up the road to long term success.

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and selling pressure. Chart patterns have a proven track-record, and traders use them to identify continuation or reversal signals, to open positions and identify price targets.

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

The challenge: Timing the market and trader psychology

Successful trading often comes down to timing – entering and exiting trades at the right moments. Yet timing the market is notoriously difficult, largely because human psychology can derail even the best plans. Two powerful emotions in particular – fear and greed – tend to drive trading decisions off course.