Over the long haul, the stock market has been a great investment, and it will likely continue to be. But its path is far from smooth. At times, it can be downright scary. Gut-wrenching volatility and ominous headlines can cause even seasoned investors to abandon stocks, which can derail a well-thought-out investment plan. That's why it's important to plan for the market's inevitable downturns before they happen.

The most effective way to reduce investment risk is to adopt a more conservative asset allocation. But many investors have a more aggressive asset allocation than they should (given their risk tolerance) because the stock market's returns are too tempting to give up, and it's easy to overestimate comfort with risk in an extended bull market.

A disciplined trend-following strategy can help investors who bite off more risk than they can chew. Trend-following is a momentum strategy that can be used to time exposure to an investment, based on the idea that an investment's (recent) past returns can help predict its (near-term) future returns. For example, a simple trend-following strategy may hold a stock index fund when its return over the past year is positive and sell it when its return is negative.

Trend-following can help cut risk while capturing most of the market's returns. That seems too good to be true, particularly for a market-timing strategy, but it has been undeniably effective.

Why It Works

Trend-following works because poor returns tend to cluster, and the strategy moves to cash before things get really bad. This clustering of poor returns arises partially because bad news tends to cluster. For example, a slowing economy can weigh on earnings and increase pressure to cut costs, leading to layoffs, higher unemployment, and weaker consumer demand, which may further depress future earnings. Rising economic risk can scare investors, pushing stock prices down further.

Investors can be slow to react to new information, causing market prices to adjust more slowly than they should. That's particularly true with respect to bad news because most investors are unwilling or unable to short stocks, and many investors buy the dips, viewing price declines as buying opportunities, even when the fundamentals have changed. These slow price adjustments mean that recent market losses may serve as an early warning sign that a downturn may be looming. Trend-following capitalizes on this by moving to the sidelines before the pain increases.

This strategy helps most during severe market downturns. But it can register some false positives, prompting a move to cash when market volatility picks up and short-lived declines are followed by better returns. This can cause trend-following to lag during extended market rallies. Yet, it has historically offered a more favorable risk/reward trade-off than a simple buy-and-hold approach and will likely continue to do so over the long term.

Historical Evidence

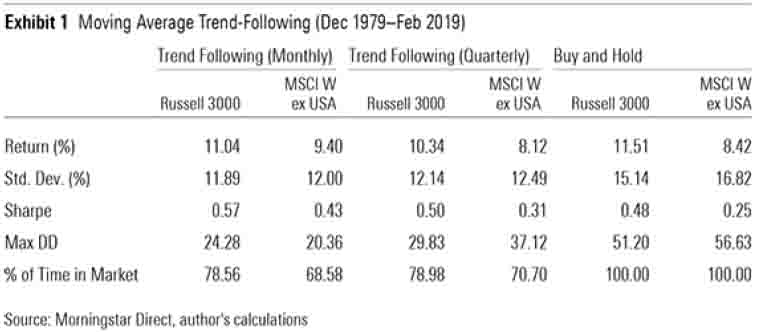

Despite its simplicity, trend-following is a robust tool for risk management. To illustrate, I created a simple trend-following strategy with the Russell 3000 and MSCI World ex USA indexes. Every month, I compared each index's current value with its average month-end value over the past 12 months. If the current index value exceeded its average over the past 12 months, the strategy held that index for the next month. If it fell below the average, it held one-month Treasury bills. I also ran a version of this strategy that updated only once per quarter. The results are shown in Exhibit 1.

This trend-following strategy was remarkably effective for both indexes, though it worked better with monthly rebalancing. Trend-following reduced volatility and losses, leading to better risk-adjusted performance (as measured by Sharpe ratio). Most importantly from a risk-management perspective, the trend-following strategies cut the maximum drawdowns of investing in stocks by more than half. This metric measures the cumulative losses that investors would experience if they had the worst timing possible.

Among U.S. stocks, trend-following (updated monthly) reduced returns only slightly compared with a buy-and-hold approach. That's better than expected. Even in bad times, stocks should always offer higher expected returns than T-bills, otherwise, no one would take the risk of owning them. So, trend-following strategies should post somewhat lower returns than the market. Yet, this strategy held U.S. stocks 78.6% of the time but captured 95.9% of the Russell 3000 Index's returns.

The strategy worked even better among international stocks, earning higher returns than the MSCI World ex USA Index despite holding stocks only 68.6% of the time. And it led to an even larger reduction in the maximum drawdown.

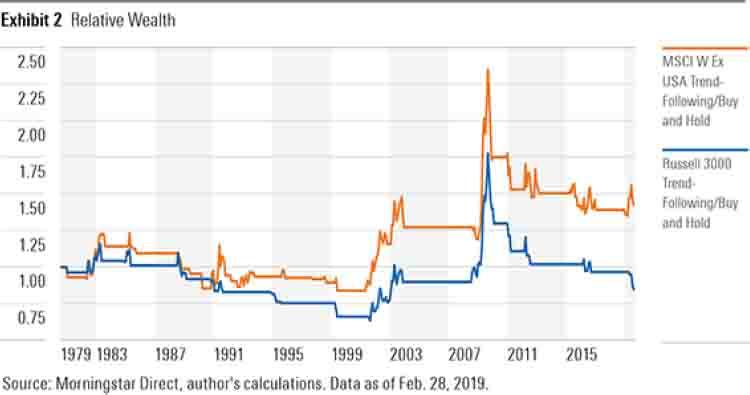

Performance won't always be this strong. Trend-following can lag the market by significant margins over long spans, as Exhibit 2 shows. (This chart illustrates the value of an investment in the monthly trend-following strategy compared with a buy-and-hold investment in each index.) But the good news is that underperformance tends to happen when the market is going up, and the strategy largely makes up for it by offering better protection.

Robustness Check

The success of this strategy isn't a fluke. It works with other signals. For example, in place of using the moving average, the strategy would have also been effective by simply holding the stock index if its return over the past year were positive and T-bills if it were negative. This signal is highly correlated with the moving-average signal, but there is no reason to expect one to work better than the other.

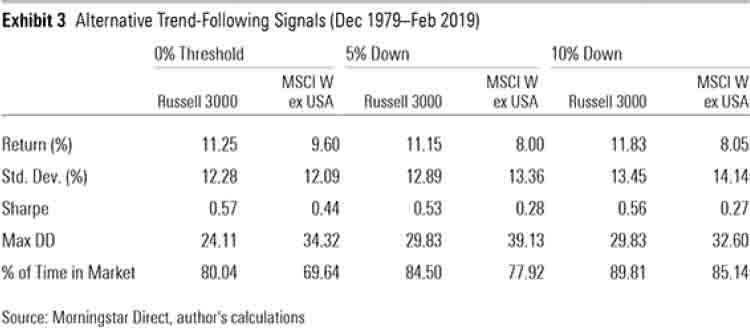

There are other decision thresholds this strategy could use. For instance, a less-conservative trend-following strategy might wait until an investment has a 5% or 10% loss before switching into T-bills. These lower return thresholds keep the strategy invested in stocks longer, which should slightly increase returns and risk, but they should still move to the sidelines before severe losses set in. Exhibit 3 shows the performance of these alternative versions of trend-following applied to the Russell 3000 and MSCI World ex USA indexes, updated monthly. Whichever signal the strategy uses, it's best to update it once a month because it becomes less effective with longer holding periods.

As expected, all three versions of the strategy offered better downside protection and better riskadjusted performance than the buy-and-hold investments in the indexes. The risk reduction was the greatest when the strategy moved to T-bills if the index's return over the past year was less than 0%. The returns for the U.S. trend-following strategy were slightly higher with the 10% loss threshold, but it was surprising that the returns for the international strategy didn't improve with the lower thresholds.

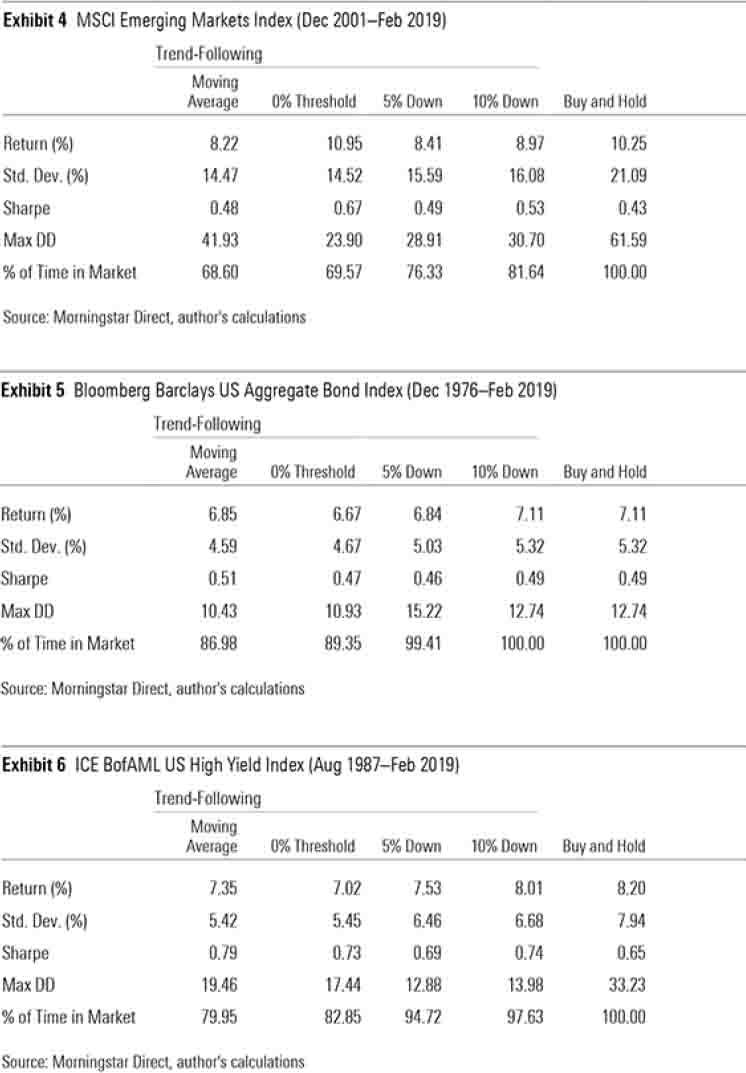

Trend-following also works in other markets. I applied all four versions of the strategy (updated monthly) to the MSCI Emerging Markets, Bloomberg Barclays U.S. Aggregate Bond, and ICE BofAML U.S. High Yield Bond indexes using the full available history of each index. The results are shown in Exhibits 4–6.

In all three markets, trend-following reduced volatility. However, these strategies were more effective for the riskier emerging-markets stock and high-yield bond indexes than they were for the relatively tame investment-grade aggregate bond index. This suggests that the strategy is more appropriate for risky assets like stocks and high-yield bonds than for low-risk investments because the downside protection it can offer makes a bigger difference there.

Caveats

While trend-following appears to be an effective risk-management strategy, it shouldn't be the first line of defense. There's no substitute as strong as adopting a conservative asset allocation if you have a low tolerance for risk.

To be successful with trend-following, it is necessary to have the discipline to follow the signal no matter what. If you don't, it's best not to do it at all. It's also important to be comfortable underperforming the market in extended rallies. Last, this strategy can create hefty tax bills, as it can trigger realized capital gains when it moves from stocks to T-bills. Consequently, it's most appropriate for tax-sheltered accounts.

Download The Full Weekly Market Commentary

WealthShield is a division of Emerald Investment Partners, an SEC Registered Investment Advisor. Advisory services are only offered to clients or prospective clients where WealthShield and it’s representatives are properly licensed or exempt from licensure. Past performance is no guarantee of future returns. Investing involves risk and possible loss of principal capital. No advice may be rendered by WealthShield unless a client service agreement is in place. Before investing, consider your investment objectives and WealthShield’s charges and expenses.

Editors’ Picks

EUR/USD: US Dollar to remain pressured until uncertainty fog dissipates Premium

The EUR/USD pair lost additional ground in the first week of February, settling at around 1.1820. The reversal lost momentum after the pair peaked at 1.2082 in January, its highest since mid-2021.

Gold: Volatility persists in commodity space Premium

After losing more than 8% to end the previous week, Gold (XAU/USD) remained under heavy selling pressure on Monday and dropped toward $4,400. Although XAU/USD staged a decisive rebound afterward, it failed to stabilize above $5,000.

GBP/USD: Pound Sterling tests key support ahead of a big week Premium

The Pound Sterling (GBP) changed course against the US Dollar (USD), with GBP/USD giving up nearly 200 pips in a dramatic correction.

Bitcoin: The worst may be behind us

Bitcoin (BTC) price recovers slightly, trading at $65,000 at the time of writing on Friday, after reaching a low of $60,000 during the early Asian trading session. The Crypto King remained under pressure so far this week, posting three consecutive weeks of losses exceeding 30%.

Three scenarios for Japanese Yen ahead of snap election Premium

The latest polls point to a dominant win for the ruling bloc at the upcoming Japanese snap election. The larger Sanae Takaichi’s mandate, the more investors fear faster implementation of tax cuts and spending plans.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a Chief trader its second knowledge how to extract cash out of the market.

5 Forex News Events You Need To Know

In the fast moving world of currency markets where huge moves can seemingly come from nowhere, it is extremely important for new traders to learn about the various economic indicators and forex news events and releases that shape the markets. Indeed, quickly getting a handle on which data to look out for, what it means, and how to trade it can see new traders quickly become far more profitable and sets up the road to long term success.

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and selling pressure. Chart patterns have a proven track-record, and traders use them to identify continuation or reversal signals, to open positions and identify price targets.

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

The challenge: Timing the market and trader psychology

Successful trading often comes down to timing – entering and exiting trades at the right moments. Yet timing the market is notoriously difficult, largely because human psychology can derail even the best plans. Two powerful emotions in particular – fear and greed – tend to drive trading decisions off course.