The Heikin-Ashi charts are one of the most visually simple chart types when it comes to determining trends. Of course, there are times when price action can get choppy, but it entirely depends on how you trade with Heikin-Ashi.

Due to the nature of the way the Heikin-Ashi candlesticks calculate price, trends are clearly visible. What this means for the trade is that it offers many opportunities to trade the markets.

In this Heikin-Ashi trading strategy, we look at a high/low breakout method. We will not go into the details of how the Heikin-Ashi candlestick depict price. But traders should know that the (Heikin-Ashi) candlesticks are not as straightforward compared to the classic candlesticks or bar charts.

The Heikin-Ashi high/low method

After you apply the Heikin-Ashi candlestick indicator on your trading platform, the first step is to look at a prevailing trend. You need to have at least 7 - 10 trending bars that are formed consecutively.

After you identify this pattern, the next step is to look for the high or the low.

In a downtrend, you should identify the lowest high (preferably with a wick). While in an uptrend, you should identify the highest low (preferably with a wick).

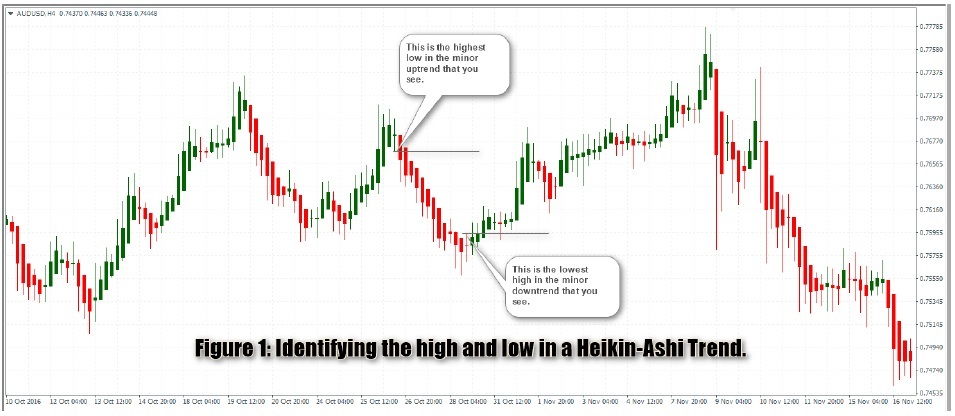

The first chart below illustrates this set up.

In Figure 1, we have two examples. In the first, you can see the higher low that is formed; this is our key market. In the second example, you can see the lowest high that is formed.

Mark this level with a horizontal tool.

To initiate a position, wait for a Heikin-Ashi candlestick to completely close above the lower high or below the highest low.

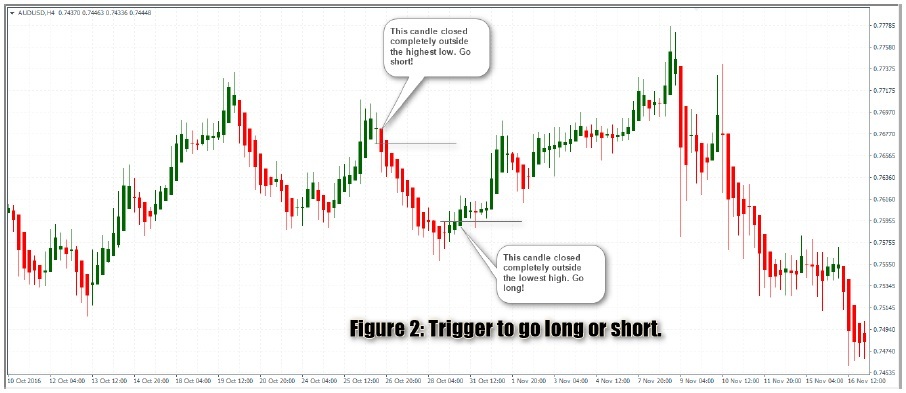

In Figure 2, you can see the long and short position examples.

The candles that are marked are the ones where you go long or short when the Heikin- Ashi candle closes completely outside the horizontal level.

Stops can be placed at the recent high or low that formed prior to the trigger.

For take profit, you can either book a fixed 1:2 risk/reward set up, or book profits at regular intervals by initiating multiple positions.

Trade Example: The Heikin-Ashi high/low method

In Figure 3, we have an example of a long position. Here, we first identified a strong downtrend. Following this, we mark the lowest high that was formed at 0.9934.

Two sessions later, we have a Heikin-Ashi candle that closes completely above this level. So, a long position is taken here with stops placed at the recent swing pivot low. This stop can later be adjusted as price moves in our favor.

The trade is then exited either after a certain number of pips depending on the timeframe this method is applied to or closed when you get an opposite signal. In the second instance, bear in mind that you will not always get an opposite signal and in some cases, price action could turn flat which can complicate a trade that has already banked some profits.

Therefore, some discretion needs to be applied as far as booking profits are concerned.

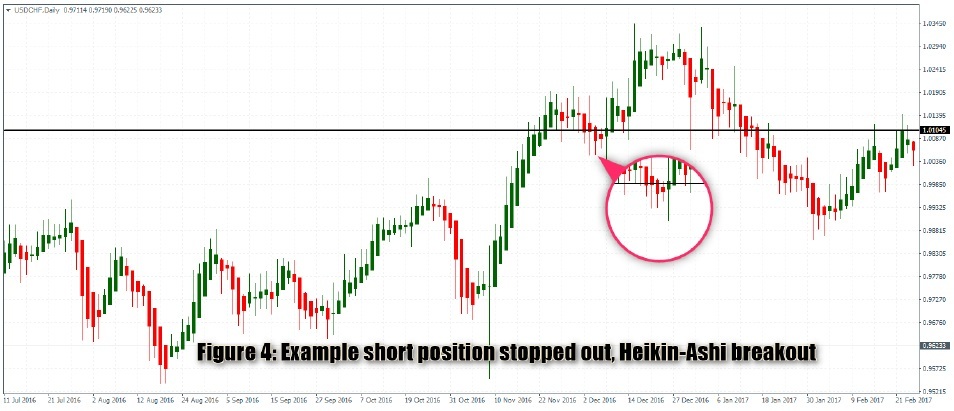

In Figure 4, we have an example of a short position that is stopped out.

In Figure 4, despite price breaking out from the highest low, price slips initially only to reverse the trend and continue to post a new higher high. This happens, and that is why the stops are placed at the recent swing high.

Figure 4 also illustrates the point that not all trades need to be taken. Rather trade only those Heikin-Ashi set ups where the risk and reward can justify taking the trade.

In conclusion, the Heikin-Ashi candlestick breakout method is very easy to trade. With a bit of practice, traders can also hone their skills in identifying what signals to filter and what signals to trade that can give them a good risk/reward ratio.

This market forecast is for general information only. It is not an investment advice or a solution to buy or sell securities.

Authors' opinions do not represent the ones of Orbex and its associates. Terms and Conditions and the Privacy Policy apply.

Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. Before deciding to trade foreign exchange, you should carefully consider your investment objectives, level of experience, and risk appetite. There is a possibility that you may sustain a loss of some or all of your investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Editors’ Picks

USD/JPY gathers strength to near 157.50 as Takaichi’s party wins snap elections

The USD/JPY pair attracts some buyers to around 157.45 during the early Asian session on Monday. The Japanese Yen weakens against the US Dollar after Japan’s ruling Liberal Democratic Party won an outright majority in Sunday’s lower house election, opening the door to more fiscal stimulus by Prime Minister Sanae Takaichi.

Gold jumps above $5,000 as China's gold buying drives demand

Gold price rises to near $5,035 during the early Asian session on Monday. The precious metal extends its recovery amid a weaker US Dollar and rising demand from central banks. The delayed release of the US employment report for January will be in the spotlight later on Wednesday.

AUD/USD: Buyers eyes 0.7050 amid upveat mood

AUD/USD builds on Friday's goodish rebound from sub-0.6900 levels and kicks off the new week on a positive note, with bulls awaiting a sustained move and acceptance above mid-0.7000s before placing fresh bets. The widening RBA-Fed divergence, along with the upbeat market mood, acts as a tailwind for the risk-sensitive Aussie amid some follow-through US Dollar selling for the second straight day.

Week ahead: US NFP and CPI data to shake Fed cut bets, Japan election looms

US NFP and CPI data awaited after Warsh’s nomination as Fed chief. Yen traders lock gaze on Sunday’s snap election. UK and Eurozone Q4 GDP data also on the agenda. China CPI and PPI could reveal more weakness in domestic demand.

Three scenarios for Japanese Yen ahead of snap election Premium

The latest polls point to a dominant win for the ruling bloc at the upcoming Japanese snap election. The larger Sanae Takaichi’s mandate, the more investors fear faster implementation of tax cuts and spending plans.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a Chief trader its second knowledge how to extract cash out of the market.

5 Forex News Events You Need To Know

In the fast moving world of currency markets where huge moves can seemingly come from nowhere, it is extremely important for new traders to learn about the various economic indicators and forex news events and releases that shape the markets. Indeed, quickly getting a handle on which data to look out for, what it means, and how to trade it can see new traders quickly become far more profitable and sets up the road to long term success.

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and selling pressure. Chart patterns have a proven track-record, and traders use them to identify continuation or reversal signals, to open positions and identify price targets.

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

The challenge: Timing the market and trader psychology

Successful trading often comes down to timing – entering and exiting trades at the right moments. Yet timing the market is notoriously difficult, largely because human psychology can derail even the best plans. Two powerful emotions in particular – fear and greed – tend to drive trading decisions off course.