USDT, aka Tether, is a highly liquid asset in the crypto market that is widely accepted in multiple exchanges and can be traded 24/7. It works like an exchange-traded fund (ETF), where the underlying asset is US Dollar; and it adopts a creation and redemption mechanism that allows trader to trade it at a premium or discount in the market. Today, we’re going to talk about the USDT discount and premium and trading strategies related to the USDT basis. We will use OKEx’s USDT linear and coin-margined inverse futures to replicate the USDT rate and arbitrage different future basis across different future tenures.

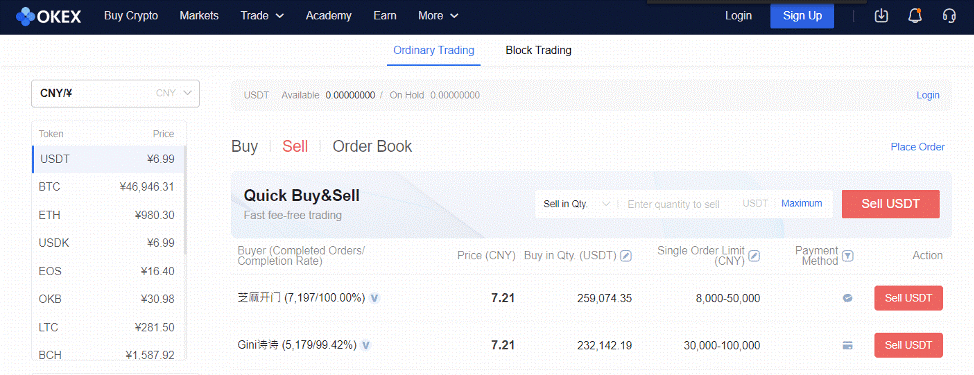

Source: OKEx Ordinary Trading

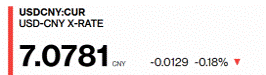

In the past few months, USDT has been trading at a premium in onshore China, while the offshore market was still trading efficiently at about 1:1. The onshore CNY rate is ~¥7.08 at the time of writing and it’s bidding at ¥7.21 on OKEx’s C2C USDT market. Essentially the market is inefficient because of capital restrictions, USDT is trading at about 2%-3% premium in China. This is not very “arb-able” unless you have some special setup. However, we should see some pent-up Chinese demand leading to market inefficiencies in other parts of the crypto market.

Source: Bloomberg

Source: In the offshore OKCoin USDT/USD market, the USDT premium is a lot more subdued and trading at a light premium

The asymmetry of holding USDT

One cannot talk about trading with USDT without first knowing Tether’s counterparty risks. Generally, as quant traders we try to minimize the counterparty risk. Although the risk of Tether blowing up is small, nonetheless it does exist, and the effects can be quite binary. In the past, we’ve seen USDT traded down to 0.9 USD and up to 1.05 USD too.

The upside of holding USDT is quite small, like traditional market ETFs, there is generally no restriction on creation. If USDT is trading at a premium, traders can quickly give Tether Limited (the manager) Dollar and get USDT to sell to the market and keep repeating this trade. Therefore the premium always stay small and only rarely above 0.5%, so we should take advantage when it is big.

But if Tether becomes illiquid and sees a bank run, a USDT will drop to $0 quickly. The permission granted by Tether to create or redeem is asymmetrical. Thus this payoff is very asymmetrical, your downside to holding Tether is 100% but your upside is very limited.

How to hedge USDT at OKEx

Quant traders try to minimize their Tether exposure by holding as little as possible or hedging its downside. Hedging is like eating vegetables, some of us do it because we know that we have to, but not because we want to. If you are holding USDT and want to earn some passive income, you can buy spot and sell rich inverse coin-margined futures (as discussed before in my other articles).

If futures are trading cheap, you can buy cheap linear futures and sell rich inverse futures. This gives you some positive carry from basis.

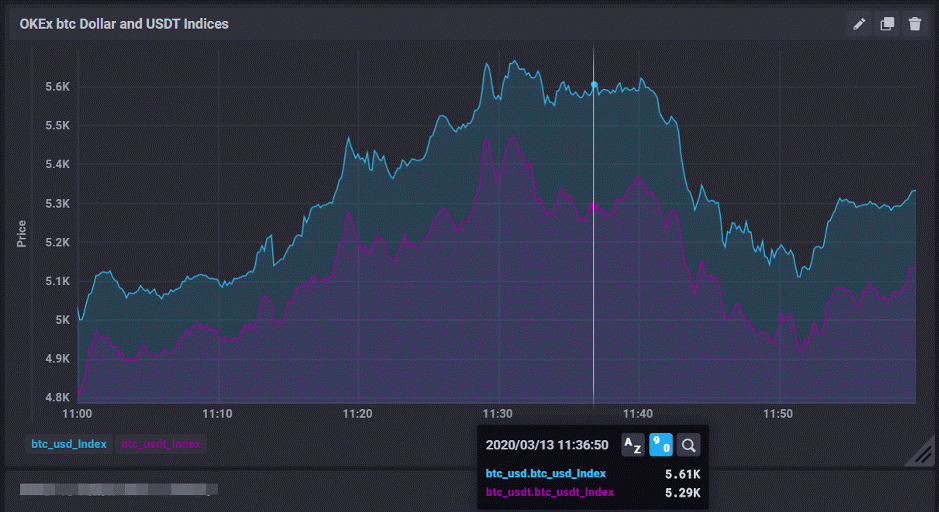

Implying USDT value from OKEx’s Indices and Buying USDT Reversal

On the morning of the March 13th turmoil, there was a rush to the safe haven (yes – Tether is a safe haven in crypto, because you can withdraw it into your own wallet). Using the BTC-USDT (5290USDT) and BTC-USD ($5590) indices, we can imply that USDT was trading at $1.05. If we believe USDT would fall back to parity (because of the asymmetrical factor as discussed above), we should sell Dollar index and buy Tether index to long dollar and short Tether.

Source: OKEx BTC Dollar and USDT Indices

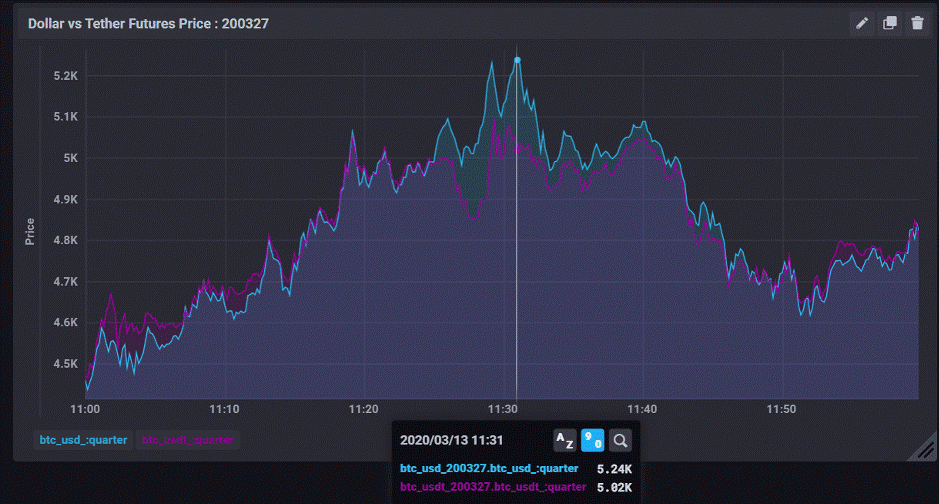

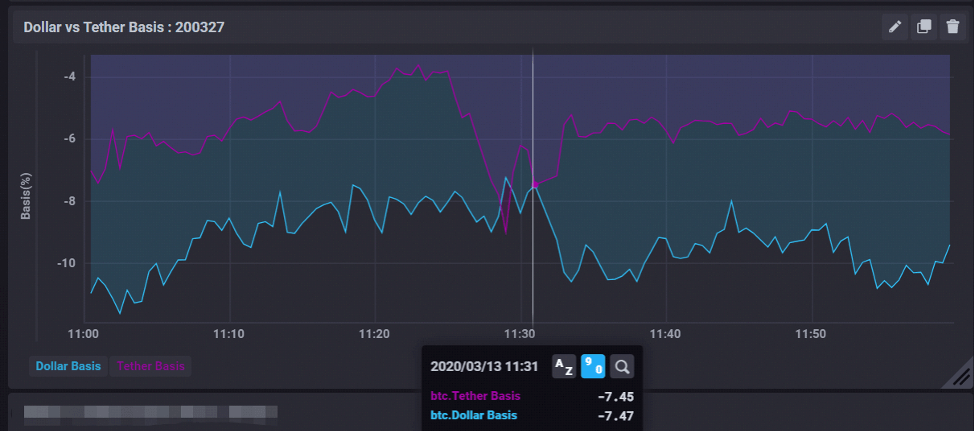

Most traders on the market are familiar with this strategy, thus the inverse dollar future was actually trading on par with the linear USDT future. As the Dollar index is higher by 5%, the basis was 5% cheaper for inverse futures because futures participants expect the USDT premium to be grinded away by expiry. At about 11:25, we finally see a disconnection, both dollar futures and swap traded at 4% above Tether prices. If you entered this position (at 2x leverage) of selling the inverse future and buying a linear future, you would have gain about 8% return in just 15 minutes.

Source: Dollar vs Tether Futures Prices (200327)

For example: You open position at 11:30:57 March 13 (assuming you have sufficient margin)

|

Side |

Instrument |

Price |

Quantity (Contracts) |

Delta |

|

Buy |

BTC-USDT-200327 |

T$5,020 |

10,000 |

1 BTC |

|

Sell |

BTC-USD-200327 |

$5,240 |

52 |

-0.9924 BTC |

If held during expiry on Mar 27 and taking the delivery price for BTC-USD-200327, which was $6725.42, for BTC-USDT-200327 which was T6703.4, your return would be around 0.032BTC (~214.76 USDT).

Source: Dollar vs Tether Basis (200327)

Your next question might be, given that I have to margin inverse futures with BTC, maybe I should just capture the inverse future’s negative -10% basis. As discussed in the nuances of index arb article, margining an inverse future during a reverse arbitrage trade is very capital intensive and because of its inverse pay off nature, it is hard to manage the margin.

What are the risks?

No article about arbitrage is complete without discussing the risks involved. Obviously, risks such as maintaining the margin, clawback, and counterparty risks are involved, but you should also take into consideration of the Tether risk. When we trade futures with different quote currencies, we are opening up to exposures in the quote currency even after hedging out the trade currency. In this case, trading any spread between inverse and linear futures will have created an artificial Tether or USDT position.

In general, we should skew toward shorting Tether (such as buying linear futures). Going short on USDT means that buying USDT linear futures or swaps or buying BTC with USDT. In the off chance that USDT crashes 50%, the BTC-USDT index will be double of the BTC-USD index and you can actually get doubled amount of USDT and in terms of Dollar, your P&L would still be flat.

Conclusion

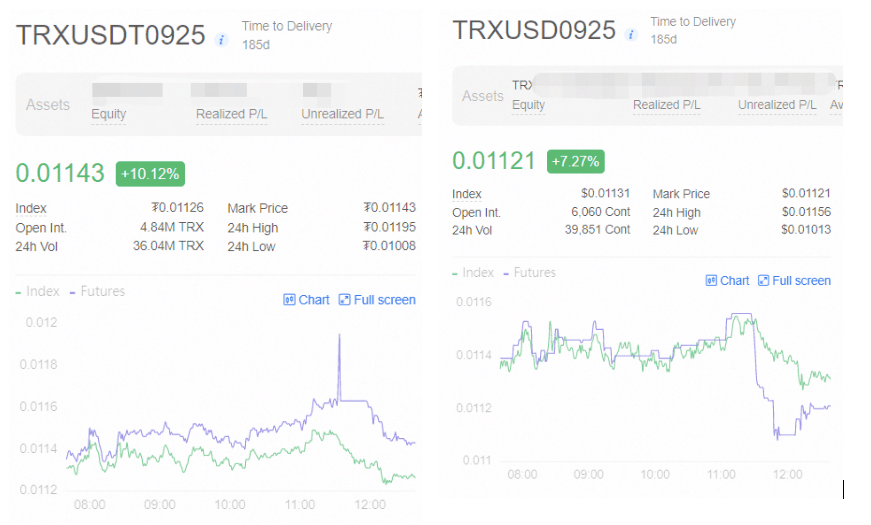

Given the market volatility, it is very easy for these futures to disconnect and arbitrage opportunities are often available to those who are always ready. By no means are these trading strategies easy or happen often, if it is highly profitable, they would only last for a short time, and are often guarded by bots – only when the bots are out of ammunition can traders feast on it. In this article, we explored an obvious example but there are countless little chances out there, such as this example below showing TRX 0925 (a less guarded future).

Source: TRXUSDT vs TRXUSD

This material should not be taken as the basis for making investment decisions, nor be construed as a recommendation to engage in investment transactions. Trading digital assets involves significant risk and can result in the loss of your invested capital. You should ensure that you fully understand the risk involved and take into consideration your level of experience, investment objectives and seek independent financial advice if necessary.

Editors’ Picks

EUR/USD Price Annual Forecast: Growth to displace central banks from the limelight in 2026 Premium

What a year! Donald Trump’s return to the United States (US) Presidency was no doubt what led financial markets throughout 2025. His not-always-unexpected or surprising decisions shaped investors’ sentiment, or better said, unprecedented uncertainty.

Gold Price Annual Forecast: 2026 could see new record-highs but a 2025-like rally is unlikely Premium

Gold hit multiple new record highs throughout 2025. Trade-war fears, geopolitical instability and monetary easing in major economies were the main drivers behind Gold’s rally.

GBP/USD Price Annual Forecast: Will 2026 be another bullish year for Pound Sterling? Premium

Having wrapped up 2025 on a positive note, the Pound Sterling (GBP) eyes another meaningful and upbeat year against the US Dollar (USD) at the start of 2026.

US Dollar Price Annual Forecast: 2026 set to be a year of transition, not capitulation Premium

The US Dollar (USD) enters the new year at a crossroads. After several years of sustained strength driven by US growth outperformance, aggressive Federal Reserve (Fed) tightening, and recurrent episodes of global risk aversion, the conditions that underpinned broad-based USD appreciation are beginning to erode, but not collapse.

Bitcoin Price Annual Forecast: BTC holds long-term bullish structure heading into 2026

Bitcoin (BTC) is wrapping up 2025 as one of its most eventful years, defined by unprecedented institutional participation, major regulatory developments, and extreme price volatility.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a Chief trader its second knowledge how to extract cash out of the market.

5 Forex News Events You Need To Know

In the fast moving world of currency markets where huge moves can seemingly come from nowhere, it is extremely important for new traders to learn about the various economic indicators and forex news events and releases that shape the markets. Indeed, quickly getting a handle on which data to look out for, what it means, and how to trade it can see new traders quickly become far more profitable and sets up the road to long term success.

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and selling pressure. Chart patterns have a proven track-record, and traders use them to identify continuation or reversal signals, to open positions and identify price targets.

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

The challenge: Timing the market and trader psychology

Successful trading often comes down to timing – entering and exiting trades at the right moments. Yet timing the market is notoriously difficult, largely because human psychology can derail even the best plans. Two powerful emotions in particular – fear and greed – tend to drive trading decisions off course.