A different topic for us to look at today as we await the outcome of the US elections. Around 15% of daily spot FX trading is executed by algorithms. So, what is an algorithm? It is an automated trading program that places a trade according to a pre-defined set of instructions. These algorithms have developed from very simple rule based mechanisms to more advanced strategies that respond to different market conditions.

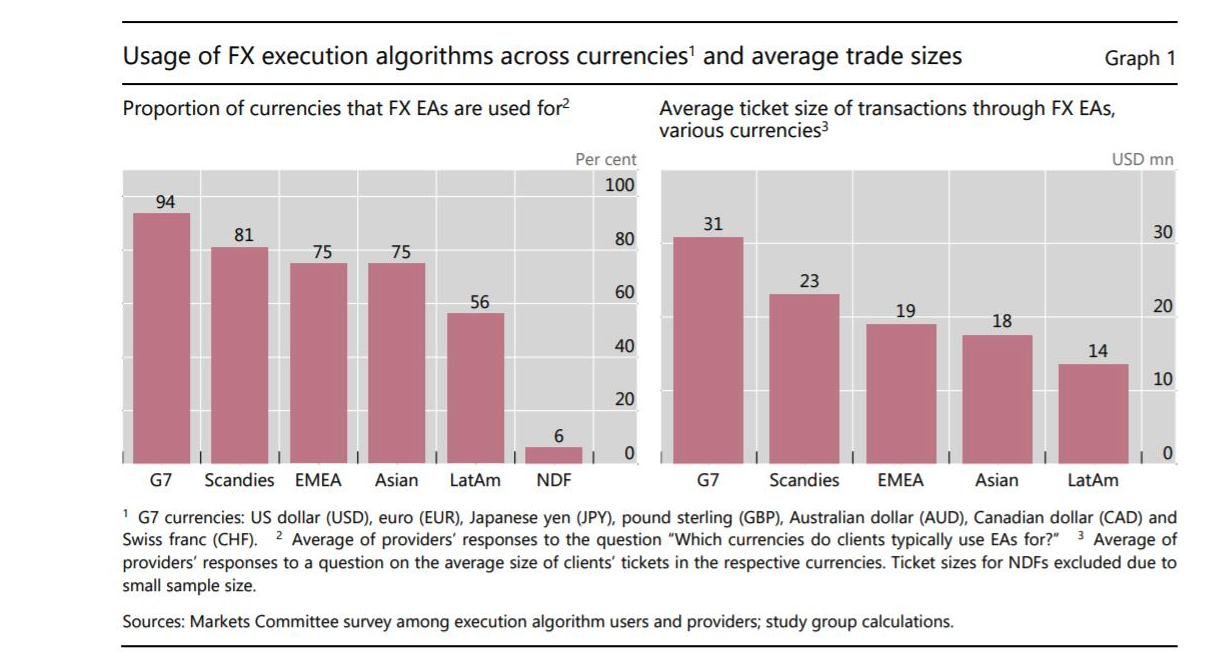

So, which are the main currencies are using EA’s?

In a Markets Committee survey where algorithm providers where asked which currencies EA’s were used with and what the size of the ticket was the following answered were given. Look at the results of the survey below. It is no surprise that around 94% of G7 currencies have clients using EA’s. This is for the major currencies like the USD, the EUR and the GBP etc. The average ticket size is around 31 million for this G7 block.

So, what are the consequences of using algorithms?

One hidden impact of their use has been a move towards market makers, often the bank, trying to match orders internally without passing them on to external venues. This trend has now raised some concerns with the Bank of International Settlements as if too much internal order sorting takes place then the quality of prices reported may be undermined. You could envisage a situation where the reported prices is not reflecting the true price. This could also cause the trading volumes on primary venues to drop. This matters because prices from primary trading venues such as Refinitiv and EBS are used as reference prices for other currency trading platforms and for bilateral trading.

Another impact to be aware of is the rise of ‘flash crashes’. These are sudden violent moves in markets and they appear to be accented by algorithmic trading. The most likely time for a flash crash is after the close of the US session and before the open of the Asian session, so this is something to be aware of if you are holding trades over that time.

Our products and commentary provides general advice that do not take into account your personal objectives, financial situation or needs. The content of this website must not be construed as personal advice.

Editors’ Picks

EUR/USD treads water above 1.1850 amid thin trading

EUR/USD stays defensive but holds 1.1850 amid quiet markets in the European hours on Monday. The US Dollar is struggling for direction due to thin liquidity conditions as US markets are closed in observance of Presidents' Day.

GBP/USD flat lines as traders await key UK and US macro data

GBP/USD kicks off a new week on a subdued note and oscillates in a narrow range near 1.365 in Monday's European trading. The mixed fundamental backdrop warrants some caution for aggressive traders as the market focus now shifts to this week's important releases from the UK and the US.

Gold slides below $5,000 amid USD uptick and positive risk tone; downside seems limited

Gold attracts fresh sellers at the start of a new week and reverses a part of Friday's strong move up of over $150 from sub-$4,900 levels. The commodity slides back below the $5,000 psychological mark during the Asian session, though the downside potential seems limited amid a combination of supporting factors.

Bitcoin, Ethereum and Ripple consolidate within key ranges as selling pressure eases

Bitcoin and Ethereum prices have been trading sideways within key ranges following the massive correction. Meanwhile, XRP recovers slightly, breaking above the key resistance zone. The top three cryptocurrencies hint at a potential short-term recovery, with momentum indicators showing fading bearish signs.

Global inflation watch: Signs of cooling services inflation

Realized inflation landed close to expectations in January, as negative base effects weighed on the annual rates. Remaining sticky inflation is largely explained by services, while tariff-driven goods inflation remains limited even in the US.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a Chief trader its second knowledge how to extract cash out of the market.

5 Forex News Events You Need To Know

In the fast moving world of currency markets where huge moves can seemingly come from nowhere, it is extremely important for new traders to learn about the various economic indicators and forex news events and releases that shape the markets. Indeed, quickly getting a handle on which data to look out for, what it means, and how to trade it can see new traders quickly become far more profitable and sets up the road to long term success.

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and selling pressure. Chart patterns have a proven track-record, and traders use them to identify continuation or reversal signals, to open positions and identify price targets.

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

The challenge: Timing the market and trader psychology

Successful trading often comes down to timing – entering and exiting trades at the right moments. Yet timing the market is notoriously difficult, largely because human psychology can derail even the best plans. Two powerful emotions in particular – fear and greed – tend to drive trading decisions off course.