The following concepts create a potent cocktail of high-octane fuel to radically propel a trader from the development phase into successful trader status.

As we dive in consider how many of these points are counterintuitive. It will help you deepen your understanding of the game.

Let's go!

Participation trumps economic data releases and outlook

My February 16th analysis article highlighted despite a bearish outpouring of sentiment and negative fundamentals, the Nasdaq was full-steam ahead to the upside because 'side-lined' buying fuel waiting for deployment was significant.

Since then, the economic outlook has deteriorated, and we've experienced a bank crisis.

But look at the chart below. Nasdaq up plus 20% 2023! But now look at the participation (COT report bottom chart). Can you see the net positions were short start of 2023 and remain so as of today?

Counterintuitive, isn't it?

You have the majority sitting on one side of the boat yet the boat topples the other way.

To make sense of it - remember the market punishes the majority and rewards the minority. Always.

Reward to risk is arbitrary and therefore a useless metric

Fact:

Professional traders don't think in terms of '4:1 reward-to-risk etc. - it's simplistic garbage.

Never was it a metric used in the professional firm I traded.

Instead truly understanding the trading game means you evaluate in terms of expected value - a dynamic measure that shifts as the market moves.

Expected value, a must-have trading skill

It's analogous to sports and poker.

If you've watched any of my previous live trading footage you'll most likely recall my references to 'expansion' as a cue to exit a trade.

When expansion occurs, the expected value is no longer positive. And you see me exit/take a portion of funds off the table.

But as a dynamic measure that moves with the market, expectancy also applies to your entry and the movement in value during the trade. It's always a factor.

Intraday trading offers the most edge, period

To gain further insight into why intraday trading offers the most edge, refer to my previous article The largest trades edges.

But note intraday trading can't be scaled to the size trading of Soros and Buffett. And the same goes for the 100 million dollar plus portfolio traders.

So you remove many champion traders from the game when you compete at the intraday level. This massively improves your chances of winning.

But as a competitive game, as soon as you step back to larger time horizons, you immediately increase the pool of competitors.

100% daily profit opportunity

You only have the opportunity to be profitable every-single-day when you trade intraday (day trade).

The only reason for day traders not to achieve a profitable day is self-inflicted. They may have made costly mistakes, including trading when the game exceeds their skill level.

And while it's not realistic to think you won't make mistakes, it doesn't change the fact that the opportunity is there.

Value underpins everything

I elaborate on the concept of value in this webinar.

Additionally when you've got a handle on relative value - you sit down at your screens, and the market is not a mystery.

To illustrate:

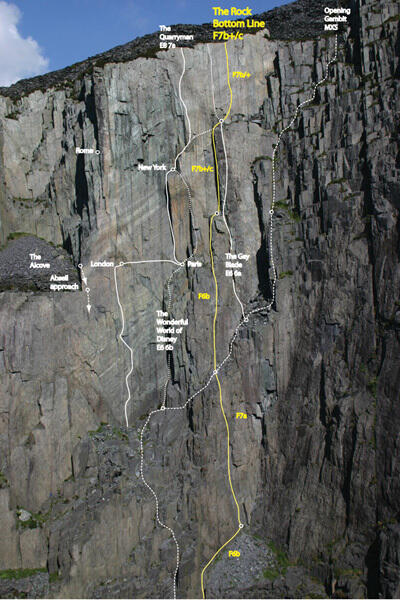

Imagine the experienced rock climber. Standing at the base of the climb - one look up, and it's clear what route to take.

As a trader there's no need to predict the direction. But once it makes its move, you know the route it can take - giving you a massive headstart on your competition

By acting early you can enter into a trade when the positive expectancy is at its greatest.

The playbook - not all movement is opportunity

Sticking with rock climbing:

The route you first mapped out might not be the fastest route. But it's going to be the route you can manage.

But fail to map out a route that matches your skills and you suddenly find yourself trapped in a precarious position.

Many traders dive into the deep end only to find themselves struggling to navigate market conditions beyond their abilities, ultimately suffocating under the pressure

Making it worse is not having intimate knowledge of conditions you can trade, leading to swinging the bat at everything that moves.

You give back all your profits from your winning trades and slide backwards because the market moves in many ways you can't navigate and adapt to. Agree?

A playbook is a catalogue of trades you can make. The challenge to the developing trader is it takes years to grow a rich playbook of trades that can take advantage of opportunities on a daily basis.

Without a playbook you act impulsively without the skills to harvest opportunities - even if you can foresee the move ahead of time. The result? You rack up losses.

Frustrated, you might have asked the question.

"How is this taking so long?" Correct?

The lack of awareness around the need for a playbook stems from not truly understanding "not all movement is opportunity".

That's why when you work at a trading firm or with a legitimate mentor - access to their playbook takes years off the development phase.

As one of the crowd I have those feelings and thoughts too

I recently illuminated seeing how others are trading to take advantage of their behavioural patterns.

Now watch what that look like in real-life.

Plus you'll see all of the concepts covered as applied in live trading.

But first:

Have you ever imagined how it would feel to lift the veil on trading and instantly cut through all the mystery and uncertainty surrounding it?

Try this:

As you watch the footage, imagine you're tuning in and replicating the same trade.

And ask yourself:

-

Do you feel safe making a live trade rather than anxious and fearful?

-

Do you feel confident in your trading decisions rather than second-guessing yourself?

-

Do you feel more in control of your emotions and impulses compared to when you are trading alone?

-

Do you feel more focused and engaged with the market rather than feeling overwhelmed or distracted?

-

Do you feel like you have a clear and concise trading strategy rather than feeling lost or unsure about your approach?

Experience everything above in real-life!

Forex and derivatives trading is a highly competitive and often extremely fast-paced environment. It only rewards individuals who attain the required level of skill and expertise to compete. Past performance is not indicative of future results. There is a substantial risk of loss to unskilled and inexperienced players. The high degree of leverage can work against you as well as for you. Before deciding to trade any such leveraged products you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with trading on margin, and seek advice from an independent

Editors’ Picks

USD/JPY tumbles below 156.00 on hawkish BoE-speak, risk-off mood

USD/JPY holds lower ground below 156.00 in the Asian session on Thursday, deep in the red amid hawkish BoE commentary, looming intervention fears and risk-off mood, which lend support to the Japanese Yen. The US Dollar remains on the back foot amid concerns about the fallout from Trump's trade policies, adding to the pair's downside.

AUD/USD grinds higher toward 0.7150 on weaker USD

AUD/USD picks up bids and grinds higher toward 0.7150 in the Asian session on Thursday. The pair eyes a three-year peak amid bets for another RBA rate hike in 2026, bolstered by the latest Australian consumer inflation figures. Moreover, a softer US Dollar acts as a tailwind for the Aussie, though trade uncertainties seem to limit the Aussie's upside.

Gold retakes $5,200 amid sustained haven demand, softer USD

Gold attracts some buyers for the second straight day as trade jitters and geopolitical tensions persist ahead of the US-Iran nuclear talks, which underpin demand for safe-haven assets. Additionally, a softer US Dollar further supports the bullion, though the underlying bullish sentiment could cap gains. Bulls might also opt to wait for acceptance above the $5,200 mark before positioning for any meaningful appreciating move.

UK financial watchdog advances stablecoin oversight as four firms pilot issuance

The Financial Conduct Authority in the United Kingdom is advancing toward the final stablecoin regulatory framework with a pilot program involving four companies, including Monee, Financial Technologies ReStabilise, Revolut and VVTX.

Nvidia delivers another monster earnings report, and forecasts big things to come

It was another monster earnings report from Nvidia for fiscal Q4. Revenues were $68.1bn, smashing estimates of $65bn. Gross profit margin was a healthy 75%, up from 73.5% in the prior quarter, and the outlook for this quarter was monstrous.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a Chief trader its second knowledge how to extract cash out of the market.

5 Forex News Events You Need To Know

In the fast moving world of currency markets where huge moves can seemingly come from nowhere, it is extremely important for new traders to learn about the various economic indicators and forex news events and releases that shape the markets. Indeed, quickly getting a handle on which data to look out for, what it means, and how to trade it can see new traders quickly become far more profitable and sets up the road to long term success.

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and selling pressure. Chart patterns have a proven track-record, and traders use them to identify continuation or reversal signals, to open positions and identify price targets.

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

The challenge: Timing the market and trader psychology

Successful trading often comes down to timing – entering and exiting trades at the right moments. Yet timing the market is notoriously difficult, largely because human psychology can derail even the best plans. Two powerful emotions in particular – fear and greed – tend to drive trading decisions off course.