Introduction

It's not easy to predict a market turn. But knowing how to do it is an important part of trading.

Being able to accurately predict a market turn can:

- Create big trades, at the point where new trends start

- Help you get out of trades that have gone bad

- Make you look cool at cocktail parties (LOL)

In this post I'll show you my favorite 7 ways to predict a market turn.

Method #1: Long-Term Divergence

My favorite method for predicting a market turn is to watch for divergence on the weekly and monthly charts.

Let's look at an example from the currency market, and then the stock market.

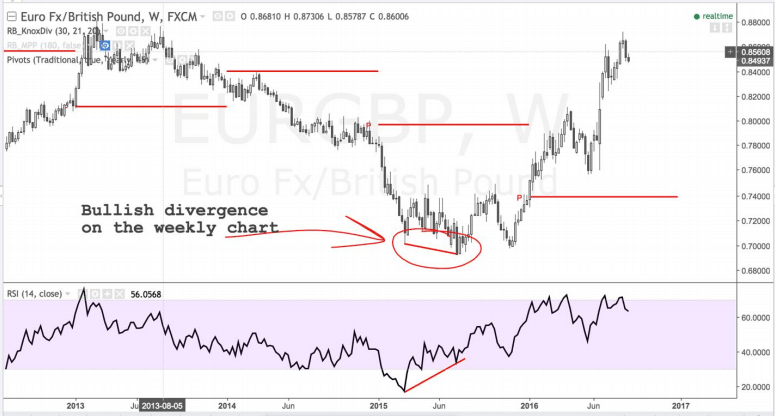

Here's a weekly chart of the currency pair EUR/GBP:

In June of 2015, the EUR/GBP was falling - but the Relative Strength Index was rising. 2 Traders were selling EUR/GBP, but the rate at which they were doing it had decreased. This was an early warning sign of a big reversal.

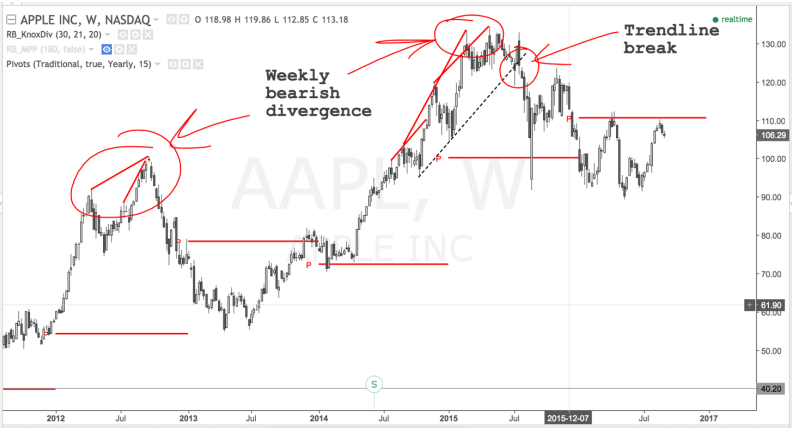

Now, let's look at Apple.

In this chart, I've removed the RSI from the bottom to make it easier to see the trades.

At point of the recent major reversal points for AAPL, weekly divergence showed up.

If we simply add a trendline to the chart - and wait for that trendline to break before the trade, we can catch huge moves lower.

Some Notes About Divergence: Divergence can be tricky. It shows up often on short-term charts, and that can create a lot of "false alarms." So when looking for major reversals, it's best to stay on the weekly - or even the monthly - charts.

Method #2: Multiple Missed Pivots

My favorite method for predicting a market turn is to look at missed pivots. Sometimes I lie awake at night and think about missed pivots. (Yes, I know I’m a weirdo).

A pivot point is an average price. A monthly pivot point is last month's high, low, and closing prices, added together, and then divided by three. Your charts can automatically calculate a monthly pivot.

A missed monthly pivot is not hit by price during the month that it is created.

The Rule: Watch for 2 or more missed monthly pivots in a row. Then wait for a trendline break or divergence to take the trade. Then let your friends wonder, "How did she see this turn in the market coming?"

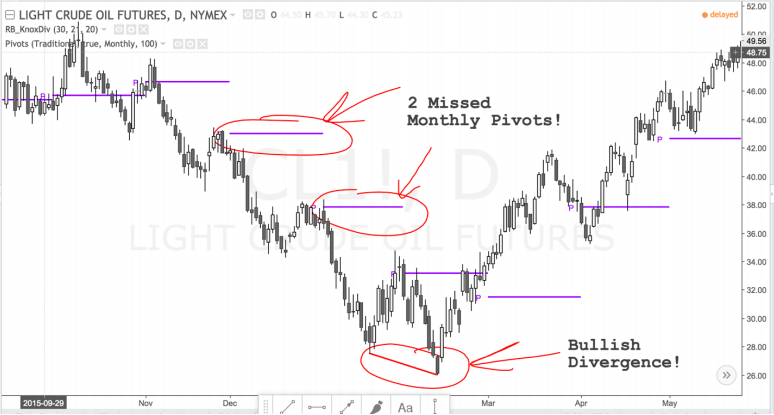

Oil gives us a perfect example:

In the example above, you can see that for two months, the price of oil did not touch its monthly pivot. (It's easy to know that a pivot is missed - no price is touching it during the month that it is created).

When price falls even farther, and then bullish divergence appears on the chart - it's time for a buy. Not surprisingly, this is when oil bottomed out in February of 2016. Socalled "experts" were calling for oil to drop even farther. They should have been looking at missed pivots.

Method #3: Yearly Pivots

You want to find huge market turns? Look at yearly pivots. Take what we've already learned above - to look for missed monthly pivots - and apply it yearly pivots. See the USD/JPY currency pair below:

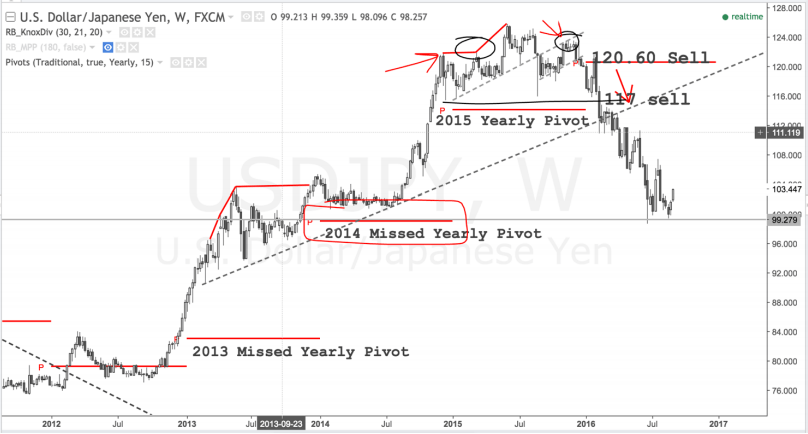

This is my chart from an actual trade, so there's lots of writing all over the place. I'll walk you through it step by step.

1. The USD/JPY missed its 2013, and 2014, and 2015 yearly pivots. This means that the bullish trend was so strong that price never hit the yearly pivots in the years they were created.

2. It would have been enough that 2 yearly pivots were missed, but in this case, 3 yearly pivots were missed! This is a huge deal and it's a massive reversal pattern!

3. Once bearish divergence formed, and the highest trendline was broken, it was time to start trading.

4. The target on the trade was the 2015 OR the 2014 yearly missed pivots - thousands of points below.

These trades don't come often, but when they do, they're awesome. These are the biggest trades of my life. I once made $164,000 on a trade on the GBP/CHF with this same method – but that’s a story for another time.

Here’s what to do, right now:

Take a look at any stock that's been moving in one direction for a long time, and missing yearly pivots. Facebook (FB) is doing this right now, and I’m planning a monster short on this stock for the 4th quarter of 2016.

If you find one of these, you’ve got giant trade on your hands. Facebook is doing this right now.

Method #4: Pin Bar on a Weekly/Monthly Chart

You want to find reversals INSIDE of a trend? So that you can take bigger and better trend trades?

Look at pin bars on the weekly (or monthly) charts.

A pin bar is a candle formation that has a longer-than-average wick, and a small body. I'll explain why they're so powerful and how they're formed in just a moment. They're easy to find once you start looking for them.

NOTE: I am not a pin bar expert. I’m not a pinball expert. Keep in mind, as you read further, that you might have a different definition for a pin bar. That’s ok.

Pin bars happen all the time on short term charts (like 5 minute or tick charts). They don’t appear frequently on weekly or monthly charts. But when they do appear, they're awesome trend-continuation patterns.

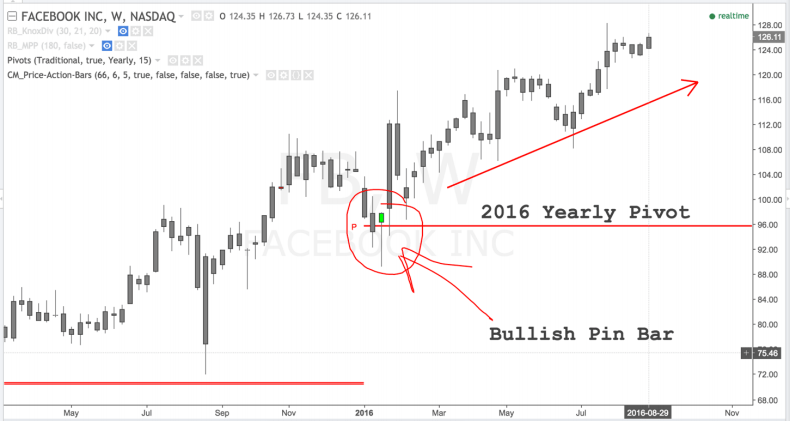

Here's a look at Facebook, on the weekly chart from January of 2016:

The green candle (circled above) is sending a massive alarm that the trend is about to continue.

1. Price dropped hard, but traders then bid the stock back up. This creates the long wick extending out the bottom. We could buy immediately on the completed formation of the pin bar and place a protective stop underneath the long wick.

2. The very next candle was a huge up move - this is further evidence that traders want to buy Facebook, not sell it. This gives us confidence that we've traded with 7 the flow of money, not against it.

3. The pin bar appears on top of the yearly pivot - this is (in my opinion) the absolute best way to trade a pin bar formation - right off a pivot, which acts as a springboard or launching pad for price.

Warning: Lots of traders argue about what constitutes a "true" pin bar. This sounds like the most boring argument in the world. I would rather shoot myself in the face than argue about pin bars. Here’s what I do to find them: I simply look for a candle with a long wick, much longer than recent wicks. And the wick must extend far outside of recent price action. And it must occur on top of or next to a long term pivot. That's all I care about.

Putting it All Together

Successful traders put multiple concepts together to create a personalized trading strategy.

Here's how you might approach trading major market reversals:

1. Pick a mix of 30-40 financial instruments from all market sectors and asset classes. You'll be looking at longer-term charts, so you'll need some energy, bonds, stocks, commodities, and currencies in the mix. ETFs can work great as proxies for commodities or stock sectors.

2. Pick a method you like, and stick with it. Maybe you like divergence + pivots. Great! Stay with it for at least six months or a year. Most traders change what they are doing so often, they never give a single method a chance to succeed.

3. Decide on a money management plan. I talk more about this in the course, but here's a short primer: Decide what your max risk will be on each trade, and place a protective stop on every trade, and never violate that stop-loss boundary. Then decide what amount of profit you'll target - and place a limit order to exit the trade at that price. Use a combination of break-even stops or trailing stops to protect your trade along the way.

Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Editors’ Picks

EUR/USD: US Dollar to remain pressured until uncertainty fog dissipates Premium

The EUR/USD pair lost additional ground in the first week of February, settling at around 1.1820. The reversal lost momentum after the pair peaked at 1.2082 in January, its highest since mid-2021.

Gold: Volatility persists in commodity space Premium

After losing more than 8% to end the previous week, Gold (XAU/USD) remained under heavy selling pressure on Monday and dropped toward $4,400. Although XAU/USD staged a decisive rebound afterward, it failed to stabilize above $5,000.

GBP/USD: Pound Sterling tests key support ahead of a big week Premium

The Pound Sterling (GBP) changed course against the US Dollar (USD), with GBP/USD giving up nearly 200 pips in a dramatic correction.

Bitcoin: The worst may be behind us

Bitcoin (BTC) price recovers slightly, trading at $65,000 at the time of writing on Friday, after reaching a low of $60,000 during the early Asian trading session. The Crypto King remained under pressure so far this week, posting three consecutive weeks of losses exceeding 30%.

Three scenarios for Japanese Yen ahead of snap election Premium

The latest polls point to a dominant win for the ruling bloc at the upcoming Japanese snap election. The larger Sanae Takaichi’s mandate, the more investors fear faster implementation of tax cuts and spending plans.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a Chief trader its second knowledge how to extract cash out of the market.

5 Forex News Events You Need To Know

In the fast moving world of currency markets where huge moves can seemingly come from nowhere, it is extremely important for new traders to learn about the various economic indicators and forex news events and releases that shape the markets. Indeed, quickly getting a handle on which data to look out for, what it means, and how to trade it can see new traders quickly become far more profitable and sets up the road to long term success.

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and selling pressure. Chart patterns have a proven track-record, and traders use them to identify continuation or reversal signals, to open positions and identify price targets.

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

The challenge: Timing the market and trader psychology

Successful trading often comes down to timing – entering and exiting trades at the right moments. Yet timing the market is notoriously difficult, largely because human psychology can derail even the best plans. Two powerful emotions in particular – fear and greed – tend to drive trading decisions off course.