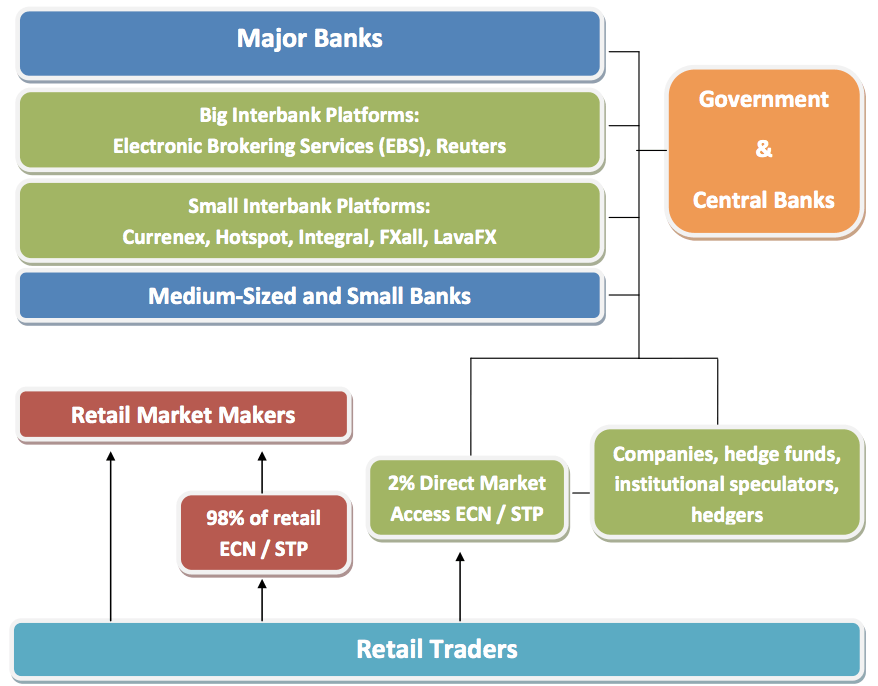

In the financial markets, there are more topics to consider, than it may seem at first glance when you open a trading platform and enter your orders. Various entities in the financial market also have completely different approaches and purposes for operating in the financial market. To correctly understand the entire financial market, you also have to know other participants in the global financial market. Retail traders – These are speculators. You and your friends probably fall into this category, along with many other traders who are reading this article. In the financial market, retail traders operate to invest their capital and their main goal is profit. Retail traders typically trade over the trading platform MetaTrader 4, or through other specific platforms or technology solutions from their broker.

Retail traders in the financial market are trading via a provider, called a broker. Profitability of traders depends on their trading strategy, money management, experiences and also how fair and solid their broker is, and it can vary considerably from 10% to 50%. According to the statistics, the higher the trader's capital, the higher success rate he is usually able to achieve because he is better at managing risk.

Brokers - Their goal is to provide trading to their clients and provide access to financial markets. For executing their clients' trades, the broker usually gets a commission. In the world, there are hundreds of brokers with very different approaches to their clients. The fact is that the vast majority of retail traders lose their capital in the financial market, and many brokers put their own profits ahead of creating a profitable trading environment for their clients.

Many brokers therefore, chose dishonest and dirty practices that accelerate the loss of their client's capital, and they directly benefit from the losses of their clients (a fair broker would only profit from a spread or commission and not from clients' losses). This is how a lot of all brokerage companies in the world are run.

In any educational materials about brokers and trading, you will read about two types of brokers:

-

Dealing desk (market maker) - market makers act like a counterparty for all your trades – and if you have a loss, the market marker earns same amount of money, and vice versa.

-

No dealing desk - ECN and STP, which send your trades further into the market for execution.

In fact, there are three types of brokers:

-

Dealing desk - market maker, these brokers do not hide the fact that they act like a counterparty to all your trades.

-

ECN / STP own or have a contract with only one market maker, which act like a counterparty to all your trades and there is a high conflict of interest as in the first case.

-

ECN / STP that are Direct Market Access brokers who actually send all your trades for execution to the interbank market without any conflict of interest.

Traders also often ask us what information about them their broker sees.

Brokers can see all your orders, either at market prices or pending orders, Stop-Loss and Profit- Target (if you type it in the trading platform on the server of your broker). Your broker, of course, can see a complete history of your trades and can tell if you entered a trade manually, by an automated trading system, or over the phone. Your broker does not see your trading strategy or a code of an automated trading system in the trading platform MetaTrader 4. Central banks - the action of central banks and governments are also very important to us. Central banks provide stability of relevant countries by controlling reserves of cash. Central banks are top institutions of banking supervision and determine monetary policy in the country.

The Central Banks perform the following functions:

-

Realization of monetary policy

-

Supervises the other banks

-

Determine exchange rate

-

Emit (issues) cash (notes and coins) in circulation

-

Maintains an account of the national budget

-

Manage foreign reserves

-

Commercial banks have their accounts at Central Banks

The main tool of central banks is the interest rate, from which rates by commercial banks are set. By raising and lowering interest rates, the central bank de facto controls the country's economy and causes severe movements in the financial market.

If we look at the distribution of central banks, depending on who is the owner, we find that there are three groups. Central Bank (CB) in private ownership (an example is - Switzerland or the USA), many other CB are in the hands of the state and the last option is called mixed ownership (eg. Japan).

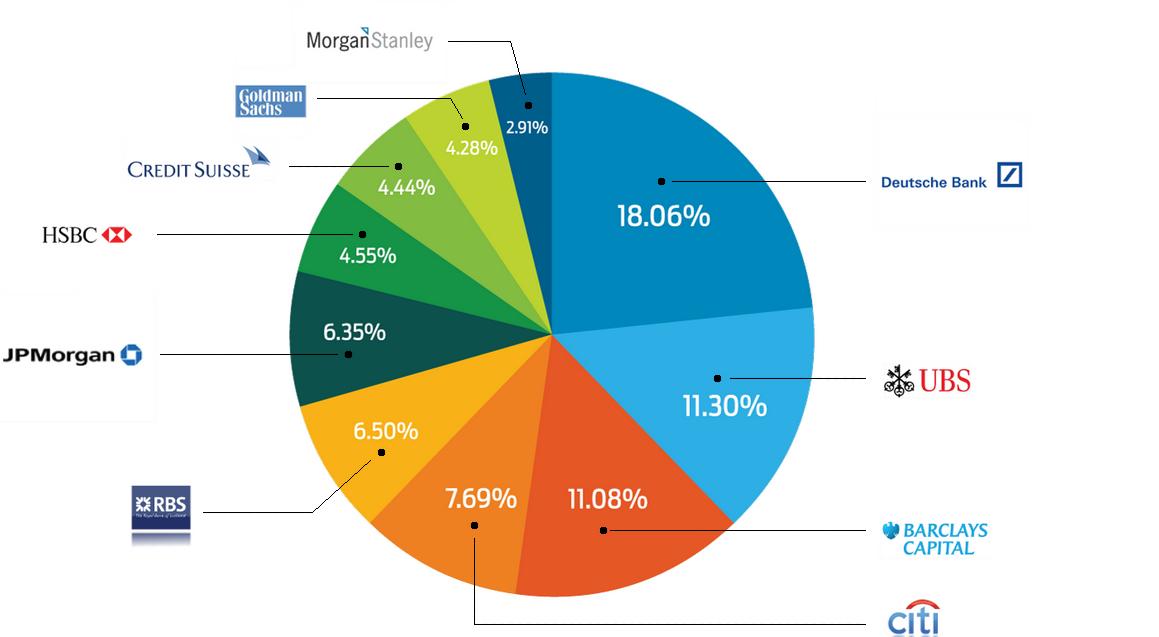

Banks. They handle Forex transactions in high volumes that often determine the future movements of financial markets. Currently, the five largest banks in the world hold almost 55% of the order volumes of the financial market. The minimum transaction in the interbank platforms is 10 million, the equivalent of 10 lots. Banks, of course, are trading without leverage, and utilize a variety of trading strategies from High Frequency Trading, latency trading, and arbitrage trading to long-term trading strategies.

The largest interbank platforms are EBS and Reuters and other interbank platforms are Integral, Currenex, Hotspot, Liquid-X, 360-T, and LavaFX.

Banks in the financial market make their biggest profits not from their own speculations, which are of course also a part of their portfolio, but from an execution of transactions for their worldwide corporate customers (car companies, technology companies, pharmaceutical companies, and all corporations that are doing business internationally).

Trades of corporate clients are executed according to the Reuters benchmark, which is the current market rate at 16:00 London time. Trillions of dollars in portfolios of money managers and investment funds are valued by this benchmark.

According to our information, bank traders on corporate transactions of 800 million USD thanks to his insider information about the transaction can earn up to an additional 2.5 million USD.

Other financial institutions – including investment funds, insurance companies, etc. They usually execute their transactions through a broker with institutional solutions or banks, and act in the financial market in order to ensure their risk management (hedging) and for speculation purposes (profit).

High Risk Warning: Please note that foreign exchange and other leveraged trading involves significant risk of loss. It is not suitable for all investors and you should make sure you understand the risks involved, seeking independent advice if necessary.

ADVISORY WARNING: Any news, opinions, research, data, or other information is provided as general market commentary and does not constitute investment or trading advice. FXTradingRevolution.com expressly disclaims any liability for any lost principal or profits without limitation which may arise directly or indirectly from the use of or reliance on such information.

Editors’ Picks

EUR/USD: Yes, the US economy is resilient – No, that won’t save the US Dollar Premium

Some impressive US data should have resulted in a much stronger USD. Well, it didn’t happen. The EUR/USD pair closed a third consecutive week little changed, a handful of pips above the 1.1800 mark.

Gold: Metals remain vulnerable to broad market mood Premium

Gold (XAU/USD) started the week on a bullish note and climbed above $5,000 before declining sharply and erasing its weekly gains on Thursday, only to recover heading into the weekend.

GBP/USD: Pound Sterling remains below 1.3700 ahead of UK inflation test Premium

The Pound Sterling (GBP) failed to resist at higher levels against the US Dollar (USD), but buyers held their ground amid a US data-busy blockbuster week.

Bitcoin: BTC bears aren’t done yet

Bitcoin (BTC) price slips below $67,000 at the time of writing on Friday, remaining under pressure and extending losses of nearly 5% so far this week.

US Dollar: Big in Japan Premium

The US Dollar (USD) resumed its yearly downtrend this week, slipping back to two-week troughs just to bounce back a tad in the second half of the week.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a Chief trader its second knowledge how to extract cash out of the market.

5 Forex News Events You Need To Know

In the fast moving world of currency markets where huge moves can seemingly come from nowhere, it is extremely important for new traders to learn about the various economic indicators and forex news events and releases that shape the markets. Indeed, quickly getting a handle on which data to look out for, what it means, and how to trade it can see new traders quickly become far more profitable and sets up the road to long term success.

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and selling pressure. Chart patterns have a proven track-record, and traders use them to identify continuation or reversal signals, to open positions and identify price targets.

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

The challenge: Timing the market and trader psychology

Successful trading often comes down to timing – entering and exiting trades at the right moments. Yet timing the market is notoriously difficult, largely because human psychology can derail even the best plans. Two powerful emotions in particular – fear and greed – tend to drive trading decisions off course.