An enormous amount has been written about the psychology of trading. Indeed, many experienced traders claim that trade strategy and execution are less important than managing the emotions of trading. This doesn’t mean, however, that you’ll find all the answers from your psychiatrist’s couch. Instead, we can embark on a critical journey to understand the basic statistics of trading — for example, the frequency and duration of winners and losers — to better navigate and anticipate the ups and downs of the trading endeavor.

Consider a simple automated intraday strategy that fades the previous day’s highs and lows. The strategy runs against the Chicago Mercantile Exchange’s E-mini S&P 500 futures contract (ES); it could be applied to a variety of assets. A long position is taken when the market retraces to the previous day’s low; a short position is taken when the market retraces to the previous day’s high. Logic is added to handle opening gaps above and below these levels, and trades are not taken when the underlying stock market, as measured by New York Stock Exchange breadth data, is either too bullish or bearish, indicating a trend may be in progress. Initial stop-loss is set at 0.5% of contract value and trailing stops are used if a 0.5% contract profit is realized.

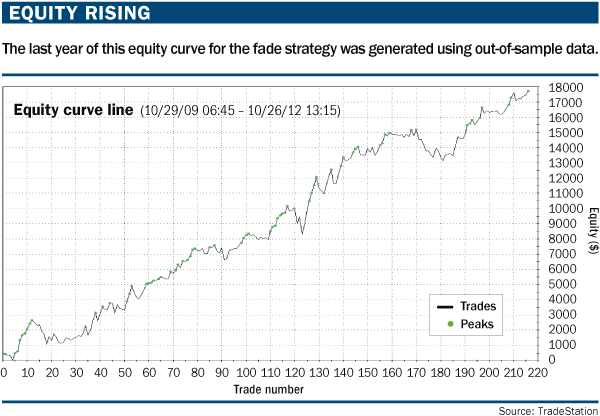

“Equity rising” (below) gives the most recent three-year performance of the strategy, trading a single ES contract, where the intraday margin requirement typically is $500. For the most part, this is in-sample data and must be viewed as such; however, the equity curve’s last year was collected as an out-of-sample test and arguably is a reasonable reflection of the strategy’s efficacy.

Measuring the pain

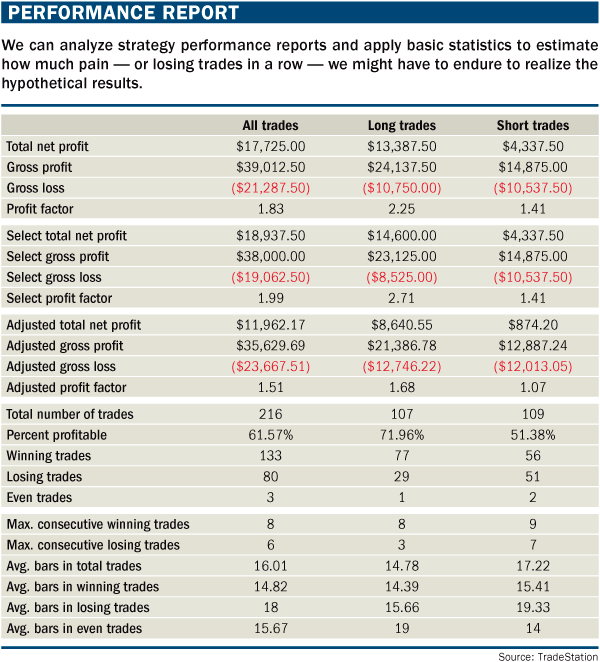

Given that trade psychology is so important, it should play a role when this strategy is put online against a live account. “Performance report” (below) provides some of the typical performance detail used to evaluate a strategy and manage it once it goes live. Of interest are the maximum number of consecutive losing trades, because a trader will want to know the extent of the pain that must be endured in running a strategy; or more objectively, how many losing trades to expect and endure before prematurely giving up. In the case of the simple fade strategy, over the last three years, six losing trades in a row would have to have been endured to realize the equity curve. Is the trader prepared for this?

To answer that question, it is helpful to know basic winning and losing run-length statistics. For example, if a trade strategy has a per-trade winning percentage of X% (say 50%, or winning half the time), and the strategy is run for N number of trades, how many losing trades in a row are expected?

We can provide some basic background to answer the winning/losing runs question. Knowing the basic statistics of trade winning and losing runs will help prepare the trader for the emotions of executing a strategy, as well as provide objective measures for when either to stay with it or throw in the towel.

Probability play

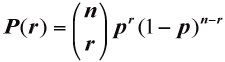

Trade win-loss statistics can be analyzed using ideas from binomial trails and distributions, similar to the way we count heads or tails when flipping a coin. A fair coin will have a 50% chance of a head or tail with any one toss, while trading typically will have an uneven win-loss percentage averaged over a series of trades. For example, our sample fade strategy has an approximate 60% winning percentage based on its performance history, meaning we expect to see six of 10 trades closed for a profit. We consider a trade strategy executed over a number of trades similar to counting the number of heads or tails realized over a number of tosses.The well-known counting formula is:

The above equation gives the probability of realizing exactly r successes in N trials, where P is the probability of success of any one trial. For example, the probability of two heads (heads = success) from four tosses of a coin, where p equals 50% or ½, is:

This kind of counting formula is a practical tool for all systematic traders, and there are many varieties that can be applied to trading. However, when the goal is to determine the number and length of winning or losing trade runs over a trading period, a closed-form solution, or formula like the above, is difficult to determine. In this case, computer simulation can be used to model a large number of trades and count the wins and losses.

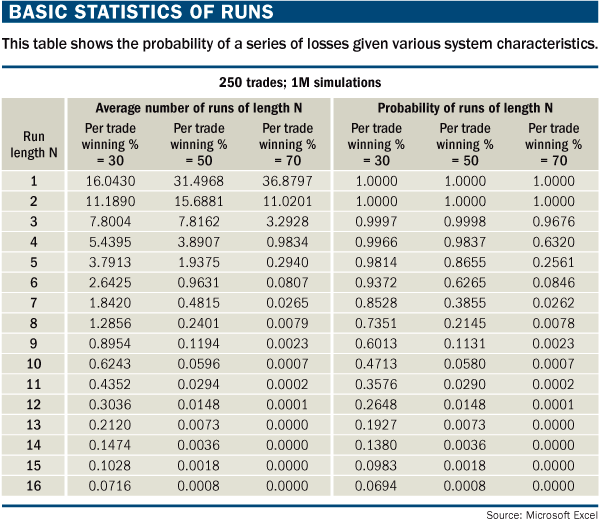

“Basic statistics of runs” (below) gives the average number and probability of various run lengths over 250 successive trades, using per-trade winning percentages of 30%, 50% and 70%. The 250 figure assumes one trade per day in a 250-trading-day year. The three winning percentages offer a range of trade execution, where 30% might represent conservative swing trading and 70% aggressive scalping. The 50% rate represents even win-loss trading similar to flipping a coin. The data were generated from 1 million simulations of the 250 trades using software random number generation.

The basic run statistics data show, for example, that over 250 trades, and with a per-trade win-loss percentage of 50%, the trader must endure six losses in a row 62% of the time. If we assume swing trading with a lower per-trade winning percentage of 30%, then the trader must endure eight losing trades in a row 73% of the time. About 98% of the time (really in every case), there will be five losses in a row and, on average, a five-loss run will occur 3.7, or almost four, times over 250 trades. The active trader can study the data here to become familiar with basic run-length statistics.

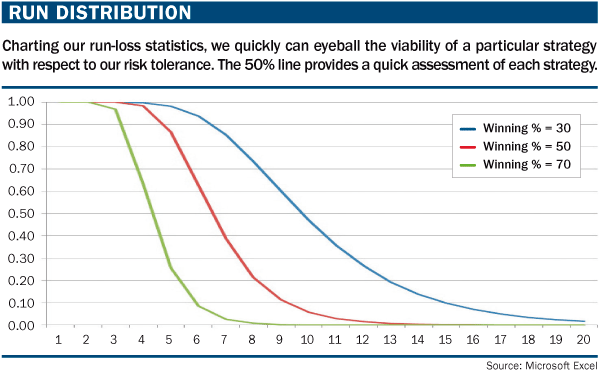

“Run distribution” (below) illustrates the probability distributions for the three per-trade winning percentages. As an example, it is informative to draw a cut-line at the 50% level to see the expected run lengths that will occur at least half the time when trading at a given per-trade winning percentage rate. (Contact the author if you would like a copy of the Windows/C++ program that generated the data.)

Trading application

We can apply the run-length statistics to specific strategies as a guide, whether discretionary or automated trading is practiced. In the fade strategy, which shows a 60% winning percentage over 216 trades, the simulation data predict an average of 0.78, or fairly close to one, run of five losing trades more than 50% of the time. That is, in the recent three-year test period of the fade strategy, half the time we should expect to encounter a five-in-a-row losing streak.Actual backtest data are consistent with this estimate, and there is no reason to pull the strategy when a losing run of five occurs at this frequency. Later, if we encounter a losing run of, say, eight trades in a row, we might retire the strategy because the simulation shows there is just a 5% chance of this occurring. A reasonable conclusion considering the unlikeliness of that occurring is that market conditions fundamentally have shifted, making the strategy obsolete.

In general, the run length statistics can be used to guide how to structure a trading program that it is consistent with a trader’s psychology, risk tolerance and expectations. There are swing trade practitioners who argue modest (25%-30%) winning trade percentages are the norm while making sure to let winners run and cutting losers quickly (see “Diary of a Professional Commodity Trader” by Peter L. Brandt, John Wiley & Sons, 2011). In this approach, the trader must realize there will be lengthy runs of losing trades. A 30% per-trade winning percentage means that approximately 75% of the time there will be a losing run of eight trades over a 250 trade cycle. If the trader finds this hard to endure, then trading with a higher per-trade winning percentage is needed. The math cannot be beaten, really.

Finally, the run-length statistics offer a clue as to why we often read about even the finest practitioners going fallow, perhaps with a sense that they have lost their touch or have somehow gotten out-of-sync with the market (see Jack Schwager’s “Market Wizards” series). In fact, what may be occurring is the inevitable losing run has been hit — from which the professional learns the importance of managing losses or is retired from the endeavor by the unrelenting nature of the market.

Editors’ Picks

EUR/USD: US Dollar to remain pressured until uncertainty fog dissipates Premium

The EUR/USD pair lost additional ground in the first week of February, settling at around 1.1820. The reversal lost momentum after the pair peaked at 1.2082 in January, its highest since mid-2021.

Gold: Volatility persists in commodity space Premium

After losing more than 8% to end the previous week, Gold (XAU/USD) remained under heavy selling pressure on Monday and dropped toward $4,400. Although XAU/USD staged a decisive rebound afterward, it failed to stabilize above $5,000.

GBP/USD: Pound Sterling tests key support ahead of a big week Premium

The Pound Sterling (GBP) changed course against the US Dollar (USD), with GBP/USD giving up nearly 200 pips in a dramatic correction.

Bitcoin: The worst may be behind us

Bitcoin (BTC) price recovers slightly, trading at $65,000 at the time of writing on Friday, after reaching a low of $60,000 during the early Asian trading session. The Crypto King remained under pressure so far this week, posting three consecutive weeks of losses exceeding 30%.

Three scenarios for Japanese Yen ahead of snap election Premium

The latest polls point to a dominant win for the ruling bloc at the upcoming Japanese snap election. The larger Sanae Takaichi’s mandate, the more investors fear faster implementation of tax cuts and spending plans.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a Chief trader its second knowledge how to extract cash out of the market.

5 Forex News Events You Need To Know

In the fast moving world of currency markets where huge moves can seemingly come from nowhere, it is extremely important for new traders to learn about the various economic indicators and forex news events and releases that shape the markets. Indeed, quickly getting a handle on which data to look out for, what it means, and how to trade it can see new traders quickly become far more profitable and sets up the road to long term success.

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and selling pressure. Chart patterns have a proven track-record, and traders use them to identify continuation or reversal signals, to open positions and identify price targets.

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

The challenge: Timing the market and trader psychology

Successful trading often comes down to timing – entering and exiting trades at the right moments. Yet timing the market is notoriously difficult, largely because human psychology can derail even the best plans. Two powerful emotions in particular – fear and greed – tend to drive trading decisions off course.