So, the election is over, the dust has settled and we have a new President Elect. The United States of America, and the rest of the world, is sitting on the edge of their collective seats waiting to see what the next four years is going to look like, but the financial markets tick along just the same. Plenty of speculation about where markets will be in the next 6 months is already in the air and irrespective of where the markets go, we have seen an increase in market volatility over the last few weeks which is likely to continue for some time. However, like anything, this volatility will come and go and our job as disciplined market speculators is to be prepared for all market conditions no matter the situation.

In the earlier days of my FX trading I tended to like volatility when it paid me on trades and hated it when I lost! My novice mentality shone through strongly back then. Today though, I look at market volatility from a very different perspective altogether. Markets will typically do what they were always meant to do, as the only thing which pushes prices higher or lower are the imbalances between willing buyers and willing sellers, namely supply and demand. When major news and volatility swings into the markets it is easy to forget this and be tempted to react to movement, as opposed to planning your moves around it. There is a huge difference in these approaches, with one being focused on planning in advance and the other just reacting to what is happening.

Reacting is easy to do because most people hate to be left out of a move in the markets. It can be hard to sit there and watch a market move hundreds of pips without you, tempting us to jump into the move far too late and right at the end of the run, resulting often in an inevitable loss. Do you think that the major banks and institutions are jumping into moves last minute and waiting for news to come out before they make their moves? Of course not! These are the people who are creating the moves in the first place! At Online Trading Academy, we teach our students to plan their trades and positions ahead of time, just like the largest institutions and banks do but only after those major market players have shown us their hand first. It doesn’t matter if it’s a vote for the UK to leave the EU, a Presidential Election or simply monthly Non-Farm Payroll figures being released; we can always plan our moves ahead of time. Our job as disciplined market speculators is to track the footprints of the big guys so we can buy and sell when they do, no matter the market volatility. If you know when to enter a trade by letting price come to you, volatility will only stop you out for a small loss when wrong and give you a big win when you are right.

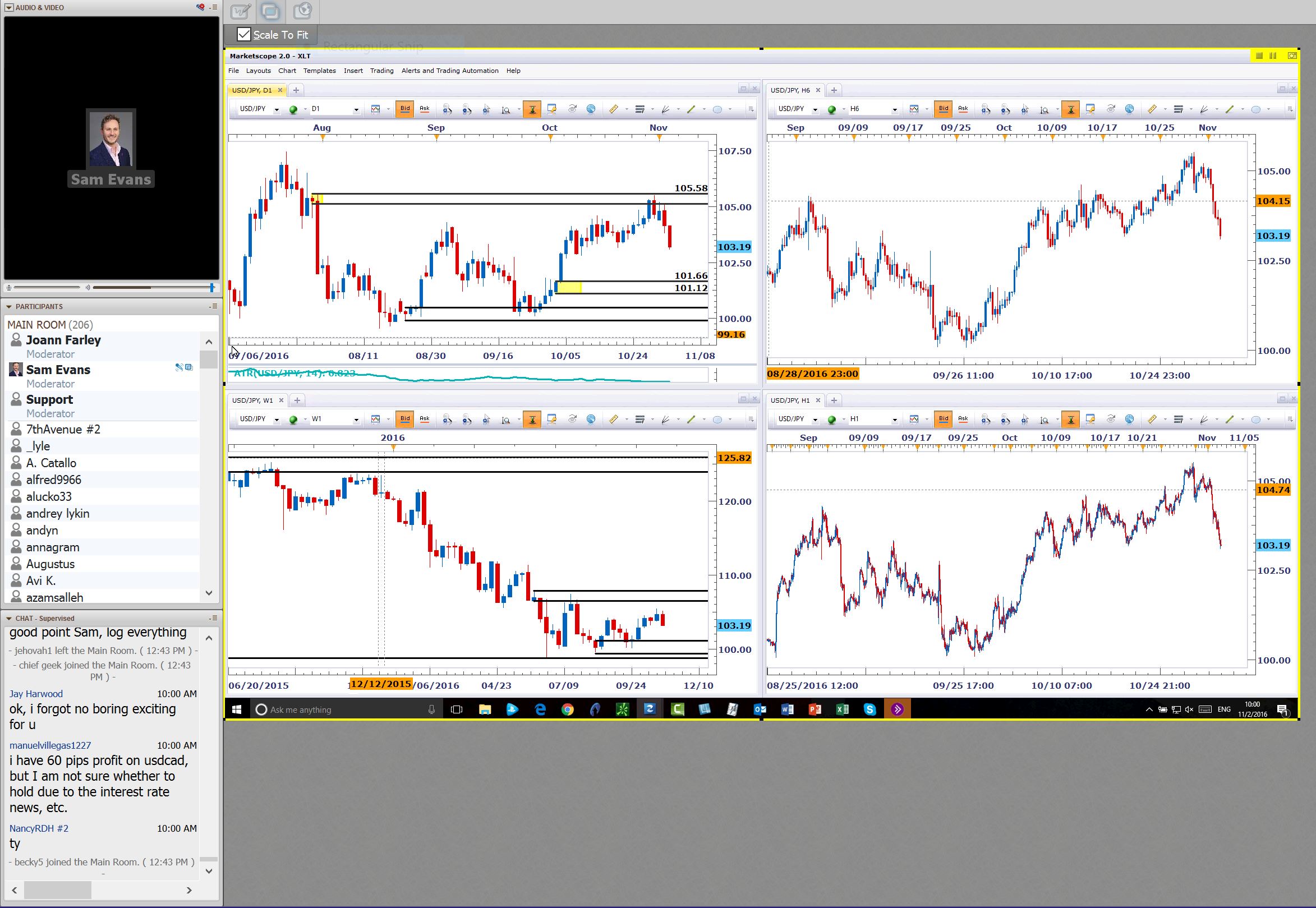

Now of course, we can also choose to trade things with lesser volatility around these major news events too, especially if we want to tighten up our risk management even further. Many FX traders will focus on pairs like the EURUSD and the GBPUSD as these will often move the most in times like this, yet it can pay us to look at some of the lesser traded instruments from time to time, especially if the charts are cleaner and the entries and exits more defined. For example, let’s look at some set ups from a recent XLT I hosted on November 2nd, a few days before the election. Below we can see setups to buy the USDJPY and sell the NZDUSD along with their respective Demand and Supply levels:

In the first example on the USDJPY we already had prices dropping steadily from our pre-defined level of supply, as we can clearly see in the screen-shot. With the downward move already well underway, it was now time to look for our next opportunity to get long on the pair. It made sense to highlight the lower level of demand for an entry to buy at 101.66 with a stop loss in case proven wrong below 101.12. The clear imbalance shown in price and qualified by the OTA odds enhancers suggested to us that this was a very low risk and potentially high reward opportunity to get long the USD and short the JPY.

At the time of setting up the trade a few students asked if I was at all concerned about taking the trade around the Presidential Election. I explained to them that prices and the major banks will do what they are going to do anyway, irrespective of the news or political events. I highly doubt these guys are waiting for the news to tell them what to do before acting, do you? They know exactly what their plan is way ahead of time. Why should we be any different?

Our next setup was a nice short entry at Supply on the NZDUSD, a slightly lower volatility pairing but also very nice to work with, especially around major economic news events. At the time of doing the analysis we found ourselves in a level for a short right away. We also set up the higher level for a short at 0.7390 with stops located above 0.7414, just in case the lower level didn’t work out as planned. We know that not every trade will work and so we plan for this eventuality by having that stop loss order in place ahead of time. Let’s see how these trades worked themselves out a little while later:

Looking at the results of these trades, we can see just how effective it can be to set up ahead of time, with the USDJPY spiking down hard on the election night and then reversing nicely for a great winner which is still playing out at the time of writing this article. Market volatility, how fast or powerfully price moves doesn’t matter, if it hits enough orders we can have ourselves a decent trade. On the other hand, our first trade on the NZDUSD stopped out for a small loss but hit the higher entry about a week later and dropped cleanly, more than making up for the first loss and turning into a nice profit which still has some nice potential left. As we can clearly see, no matter the news, the data of the economic climate, there is always a safe chance to make money if you follow the bank’s footprints in price and stick to your plan throughout. Many have asked me for my thoughts on the markets following the surprise US Election results and what approach I will be taking in the coming months and into 2017. Well, to be honest it’s just business as usual for my students at OTA and myself. We follow price because price always behaves the same no matter what. In our trade plans, the rules are always the same as the market flows from one day to the next. Take the same approach in your own trading and you’ll be pleasantly surprised with your results.

Be well and thanks for reading.

The information provided is for informational purposes only. It does not constitute any form of advice or recommendation to buy or sell any securities or adopt any investment strategy mentioned. It is intended only to provide observations and views of the author(s) or hosts at the time of writing or presenting, both of which are subject to change at any time without prior notice. The information provided does not have regard to specific investment objectives, financial situation, or specific needs of any specific person who may read it. Investors should determine for themselves whether a particular service or product is suitable for their investment needs or should seek such professional advice for their particular situation. Please see our website for more information: https://bustamanteco.com/privacy-policy/

Editors’ Picks

USD/JPY gathers strength to near 157.50 as Takaichi’s party wins snap elections

The USD/JPY pair attracts some buyers to around 157.45 during the early Asian session on Monday. The Japanese Yen weakens against the US Dollar after Japan’s ruling Liberal Democratic Party won an outright majority in Sunday’s lower house election, opening the door to more fiscal stimulus by Prime Minister Sanae Takaichi.

EUR/USD: US Dollar to remain pressured until uncertainty fog dissipates

Unimpressive European Central Bank left monetary policy unchanged for the fifth consecutive meeting. The United States first-tier employment and inflation data is scheduled for the second week of February. EUR/USD battles to remain afloat above 1.1800, sellers moving to the sidelines.

Gold: Volatility persists in commodity space

After losing more than 8% to end the previous week, Gold remained under heavy selling pressure on Monday and dropped toward $4,400. Although XAU/USD staged a decisive rebound afterward, it failed to stabilize above $5,000. The US economic calendar will feature Nonfarm Payrolls and Consumer Price Index data for January, which could influence the market pricing of the Federal Reserve’s policy outlook and impact Gold’s performance.

Week ahead: US NFP and CPI data to shake Fed cut bets, Japan election looms

US NFP and CPI data awaited after Warsh’s nomination as Fed chief. Yen traders lock gaze on Sunday’s snap election. UK and Eurozone Q4 GDP data also on the agenda. China CPI and PPI could reveal more weakness in domestic demand.

Three scenarios for Japanese Yen ahead of snap election Premium

The latest polls point to a dominant win for the ruling bloc at the upcoming Japanese snap election. The larger Sanae Takaichi’s mandate, the more investors fear faster implementation of tax cuts and spending plans.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a Chief trader its second knowledge how to extract cash out of the market.

5 Forex News Events You Need To Know

In the fast moving world of currency markets where huge moves can seemingly come from nowhere, it is extremely important for new traders to learn about the various economic indicators and forex news events and releases that shape the markets. Indeed, quickly getting a handle on which data to look out for, what it means, and how to trade it can see new traders quickly become far more profitable and sets up the road to long term success.

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and selling pressure. Chart patterns have a proven track-record, and traders use them to identify continuation or reversal signals, to open positions and identify price targets.

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

The challenge: Timing the market and trader psychology

Successful trading often comes down to timing – entering and exiting trades at the right moments. Yet timing the market is notoriously difficult, largely because human psychology can derail even the best plans. Two powerful emotions in particular – fear and greed – tend to drive trading decisions off course.