Imagine you've joined a professional trading firm—what would it look like?

But before I show you, why does anyone go this route?

Because it gets you off the 'win some, lose more' trading hamster wheel—fast-tracking your transition to confident and consistent trading.

Here's how that looks:

Step 1: You uncover a wealth of market knowledge that most traders never discover.

They don't know it—don't understand it—which ends with costing them loss after loss.

Does that mean they're unknowingly passing their money onto you?

Not just yet. Knowledge alone doesn't make money. It's what you do with it that matters. Which brings us to Step 2...

Step 2: What's the easiest way to win again at trading? Win where you've won before.

Let me explain:

You're shown proven trading strategies and the skills required to implement them.

These are your keys to the vault to print money—so long as...

Step 3: You trade those strategies over and over until you reach consistency.

But you're not on your own:

To fast-track your progress, you'll execute these strategies live—guided by an expert who knows them inside out.

Why does it matter?

Trading is a sophisticated skill, best mastered under live conditions with someone who's been there, done that—pointing out what otherwise takes years to decipher.

And propelling your trading forward is personalised feedback.

It's a crucial step because when you don't know what you don't know, blind spots stay hidden, and you miss the changes needed to win. Make sense?

Now, all of this is a multi-month process. For some, it's longer.

I'm curious if you're familiar with a trader who made eight figures two years in a row only a few years back.

But as Trillium's most successful trader, he was a losing trader every month for two years. It goes to show—failure can't cope with perseverance.

And while that all sounds great—here's a question for you...

Right now, are you already past Step 3? Between Steps 1 and 2?

Or is it a case of not even past Step 1?

You know, a lot of people think they can work out Step 2 themselves without realising they have considerable gaps in Step 1.

What are the odds they'll make it? Exactly.

Not to mention—those trading strategies you're shown? They're built on thousands of hours of real trading experience.

Got a spare decade to devote to working it out yourself?

But here's the thing:

Because trading can be remarkably lucrative, it's fiercely competitive.

Hypothetically—even if you do have all the right information—without experience guiding you, you'll likely run out of time, money or persistence before you make it. Agree?

You see:

Running your own trading business, you understand...

With a low barrier to entry and allure of big money—there's a never-ending gravy train of people handing over their money to you because they haven't completed Steps 1, 2, and 3.

And it's as straightforward as that.

It's similar to buying into a franchise, where you pay for proven systems and expert training.

You know it's ironic. Putting in the reps can seem like a grind, but once you're there, maintaining them takes considerably less effort.

What happens next?

Post reps, you get on with running your business.

The following will give you an idea of what that looks like day-to-day

Take your seat at the nerve centre of your business and prepare for the day ahead.

And while each day is unique, the steps remain the same.

Monday

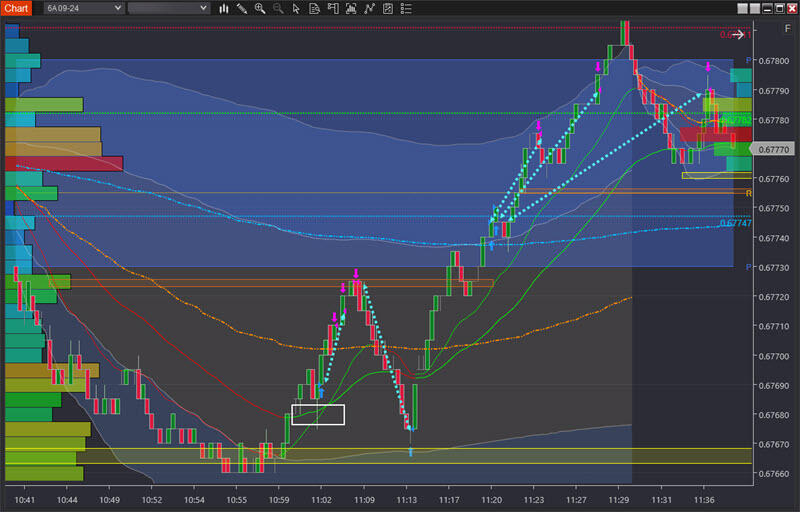

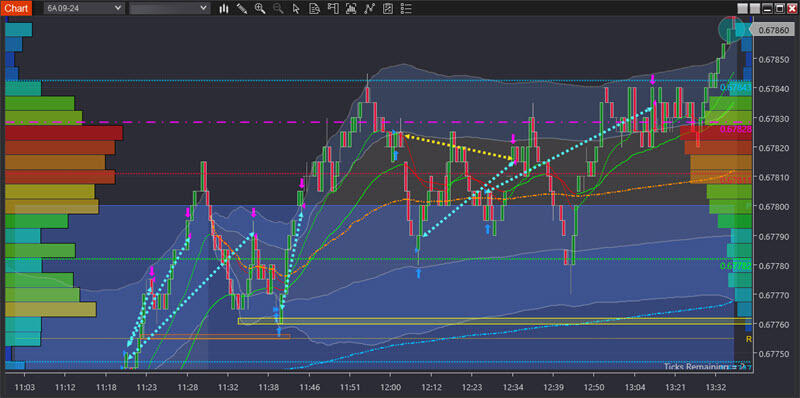

Blue lines = profits. Yellow lines = cost the business.

Tuesday

Blue lines = profits. Yellow lines = cost the business.

Wednesday

Blue lines = profits. Yellow lines = cost the business.

In summary

When you see Steps 1, 2, and 3 laid out, you can see a path forward with light at the end of the tunnel. Right?

And while joining a professional firm has its benefits, it’s a cutthroat environment, and many don’t last. More on that in a moment, but first...

What if there’s a better option?

A better option might be working with someone who provides a similar pathway, having walked those steps first-hand at a professional trading firm.

These cutthroat environments are by design—just like the markets.

It’s a brutal experience for the uninitiated—and I know you know what I mean.

Before you can truly benefit from the support and guidance of an experienced professional trader, it's crucial to first know and feel the predatory nature of the markets. It’s a required part of your trading journey.

To finish on a personal note:

The pain of regret burns deeper and longer than the pain of investing financially, emotionally, and time-wise into something important to you.

Forex and derivatives trading is a highly competitive and often extremely fast-paced environment. It only rewards individuals who attain the required level of skill and expertise to compete. Past performance is not indicative of future results. There is a substantial risk of loss to unskilled and inexperienced players. The high degree of leverage can work against you as well as for you. Before deciding to trade any such leveraged products you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with trading on margin, and seek advice from an independent

Editors’ Picks

EUR/USD: Fed calm, ECB steady, but the Dollar still leads Premium

EUR/USD is still struggling to find real traction. The pair has tried to stabilise, but momentum keeps fading, leaving the door open to further weakness.

Gold: Falling US yields, geopolitics help XAU/USD hold ground Premium

Gold (XAU/USD) gained traction and climbed above $5,200, ending the fourth consecutive week in positive territory. The next round of US-Iran talks and crucial macroeconomic data releases from the US will be watched closely by market participants in the short term.

GBP/USD: Will Pound Sterling defend key 1.3450 support ahead of US jobs data? Premium

The Pound Sterling (GBP) entered a bearish consolidation phase against the US Dollar (USD), after having tested critical support near the 1.3450 level on several occasions.

Bitcoin: Another month of losses, and it’s been five

Bitcoin (BTC) price is stabilizing around $68,000 at the time of writing on Friday, but the Crypto King is poised to close February on a fragile footing, marking its fifth consecutive month of losses since October and a rare start to the year with back-to-back monthly corrections.

US Dollar: At a crossroads; Fed steady, tariffs in flux Premium

The US Dollar’s (USD) upward momentum from the previous week seems to have encountered a tough nut to crack in the 98.00 region, as measured by the US Dollar Index (DXY).

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a Chief trader its second knowledge how to extract cash out of the market.

5 Forex News Events You Need To Know

In the fast moving world of currency markets where huge moves can seemingly come from nowhere, it is extremely important for new traders to learn about the various economic indicators and forex news events and releases that shape the markets. Indeed, quickly getting a handle on which data to look out for, what it means, and how to trade it can see new traders quickly become far more profitable and sets up the road to long term success.

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and selling pressure. Chart patterns have a proven track-record, and traders use them to identify continuation or reversal signals, to open positions and identify price targets.

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

The challenge: Timing the market and trader psychology

Successful trading often comes down to timing – entering and exiting trades at the right moments. Yet timing the market is notoriously difficult, largely because human psychology can derail even the best plans. Two powerful emotions in particular – fear and greed – tend to drive trading decisions off course.