![]()

Over the last few months especially, there’s been a lot of focus in the world of Currency Trading upon the state of the US Dollar. No matter what your opinion is of the Greenback, it is still, without question, regarded as the world’s primary reserve currency and holds its weight of recognition across the board. Any active trader in today’s FX markets should be aware of the performance of the dollar at any given time not only because of its status as the world’s leading currency, but also because it can give us clues as to the behavior of other currency pairs as well. This is a key concept which is taught in the Online Trading Academy Professional Forex Trader class, because we know the importance of the US dollar when trading the global currency markets. Just by knowing the value of the dollar and how its current price relates to previous levels historically can give the disciplined trader a distinct advantage over the competition.

Without a doubt, the best way to track the ongoing price changes in the US dollar is by charting and analyzing the dollar index itself. The Dollar index (DXY) is very similar to a stock market index. Where a stock index is made up of different stocks, the dollar index is comprised of a basket of different currencies that are weighted against the dollar itself, giving us a measurement of how the buck is performing against other denominations. The structure looks like this:

- Euro (EUR) 57.6%

- Japanese Yen (JPY) 13.6%

- British Pound (GBP) 11.9%

- Canadian Dollar (CAD) 9.1%

- Swedish Krona (SEK) 4.2%

- Swiss Franc (CHF) 3.6%

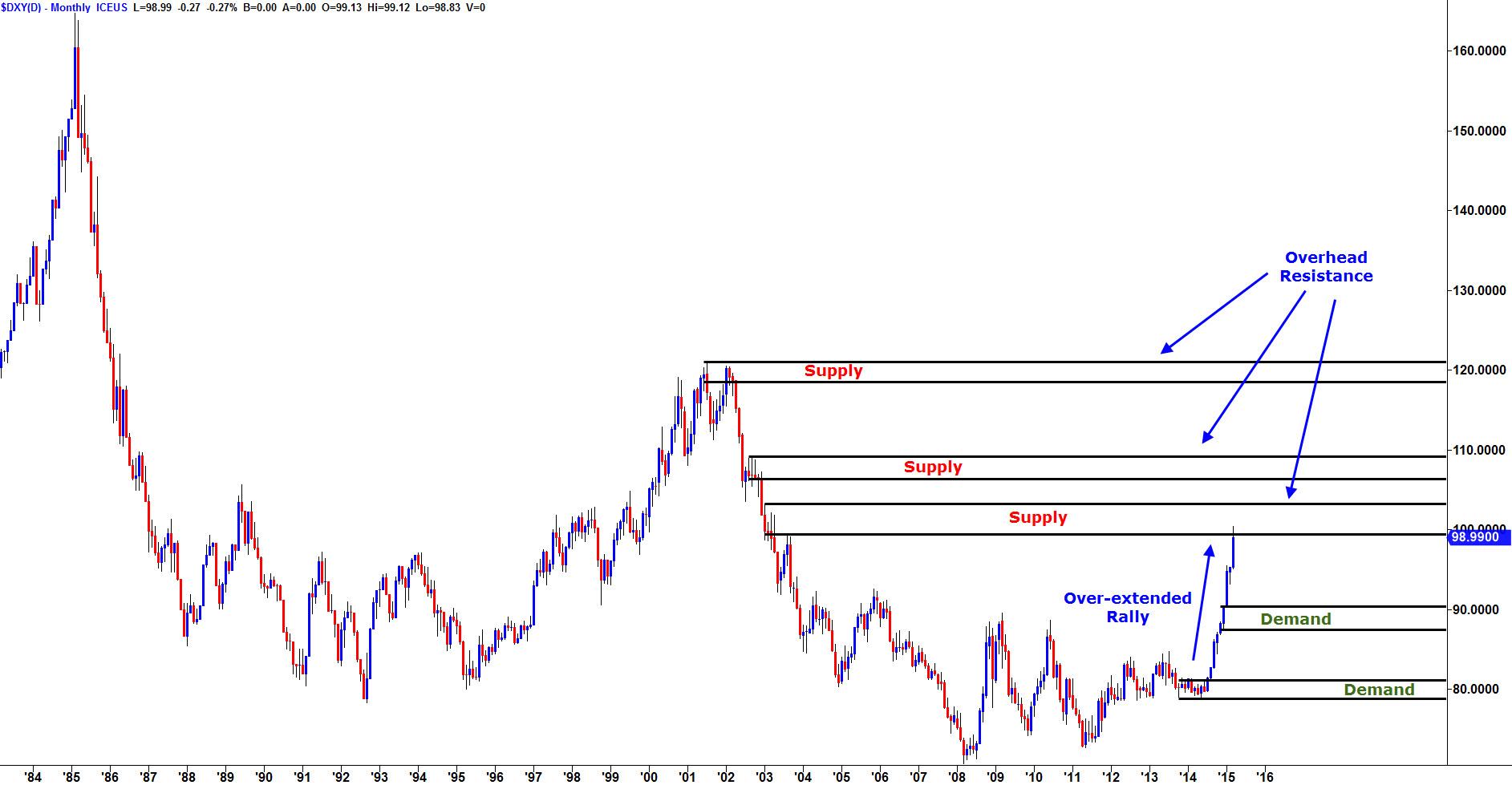

As you can see, the Australian dollar and the New Zealand dollar are not included and obviously the index was comprised of many more currencies before the introduction of the EUR, hence the Euro’s current majority weighting. Some argue that the index itself needs to be upgraded and adjusted to be a fairer reflection of the current markets, with an update of other currencies which play their part in the global economy too; but that is a discussion for another time. Now we know how the DXY is created, let’s take a look at the chart itself:

This is a screenshot of the DXY at the back end of 2011. As you can see, it is a chart not unlike any other currency chart that you may have seen. A rise in the chart shows us dollar strength, with a fall in the chart representing dollar weakness.

I remember very clearly teaching classes and giving commentary on the markets when the dollar was at these levels back in 2009 to 2011. I remember at the time how people were talking about the demise of the buck due to its continual weakness over that two year period.

The market was pretty much back to where it was when it was at its lowest ever point in 2008, recording a price of 70.698 back in March of that year. This is a stark contrast to where we are now, with the dollar, itself, having rallied consistently since July of last year with little pause or pull back. This is how things look now:

When you look at that chart it truly is an amazing turnaround, yet is it an unexpected one? To somebody like me who focuses on price alone and chooses to take fundamental analysis with a pinch of salt, I would say it really isn’t that surprising. If you look back at the charts between 2008 and 2011 you’ll notice that the market was extremely undervalued and on numerous occasions it failed to break the lows of 2008, which I regard as a great sign that any market can rally when in this situation.

It can often be difficult and challenging to put your attention into what could happen next, instead of focusing on what has been happening so far. Sure it is easy to assume that the US dollar is going to continue its gains and according to the charts this is a possibility, however is it really any different to when the market was at its lows back in 2011? In our school we focus purely on the concept of recognizing institutional supply and demand on price charts. When we know what this picture looks like, it gives us the opportunity to analyze and potentially predict where the next market turn is going to occur. Looking back to our chart from 2011, we can see the dollar was sitting down right on top of major levels of demand. Those demand levels held and resulted in a big rally in the greenback. Now, after this rally we are approaching and are right under major levels of supply, which look like this:

As we can see, that overextended rally that we have witnessed on the dollar is now entering some major levels of supply which could cause a real challenge to the current upwards momentum. Yes, there is room for this market to continue to the upside but as unemotional and objective traders we must be aware of the imbalances in the market where previous major selling and buying took place and respect these levels accordingly. I would not be surprised to see a decent correction in the dollar at these major levels of supply with the market potentially picking back up at the newly formed levels of demand. This would have a big impact on other currency pairs like the EURUSD, GBPUSD and the AUDUSD, which are all heavily oversold, themselves.

By keeping one eye on the DXY, we can get a distinct heads up of what is to come, and this proves to be a useful analytical tool when trading other major currency pairs. As a rule of thumb, I always analyze the DXY on a daily and weekly basis and use it as a gauge to measure my expectations for the upcoming trading opportunities in front of me. I hope this was helpful.

The information provided is for informational purposes only. It does not constitute any form of advice or recommendation to buy or sell any securities or adopt any investment strategy mentioned. It is intended only to provide observations and views of the author(s) or hosts at the time of writing or presenting, both of which are subject to change at any time without prior notice. The information provided does not have regard to specific investment objectives, financial situation, or specific needs of any specific person who may read it. Investors should determine for themselves whether a particular service or product is suitable for their investment needs or should seek such professional advice for their particular situation. Please see our website for more information: https://bustamanteco.com/privacy-policy/

Editors’ Picks

EUR/USD: US Dollar to remain pressured until uncertainty fog dissipates Premium

The EUR/USD pair lost additional ground in the first week of February, settling at around 1.1820. The reversal lost momentum after the pair peaked at 1.2082 in January, its highest since mid-2021.

Gold: Volatility persists in commodity space Premium

After losing more than 8% to end the previous week, Gold (XAU/USD) remained under heavy selling pressure on Monday and dropped toward $4,400. Although XAU/USD staged a decisive rebound afterward, it failed to stabilize above $5,000.

GBP/USD: Pound Sterling tests key support ahead of a big week Premium

The Pound Sterling (GBP) changed course against the US Dollar (USD), with GBP/USD giving up nearly 200 pips in a dramatic correction.

Bitcoin: The worst may be behind us

Bitcoin (BTC) price recovers slightly, trading at $65,000 at the time of writing on Friday, after reaching a low of $60,000 during the early Asian trading session. The Crypto King remained under pressure so far this week, posting three consecutive weeks of losses exceeding 30%.

Three scenarios for Japanese Yen ahead of snap election Premium

The latest polls point to a dominant win for the ruling bloc at the upcoming Japanese snap election. The larger Sanae Takaichi’s mandate, the more investors fear faster implementation of tax cuts and spending plans.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a Chief trader its second knowledge how to extract cash out of the market.

5 Forex News Events You Need To Know

In the fast moving world of currency markets where huge moves can seemingly come from nowhere, it is extremely important for new traders to learn about the various economic indicators and forex news events and releases that shape the markets. Indeed, quickly getting a handle on which data to look out for, what it means, and how to trade it can see new traders quickly become far more profitable and sets up the road to long term success.

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and selling pressure. Chart patterns have a proven track-record, and traders use them to identify continuation or reversal signals, to open positions and identify price targets.

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

The challenge: Timing the market and trader psychology

Successful trading often comes down to timing – entering and exiting trades at the right moments. Yet timing the market is notoriously difficult, largely because human psychology can derail even the best plans. Two powerful emotions in particular – fear and greed – tend to drive trading decisions off course.