![]()

Many years ago in the very first trading class I ever took, my instructor told us a vital truth about the markets: Trading is simple but far from easy. Looking back I don’t think I really took much notice of the vital importance behind what he said to us all in the classroom that day. I was more interested in getting to the “good stuff,” that being the strategies and the charts! Now, some eleven years later it really makes complete and utter sense to me. In fact, I make a point of telling my own students the exact same thing whenever I am teaching them the ways of trading.

The simplicity of trading for short term income or long term wealth generation is really down to the basic dynamics concerned with how to actually trade in an effective, objective and logical manner. Let’s face it there are only three things you can do in the market after all, that is buy it, sell it or do nothing. It doesn’t get much simpler that that, does it? Once you are in a trade you have to decide for yourself what you are going to do next. This is the more complex part. Obviously you are either going to win on the trade, lose on it or maybe break even from time to time but whatever the outcome, this is the one true unknown element and thus, is what makes the act of trading not so easy.

You see, as human beings going about our daily lives, we have become used to having a high degree of certainty running throughout our existence as we go about our daily business. Of course Murphy’s Law suggests that if anything can happen, it will happen but again we are still fairly comfortable in knowing that many events which transpire in our lives have fairly predictable outcomes. We have gotten used to pretty much knowing what is going to happen next in most aspects of our lives and have taken a deep-rooted level of comfort in this habitual awareness. Therefore, I would suggest that when it comes to trading, the majority of people find a huge challenge in not knowing what is going to happen next.

Of course the markets are rather predictable to a certain extent, firstly because if they weren’t nobody would make any money out of them and secondly because they are created by none other than human beings, which we have already recognised as being creatures of habit and repetition. Taking these two factors into account is what makes it possible to make consistent gains from today’s markets if a solid and disciplined trade plan is followed to the letter. We must accept the unknown variables that the FX market is happy to throw our way on a daily basis and also understand that there will always be things that we never have any control over whatsoever. There are on the other hand, things that we can control and must do so efficiently so as to account for the unknown and keep our emotions in check at all times.

I can’t control how far the market will move for me when I am on the right side of a trade. This is one of those big unknowns which makes trading not so easy. What though, can we do to compensate for this? Well straight away we can control our losses by deciding in advance exactly how much we are prepared to lose if the trade fails. Secondly, we can also go for achievable profit targets on the trades we decide to take. I like to encourage my students to “grab the low-hanging fruit” on their positions, meaning that they should train themselves to not be too greedy and going for unachievable targets. This too often results in gaining large chunks of upside potential gains, only to then watch them be given back and ending up with nothing or maybe even a small loss at the end of the trade. This is a common mistake by many traders and definitely is an issue which tends to contribute to the “not easy” scenario. To keep things simple and as effective as possible, we must overcome any potential hurdles on our trades well before we face them. Objective and unemotional profit-taking is one such example of how to do this.

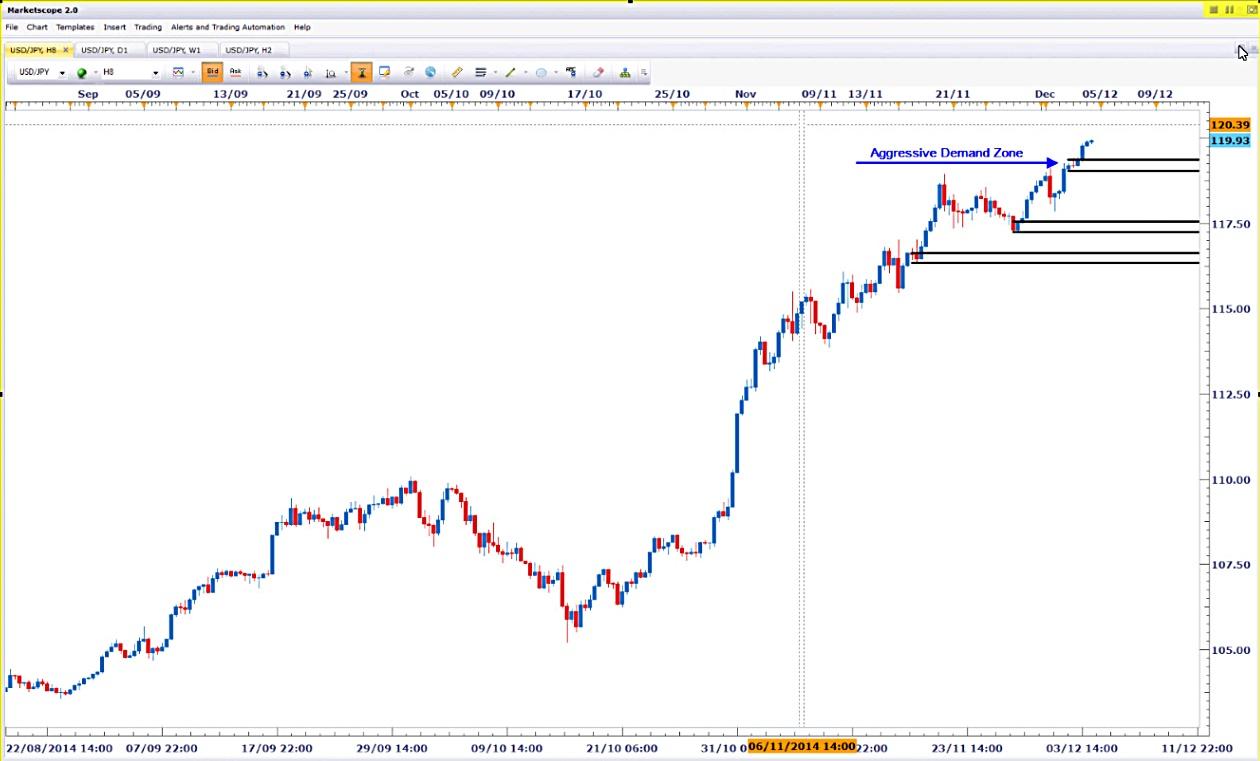

Let me reference a recent example from one of my more current XLT sessions I was leading for Online Trading Academy. Using our patented Core Strategy to recognize imbalances between supply and demand created by institutional order flow, the class had decided to do some real-time analysis and trading setups on the USDJPY currency pair. As you may be well aware, the USDJPY has been enjoying a tremendous ride to the upside as of late and there were students looking to capitalize on this price action. While I have no problem with joining a trend, I also like to be aware of where trend is likely to end, especially when the trend in question has been running for quite some time. Taking this into account I found opportunity to buy the pair at a recently formed institutional demand zone as shown in the screenshot below:

Having highlighted the level in advance, we simply then needed to wait for price to come to us, then buying the pair and placing a stop loss order below the zone in the event that the trade did not work out as we expected; the only thing left to work out then was the profit objective. It was suggested by a few of the students that we should let the trade run as far as possible, allowing the trend to continue to develop. Now, while this was a decent plan to have, it also relied on the trend being able to continue. In this trade the charts were suggesting that there was a major level of supply a few hundred pips above our demand zone (not shown on this example), thus limiting our profit potential a little. I suggested taking a conservative 3:1 reward to risk on the trade and to set up a shorting opportunity at the higher supply level for if price ever got there. After all, 3:1 is always a solid outcome for a trade. The trade triggered as expected sometime later:

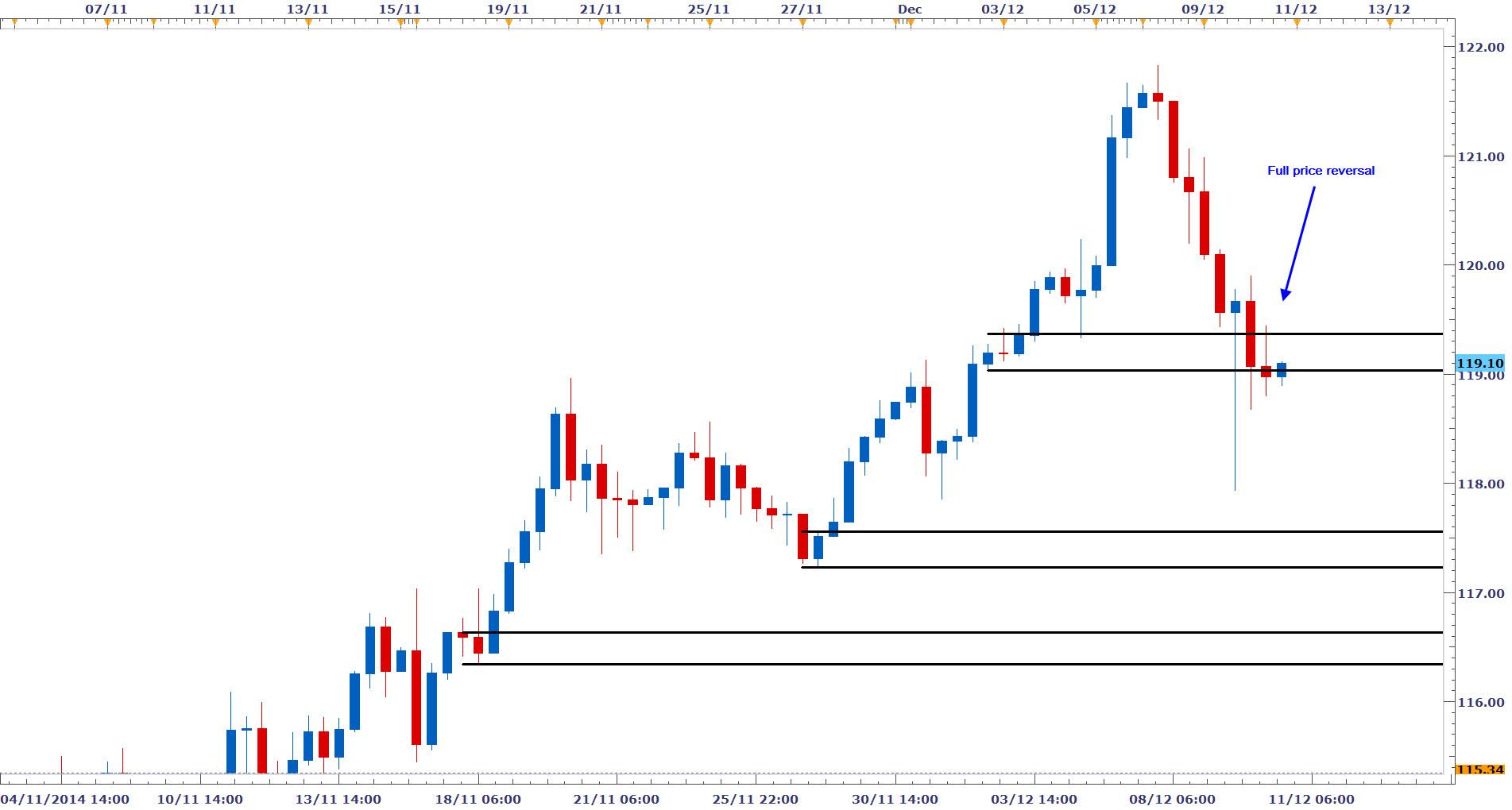

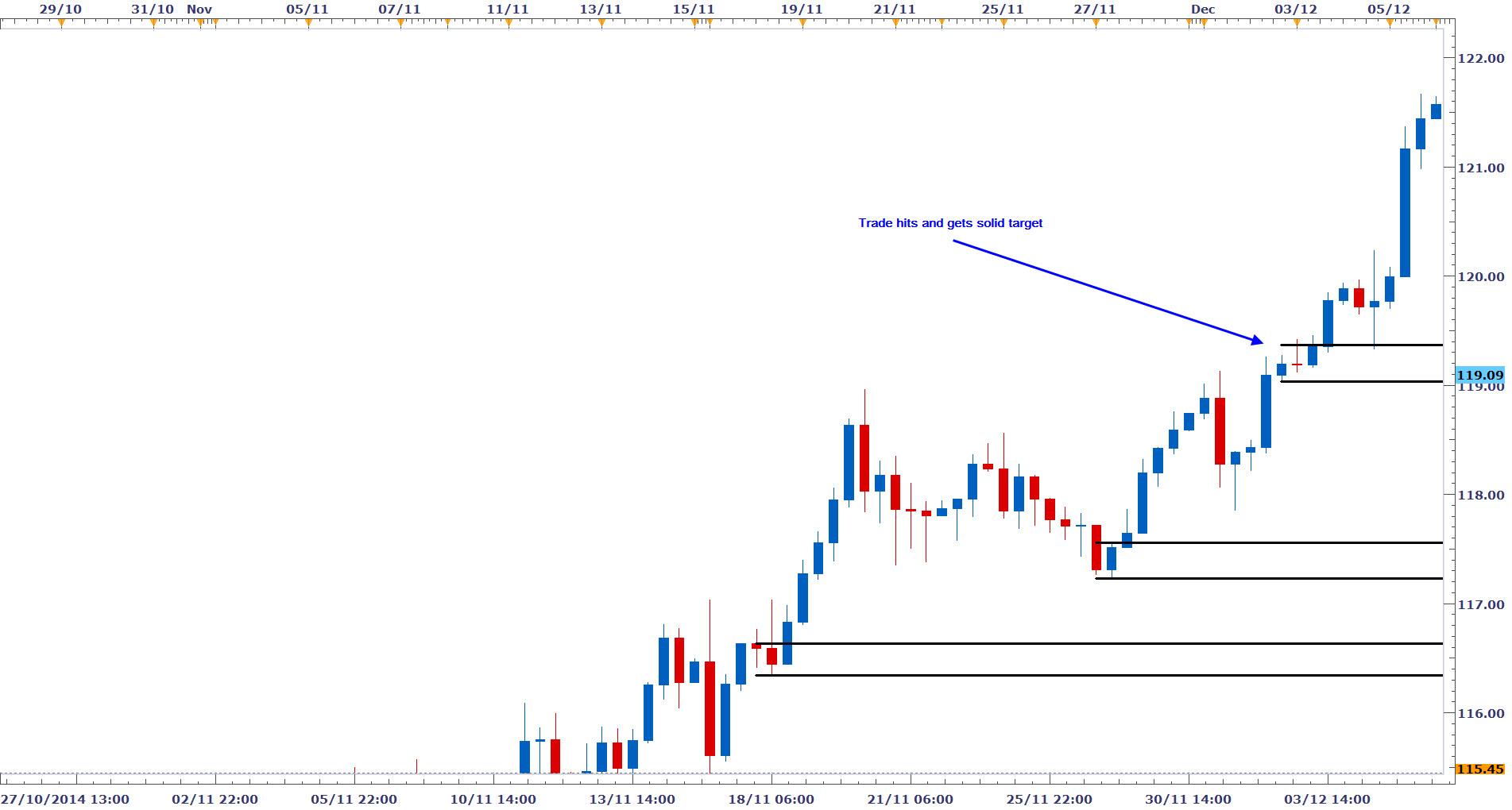

As we can see, the zone was hit and price rallied considerably from our level of demand, giving us a solid profit. The speed of the move away with such momentum can make it hard to want to close the trade out, as it makes us think it will carry on moving in our favor. While this is always possible, we must remember that this is also a huge unknown, suggesting that we should take a decent profit and move on to the next trade when it presents itself to us. Nobody ever went broke from taking decent profits from the market after all. As we can see below, closing out our position was a wise thing to do:

If we had not closed out the trade, most, if not all of the profit would have been sacrificed. Maybe even a loss would have been incurred. No matter the variables, it must be noticed that the easy profit was there and had to have been taken. Throughout the years of my own trading, I have been good with some things and bad with others. I can safely say though that one of the biggest challenges I had to overcome was that of learning to take a profit, ironic really when you think about it as what else is the reason for trading in the first place other than taking a profit? When I kept records and got consistently better at finding decent trades, I soon learned that if I took the smart profits off the table when I had the chance to do so, I made money consistently. When I didn’t, well I think you know the story…Yes we all want the most out of trades when we take them but we never really know how far they will run, so why not take a profit that is possible rather than hold out for a payday that’s never coming? I hope this makes an impact in your results moving forward.

The information provided is for informational purposes only. It does not constitute any form of advice or recommendation to buy or sell any securities or adopt any investment strategy mentioned. It is intended only to provide observations and views of the author(s) or hosts at the time of writing or presenting, both of which are subject to change at any time without prior notice. The information provided does not have regard to specific investment objectives, financial situation, or specific needs of any specific person who may read it. Investors should determine for themselves whether a particular service or product is suitable for their investment needs or should seek such professional advice for their particular situation. Please see our website for more information: https://bustamanteco.com/privacy-policy/

Editors’ Picks

EUR/USD: US Dollar to remain pressured until uncertainty fog dissipates Premium

The EUR/USD pair lost additional ground in the first week of February, settling at around 1.1820. The reversal lost momentum after the pair peaked at 1.2082 in January, its highest since mid-2021.

Gold: Volatility persists in commodity space Premium

After losing more than 8% to end the previous week, Gold (XAU/USD) remained under heavy selling pressure on Monday and dropped toward $4,400. Although XAU/USD staged a decisive rebound afterward, it failed to stabilize above $5,000.

GBP/USD: Pound Sterling tests key support ahead of a big week Premium

The Pound Sterling (GBP) changed course against the US Dollar (USD), with GBP/USD giving up nearly 200 pips in a dramatic correction.

Bitcoin: The worst may be behind us

Bitcoin (BTC) price recovers slightly, trading at $65,000 at the time of writing on Friday, after reaching a low of $60,000 during the early Asian trading session. The Crypto King remained under pressure so far this week, posting three consecutive weeks of losses exceeding 30%.

Three scenarios for Japanese Yen ahead of snap election Premium

The latest polls point to a dominant win for the ruling bloc at the upcoming Japanese snap election. The larger Sanae Takaichi’s mandate, the more investors fear faster implementation of tax cuts and spending plans.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a Chief trader its second knowledge how to extract cash out of the market.

5 Forex News Events You Need To Know

In the fast moving world of currency markets where huge moves can seemingly come from nowhere, it is extremely important for new traders to learn about the various economic indicators and forex news events and releases that shape the markets. Indeed, quickly getting a handle on which data to look out for, what it means, and how to trade it can see new traders quickly become far more profitable and sets up the road to long term success.

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and selling pressure. Chart patterns have a proven track-record, and traders use them to identify continuation or reversal signals, to open positions and identify price targets.

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

The challenge: Timing the market and trader psychology

Successful trading often comes down to timing – entering and exiting trades at the right moments. Yet timing the market is notoriously difficult, largely because human psychology can derail even the best plans. Two powerful emotions in particular – fear and greed – tend to drive trading decisions off course.