Many traders are of the mind set that they should follow only one or a very few instruments and therefore, you would come across many traders who trade just EURUSD, GBPUSD, ES_F or Gold (XAUUSD) for example. We at www.elliottwave-forecast.com believe that market works as a whole and as a forecaster we need to analyse the market as a whole and find a path which fits all the groups / instruments in the market rather than analysing the instruments individually. In this article, we will talk about why it’s important to follow Forex crosses and how traders could use them in different ways to gain an edge in their trading.

1. Look for trend in crosses when major forex pairs are consolidating

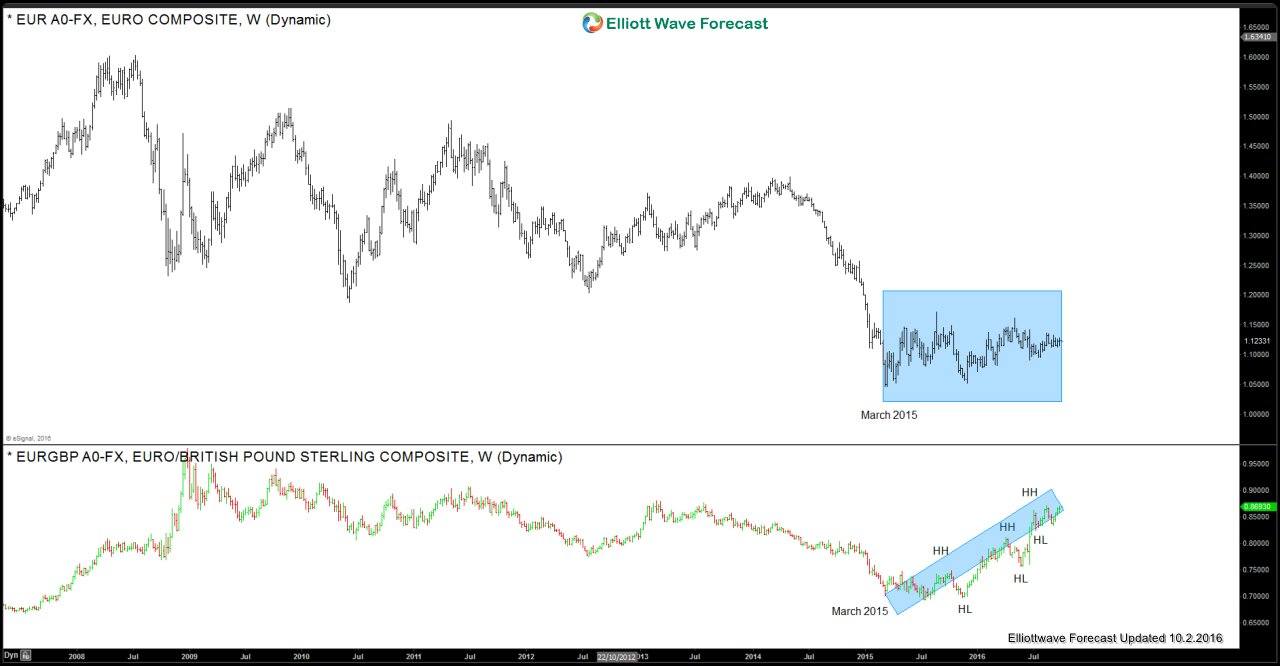

It’s a good practise to look find a trending instrument in the market and then use that instrument to buy the pull backs in an uptrend and sell the rallies in a downtrend. However, market is not always in a trending mode and most markets spend majority of the time consolidating. Consolidations can be very frustrating for traders as they result in a range which can often given many false break out signals causing traders to jump in using break out strategies and then getting hurt as the market falls back within the range. This is where crosses can come in handy because when major forex pairs are consolidating, traders could look at crosses to find a cross which is trending to trade that cross. For example, EURUSD has been consolidating in a sideways range since March 2015 and December 2015 lows but EURGBP on the other hand has been making a series of higher highs and higher lows since seeing a low back in March 2015. Therefore, a trader who only trades EURUSD or DXY would have seen a lot of frustration over the last year and a half whereas someone who keeps an eye on crosses could have done well by buying the dips in EURGBP after it making a series of higher highs and higher lows.

2. Use the crosses to decide which major pair to trade

Let’s say the trend in US Dollar is down and both EURUSD (57.6% weight) and GBPUSD (11.6% weight) or trending higher or expected to end a down cycle and bounce. Some traders would pick EURUSD to trade and others would pick GBPUSD to trade, selection could be based on personal preference, past trading results or which pair rallied the most in the last session, last few days / weeks etc. However, a smart trader would analyse EURGBP cross to determine the trend in EURGBP and then decide whether to buy EURUSD or GBPUSD to play the downtrend in US Dollar. If the trend in EURGBP is up, then EURUSD would be a better option to buy in the pull backs and if trend in EURGBP is down, then GBPUSD would be a better option to buy in the pull backs.

3. Use synthetic pairs to build a synthetic cross pair to trade

Donald Trump’s presidency campaign has had some impact in the FX markets, especially in the Mexican Peso and (more slightly) in the Russian Ruble. The RUB/MXN cross pair has been re-named by some as the “Trump Trade”. This is a very odd cross, hardly offered to be traded by the main brokers, but it can be operated indirectly as a synthetic pair using the USD/RUB and the USD/MXN. Let’s say you wanted to buy RUB/MXN but as it is not offered by most of the brokers and it’s a very hard cross to find in a trading platform, you could initiate a long position in RUB/MXN by buying USD/MXN (which means you are short MXN and long USD) and then by opening a short position in USD/RUB (short USD and long RUB), this will effectively give you a long position in RUB/MXN.

FURTHER DISCLOSURES AND DISCLAIMER CONCERNING RISK, RESPONSIBILITY AND LIABILITY Trading in the Foreign Exchange market is a challenging opportunity where above average returns are available for educated and experienced investors who are willing to take above average risk. However, before deciding to participate in Foreign Exchange (FX) trading, you should carefully consider your investment objectives, level of xperience and risk appetite. Do not invest or trade capital you cannot afford to lose. EME PROCESSING AND CONSULTING, LLC, THEIR REPRESENTATIVES, AND ANYONE WORKING FOR OR WITHIN WWW.ELLIOTTWAVE- FORECAST.COM is not responsible for any loss from any form of distributed advice, signal, analysis, or content. Again, we fully DISCLOSE to the Subscriber base that the Service as a whole, the individual Parties, Representatives, or owners shall not be liable to any and all Subscribers for any losses or damages as a result of any action taken by the Subscriber from any trade idea or signal posted on the website(s) distributed through any form of social-media, email, the website, and/or any other electronic, written, verbal, or future form of communication . All analysis, trading signals, trading recommendations, all charts, communicated interpretations of the wave counts, and all content from any media form produced by www.Elliottwave-forecast.com and/or the Representatives are solely the opinions and best efforts of the respective author(s). In general Forex instruments are highly leveraged, and traders can lose some or all of their initial margin funds. All content provided by www.Elliottwave-forecast.com is expressed in good faith and is intended to help Subscribers succeed in the marketplace, but it is never guaranteed. There is no “holy grail” to trading or forecasting the market and we are wrong sometimes like everyone else. Please understand and accept the risk involved when making any trading and/or investment decision. UNDERSTAND that all the content we provide is protected through copyright of EME PROCESSING AND CONSULTING, LLC. It is illegal to disseminate in any form of communication any part or all of our proprietary information without specific authorization. UNDERSTAND that you also agree to not allow persons that are not PAID SUBSCRIBERS to view any of the content not released publicly. IF YOU ARE FOUND TO BE IN VIOLATION OF THESE RESTRICTIONS you or your firm (as the Subscriber) will be charged fully with no discount for one year subscription to our Premium Plus Plan at $1,799.88 for EACH person or firm who received any of our content illegally through the respected intermediary’s (Subscriber in violation of terms) channel(s) of communication.

Editors’ Picks

EUR/USD: Yes, the US economy is resilient – No, that won’t save the US Dollar Premium

Some impressive US data should have resulted in a much stronger USD. Well, it didn’t happen. The EUR/USD pair closed a third consecutive week little changed, a handful of pips above the 1.1800 mark.

Gold: Metals remain vulnerable to broad market mood Premium

Gold (XAU/USD) started the week on a bullish note and climbed above $5,000 before declining sharply and erasing its weekly gains on Thursday, only to recover heading into the weekend.

GBP/USD: Pound Sterling remains below 1.3700 ahead of UK inflation test Premium

The Pound Sterling (GBP) failed to resist at higher levels against the US Dollar (USD), but buyers held their ground amid a US data-busy blockbuster week.

Bitcoin: BTC bears aren’t done yet

Bitcoin (BTC) price slips below $67,000 at the time of writing on Friday, remaining under pressure and extending losses of nearly 5% so far this week.

US Dollar: Big in Japan Premium

The US Dollar (USD) resumed its yearly downtrend this week, slipping back to two-week troughs just to bounce back a tad in the second half of the week.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a Chief trader its second knowledge how to extract cash out of the market.

5 Forex News Events You Need To Know

In the fast moving world of currency markets where huge moves can seemingly come from nowhere, it is extremely important for new traders to learn about the various economic indicators and forex news events and releases that shape the markets. Indeed, quickly getting a handle on which data to look out for, what it means, and how to trade it can see new traders quickly become far more profitable and sets up the road to long term success.

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and selling pressure. Chart patterns have a proven track-record, and traders use them to identify continuation or reversal signals, to open positions and identify price targets.

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

The challenge: Timing the market and trader psychology

Successful trading often comes down to timing – entering and exiting trades at the right moments. Yet timing the market is notoriously difficult, largely because human psychology can derail even the best plans. Two powerful emotions in particular – fear and greed – tend to drive trading decisions off course.