Before I answer the question, let’s do some simple math:

When I use PowerX Optimizer, I am looking for stocks that had at least 60% return on investment over the past year.

Making 60% in the stock market consistently is a great accomplishment!

Yes, of course, every now and then you will have a trade that doubles, triples and maybe even quadruples your money.

But you will also have some losing trades. 60% per year is an excellent result if you can make it consistently.

For this article, I want to be even more optimistic.

Let’s say you can DOUBLE that, and you can achieve 120% per year.

Based on a $500 account, you would make $600. You would grow your account from $500 to $1,100.

Or, if we look at it in a different way, you would make $50 per month = $600 per year / 12 months.

I don’t know about you, but $50 per month doesn’t sound very exciting.

You would make more money when you drive 1 day per month for Uber!

But let’s dive a little bit deeper:

What Can I Invest In With $500?

Most brokers will allow you to open an account with $500 to trade stocks and options.

Oh yeah, you also can trade Forex, but when trading Forex you’re trading against the house, so you’re almost guaranteed to lose money.

I’ll do another video on that topic.

So let’s take a look at stocks first:

The so-called “blue chips” are the 30 stocks in the Dow Jones, and right now, a stock in the Dow costs you between $35 for Pfizer (PFE) and $320 for Apple (AAPL).

You should never put all your eggs in one basket. I recommend that you diversify and have at least 5 different positions in your account.

This means that you divide your $500 into 5 equal parts, i.e. you can allocate $100 per stock.

Only 10 of the 30 stocks in the Dow are trading below $100, so you could only trade these stocks.

Of course, you can look at the Nasdaq or the S&P500 for additional stocks.

My point is: You’re restricting the stocks that you can invest in, simply because you don’t have enough capital.

And for me, that’s a significant handicap.

It’s like going to the grocery store and trying to buy food for a week for $20. Yes, it’s possible, but not easy. Same here when you’re trading stocks.

Ok, so if trading stocks with $500 is not possible, or very difficult, what about options?

Learn to trade stocks & options in 15 minutes a day

Get A FREE Copy Of My New Book!

Can You Start Trading Options With $500?

Options sound like a great alternative for people with smaller accounts.

After all, most options are priced between $1 and $2! The problem: options come in 100 packs, so if an option costs $1, you actually have to bring $100 to the table.

So you’re running into the same problem as with stocks: In order to diversify your $500 into multiple positions, you need to trade options that cost less than $1.

Here’s the problem: When an option costs less than $1, it’s usually “out of the money”. This means that the probability of making money with this option is rather small.

Here’s an example:

Let’s say you want to trade an option on Disney (DIS). Right now, DIS is trading at $135, and you expect it to go up to $150.

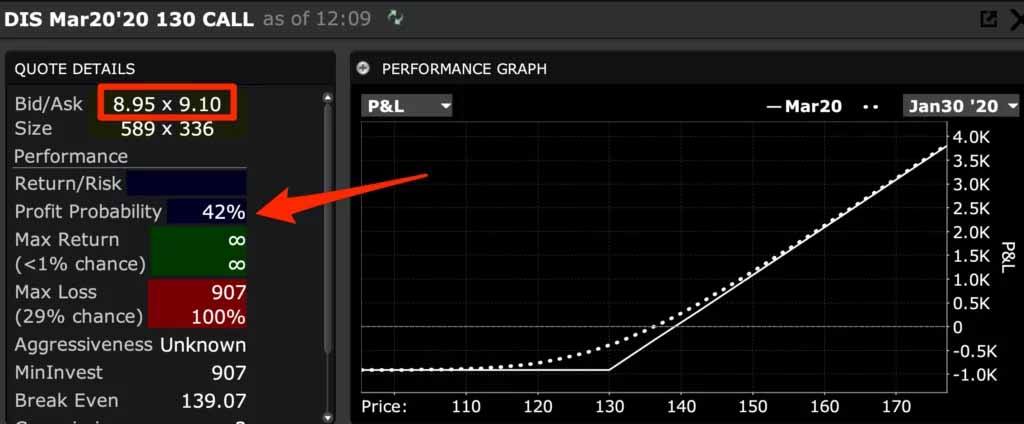

You could buy the 130 Call Option, and this trade would have a 42% chance of success.

The problem: The price of the option is between $8.95 and $9.10, and since they come in 100 packs, you would have to invest $895 – $910.

But you only have $500, so this option doesn’t work.

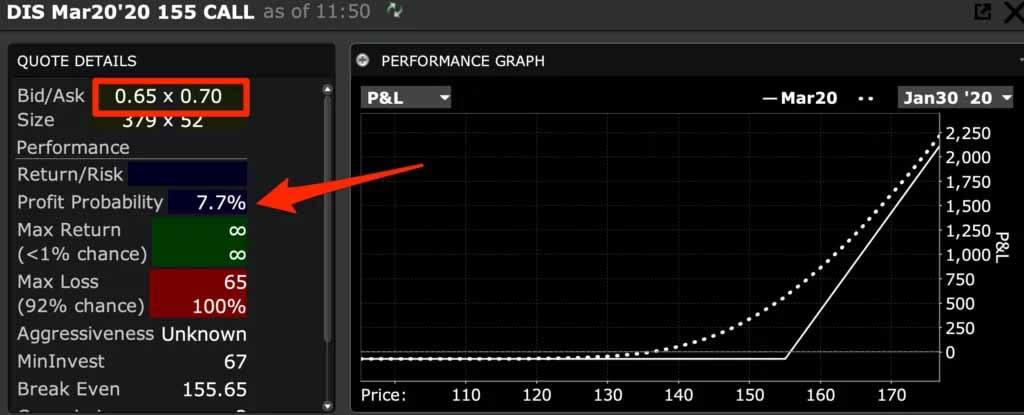

Most people then look for a cheaper option, would look at the 155 Call option.

It only costs between $0.65 – $0.70, so you need only $60 – $70 to buy this option. With a $500 account, that’s possible.

But take a look at the “Profit Probability:”

It went down from 42% to only 7.7%.

YES: The option is cheaper and more affordable, but the chances of making money with the option are slim to none.

So what’s the solution?

How To Start Trading With $500?

As you can see, even though technically you can open an account with $500, the odds of making money with such a small amount are stacked against you:

-

You would only make $50 per month, which doesn’t make sense.

-

You can only trade very few stocks since you need to buy cheap stocks. So your trade selection becomes extremely difficult.

-

You can only trade cheap options, and there’s a reason why they are “cheap:” The probability of making money with cheap options is slim to none.

For these reasons, most people who start with $500, will lose it all within a few weeks or a few months.

I know that THIS is now what you want to hear, but try to save up some more money before you start trading.

Think about it as starting a business:

Yes, you might be able to start a business with $500, but the chances of making any money with the business are small.

The good news:

You can still learn how to trade and practice on a simulator until you have more money available for trading.

So take your time to master trading on a practice account until you have enough money to start starting – and your chances of making it as a trader will be much, much higher.

Trading Futures, options on futures and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. The lower the day trade margin, the higher the leverage and riskier the trade. Leverage can work for you as well as against you; it magnifies gains as well as losses. Past performance is not necessarily indicative of future results.

Editors’ Picks

AUD/USD stalls near 0.7150 after RBA Bullock's comments

AUD/USD has paused its uptick to near 0.7150 in the Asian session on Thursday, at a three-year high. Cautious remarks from RBA Governor Bullock seem to cap the Aussie's upside. However, renewed US Dollar weakness cushions the pair's downside ahead of US Jobless Claims data.

USD/JPY returns to the red below 153.00 after Japan's verbal intervention

USD/JPY attracts fresh sellers and falls back below 153.00 in the Asian session on Thursday. The US Dollar reverses the strong jobs data-led recovery, weighing on the pair amid the ongoing bullish momentum in the Japanese Yen, helped by Japanese verbal intervention. Japan's PM Sanae Takaichi's landslide election victory also keeps the local currency buoyed. The attention now remains on Friday's US Consumer Price Index inflation report.

Gold holds losses near $5,050 despite renewed USD selling

Gold price trades in negative territory near $5,050 in Thursday's Asian session. The precious metal faces headwinds from stronger-than-expected US employment data, even as the US Dollar sees a bout of fresh selling. All eyes now remain on the next batch of US labor statistics.

Crypto trades through a confidence reset as ETF flows, liquidity gaps and realized losses shape price action

The cryptocurrency market is navigating a liquidity-driven reset rather than a narrative-driven rally. Bitcoin, Ethereum and major altcoins remain under pressure even as new exchange-traded fund filings continue and selected inflow days appear on the tape.

The market trades the path not the past

The payroll number did not just beat. It reset the tone. 130,000 vs. 65,000 expected, with a 35,000 whisper. 79 of 80 economists leaning the wrong way. Unemployment and underemployment are edging lower. For all the statistical fog around birth-death adjustments and seasonal quirks, the core message was unmistakable. The labour market is not cracking.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a Chief trader its second knowledge how to extract cash out of the market.

5 Forex News Events You Need To Know

In the fast moving world of currency markets where huge moves can seemingly come from nowhere, it is extremely important for new traders to learn about the various economic indicators and forex news events and releases that shape the markets. Indeed, quickly getting a handle on which data to look out for, what it means, and how to trade it can see new traders quickly become far more profitable and sets up the road to long term success.

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and selling pressure. Chart patterns have a proven track-record, and traders use them to identify continuation or reversal signals, to open positions and identify price targets.

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

The challenge: Timing the market and trader psychology

Successful trading often comes down to timing – entering and exiting trades at the right moments. Yet timing the market is notoriously difficult, largely because human psychology can derail even the best plans. Two powerful emotions in particular – fear and greed – tend to drive trading decisions off course.