Things might get very frustrating when you miss a possible good trade setup in the market. Many traders that are new to the market think that they have missed a “once in a lifetime” opportunity and try to chase the trade and ultimately lose a huge amount of money. But the professional traders in the financial market consider a missed trade setup as a new possibility of getting into a much better trade once the market settles.

Most of the time, the price retraces back and gives a second chance to traders during trending market. Please note the below-mentioned points as this will give you a clear insight of when you can ride a missed trade in the market. The market conditions should be as follows:

1) Trending market

2) Price makes higher highs or lower lows

3) Ranging market

Let’s go through some examples and explain some high quality missed setups, and how you can re-enter the market.

1. Missing the entry in a trending market

Figure: Missed bounce off the bearish trend line in the AUDUSD pair

From the above figure, you can clearly see that there was a nice selling opportunity at the bearish trend line. But if you face such scenario in the market then there is no need to worry – the market retraces back to a certain extent and gives a second chance to traders who missed the first opportunity. So, let’s see what happens next.

Figure: Price retracing back and giving the traders a second chance to board on the missed trade

From the above figure, you can clearly see that the AUDUSDpair retraced back to the trend line resistance level and gave the traders a second chance to execute a short order in the market. To be precise, the second trade setup is much more reliable as it formed a nice “bearish pin bar” right at the trend line resistance level which was not the case during the first time. So there is nothing to worry if you have missed a trade in the market, all you need to do is to wait for the minor retracement of the price towards the support and resistance level before you execute the trade in the market.

If you missed a trade when the market exhibits any of the above mentioned three characteristics then chances are very high that you will be able to ride a missed trade in the market with much more reliable trade setups. But, when you trade the trend line in the market always have on mind that executing the trade at the third trendline retracement is a little bit aggressive. Professional traders love to trade the “third retracement” as the market proves the underlying trend, and offers the opportunity for a quick profit. Remember, if you missed the first retracement, then the second one will usually give you a much better opportunity.

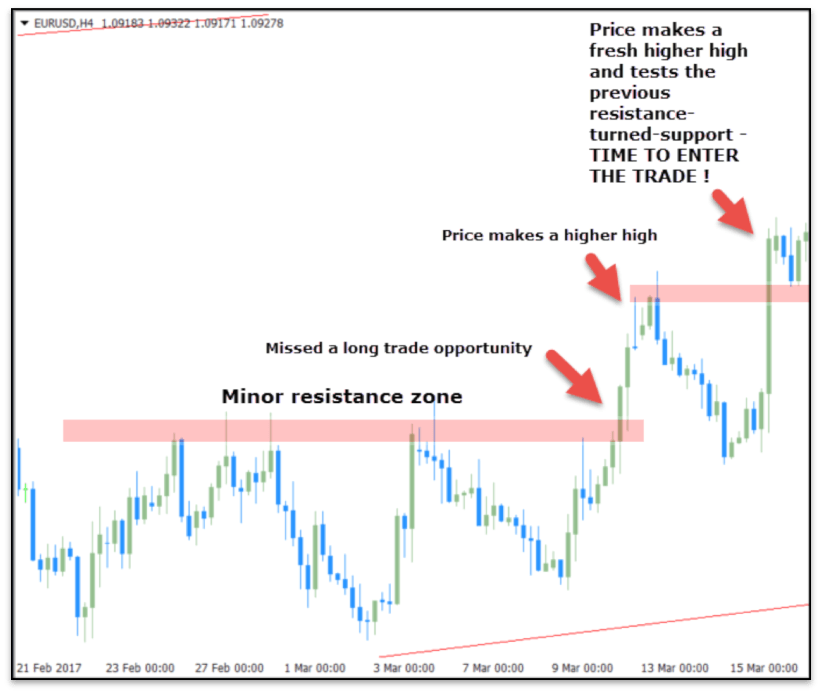

2. Missing a trade setup when the market makes higher highs or lower lows

If the market doesn’t look like it is trending, you can still enter a missed trade. The key is to wait for the price to make a repeating pattern, like higher highs or lower lows. In the next chart, I will show you how such a trade setup looks like.

Figure: Missing trades when price makes higher highs

The EUR/USD pair didn’t trade in a trend when the missed opportunity for a long position occurred. The key for traders in this case is to be patient and wait for the price to retrace, eventually making a new higher high. With a new break-out of the red resistance zone, and additional testing of the resistance-turned-support, it’s time to enter the market. This setup is nicely followed with a long bullish candlestick, which confirms a possible new higher-high is to come. Let’s see what happened next.

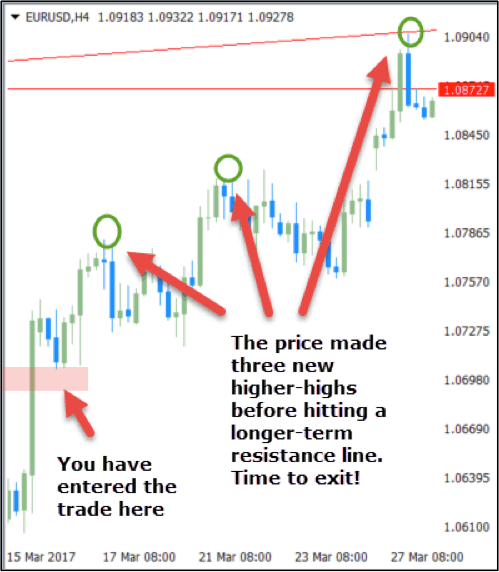

Figure: Higher highs provide a good opportunity to re-enter the market

The market continued to make higher-highs after we entered the market. It made three new higher-highs before finally hitting a longer-term resistance line, which is a signal to exit the trade at this place. The trader would have made a nice profit by following these instructions, despite missing the initial trade.

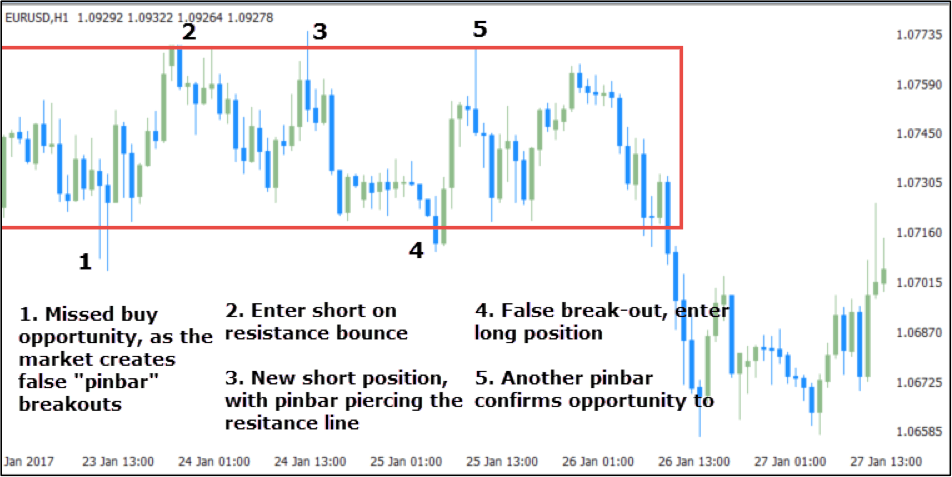

3. Re-entering a trade in ranging markets

Ranging markets offer a load of opportunities to re-enter the market once a you’ve missed a trade setup. Generally, the strategy involves trading bounces off the rectangle, or support and resistance lines. The following chart shows a sideways-trading market with the missed first trade setup.

Figure: Missing a bounce in a ranging market gives new trading opportunities

The trader has missed the first setup (1), but there is nothing to worry about. Don’t jump in immediately, but wait for the price to reach the upper resistance line of the rectangle (2). With the next bearish candlestick confirming the bounce, it’s time to open a short position. The same opportunity appeared at number (3), where the pinbar candlestick touched the upper resistance line. Stick to the position until the price bounces to the lower support line (4), which made a false break-out signal. With the next bullish candlestick returning into the rectangle, and covering the prior two bearish candlesticks with its body, this is a strong signal to enter a long position. Again, at number (5), the price touched the upper resistance line with a pinbar candlestick – it’s time to close the long and open a short.

Conclusion

As can be seen from all of the charts, never chase a missed trade setup. In doing so, novice traders lose money in the long run. Instead, focus on the market signals that the price will send afterwards. Wait for pullbacks, trendline bounces, rectangle bounces, higher highs or lower lows. Trading the support and resistance will create new trade opportunities very soon. There is never a lack of volatility in the forex market, just be patient and the market will create the new perfect setup for you. You can also use the Fibonacci retracement tools or chart patterns to trade the missed trade with minor retracement of the price. But when you trade the market make sure that you follow proper risk management factors to reduce the risk exposure in trading.

This material is written for educational purposes only. By no means do any of its contents recommend, advocate or urge the buying, selling or holding of any financial instrument whatsoever. Trading and Investing involves high levels of risk. The author expresses personal opinions and will not assume any responsibility whatsoever for the actions of the reader. The author may or may not have positions in Financial Instruments discussed in this newsletter. Future results can be dramatically different from the opinions expressed herein. Past performance does not guarantee future results.

Editors’ Picks

EUR/USD off highs, back to 1.1850

EUR/USD loses some upside momentum, returning to the 1.1850 region amid humble losses. The pair’s slight decline comes against the backdrop of a marginal advance in the US Dollar as investors continue to assess the latest US CPI readings.

GBP/USD advances to daily tops around 1.3650

GBP/USD now manages to pick up extra pace, clinching daily highs around 1.3650 and leaving behind three consecutive daily pullbacks on Friday. Cable’s improved sentiment comes on the back of the inconclusive price action of the Greenback, while recent hawkish comments from the BoE’s Pill also collaborates with the uptick.

Gold surpasses $5,000/oz, daily highs

Gold is reclaiming part of the ground lost on Wednesday’s marked decline, as bargain-hunters keep piling up and lifting prices past the key $5,000 per troy ounce. The yellow metal’s upside is also propped up by the lack of clear direction around the US Dollar post-US CPI release.

Crypto Today: Bitcoin, Ethereum, XRP in choppy price action, weighed down by falling institutional interest

Bitcoin's upside remains largely constrained amid weak technicals and declining institutional interest. Ethereum trades sideways above $1,900 support with the upside capped below $2,000 amid ETF outflows.

Week ahead – Data blitz, Fed Minutes and RBNZ decision in the spotlight

US GDP and PCE inflation are main highlights, plus the Fed minutes. UK and Japan have busy calendars too with focus on CPI. Flash PMIs for February will also be doing the rounds. RBNZ meets, is unlikely to follow RBA’s hawkish path.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a Chief trader its second knowledge how to extract cash out of the market.

5 Forex News Events You Need To Know

In the fast moving world of currency markets where huge moves can seemingly come from nowhere, it is extremely important for new traders to learn about the various economic indicators and forex news events and releases that shape the markets. Indeed, quickly getting a handle on which data to look out for, what it means, and how to trade it can see new traders quickly become far more profitable and sets up the road to long term success.

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and selling pressure. Chart patterns have a proven track-record, and traders use them to identify continuation or reversal signals, to open positions and identify price targets.

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

The challenge: Timing the market and trader psychology

Successful trading often comes down to timing – entering and exiting trades at the right moments. Yet timing the market is notoriously difficult, largely because human psychology can derail even the best plans. Two powerful emotions in particular – fear and greed – tend to drive trading decisions off course.