Trading the forex market involves much complex procedure which requires extensive knowledge of the financial industry. There are many professional in the world that prefers to trade the synthetic cross pair in order to experience high liquidity. They compare the like currency rate of the major pairs and make a synthetic cross pair. Making synthetic pair from the major pair and trading it in the real market with live currency rate can be extremely difficult for the new traders. But if you want to build a strong trading career then you must know how to build synthetic pair since their high volatility will help you to make a sizeable profit in the forex market. But always remember trading the synthetic pair at the initial stage is highly risky and this synthetic pair should be only be traded by the long-term, professional traders. Basically, traders make the correlation of the two major pairs containing the green bucks and create a new pair which is known as a synthetic pair or exotic pair. Let’s see how the professional traders create synthetic pair and trade them in the real market.

Simple method to create the synthetic pair

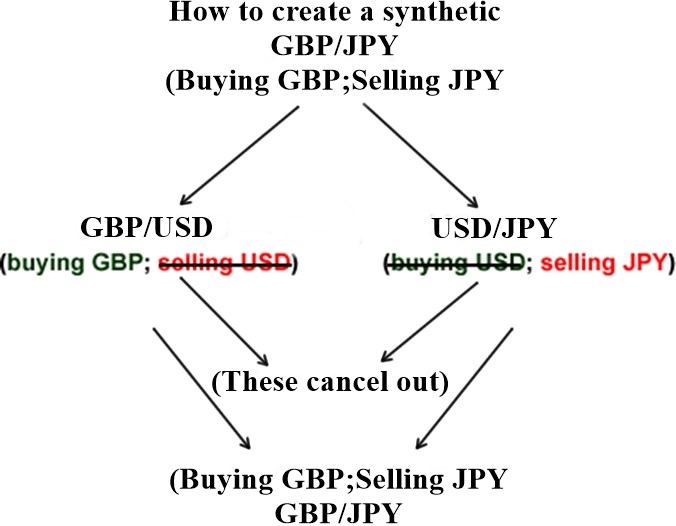

Before we go more into the details of synthetic pair lets site an example why we need to create a synthetic pair. For instance, retail traders want to buy to the GBPJPY. But in order to buy the GBPJPY they need to buy two major currency pair in the forex market. They must buy GBPUSD and USDJPY simultaneously in order to buy GBPJPY pairs since there is not enough liquidity in GBPJPY. Still confused? No worries! Let’s see a simple diagram for synthetic cross and everything will be crystal clear to you.

Let’s see how synthetic pair is created

Figure: Synthetic pair

So, you can see clearly that the retail traders can also trade the synthetic pair by following these simple steps. But before you master the true art of forex trading the synthetic pair is very risky since the volatility is extremely high in synthetic pair compared to the major pairs. You should try synthetic pair only if you have strong knowledge about the major pairs. Many traders often think that only technical analysis of well enough to make you strong in this sector. This statement is somewhat true if you have strict trading discipline and put your trade only on the major pair. But if you are thinking to take your trading career into next level then you should also consider fundamental analysis as one of the most vital element.

The synthetic pair is only for long term investors since the relative volatility is extremely higher in exotic/synthetic pairs. Always remember that buying the synthetic pair always involve three countries currency. Unlike the major pairs, you are buying and selling three countries currency when trading the synthetic pair. In another way, we can say that two pairs are being traded while we open any position in synthetic pairs. Many traders often wonder why the spread is so huge in a synthetic pair. The answer is pretty simple. Brokers are adding two major pair spreads used in the creation of synthetic pair and imposing a new high spread for the traders. So if you are scalper then it would be nearly impossible for you to make the consistent profit by covering the large spread. Honestly, this pair is not for the scalpers. On the country scalper uses tight stop loss and their trade is more likely to hit their stop loss due to the high volatility in the synthetic pair. However, there are some professional who also scalp in the synthetic pair by using simple technique but always remember exception can’t be an example. Most advanced synthetic pair traders prefer trailing stop loss features in order to maximize the potential profit from their trade. And another important thing about synthetic traders is, they always trade in the direction of the prevailing long-term trend.

Long-term investors always prefer synthetic pair in their trading. They know that the market will remain extremely volatile compared to other major pairs. So they use large stop loss and aim for huge gain while trading the financial instrument. They also use higher time frame charts while taking any trading decision because large time frame tends to produce more accurate and stable result. Most professional traders always consider fundamental analysis as their strong trading tools. They draw a close relation line between the three currency economies and make a sequence of their economic performance. Based on their researched fundamental data and technical analysis trained professional execute their trade using the live currency rate of the synthetic pairs.

Summary: Trading the synthetic pair can be extremely profitable if done properly. There are many new traders in the forex industry who are losing tons of money in the hands of greed just by trading these high volatile pairs. On the contrary professional forex traders are taking the maximum advantage of this high volatile pair. They are simply creating a synthetic pair and trading the differential live currency rate in the financial market. The best way to trade the synthetic pair is by using simple support and resistance level along with price action confirmation signal. Though there are many different ways of trading the synthetic pair but price action strategy tends to minimize the risk involve in synthetic pair trading. As a synthetic pair trader, you must follow proper money management .Unlike traditional risk management you should look for higher risk reward ratio like 1:3 or more to make consistent profit in the long run. A solid grip of fundamental knowledge is also required for successful synthetic pair trading.

Editors’ Picks

EUR/USD weakens to four-week lows near 1.1750

EUR/USD’s selling pressure is gathering pace now, approaching the area of multi-week troughs in the mid-1.1700s on Thursday. The pair’s intense decline comes on the back of another day of solid gains in the US Dollar, particulalry exacerbated following firm prints from the weekly US labour market.

GBP/USD drops further, hovers around 1.3460

In line with the rest of its risk-linked peers, GBP/USD faces increasing selling pressure and recedes toward the 1.3460 region, or four-week lows, on Thursday. Cable’s persistent pullback comes in response to the continuation of the recovery in the Greenback amid a solid US data and a divided FOMC when it comes to the Fed’s rate path.

Gold clings to daily gains near $5,000

Gold struggles for direction and clings to its daily gains around the key $5,000 mark per troy ounce on Thursday. The precious metal sticks to the bid bias amid reignited geopolitical tensions in the Middle East and despite marked gains in the US Dollar and rising US Treasury yields across the curve.

Ripple slips toward $1.40 despite SG-FORGE tapping protocol for EUR CoinVertible

XRP extends its decline, nearing $1.40 support, as risk appetite fades in the broader market. SG-FORGE’s EUR CoinVertible launches on the XRP Ledger, leveraging the blockchain’s scalability, speed, security, and decentralization.

Hawkish Fed minutes and a market finding its footing

It was green across the board for US Stock market indexes at the close on Wednesday, with most S&P 500 names ending higher, adding 38 points (0.6%) to 6,881 overall. At the GICS sector level, energy led gains, followed by technology and consumer discretionary, while utilities and real estate posted the largest losses.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a Chief trader its second knowledge how to extract cash out of the market.

5 Forex News Events You Need To Know

In the fast moving world of currency markets where huge moves can seemingly come from nowhere, it is extremely important for new traders to learn about the various economic indicators and forex news events and releases that shape the markets. Indeed, quickly getting a handle on which data to look out for, what it means, and how to trade it can see new traders quickly become far more profitable and sets up the road to long term success.

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and selling pressure. Chart patterns have a proven track-record, and traders use them to identify continuation or reversal signals, to open positions and identify price targets.

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

The challenge: Timing the market and trader psychology

Successful trading often comes down to timing – entering and exiting trades at the right moments. Yet timing the market is notoriously difficult, largely because human psychology can derail even the best plans. Two powerful emotions in particular – fear and greed – tend to drive trading decisions off course.