With the US Presidential election coming up, a unique trade has developed called a synthetic cross pair with the Mexican Peso and the Russian Ruble. A synthetic cross pair is a trade between 2 currencies of which neither one of the currencies is referencing the US dollar. They do not directly trade against each other. This strategy is based off of one currency weakening against the US Dollar while at the same time another currency strengthens. The synthetic cross pair that has been gaining in popularity over the last few weeks has been dubbed the “Trump Trade”.

This synthetic cross pair is created when you buy a USDMXN and sell a USDRUB. In this trade, the Mexican Peso would weaken against the US Dollar while the Russian Ruble would strengthen against the US Dollar. This strategy can be utilized off of a macro/geo political event or a potential change in monetary policy. In this case, it is a geo political event. The two currencies involved should have an inverse relationship to each other against the US dollar, boosting the return of the trade. This type of trade should not be looked at as any sort of hedge.

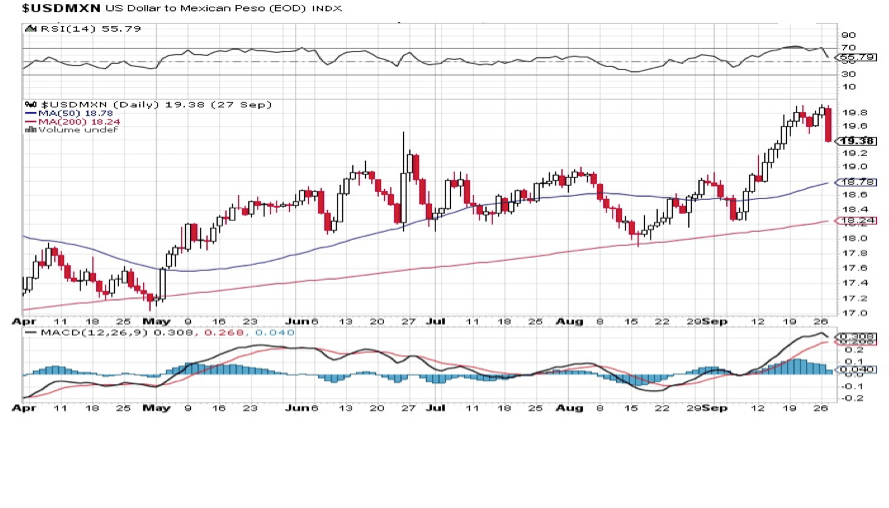

Their has been a direct correlation to a weakening of the Mexican Peso against the US Dollar as Presidential polling numbers show the Republican candidate, Donald Trump closing the lead against Democratic candidate, Hillary Clinton. With Trump’s rhetoric about building a wall on the Mexican border and altering NAFTA, Mexico’s economy would suffer sending the price of the Peso lower against the US dollar. In the last few weeks, as Trump’s polling numbers continue to climb, we saw the Mexican Peso hit an all-time low against the US Dollar the other week. However, with polls suggesting that Trump lost the first debate this past Monday, the Peso strengthened but is still down 6% for the month.

We can say the opposite for the Russian Ruble as that currency has strengthened as Trump makes Pro Russian statements, talks about a potential shift in NATO and would likely build a strong relationship with the Russian President Vladimir Putin. If Trump were President, sanctions against Russia by the US would be lifted strengthening Russia’s economy. This new US-Russian relationship would strengthen the Ruble against the US Dollar. Similar to Mexico, as recent polls showed Trump narrowing Clinton’s lead, the Ruble gained in strength. And as reiterated earlier, with polls suggesting that Trump lost the debate, the Ruble weakened as a vote for Clinton is a vote for the staus quo. Clinton and Putin are also not the biggest fans of eachother.

With the information given above, to now create this synthetic cross pair would include 2 trades. One downside to the potential boost in return is that you will have to pay more in bid offers since you are paying for both trades.

This blog represents the view/opinions of the author and not those of his employer.

Editors’ Picks

EUR/USD trims gains toward 1.1000 as focus shifts to Fed Minutes Premium

EUR/USD heads toward 1.1000 in the European session on Wednesday, reversing the uptick to near 1.1100 , The US Dollar recover as traders resort to repositioning ahead of the Fed Minutes release. However, USD buyers stay cautious as the trade war escalation aggravates US economic concerns.

GBP/USD revisits 1.2800 as US Dollar finds footing

GBP/USD is trimming gains to retest 1.2800 in European trading on Wednesday. The pair faces headwinds as the US Dollar stages a modest comeback even as investors remain wary over the impact of the escalating global trade war on the US economic prospects. Tariff updates and Fed Minutes awaited.

Gold price builds on strong intraday gains; bulls retain control near $3,050 area amid risk-off mood

Gold price climbs back closer to the $3,050 area during the early European session on Thursday as worries that an all-out global trade war would push the world economy into recession continue to boost safe-haven demand.

XRP Price Forecast: XXRP ETF and Trump tariffs shaping XRP fundamental outlook

XRP struggles to stay afloat, with key support levels crumbling due to volatility from macroeconomic factors, including United States President Donald Trump's reciprocal tariffs kicking in on Wednesday.

Tariff rollercoaster continues as China slapped with 104% levies

The reaction in currencies has not been as predictable. The clear winners so far remain the safe-haven Japanese yen and Swiss franc, no surprises there, while the euro has also emerged as a quasi-safe-haven given its high liquid status.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

Discover how to make money in forex is easy if you know how the bankers trade!

5 Forex News Events You Need To Know

In the fast moving world of currency markets, it is extremely important for new traders to know the list of important forex news...

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and...

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.