If you can spot a trend reversal you will become a very successful margin trader. That’s what’s it all about.

Let’s begin with what a reversal is. This is the point when the trend changes. You can see a price of Bitcoin, gold, or a currency pair going up with some smaller corrections. Until each local high and low is higher than the previous high and low, we are dealing with an uptrend.

The same is true the other way around. The price of an asset goes down you can see the trend if the local ups and downs are lower than the previous ones. The local rallies (increases in the price) are called retracements. You can also use them to enter the market at a better price.

You can imagine why making the difference between a retracement and a trend reversal is a key part of a successful trade. If you time it right, you will be able to make great gains.

On the other hand, if you notice a reversal and have an opposite position open, you want to close it as soon as possible. So identifying the trend reversal also helps you avoid a potential loss.

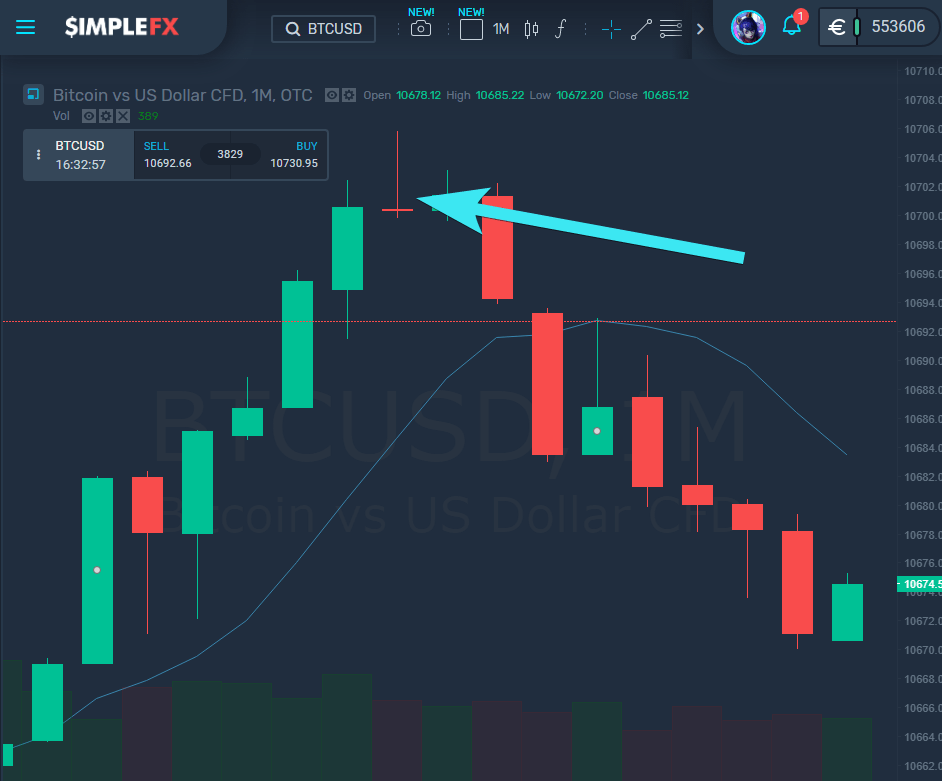

A pin bar is a common reversal pattern. It’s easy to spot and many margin traders find it very useful. You can spot the pin bar pattern using the Japanese candlestick chart view.

Above you can see an example of a red bearish pin bar that may signal a reversal from uptrend to downtrend.

The pin bar as a long wick and a short body. In the case of this red pin bar, the shape indicates that the price went up for a while, but then all the way down to the level indicated by the bottom of the candle’s body.

Here are some characteristics of a pin bar pattern to more likely signal a trend change:

-

Its wick has to be longer than the body

-

Its wick has to be longer than the wicks of previous candlesticks

-

Its body has to be on one side of the wicks

-

Its body has to be enclosed in the previous candlestick body.

You can also confirm the pattern with some other indicators, such as support and resistance or trend lines. You can also combine it with a moving average indicator.

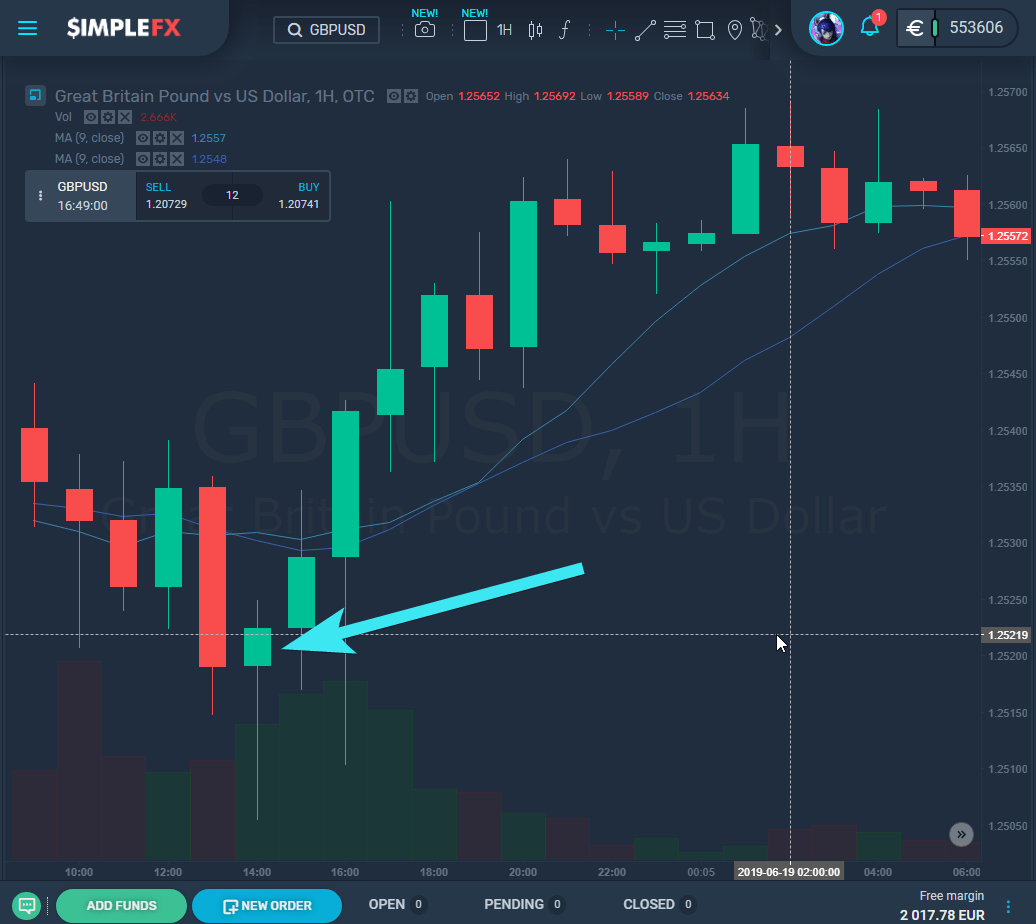

Now, let’s discuss when to make an entry then seeing a pin bar pattern. In the one-hour GBPUSD chart above you can see an example of a bullish green pin bar that signaled a reversal from a downtrend to an uptrend.

You can safely make the order at the close of the period (which is the upper edge of the body since it’s a green candlestick). This will hedge your position against the scenario when the pattern doesn’t work.

You can also consider trading at the tip of the nose (the upper wick) of such a bullish pin bar. You may also try trading at the break of the nose.

All these strategies have their trade-offs. The lower you try to buy the upward reversal, the higher the profit you may get, but then take more risks if the signal proves to be false.

You should also adjust your stop-loss points accordingly. If you put them too tight, you may be stopped out from your position even if you identify the trend swift correctly.

Remember, you should avoid entering too early or too late as you can lose the profit.

Trading in the products and services of SimpleFX may result in losses as well as profits. In particular trading in leveraged products, such as but not limited to, cryptocurrency, foreign exchange, derivatives and commodities can be very speculative. Losses and profits may fluctuate both violently and rapidly.

Editors’ Picks

EUR/USD stays in positive territory near 1.1000, looks to post weekly gains

EUR/USD trades modestly higher on the day at around 1.1000 in the American session on Friday. Although the cautious market stance limits the upside, the pair remains on track to post its highest weekly close of 2024.

GBP/USD climbs to multi-week highs above 1.2900

GBP/USD trades at its highest level in three weeks at around 1.2900 in the American session on Friday. The bearish opening seen in Wall Street points to a negative tilt in risk mood and makes it difficult for the pair to gather further bullish momentum.

Gold retreats after setting a new record high of $2,500

Gold stages a technical correction and trades below $2,490 after setting a new record high of $2,500 earlier in the day, boosted by falling US Treasury bond yields. Profit-taking could ramp up the volatility heading into the weekend.

Dogecoin price is set for a downturn as it encounters its resistance barrier

Dogecoin price is testing the resistance around the 100-day EMA at $0.1073, with an impending decline ahead. On-chain data shows DOGE's daily active addresses decreasing and dormant wallets moving again, signaling a bearish move.

Easing inflation worries despite robust sales data

The market mood got a further boost yesterday after the latest data release from he US hinted that the economy is not doing that bad, after all.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

Discover how to make money in forex is easy if you know how the bankers trade!

5 Forex News Events You Need To Know

In the fast moving world of currency markets, it is extremely important for new traders to know the list of important forex news...

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and...

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.