A deep dive into monetary and fiscal policies and how they shape the financial markets at large.

The Forex market - also known as foreign exchange - is the largest and most liquid market in the world, with trillions of US dollars being traded on a daily basis. Underpinned by currency interest rate fluctuations, it is also arguably more volatile than the stock market, given the multitude of economic and socio-political factors directly impacting it.

Among these, monetary and fiscal policies are the primary factors moving the Forex and equity markets, playing a pivotal role in defining currency strength.

Understanding the difference between monetary and fiscal policies

Monetary policy relates to central bank activities that dictate the amount of money being printed and credit in an economy. Contrastingly, fiscal policy refers to a set of government-established rules on taxation and public spending to regulate economic activities.

Used concurrently to regulate economic activity, they employ different tools to either accelerate or abate growth to prevent the economy from slowing down or overheating, as the case may be.1

Interest rates, inflation and money supply

To safeguard economic stability, central banks set inflation targets. They adjust the money supply through buying and selling securities in the open market. These actions impact short-term interest rates, which in turn, affect longer-term rates and the broader economy.2

When central banks reduce interest rates, it is referred to as a monetary policy easing or a “dovish” stance. This encourages consumer spending, investment, and business activity by making borrowing cheaper.

For example, in June 2024, the European Central Bank (ECB) decided to trim interest rates by 25 basis points for the first time since 2019, causing the EUR to slightly depreciate against the USD and other major currencies.

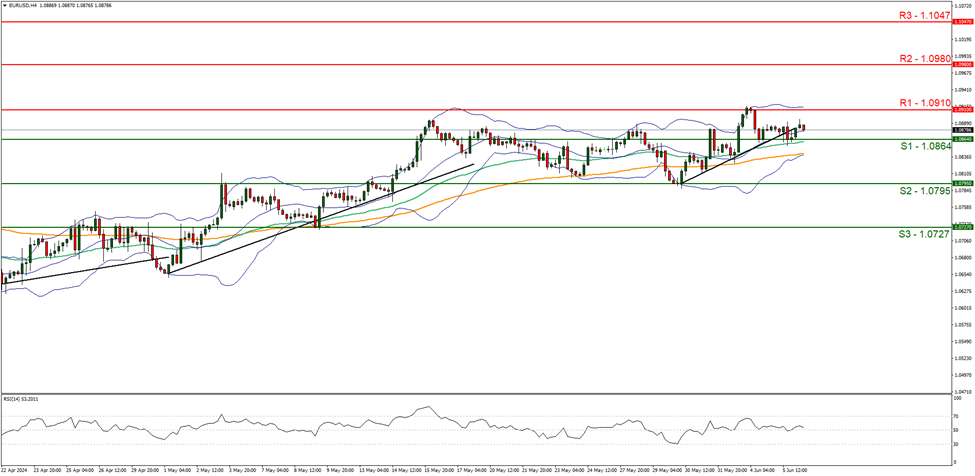

June 6-dated advanced prints from IronFX, a leader in online Forex and CFD trading, traced the negative price action in the EURUSD pair as traders had already priced in the ECB decision, hours ahead of the official release.

EUR/USD four-hour chart

Support: 1.0864 (S1), 1.0795 (S2), 1.0727 (S3).

Resistance: 1.0910 (R1), 1.0980 (R2), 1.1047 (R3).

Conversely, a “hawkish” stance involves raising interest rates, which is generally regarded as positive for the currency.

In July 2022, the ECB adopted a hawkish stance when it hiked interest rates by 50 basis points to steer inflation towards its 2% target,4 resulting in the Euro gaining momentum against the US dollar.

How do quantitative easing and tightening affect currency strength?

Quantitative easing (QE) and tightening (QT) are broadly considered unconventional monetary policy tools used to manage liquidity.

Through QE, central banks expand their balance sheets by purchasing securities, including government and corporate bonds to inject capital into the economy. Although it can stimulate economic growth, QE can also cause the currency to depreciate due to the increased money supply.

Contrastingly, QT involves reducing a central bank’s balance sheet by selling securities or allowing them to mature without replacement. This leads to higher interest rates and a stronger currency.

Following the 2008 financial crisis, the Federal Reserve employed QT to harmonise monetary policy, leading to a stronger USD as liquidity shrinked and interest rates rose.

Bond issuing and repurchase programmes

Central banks also use bond issuing and repurchase programmes to control currency strength. These measures are often utilised alongside QE and QT to either combat liquidity surplus (by fuelling demand for domestic currency through bond issuing) or increase liquidity (through bond buying and repurchase programmes).

During the COVID-19 pandemic, the Bank of England (BoE) launched its bond repurchase programmes to kickstart the economy. As a result, the GBP weakened as money supply increased.

Similarly, the ECB’s 2015 Asset Purchase Programme (APP)5 funnelled billions of Euros into the economy, stimulating consumer confidence while pressuring the single currency.

Understanding the implications of fiscal policy

As highlighted earlier, monetary and fiscal policies work together to regulate business activities and secure growth.

Both government and central banks’ actions significantly impact the economy, inflation, and currency strength, reverberating across the financial markets.

Governments may adopt either an expansionary or a contractionary fiscal policy, depending on the domestic economic environment. An expansionary policy like the US government’s stimulus packages during the COVID-19 pandemic, involves increased public spending and borrowing.

While these measures can provide immediate benefits, they can also raise concerns about inflation, as seen in the USD's mixed performance during that period.

Comparatively, a contractionary fiscal policy involves reducing government spending and hiking taxes to prevent the economy from overheating. This approach can strengthen the currency and reduce inflationary pressures but may also slow economic growth.

Germany's austerity measures of 2010, aimed at reducing public debt in anticipation of the Eurozone crisis, are a vivid example. While strengthening the Euro, they slowed economic growth through higher taxes and lower government spending.

Broader economic impact of monetary and fiscal policies

Monetary and fiscal policies have broad effects on financial markets, influencing economic growth, market stability, and investor sentiment. Understanding how financial markets react to policy shifts is crucial for trading.

Impact on the forex market

Changes in interest rates, QE/QT, and public spending directly influence currency movements and price action, as traders adjust their positions to anticipated shifts. Likewise, fiscal policies have a direct impact on currency strength and market dynamics.

Impact on the bond market

Bonds are closely linked to monetary and fiscal policies. Interest rate decisions affect bond yields which influence currency strength. Rising bond yields attract foreign investment, leading to currency appreciation. Similarly, fiscal policies affect bond yields and have a ripple effect on currency price movements.

Impact on the stock markets

Currency strength and stock market performance are interrelated. A strong currency has a negative effect on export-focused companies, leading to lower stock prices. In contrast, a weaker currency can boost exports and improve corporate earnings, resulting in higher stock prices. Therefore, traders must take into account monetary and fiscal policy decisions when assessing potential stock market performance.

Impact on the commodity markets

Lastly, commodities such as oil and gold are also affected by monetary and fiscal policies. Generally, a weaker currency is counterbalanced by higher commodity prices and vice-versa. However, this may not always apply.

For example, during the 2008-2009 financial crisis, gold and the USD moved in tandem as investors liquidated their positions to finance their USD-denominated debts (including gold).6 Consequently, traders must be cautious when analysing the relationship between commodity prices and currency performance.

Joining the dots

To sum up, understanding the complex relationship between monetary and fiscal policies and their impact on the financial markets is essential for developing a lucrative trading strategy. These policies not only influence currency valuation but also have a broader impact on the economy.

With this in mind, traders must stay informed about financial market trends and economic events to inform their decision making and navigate the complexities of the global forex market confidently.

IronFX offers a wealth of tools and insights required to understand financial market dynamics to empower traders on their journey.

This is a sponsored post. The opinions expressed in this article are those of the author and do not necessarily reflect the views of FXStreet. FXStreet has not verified the accuracy or basis-in-fact of any claim or statement made by any independent author. You should be aware of all the risks associated with trading and seek advice from an independent financial advisor if you have any doubts.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 69.80% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Our services include products that are traded on margin and carry a risk of losing all your initial deposit. Before deciding on trading on margin products you should consider your investment objectives, risk tolerance and your level of experience on these products. Margin products may not be suitable for everyone. You should ensure that you understand the risks involved and seek independent financial advice, if necessary. Please consider our Risk Disclosure. IronFX is a trade name of Notesco Limited. Notesco Limited is registered in Bermuda with registration number 51491 and registered address of Nineteen, Second Floor #19 Queen Street, Hamilton HM 11, Bermuda. The group also includes CIFOI Limited with registered office at 28 Irish Town, GX11 1AA, Gibraltar.

Editors’ Picks

EUR/USD treads water just above 1.0400 post-US data

Another sign of the good health of the US economy came in response to firm flash US Manufacturing and Services PMIs, which in turn reinforced further the already strong performance of the US Dollar, relegating EUR/USD to the 1.0400 neighbourhood on Friday.

GBP/USD remains depressed near 1.2520 on stronger Dollar

Poor results from the UK docket kept the British pound on the back foot on Thursday, hovering around the low-1.2500s in a context of generalized weakness in the risk-linked galaxy vs. another outstanding day in the Greenback.

Gold keeps the bid bias unchanged near $2,700

Persistent safe haven demand continues to prop up the march north in Gold prices so far on Friday, hitting new two-week tops past the key $2,700 mark per troy ounce despite extra strength in the Greenback and mixed US yields.

Geopolitics back on the radar

Rising tensions between Russia and Ukraine caused renewed unease in the markets this week. Putin signed an amendment to Russian nuclear doctrine, which allows Russia to use nuclear weapons for retaliating against strikes carried out with conventional weapons.

Eurozone PMI sounds the alarm about growth once more

The composite PMI dropped from 50 to 48.1, once more stressing growth concerns for the eurozone. Hard data has actually come in better than expected recently – so ahead of the December meeting, the ECB has to figure out whether this is the PMI crying wolf or whether it should take this signal seriously. We think it’s the latter.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

Discover how to make money in forex is easy if you know how the bankers trade!

5 Forex News Events You Need To Know

In the fast moving world of currency markets, it is extremely important for new traders to know the list of important forex news...

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and...

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.