Intraday trading isn't just for quick thinkers—and that's a good thing.

Because intraday offers:

- Frequent opportunity.

- Less competition.

- Low-risk trades.

What looks like 'fast thinking and reaction times'—in how I trade—is anything but.

Keep reading to see how intraday trading and slow thinking synergise when paired with a framework of robust principles.

Process not speed

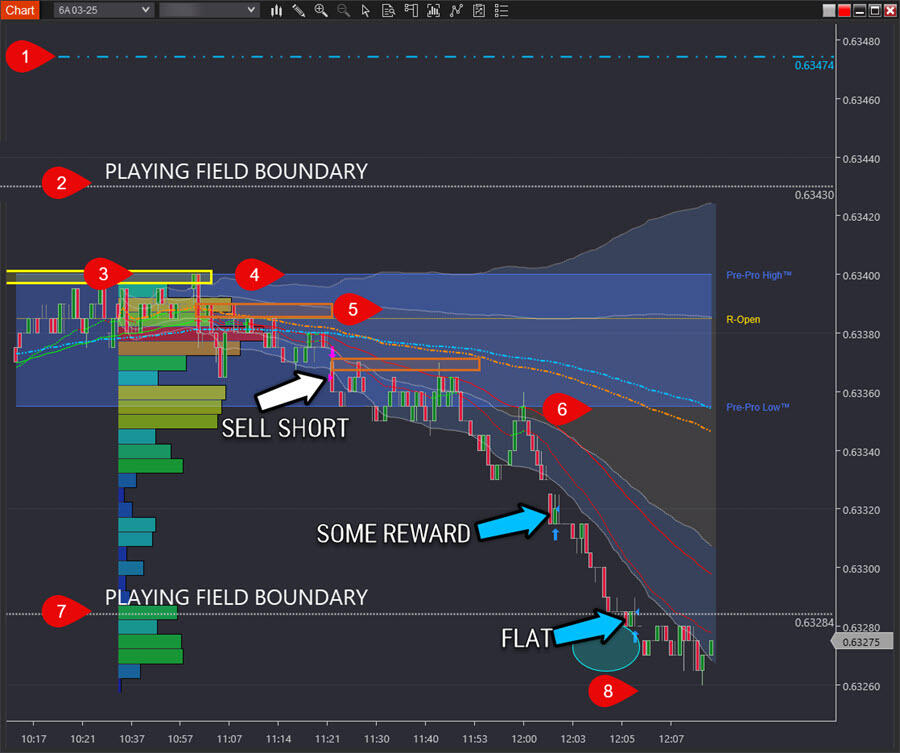

Slow-thinkers show strength in creative problem-solving and analytical reasoning. Take the first trade of the day shown below:

Like a sports match played within specific dimensions, the trade is the by-product of analysing your 'playing field', directing you on where you can and can't trade.

Once you know your playing field, this framework extends to:

- Who's going to move the price?

- Why will they move the price?

- Where will they move the price to?

This approach suits the complexity and nuances of markets yet reduces them to a robust system you become familiar with.

Systems exist to achieve consistency. Through repetition, they make the complex straightforward.

Anticipation not reaction

Knowing where and why you'll trade before 'trading time' starts, you avoid the mental stress of needing to react instantly.

Instead, your entry is calm and measured because you anticipated this moment long ago.

But before you pounce:

You first want to know what price route your trade is taking.

Price regularly takes different routes as it travels from one price level to another. And it's these different routes that cause you havoc, whether it be through:

- Overtrading.

- Exiting at the wrong times.

- Losses instead of profits.

But there's a solution professional traders swear by—a collection of maps for different price routes—in the form of signature trades that give you clear directions.

Imagine you're driving to the local shop—a trip you make every week. Thanks to repetition, you don't need Google Maps because you know the route from memory.

Signature trades work in the same way. Through repetition, you know your trade directions by heart.

Mental shortcuts to acting quickly

Did you know your brain processes visuals such as colours and simple shapes 60,000 times faster than text?

A key principle of how I trade is to base decisions on 'multiple points of evidence'. As Dr Brett Steenbarger says: "If everyone engaged in evidence-based trading, there would be no overtrading."

Zoom out on the trade from above, and you will see a reference to eight different simple coloured shapes and lines. Each represents a key piece of evidence.

Putting the meaning of each evidence piece into words would take several sentences. Add all eight pieces, and you’ll have pages of notes.

Add the additional evidence shown but not numbered, and the details can fill an entire chapter of a novel.

But when the information is presented visually, you can comprehend a whole chapter in an instant.

Anyone in a mentorship relationship with me knows I’m meticulous about sticking to the designated colour key—because it's just so damn powerful.

At 60,000 times faster comprehension, consider how significant your advantage over so many of the traders competing to get paid is.

Combine this with signature trades, and you have a powerful trading system that doesn’t rely on fast thinking or quick reflexes.

Slow-thinkers kryptonite

The one thing you don't do as a slow-thinker is get out of your lane. That's when things come unstuck.

If you are experiencing a moment in the market that's not something you've done numerous times before, you can't think fast enough to adapt.

But relying on a playbook of signature trades insulates you against doing this.

Your most important asset? Energy

You may relate to not having the same 'staying power' you did in my 30's.

Trading as you age requires a mindset shift: time is no longer your most valuable asset—it's energy.

With robust principles and a playbook of income-producing trades, your trading business maximises your output efficiently.

In summary

Slower thinkers tend to steer towards reflection—one of the most potent techniques for deep learning.

It could be while walking the dog during a break from the screens (There's a point of evidence that tells you when to take a break).

A sophisticated endeavour like trading becomes simple when you rely on intelligent principles, signature trades and mental shortcuts.

Simple doesn't mean instant. But what you can repeat, you can master. Agree?

Repeatedly apply the framework and principles discussed, and each trading day, you win where you've won before.

Forex and derivatives trading is a highly competitive and often extremely fast-paced environment. It only rewards individuals who attain the required level of skill and expertise to compete. Past performance is not indicative of future results. There is a substantial risk of loss to unskilled and inexperienced players. The high degree of leverage can work against you as well as for you. Before deciding to trade any such leveraged products you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with trading on margin, and seek advice from an independent

Editors’ Picks

GBP/USD holds above 1.3600 after UK data dump

\GBP/USD moves little while holding above 1.3600 in the European session on Thursday, following the release of the UK Q4 preliminary GDP, which showed a 0.1% growth against a 0.2% increase expected. The UK industrial sector activity deteriorated in Decembert, keeping the downward pressure intact on the Pound Sterling.

EUR/USD stays defensive below 1.1900 as USD recovers

EUR/USD trades in negative territory for the third consecutive day, below 1.1900 in the European session on Thursday. A modest rebound in the US Dollar is weighing on the pair, despite an upbeat market mood. Traders keep an eye on the US weekly Initial Jobless Claims data for further trading impetus.

Gold sticks to modest intraday losses as reduced March Fed rate cut bets underpin USD

Gold languishes near the lower end of its daily range heading into the European session on Thursday. The precious metal, however, lacks follow-through selling amid mixed cues and currently trades above the $5,050 level, well within striking distance of a nearly two-week low touched the previous day.

Cardano eyes short-term rebound as derivatives sentiment improves

Cardano (ADA) is trading at $0.257 at the time of writing on Thursday, after slipping more than 4% so far this week. Derivatives sentiment improves as ADA’s funding rates turn positive alongside rising long bets among traders.

The market trades the path not the past

The payroll number did not just beat. It reset the tone. 130,000 vs. 65,000 expected, with a 35,000 whisper. 79 of 80 economists leaning the wrong way. Unemployment and underemployment are edging lower. For all the statistical fog around birth-death adjustments and seasonal quirks, the core message was unmistakable. The labour market is not cracking.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a Chief trader its second knowledge how to extract cash out of the market.

5 Forex News Events You Need To Know

In the fast moving world of currency markets where huge moves can seemingly come from nowhere, it is extremely important for new traders to learn about the various economic indicators and forex news events and releases that shape the markets. Indeed, quickly getting a handle on which data to look out for, what it means, and how to trade it can see new traders quickly become far more profitable and sets up the road to long term success.

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and selling pressure. Chart patterns have a proven track-record, and traders use them to identify continuation or reversal signals, to open positions and identify price targets.

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

The challenge: Timing the market and trader psychology

Successful trading often comes down to timing – entering and exiting trades at the right moments. Yet timing the market is notoriously difficult, largely because human psychology can derail even the best plans. Two powerful emotions in particular – fear and greed – tend to drive trading decisions off course.