What are Gold options? How to trade them

Gold options trading presents market participants with the chance to either speculate on the price movements of Gold or, alternatively, hedge their potential losses in a manner that is flexible but potentially very profitable.

To understand trading in Gold options, it is important to identify that options are financial derivatives. Their value is derived from the price of an underlying asset, in this case, that would be Gold. The word "options" implies contracts that give the buyer the right but not the obligation to buy or sell Gold at a specified price within a certain time frame. Such freedom makes options versatile, offering different strategies for both bullish and bearish outlooks.

What is Gold options trading?

Gold options trading is a sophisticated investment strategy that allows traders to speculate on or hedge against movements in the asset price without physically buying or selling the metal.

In essence, a Gold option is a type of financial derivative. It's a contract deriving its value from the price of the precious metal, often through futures contracts. The owner of such a derivative has the right, but not the obligation, to buy or sell Gold at a specified price (the "strike price") on or before a certain date.

The two basic types of contracts in Gold options trading are call options and put options.

- A call option gives the right to buy Gold at the strike price, which an investor can buy if he thinks the price is going to go up.

- On the other hand, a put option carries the right to sell Gold at the strike price. It becomes valuable if the trader's expectation is that prices will drop.

This way, through the payment of a premium – the cost of the option – a trader is able to control large volumes of Gold at an investment far less than buying the yellow metal outright or entering into a futures contract.

Many traders seek out Gold options, knowing that they have both flexibility and leverage in being able to fit various strategies depending on market expectations.

Gold options trading pros and cons

Gold options trading, like any sophisticated investment tool, offers both opportunities and risks.

Pros

- Leverage: Gold options allow traders to control a large quantity of the asset with a relatively small upfront cost, the premium. This leverage means that even small price movements in Gold can lead to significant gains, allowing traders to amplify their profits without investing the full amount required to buy physical metal or futures contracts. But leverage also comes with a higher risk.

- Flexibility and strategy: Gold options are highly versatile, enabling traders to employ a variety of strategies that cater to different market conditions. Whether the market is bullish, bearish, or volatile, options strategies can be adapted to align with the trader’s outlook on prices.

- Defined risk: One of the primary advantages of options is that they provide a defined risk for the buyer. When purchasing a Gold option, the maximum loss is limited to the premium paid for the option. This capped risk makes options attractive to traders seeking exposure to the asset with a level of protection against substantial losses.

- Hedging opportunities: Gold options can serve as a valuable hedging tool. For instance, investors who hold the yellow metal physically can buy put options to protect their holdings against a potential decline in price. Conversely, a call option can be used to hedge against inflation or currency devaluation risks that may drive prices up.

Cons

- Complexity: Gold options trading is complex and requires a deep understanding of derivatives, market conditions, and pricing mechanics. Factors like time decay, volatility, and strike price selection significantly impact an option's value, making Gold options less straightforward than other investment tools like stocks or the physical precious metal.

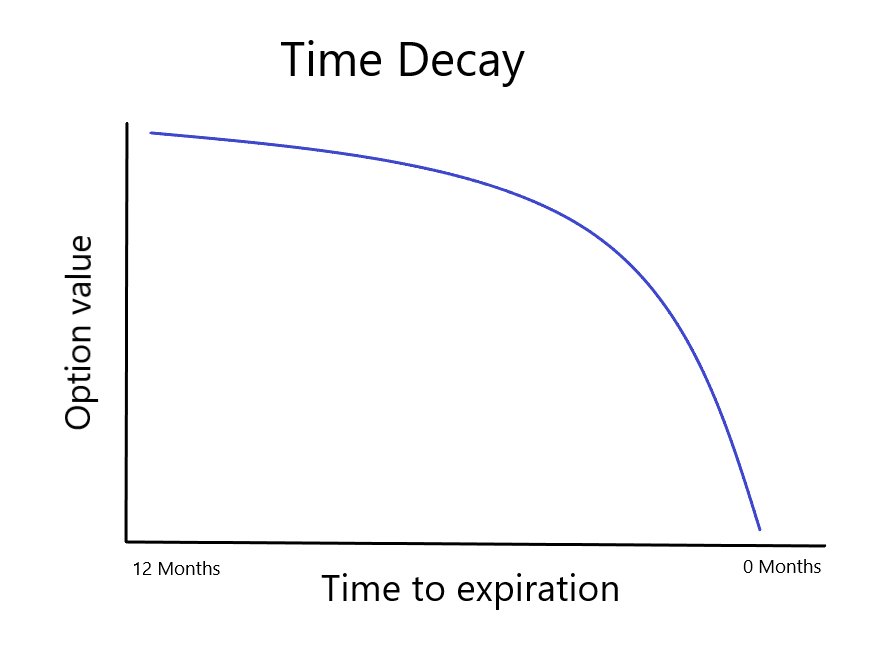

- Time decay: Options have an expiration date, and their value diminishes over time, a phenomenon known as time decay. As the expiration date approaches, options lose value if the underlying asset does not move favorably. This time sensitivity can be challenging, particularly for traders holding options close to expiration.

- Higher premiums for volatile markets: In periods of high market volatility, Gold options can become more expensive as premiums increase. This price inflation is due to the greater potential for significant price movements, which raises the cost of acquiring options. Consequently, traders might face higher costs during uncertain or unstable economic periods.

- Limited availability and liquidity: Gold options, especially those tied to specific futures contracts, may not be as liquid as other investment vehicles. Lower liquidity can lead to wider bid-ask spreads, making it more difficult to execute trades at favorable prices and potentially impacting the ability to exit positions smoothly.

How does Gold options trading work?

Trading Gold options involves buying or selling contracts linked to the price of Gold, and traders are placing bets on how the price of the metal will move.

For example, if a trader purchases a call option with an exercise price of $1,900, due in three months, they are speculating that the value of the Gold will exceed $1,900 within the time frame.

When the price of Gold breaches the strike price, the market value of the option increases and hence the trader can decide to sell the option at a higher price. That is, the trader can alternatively exercise the contract to buy Gold at the strike price of $1,900.

Time decay

In addition to potential profit from price movement, traders must manage the impact of time decay, as options lose value as they approach expiration.

The timing of entry and exit, choice of strike price, and selection of expiration date are all crucial decisions that determine the option’s success.

Effective Gold options trading thus requires a strategic approach, with an understanding of both market trends and the complex mechanics of options pricing and valuation.

European vs American options

European options can only be exercised at the expiration date. This limitation means that the holder cannot exercise the option early, even if it is highly profitable before expiration.

For instance, if you own a European call option with a strike price of $1,800 expiring on December 31, you cannot exercise the option until that specific date. If Gold price rises to $1,900 in November, you would need to wait until December 31 to realize your profit from exercising the option.

American options offer more flexibility, as they can be exercised at any time up to and including the expiration date.

This means that if the option becomes profitable at any point during its life, the trader can choose to exercise it immediately.

This flexibility often makes American options typically priced slightly higher than European options.

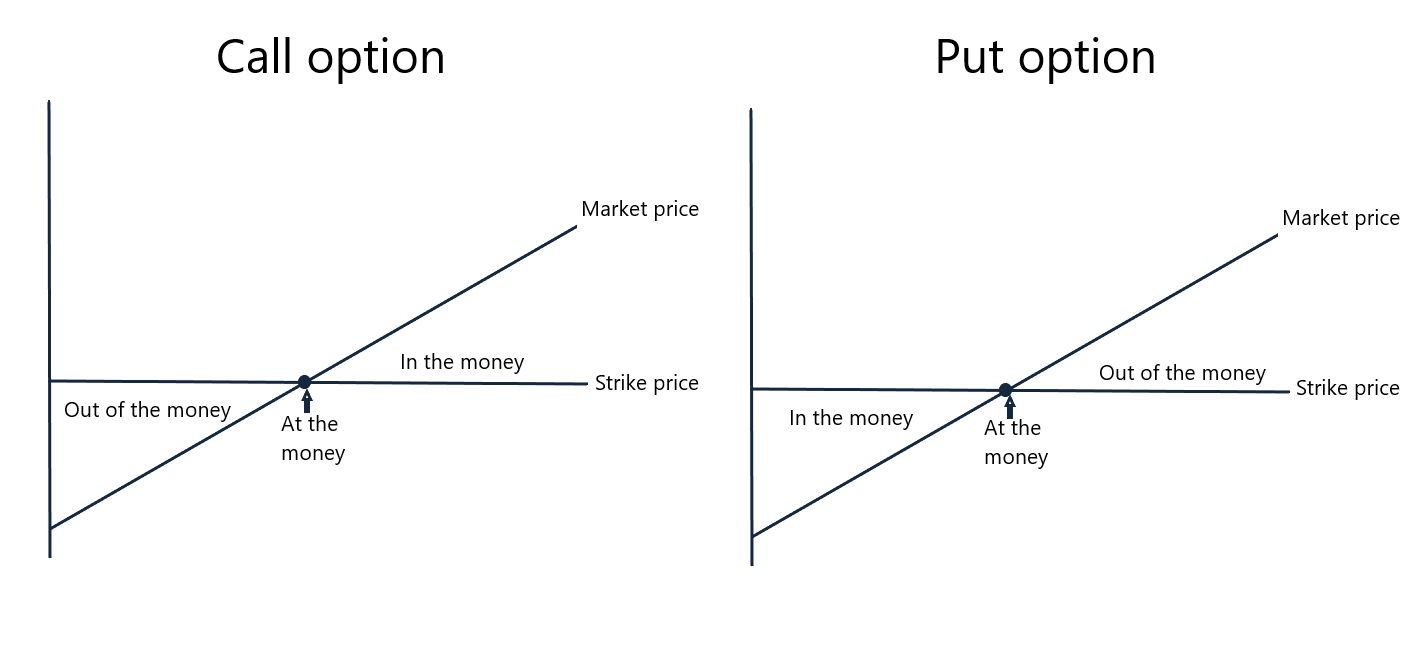

In the money options

An option is in the money if exercising it would lead to a profit. This means that for a call option, the strike price is below the current market price, while for a put option, the strike price is above the market price.

Being in the money means the option has intrinsic value and, therefore, is generally more expensive because it has a better chance of being profitable upon exercise.

Out of the money options

An option is out of the money if exercising it would not be profitable, meaning it has no intrinsic value. This means that for a call option, the strike price is above the current market price, while for a put option, the strike price is below the market price.

These options are typically cheaper, as they require a favorable price move to become profitable by expiration.

At the money options

An option is at the money if the strike price is approximately equal to the current market price of the underlying asset.

At the money options have no intrinsic value but are highly sensitive to market movement, as even a small shift can push them into or out of the money.

How do I buy Gold options?

Here’s a step-by-step guide to help you buy Gold options.

Open an account at an options trading broker

To start trading Gold options, you'll need a brokerage account that supports options trading, particularly commodities options

There are plenty of brokers available online for Gold options trading, so be sure to choose one that matches your criteria in terms of security, regulation, costs and platform.

Analyze market conditions

Before purchasing a Gold option, conduct a thorough analysis of the market. This analysis might involve assessing economic indicators, inflation expectations, currency trends, and geopolitical events, as these factors significantly impact Gold prices.

In this process, consider consulting FXStreet's Gold analysis to get top-notch market insights from expert traders.

Then, decide whether you anticipate the price to rise or fall and choose a strategy that aligns with your market view.

Select the type of option: call or put

If you expect Gold prices to increase, you’ll likely consider buying a call option, which gives you the right to buy Gold at a specified price.

If you expect prices to decrease, a put option allows you to sell Gold at the strike price.

Choosing the right option type is critical, as it aligns your position with your market forecast.

Choose the strike price and expiration date

Selecting a strike price close to the current market price (referred to as "at-the-money") often comes at a higher premium, as it has a greater chance of profitability. Conversely, choosing a strike price that is further away (known as "out-of-the-money") costs less but may require more significant market movement to become profitable.

The expiration date determines how long your option will remain valid. A longer expiration provides more time for the market to move in your favor but also increases the premium cost due to additional time value. Traders must balance their market outlook with the costs associated with the chosen expiration.

Place the order

Once you've selected the type of option, strike price, and expiration, you can place your order through your broker.

Monitor and manage the position

After purchasing the option, it’s crucial to actively monitor your position, particularly as the expiration date approaches. Changes in Gold prices, market sentiment, and time decay all affect the value of the option.

You may decide to sell the option if it becomes profitable, hold it until expiration to potentially exercise your rights, or close it if the market moves against you to minimize your losses.

Gold options vs Gold futures: What is the difference?

Gold options and Gold futures are both powerful tools for trading and investing in the yellow metal, yet they differ significantly in structure, risk, and purpose.

Understanding the differences between these two financial instruments is essential for traders and investors who wish to tailor their strategies to align with their goals and risk tolerance.

Here’s a closer look at what sets Gold options and futures apart.

Nature of the contract

The most fundamental difference between options and futures lies in the nature of the contract.

A Gold futures contract is a legally binding agreement to buy or sell a specific quantity of the yellow metal at a predetermined price on a set future date.

This contract requires the holder to fulfill their obligation at the expiration, meaning they must either take delivery of the yellow metal (if they hold a long position) or deliver it (if they hold a short position), unless they close the position before expiration.

In contrast, an options contract gives the holder the right, but not the obligation, to buy or sell Gold at a specified strike price before the expiration date.

This flexibility is the hallmark of options. If the market doesn’t move in the desired direction, the trader can let the option expire worthless, limiting their loss to the premium paid for the option.

This feature makes options more appealing to those seeking limited risk exposure without a binding obligation.

Exposure to risk

The nature of risk exposure is quite different for futures and options trading. With Gold futures, a trader’s potential loss or gain is theoretically unlimited because the price can move significantly away from the initial entry point.

This exposure to substantial risk makes futures contracts best suited for traders who are highly confident in their predictions and can tolerate larger fluctuations.

Gold options, on the other hand, limit the buyer’s risk to the premium paid. If the price doesn’t move favorably, the maximum loss is the premium, while the potential gain remains uncapped for a call option if prices rise sharply. For put options, the profit is capped at the strike price because prices cannot drop below zero.

This defined risk appeals to traders looking for high leverage with limited downside, especially in uncertain markets.

Expiration impact

Futures and options also differ in how expiration affects the contracts. A Gold futures contract loses its value after expiration if the holder does not close the position. Futures are a pure play on price movement.

In Gold options, however, the value of the option gradually declines as the expiration date nears, a phenomenon known as time decay. Options lose value as they approach expiration if the market doesn’t move in the direction of the option.

Purpose and strategy

The different structures of futures and options lend themselves to distinct purposes and strategies. Futures are often used by traders looking for unfiltered exposure to Gold price movements, providing direct participation in the market’s ups and downs.

Options, however, offer more flexibility for a wider range of strategies. Options can be used in complex strategies. This flexibility allows traders to design positions that can profit from any combination of upward, downward, or neutral movements in the Gold market.

Options are also often used by those looking to capitalize on market volatility rather than just directional price movement.

Trade Gold futures or options?

Futures and options serve different purposes and cater to various trading styles and risk preferences.

Gold futures offer a straightforward, high-leverage method for those seeking direct exposure to price movements, but they require a higher risk tolerance and a commitment to market direction.

Gold options, with their limited risk and flexible strategies, appeal to those who seek more nuanced approaches to trading, such as hedging or capturing profits from price volatility.

Gold options trading strategies

Gold options trading offers a range of strategies, each suited to different market conditions, risk tolerance, and trading objectives. Here are some of the most popular strategies for trading Gold options.

Long call: Betting on a price increase

The long call is one of the most basic strategies in options trading and is ideal for traders who believe that Gold prices will rise significantly.

By purchasing a call option, the trader gains the right to buy Gold at the strike price before the option’s expiration. If price moves above the strike price, the option can be sold or exercised for a profit.

The maximum loss in this strategy is limited to the premium paid, making it a relatively low-risk way to speculate on a price increase.

Long put: Protecting against price decline

The long put is used when a trader expects prices to fall. By buying a put option, the trader acquires the right to sell Gold at a predetermined strike price, even if the market price drops.

This strategy is not only profitable when prices decline but can also serve as a hedge for investors holding physical Gold or futures.

Gold options, on the other hand, limit the buyer’s risk to the premium paid. If the price doesn’t move favorably, the maximum loss is the premium, while the potential gain remains uncapped for a call option if prices rise sharply. For put options, the profit is capped at the strike price because prices cannot drop below zero.

As with the long call, the maximum loss is limited to the premium paid.

Covered call: earning premium income from a bullish position

In a covered call strategy, the trader owns Gold or a futures contract and sells a call option against that position.

This approach generates income through the premium received from selling the call, which can offset holding costs or provide additional returns. However, it limits the upside potential, as the trader may have to sell Gold at the strike price if the market rises above it.

Protective put: Insurance for long Gold holdings

A protective put is a strategy used by investors who own physical Gold or futures and want to protect against downside risk.

By purchasing a put option, the trader creates a "floor" on their investment. If Gold prices decline, the put option gains in value, offsetting losses on the underlying asset.

This strategy functions as insurance for long positions.

Straddle: Profiting from high volatility

The straddle is a neutral strategy designed for situations when a trader expects significant volatility in Gold prices but is unsure of the direction.

The trader buys both a call and a put option with the same strike price and expiration date. If Gold price swings widely in either direction, the strategy can become profitable as one of the options moves into the money, potentially covering the cost of both premiums.

Strangle: A cost-effective bet on volatility

A strangle is similar to the straddle, but instead of purchasing options at the same strike price, the trader buys a call option with a higher strike price and a put option with a lower strike price.

This approach reduces the premium cost, as the options are farther from the money, but requires a more substantial price movement to be profitable.

Strangles are useful when expecting volatility but with less certainty about extreme price shifts.

Butterfly spread: A low-volatility strategy

A butterfly spread is a sophisticated strategy that profits when Gold’s price remains stable.

It involves buying a call (or put) at a low strike price, selling two calls (or puts) at a middle strike price, and buying another call (or put) at a higher strike price.

This setup creates a position that benefits from low volatility, as it achieves maximum profitability if Gold’s price settles near the middle strike at expiration.

Calendar spread: Profiting from time decay differences

A calendar spread (or time spread) is used to exploit differences in time decay rates between options with different expiration dates.

The trader buys a long-term option and sells a short-term option at the same strike price. If Gold’s price remains stable, the near-term option loses value faster due to time decay, allowing the trader to profit from the spread.

Strategies for managing expiring options

Traders have several strategic choices as an options contract nears expiration:

- Close the position: By selling or buying back the option, traders can realize any profit or loss based on the market value of the option. This approach prevents automatic exercise and can be useful when an option has some remaining time value.

- Roll the option: If a trader wants to extend their exposure to Gold, they can roll the option by closing the current contract and opening a new one with a later expiration. This strategy maintains the position while managing time decay.

- Let it expire: If the option is out-of-the-money or has minimal value, the trader may choose to let it expire worthless, incurring a loss equal to the premium paid.

Conclusion

Gold options trading is an exciting investment that can offer great profits in any kind of market, whether rising or falling.

Gold options enable traders to develop tailored strategies and modify them depending on their views on the market and appetite for risk, since they give the right, and not the obligation, to buy or sell Gold at a certain price.

However, as with any sophisticated financial instrument, Gold options come with their own set of risks, which require disciplined management techniques.

For those willing to invest the time to understand the mechanics of options trading, they offer a powerful tool for traders looking to take advantage of Gold price movements.