How to trade Gold: Investing in the biggest commodity

Gold has long been one of the most attractive investment assets, offering a safe-haven store of value in times of economic uncertainty and inflation. Nowadays, Gold trading provides a range of opportunities for both short-term traders and long-term investors, thanks to various instruments like exchange-traded funds (ETFs), futures and contracts for difference (CFDs). In this detailed guide, we will cover everything you need to know about how to trade Gold, specifically targeting those who are new to this market. We will walk you through different methods of trading the yellow metal, offer strategies, and explore how you can get started with a Gold trading account.

How to trade Gold

Gold has long been one of the most attractive investment assets, offering a safe-haven store of value in times of economic uncertainty and inflation. Nowadays, Gold trading provides a range of opportunities for both short-term traders and long-term investors, thanks to various instruments like exchange-traded funds (ETFs), futures and contracts for difference (CFDs). In this detailed guide, we will cover everything you need to know about how to trade Gold, specifically targeting those who are new to this market. We will walk you through different methods of trading the yellow metal, offer strategies, and explore how you can get started with a Gold trading account.

Gold CFDs: Understanding leverage and short-selling

Gold CFDs offer traders a flexible way to speculate on Gold price movements without owning the physical asset. Unlike physical Gold or even futures, CFDs are derivative contracts where you agree to exchange the difference in the asset price between the time you open and close the trade. This allows traders to benefit from both rising and falling markets.

CFDs are one of the most common and widespread ways to trade Gold and benefit from short-term price movements.

One of the key advantages of trading CFDs is leverage. With leverage, traders can control a larger position in Gold with a relatively small amount of capital. For example, a broker may offer 10:1 leverage, which means that for every $1,000 you have in your account, you can control a $10,000 position in Gold. While leverage amplifies potential profits, it also increases risk. A small price movement can result in significant gains or losses, so proper risk management is crucial.

Another unique feature of CFDs is the ability to short-sell. Unlike holding physical Gold, where you profit only if the price increases, CFDs allow you to profit from a decline in price by short-selling. If you expect Gold prices to fall, you can open a short CFD position. When the price drops, you buy back the contract at a lower level, making a profit from the price difference.

This is particularly beneficial during periods of market downturns or when economic conditions suggest that Gold prices may fall. For example, in times of rising interest rates or economic recovery, Gold price might decline, making short-selling CFDs a profitable strategy.

Note that Gold price against the US Dollar is often referred to as the XAU/USD pair in trading platforms. XAU is an abbreviation for gold.

Gold futures: Hedging tool for big market players

Gold futures allow traders to speculate on the future price of the yellow metal without actually owning physical Gold. A futures contract is an agreement to buy or sell a specific amount of an asset at a predetermined price on a set date in the future.

The most popular market for Gold futures is the COMEX (Commodity Exchange), a division of the Chicago Mercantile Exchange (CME). The standard contract size is 100 troy ounces, which means each contract represents a significant amount of Gold, making it highly leveraged.

Gold futures are primarily used by short-term traders or speculators looking to profit from price fluctuations. Futures contracts also allow for hedging, where a gold miner, for instance, might use futures contracts to lock in prices for their output, thus protecting themselves from price declines.

Futures have some similarities with CFDs, like leverage and short selling. But they also have several differences. For exemple, in futures trading, you typically deal with standardized contract sizes, such as 100 troy ounces per Gold futures contract on COMEX. CFDs, on the other hand, offer much more flexibility. You can trade smaller increments of Gold, making it more accessible for retail traders with smaller capital.

Also, while both CFDs and futures offer leverage, the margin requirements for CFDs are often lower, allowing traders to take larger positions with less capital.

Gold options: Flexibility to go long or short

Gold options provide a more flexible way to trade the yellow metal compared to futures. With options, you are not obligated to buy or sell Gold, instead, you have the right to do so at a specific price before the contract expires.

- Call options: These give you the right to buy Gold at a specific price (strike price) before the option’s expiration. Call options are purchased by traders who believe Gold prices will rise.

- Put options: These give you the right to sell Gold at a specific price before the expiration date. Put options are typically purchased by traders expecting Gold prices to decline.

Options are often used by more experienced traders who want to manage risk or increase leverage while limiting potential losses to the price of the option premium.

Gold ETFs: Long-term investing through the stock markets

Gold ETFs offer a simpler way to gain exposure to the price of the yellow metal without owning it physically. These funds are traded on major stock exchanges, just like regular stocks, and they track the price of Gold.

Although ETFs can be used for short-term trading, they are more primarily seen as a way to invest in Gold in the medium-to-long term, without leverage.

The SPDR Gold Shares ETF (GLD) is one of the largest and most popular Gold ETFs. It holds physical Gold in secure vaults and issues shares that represent ownership. When you buy a share of GLD, you're essentially buying a fraction of the physical Gold held by the fund.

Another prominent Gold ETF is the iShares Gold Trust (IAU). It operates similarly to GLD but has lower expense ratios, making it a slightly cheaper option for investors who want to hold Gold over the long term.

Physical Gold: Coins and bullions come at a premium

When most people think of Gold, they picture the physical metal, the one you can touch and hold. Physical Gold comes in several forms, including coins, bars, and bullion. Owning the metal physically offers a tangible, secure way to invest in Gold but also comes with some unique challenges.

Gold coins are popular among investors and collectors. Coins are typically minted by government authorities, which adds credibility and trust. They often have an aesthetic appeal and are easier to trade than larger bars due to their smaller size.

However, Gold coins typically come with a premium over the spot price of Gold. This premium is higher for smaller denominations and may include minting costs, distribution costs, and demand. For instance, a 1-ounce American Gold Eagle may sell for a few percentage points over the spot price of Gold.

For investors looking to buy larger quantities of the commodity, Gold bars and bullion are a better option. Gold bars come in sizes ranging from small 1-gram bars to large 400-ounce bars. Gold bullion refers to pure gold with a high purity level (often 99.99%), and it's generally sold at lower premiums compared to coins.

Gold trading instruments: Pick the right one for your needs

In conclusion, there are several effective ways to trade or invest in Gold, each suited to different objectives and risk profiles. Whether you are seeking long-term exposition or short-term profits, understanding the different instruments and their nuances can help you choose the right strategy for your financial goals. Gold's unique properties as both a commodity and a store of value offer a variety of opportunities for different types of traders and investors.

Physical Gold, such as coins, bars, or bullion, is an excellent choice for long-term investors seeking the security of tangible assets, though it comes with challenges like storage and liquidity. Physical ownership allows investors to hold a direct, tangible asset, but they must also factor in costs for secure storage and insurance, as well as the sometimes slower process of selling.

Gold ETFs provide a more accessible and liquid option for investors who want exposure to the asset price without handling physical Gold. They are traded on major exchanges, making it easy to buy and sell shares with low transaction costs. Additionally, Gold ETFs eliminate the need for storage and can be easily integrated into a diversified portfolio, making them a convenient choice for both novice and experienced investors.

For traders, Gold futures offer the potential for substantial gains through leverage, but also carry significant risk due to the amplified effect of price movements. Similarly, Gold options allow for flexibility in trading, giving investors the ability to speculate on both price increases and declines while limiting potential losses to the option premium.

Gold CFDs, on the other hand, combine flexibility and leverage, allowing traders to profit from price movements in either direction and trade smaller quantities of Gold. However, CFDs require careful risk management, particularly when using leverage.

Ultimately, each method of trading Gold has its benefits and drawbacks, and the best approach depends on your individual financial goals, experience level, and risk tolerance. A thorough understanding of each trading instrument will enable you to choose the most appropriate strategy for participating in the Gold market.

Trading Gold for beginners

For beginners entering the gold market, the journey can seem complex given the array of options available for trading and investing in Gold. However, with a clear understanding of how the Gold market works and what factors drive its prices, even newcomers can build a solid foundation for trading. This section will guide you through the essentials of Gold trading, from understanding the forces that influence the yellow metal prices to exploring factors that can make you a profitable trader.

Why trade Gold?

Gold has a unique status in the financial world as both a commodity and a form of currency. Its value isn’t just rooted in its physical properties but also in its historical role as a store of wealth. Gold is considered a "safe-haven" asset, which means it tends to perform well during periods of economic instability, inflation, or geopolitical tensions. This quality makes it a popular asset for investors looking to hedge against market volatility or currency depreciation.

For beginners, trading Gold offers the opportunity to benefit from these qualities. Whether you want to safeguard your wealth during uncertain times or profit from price fluctuations, Gold provides a relatively stable and accessible asset class for both short-term and long-term trading strategies.

Understanding the Gold market – Six factors to figure out

Before making your first trade, it’s important to understand how the Gold market operates and what factors influence its price movements.

Gold prices are influenced by a variety of economic and market related factors, many of which are interrelated. As a beginner, understanding these drivers will help you anticipate potential price movements and make informed trading decisions.

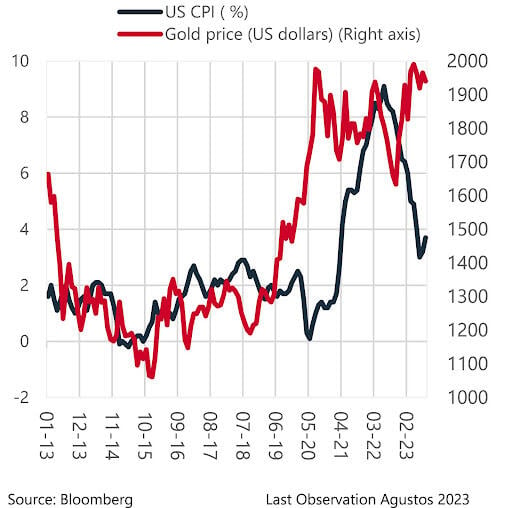

- Inflation: One of the most important factors affecting Gold prices. Gold tends to perform well in inflationary environments because it is viewed as a store of value that retains purchasing power when currencies lose theirs. For example, when inflation rates increase, the value of fiat currencies may decline, prompting investors to flock to Gold to preserve their wealth.

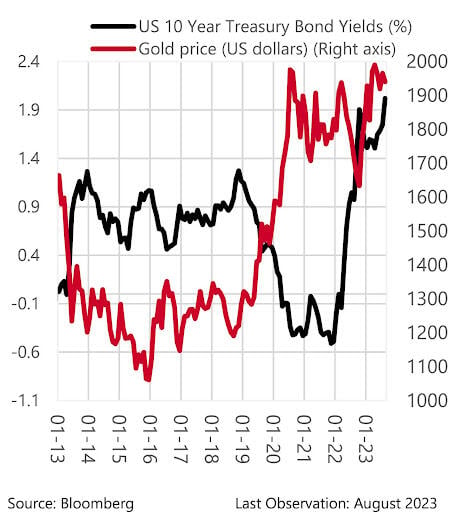

- Interest rates: The cost of money also has a direct impact on Gold prices. When interest rates are low, the opportunity cost of holding Gold, which does not generate interest, decreases. This makes the yellow metal more attractive to investors. Conversely, when interest rates rise, assets like bonds and savings accounts that offer returns become more appealing, reducing the demand for Gold.

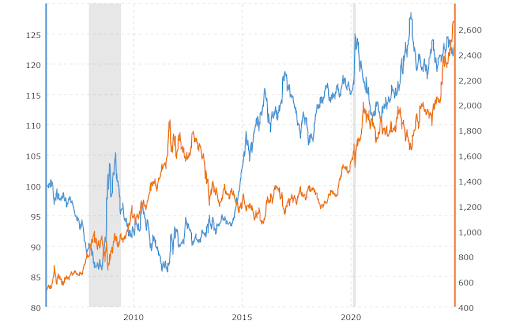

- US Dollar: Gold is typically priced in the world’s reserve currency, meaning its price often moves inversely to the US Dollar’s strength. When the USD strengthens, Gold becomes more expensive for foreign buyers, reducing demand and pushing prices down. Conversely, a weaker Dollar tends to support higher Gold prices.

Source: Macrotrends

- Geopolitical events: Gold’s status as a safe-haven asset comes into play during periods of geopolitical uncertainty or economic crisis. Events like wars, political instability, or financial market crashes often drive investors to Gold, leading to price spikes.

- Market sentiment: The way the markets perceive risk events plays a crucial role in influencing Gold prices, especially in the short term. Market sentiment refers to the overall mood or attitude of investors toward a particular asset or the market as a whole. When it comes to Gold, sentiment can shift rapidly based on economic data, geopolitical events, or financial market volatility.

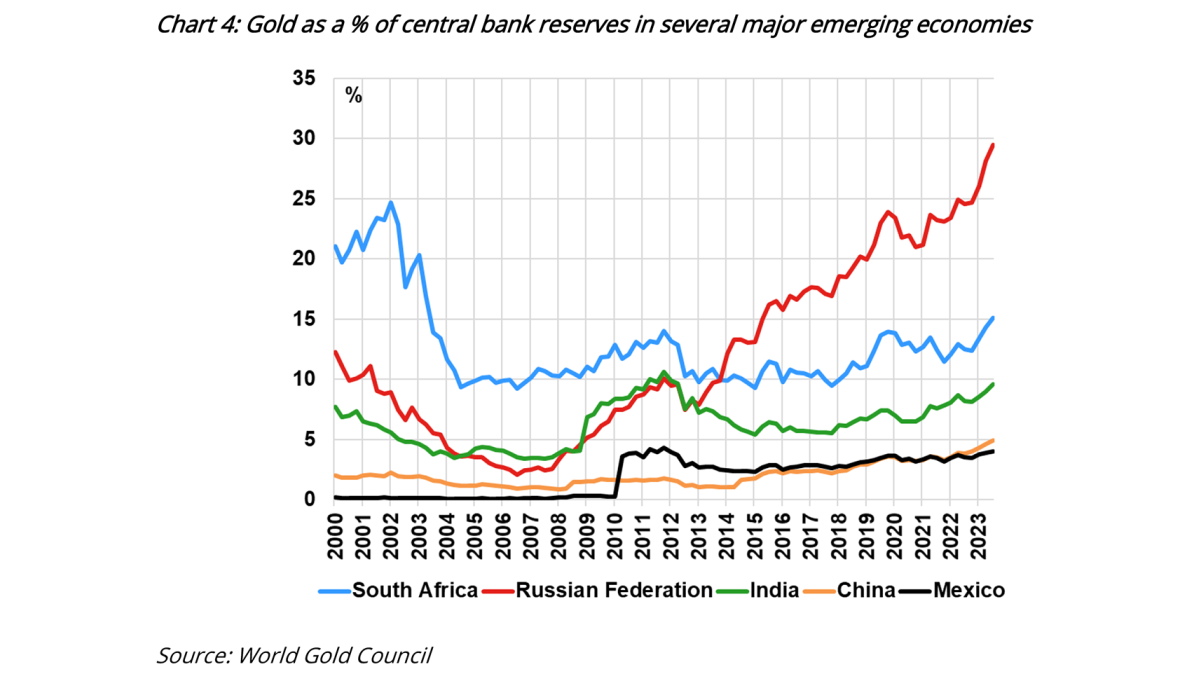

- Supply and demand dynamics: Like all financial assets, Gold price is also influenced by the basic forces of supply and demand on the yellow metal. The supply of Gold is primarily driven by mining production and central bank activities, while demand comes from several sectors, including jewelry, technology, and investment.

Managing risk in Gold trading

For beginners, managing risk is one of the most important aspects of trading. The Gold market, like any financial market, can be volatile, and even experienced traders can face significant losses if they don’t properly manage risk. Here are a few tips to help beginners manage risk:

Using leverage with caution

Leverage can be a double-edged sword in Gold trading. While it allows traders to control larger positions with a relatively small amount of capital, it also magnifies both potential gains and losses. Many beginners are attracted to the idea of making substantial profits with minimal capital through leverage, but it's important to recognize the increased risk this introduces. A small adverse price movement can lead to outsized losses, wiping out an entire account if not managed properly.

This is why it’s critical to use leverage cautiously, particularly when you’re still learning the ropes of trading. Beginners are advised to start with lower leverage ratios or avoid leverage until they fully understand how it impacts their trades.

Setting stop-loss orders

Using stop-loss orders is one of the most effective ways to manage risk. A stop-loss is a predefined price at which your trade will automatically close if the market moves against you. This helps limit your losses on any given trade and prevents emotional decision-making in volatile markets.

Setting a stop-loss order at a level that balances protection from excessive losses with enough room for market fluctuations is key. A stop-loss that is too tight might result in getting stopped out of trades prematurely, while one set too far from the entry point might expose you to larger losses than you are comfortable with.

Position sizing

Another fundamental aspect of managing risk in Gold trading is position sizing. Position sizing refers to how much of your capital you allocate to a single trade. Beginners often make the mistake of putting too much capital into a single position, which increases the risk of losing a substantial portion of their funds on one bad trade.

A general rule of thumb is to risk no more than 1-2% of your trading capital on any given trade. This ensures that even if a trade goes wrong, it won’t have a devastating impact on your overall account balance.

Diversification

For long-term investors willing to add Gold to their portfolio, diversification is key. Rather than placing all of your capital into gold or related assets, it's prudent to spread your investments across different asset classes.

This reduces the overall risk of your portfolio, as the performance of different assets is often not correlated. For example, while Gold might be underperforming, stocks or bonds in your portfolio could be doing well, helping to offset potential losses in the Gold market. Diversification helps to balance risk and reward, ensuring that you’re not overly exposed to any one asset.

Forex vs Gold trading

Both forex (foreign exchange) and Gold trading offer exciting opportunities for traders, but they operate in distinct markets with different characteristics. Understanding the key differences and similarities between forex and Gold trading is essential for anyone looking to participate in these markets.

Market nature and liquidity

The forex market is the largest and most liquid financial market in the world, with over $6 trillion in daily trading volume. It involves the exchange of one currency for another, with major currency pairs like EUR/USD, GBP/USD, and USD/JPY dominating the market.

Forex trading is typically focused on short-term price movements, and it is popular for its high liquidity and 24-hour availability, five days a week.

Gold trading, on the other hand, involves the buying and selling of the precious metal, either through physical Gold, futures contracts, CFDs, ETFs, or other financial instruments. While the Gold market is also highly liquid, especially when trading derivatives, it is still smaller in scale compared to forex.

Price drivers and market influences

The forex market is primarily influenced by macroeconomic factors such as interest rates, inflation, and economic growth. Central banks play a key role in shaping currency values by setting interest rates and controlling monetary policies. Geopolitical events, trade balances, and market sentiment also have a significant impact on currency price movements. For example, a stronger-than-expected US jobs report might lead to a rise in the value of the US Dollar against other currencies.

Gold is viewed primarily as a safe-haven asset, and its price tends to move in response to broader economic uncertainty, inflationary pressures, and geopolitical risks. Unlike currencies, which are tied to the economic performance of their issuing countries, Gold is valued independently as a physical store of wealth. In times of financial crisis, political instability, or high inflation, investors tend to flock to the yellow metal, driving up its price.

Volatility and risk

Forex markets are known for their volatility, particularly when trading minor or exotic currency pairs. Major currency pairs like EUR/USD or GBP/USD tend to have more stable price movements due to their high liquidity, but they can still experience sharp swings in response to economic data releases, central bank decisions, or geopolitical events. This volatility can present both opportunities and risks for traders, as rapid price movements can lead to significant profits or losses.

Gold is generally less volatile than currency pairs, especially major forex pairs. However, the yellow metal can experience significant price movements during times of economic instability, central bank policy shifts, or geopolitical crises. Gold's volatility often spikes in response to events that rise uncertainty, making it an attractive asset for traders who anticipate market disruptions.

Leverage and trading strategies

Forex trading is commonly associated with the use of leverage, allowing traders to control large positions with relatively small capital. Leverage can amplify both profits and losses, and while it offers the potential for significant returns, it also increases the risk of losing more than the initial investment. Leverage ratios in the forex market can vary depending on the broker, but they are typically much higher than in other markets, sometimes reaching 500:1 or even higher.

Gold trading can also involve leverage, particularly when trading gold futures or CFDs. However, leverage ratios in Gold trading are often lower compared to forex, and traders typically use more conservative strategies due to gold’s slower price movements. Gold traders often adopt longer-term strategies that align with broader economic trends or geopolitical developments.

Hedging and portfolio diversification

Forex trading can be used to hedge against currency risk, especially for businesses or investors with international exposure. By trading currency pairs, companies and investors can protect themselves against unfavorable currency fluctuations that might affect the value of international transactions or investments.

Gold is often seen as a hedge against inflation and currency devaluation. Investors also use Gold to diversify their portfolios, as it typically moves inversely to stocks and bonds during periods of market turmoil. Gold’s ability to retain value in uncertain times makes it a critical component of a well-diversified investment strategy.

Which is better: Forex or Gold trading?

The decision to trade forex or Gold depends on the trader's goals, risk tolerance, and trading style. Forex trading offers higher liquidity, more volatility, and the potential for quick profits through leverage, making it suitable for short-term traders who thrive in fast-paced environments. However, the risks are also higher due to currency volatility and leverage.

Gold trading, on the other hand, provides stability, particularly during times of market uncertainty. It’s an excellent option for traders and investors looking for a longer-term strategy or those seeking to hedge against economic instability and inflation. Gold is also less volatile than forex, making it appealing to traders who prefer a more cautious approach.

Both forex and Gold trading have their advantages, and many traders use them together to create a balanced and diversified trading strategy. By understanding the key differences and similarities between these markets, traders can choose the best approach for their individual needs and capitalize on the unique opportunities each offers.

Is Gold trading profitable?

Gold trading can certainly be profitable, but as with any financial market, it comes with both opportunities and risks. The profitability of Gold trading depends on various factors, including market conditions, the trader’s knowledge and experience, their risk management strategies, and their ability to analyze and anticipate price movements.

Several key factors influence the profitability of Gold trading. Understanding these variables can help traders to maximize their profit potential.

Market conditions

One of the most significant factors affecting Gold trading profitability is the broader market and economic environment. Gold tends to perform well during periods of economic uncertainty, high inflation, and geopolitical instability.

On the other hand, Gold may underperform during periods of economic growth and rising interest rates, as investors turn to higher-yielding assets like stocks or bonds.

Traders who manage to anticipate and especially react to changes in market conditions can have a very profitable Gold trading activity. But traders who fail to adjust their strategies during these periods could face losses or miss out on opportunities.

Timing and market entry

Profitability in gold trading heavily depends on timing. Entering and exiting the market at the right time is critical. This is where both technical and fundamental analysis come into play.

For instance, let’s say you enter a long gold trade at $1,500 per ounce during an economic slowdown. If the price rises to $1,700, you’ve made a $200 profit per ounce. However, if you miss the signals to exit and Gold prices start to fall back to $1,600 due to an unexpected recovery in the global economy, your profits could shrink or even turn into a loss.

Fundamental analysis can help Gold traders and investors to understand the market situation and anticipate the upcoming trend. This kind of analysis can be hard to complete by beginners, but our professional analysts at FXStreet get you covered with daily Gold analysis to understand the market. Technical analysis, though, needs to be mastered by a trader to time the market and take trading opportunities with the right entry and exit signals and make profits.

Risk management strategies

Risk management plays a crucial role in determining profitability. Successful Gold traders implement robust risk management techniques to protect their capital from sudden market movements. This often involves setting stop-loss orders, using proper position sizing, and avoiding excessive leverage

For example, a trader who risks 1-2% of their capital on each trade is more likely to survive the inevitable losses that occur in trading. Without a sound risk management strategy, a trader can experience large losses that wipe out months of gains in a single bad trade.

Knowledge and trading experience

One of the main differentiators between profitable and less successful Gold traders is experience and knowledge. Profitable traders invest time in learning market dynamics, studying price patterns, and developing strategies based on historical data and real-time events. They also remain disciplined, following a well-defined trading plan and sticking to it even during periods of volatility.

This is why it is essential for beginners to educate themselves, practice on demo accounts, and start with smaller trades before gradually increasing their position sizes as they gain more confidence and experience.

The profitability of Gold trading often boils down to a combination of factors: market knowledge, timing, risk management, and discipline. Traders who take the time to educate themselves about market drivers, develop a trading strategy, and stick to it are more likely to be consistently profitable. Additionally, traders who employ strict risk management techniques, such as proper position sizing, setting stop-loss orders, and avoiding excessive leverage, tend to perform better over the long term.

Gold trading strategies

There are several trading strategies that can help you profit from Gold price movements. Each strategy has its own strengths and weaknesses, and the best approach depends on your trading style and risk tolerance.

Trend trading

Trend trading involves identifying a sustained trend in the Gold market, whether it’s upward (bullish) or downward (bearish), and riding that trend for as long as it persists.

Traders use moving averages to smooth out price fluctuations and identify the general direction of the market. For example, a trader might use a 50-day and 200-day moving average to confirm whether a trend is bullish or bearish.

Drawing trend lines on a chart helps visualize the direction of the market and potential points of support and resistance.

Trend traders typically hold positions until there is a clear indication that the trend is reversing.

-638664022839124638.png)

Range and breakout trading

Gold often trades within a defined price range, fluctuating between support and resistance levels. Range trading involves buying at the lower end of the range (support) and selling at the upper end (resistance).

Support is a price level where Gold tends to stop falling and rebound. This level is often tested multiple times and can provide buying opportunities for range traders.

Resistance is the price level where Gold tends to stop rising and reverse. Resistance levels are key points for selling in a range-bound market.

This strategy relies on the assumption that Gold will continue to trade within this range, but if a breakout occurs, the trader must quickly adjust their strategy to avoid losses.

This is where the breakout trading strategy comes in. The breakout could be the start of a new trend that the trader can follow according to the trend trading strategy we spoke about previously.

-638664025253548977.png)

News trading

News trading involves making trading decisions based on the latest economic news and geopolitical events that affect gold prices. Gold is highly sensitive to global events, making it an ideal asset for news-driven strategies.

There are several news items, which can be followed in real time on the economic calendar, that Gold reacts to.

- Central bank announcements: Gold prices often react to decisions made by major central banks, such as changes in interest rates or quantitative easing policies.

- Inflation data: Reports on inflation can significantly impact Gold, as rising inflation typically boosts demand for the yellow metal as a hedge.

- Geopolitical risks: Gold is often referred to as a "safe-haven" asset, meaning that during times of geopolitical tension (e.g., war, political instability), investors flock to Gold, driving its price higher.

However, these news often bring big surprises to the market, and the volatility can be very important around these events. News trading is to be considered as an advanced and risky trading strategy as it's very difficult to trade when price movements are wild.

Start trading Gold: How to create a Gold trading account

To start trading Gold, you first need to create a trading account with a reputable broker. This process is straightforward and involves choosing the right broker, opening an account, funding it, and selecting your preferred Gold trading instruments. Follow this step-by-step guide to get started and begin your journey in the Gold market.

Choose a reputable broker

The first step in starting your gold trading journey is to choose a broker that offers Gold trading instruments such as futures, ETFs, or CFDs. Look for brokers that are regulated by recognized authorities, such as the FINRA in the United States, the FCA in the United Kingdom, or the ASIC in Australia.

Factors to consider when choosing a Gold trading broker

- Fees: Compare trading fees, commissions, and spreads among different brokers. Low fees are especially important if you plan to trade frequently.

- Leverage: If you're interested in trading Gold futures or CFDs, check the broker’s leverage offerings and margin requirements.

- Platform features: A user-friendly trading platform with good charting tools, real-time data, and technical indicators is essential for executing trades efficiently.

Open and fund your account

Once you've selected a broker, you'll need to open an account. This typically involves providing identification documents and financial information. After your account is approved, you'll need to fund it. Most brokers accept various methods such as bank transfers, credit cards, and electronic payments.

Access the Gold trading platform

After funding your account, the next step is to familiarize yourself with your broker’s trading platform. Most brokers provide a desktop platform, mobile app, or web-based interface for accessing the market. Take time to explore the platform’s features, including charting tools, real-time market data, and order types.

Understanding how to navigate the platform will make it easier to execute trades efficiently and monitor your positions.

Develop a trading plan

Before placing your first trade, it’s important to have a well-defined trading plan. This should include your goals, risk tolerance, and strategies for both entering and exiting trades.

A solid trading plan helps you avoid emotional decisions and stay disciplined during periods of market volatility.

Monitor and adjust your trades

Once you’ve entered the market, continually monitor your trades. Use stop-loss orders to manage risk, and be ready to adjust your strategy as market conditions change. Keep up with the latest news, economic reports, and technical analysis to make informed decisions.

Conclusion

-638669191781407922.png)

Gold trading offers a wide range of opportunities for both novice and experienced investors. From physical gold to futures, options, and ETFs, there are many ways to participate in the Gold market based on your risk tolerance, investment horizon, and market knowledge. Understanding the fundamental factors that drive Gold prices, such as inflation, interest rates, and geopolitical events, will help you make informed trading decisions.

While Gold is often seen as a safe-haven asset, it’s important to recognize that all forms of trading involve risk. By developing sound strategies, applying proper risk management techniques, and staying informed about market conditions, you can take advantage of the unique benefits that Gold trading offers. Whether you’re hedging against inflation, speculating on price movements, or looking for portfolio diversification, gold remains a vital part of the global financial landscape.

Now that you’ve explored this detailed guide, you should have the tools and knowledge to start trading Gold with confidence. Remember, successful Gold trading requires patience, discipline, and a deep understanding of both the markets and yourself as a trader.