Investors are constantly seeking out the best opportunities for earning profits on their investments. Most will research a company and then buy the stock of that company expecting to profit from the rise in price of the stock. There are many other ways of investing which, by employing more creative investment strategies, may allow investors to earn a higher rate of return.

What Are Stock Warrants?

Stock warrants are an opportunity for investors to purchase stocks at a certain price without obligation to buy. If you think this sounds like an option trade, you are correct, warrants are similar to options.

Both call options and stock warrants allow the owner to purchase a set number of shares at a set price. There are also put warrants that, like a put option, allow an investor to sell stock back to the company at a set price. The price at which the shares can be bought or sold is called the strike price. Warrants are contracts that do allow for the purchase or sale of the stock at the strike price, but that transaction must be completed prior to the expiration of the warrant. All warrants have expiration dates, although the expiration may be as far out as fifteen years.

Exercising a stock warrant means that the investors has agreed to purchase the stock and must pay for the stock. There are two types of warrants, American style and European style.

American style warrants can be exercised whenever the holder chooses, prior to expiration.

European style warrants can only be exercised at the expiration of the warrant itself.

On rare occasions the two styles are combined. In this case, the warrant starts out European style and on a specified date through its maturity, takes on features of an American style warrant.

Types of Stock Warrants

Most warrants are issued by the company itself and are traded over-the-counter rather than on exchanges. When company issued warrants are exercised, new shares are issued to give to the buyer. This dilutes the ownership of shares as the new shares add new pieces of ownership to the already existing shares. There are a couple of ways company issued warrants are offered.

Warrant-linked Bonds

Stock warrants are often offered to make a bond purchase more appealing. In exchange for accepting a lower interest rate for the bond, the buyer will receive several warrants allowing for the purchase of stock at a set price. These warrants are often detachable. This means that the warrant can be sold in a secondary market by the owner without selling the bond.

Some warrant-linked bonds, called wedded or wedding warrants, may not be separated from the bond and, if sold, the holder must also surrender the bond at the same time.

Covered or Naked Warrants

Warrants issued by financial institutions are called Covered warrants and are sold from the financial institution’s existing inventory. These are not linked to bonds or preferred stock. There are no new shares issued and the ownership is not diluted. The warrants are covered by shares held by the selling institution.

Options vs. Warrants

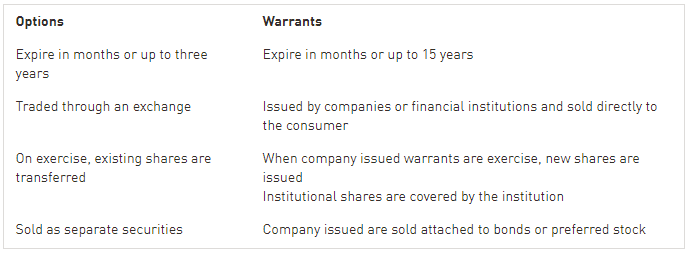

As mentioned previously, warrants are similar securities to options. Both are contracts that allow the holder to buy a set number of shares of a stock at a strike price. The purchase of shares for both is known as exercise. Warrants and options have expiration dates and prices can change based on market conditions, and both decay in value with the passing of time.

However, while warrants are similar to options, there are also many differences.

Risks and Benefits of Trading Stock Warrants

Purchasing warrants is not the easiest thing to do and may be something more suited to sophisticated investors. Since warrants are not traded on exchanges, investors would have to search for warrant information and perhaps subscribe to lists where they are available to purchase. Warrants can provide extra leverage to the investor but, in exchange, they are also riskier investments, especially in declining markets.

The advantage of purchasing or receiving a warrant is that it gives the investor the opportunity to buy the company stock at a discount to future prices. Of course, if the stock price drops below their strike price, the warrant would expire worthless and they would lose some or all of their investment. Receiving a warrant as part of a bond or preferred stock purchase has the potential to increase rate of return dramatically.

To learn more about investment opportunities and the chance to live your life with more freedom, visit your local Online Trading Academy center today. You can enroll in a workshop that will expand your knowledge on the financial markets and prospects for creating wealth and a better life.

Neither Freedom Management Partners nor any of its personnel are registered broker-dealers or investment advisers. I will mention that I consider certain securities or positions to be good candidates for the types of strategies we are discussing or illustrating. Because I consider the securities or positions appropriate to the discussion or for illustration purposes does not mean that I am telling you to trade the strategies or securities. Keep in mind that we are not providing you with recommendations or personalized advice about your trading activities. The information we are providing is not tailored to any individual. Any mention of a particular security is not a recommendation to buy, sell, or hold that or any other security or a suggestion that it is suitable for any specific person. Keep in mind that all trading involves a risk of loss, and this will always be the situation, regardless of whether we are discussing strategies that are intended to limit risk. Also, Freedom Management Partners’ personnel are not subject to trading restrictions. I and others at Freedom Management Partners could have a position in a security or initiate a position in a security at any time.

Editors’ Picks

EUR/USD treads water above 1.1850 amid thin trading

EUR/USD stays defensive but holds 1.1850 amid quiet markets in the European hours on Monday. The US Dollar is struggling for direction due to thin liquidity conditions as US markets are closed in observance of Presidents' Day.

GBP/USD flat lines as traders await key UK and US macro data

GBP/USD kicks off a new week on a subdued note and oscillates in a narrow range near 1.365 in Monday's European trading. The mixed fundamental backdrop warrants some caution for aggressive traders as the market focus now shifts to this week's important releases from the UK and the US.

Gold sticks to intraday losses; lacks follow-through

Gold remains depressed through the early European session on Monday, though it has managed to rebound from the daily trough and currently trades around the $5,000 psychological mark. Moreover, a combination of supporting factors warrants some caution for aggressive bearish traders, and before positioning for deeper losses.

Bitcoin consolidates as on-chain data show mixed signals

Bitcoin price has consolidated between $65,700 and $72,000 over the past nine days, with no clear directional bias. US-listed spot ETFs recorded a $359.91 million weekly outflow, marking the fourth consecutive week of withdrawals.

The week ahead: Key inflation readings and why the AI trade could be overdone

It is likely to be a quiet start to the week, with US markets closed on Monday for Presidents Day. European markets are higher across the board and gold is clinging to the $5,000 level after the tamer than expected CPI report in the US reduced haven flows to precious metals.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a Chief trader its second knowledge how to extract cash out of the market.

5 Forex News Events You Need To Know

In the fast moving world of currency markets where huge moves can seemingly come from nowhere, it is extremely important for new traders to learn about the various economic indicators and forex news events and releases that shape the markets. Indeed, quickly getting a handle on which data to look out for, what it means, and how to trade it can see new traders quickly become far more profitable and sets up the road to long term success.

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and selling pressure. Chart patterns have a proven track-record, and traders use them to identify continuation or reversal signals, to open positions and identify price targets.

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

The challenge: Timing the market and trader psychology

Successful trading often comes down to timing – entering and exiting trades at the right moments. Yet timing the market is notoriously difficult, largely because human psychology can derail even the best plans. Two powerful emotions in particular – fear and greed – tend to drive trading decisions off course.