Gold has been valued for its stability when the financial fires are raging. That stable nature was underscored in 2024 when its price shot upward, gaining over $700 per ounce. This amounted to a 34% increase since January. The vibrant price increase has gotten traders and investors all jazzed up again about gold, with the most pressing question among them being: could gold exceed the $3,000 price point by 2025? Kar Yong Ang, a financial market analyst at Octa broker, delves into the topic.

Inflation, interest rates, and geopolitics

Inflation and interest rates influence gold prices. When inflation soars, investors tend to buy gold to protect their purchasing power. They view it as a much safer investment than stocks or bonds because stocks are prone to sudden price drops, and bonds can lose value when interest rates rise due to high inflation. Historically, though, when real interest rates (which are inflation-adjusted) have declined, gold has just soared. As some would say, 'There is no better buy'.

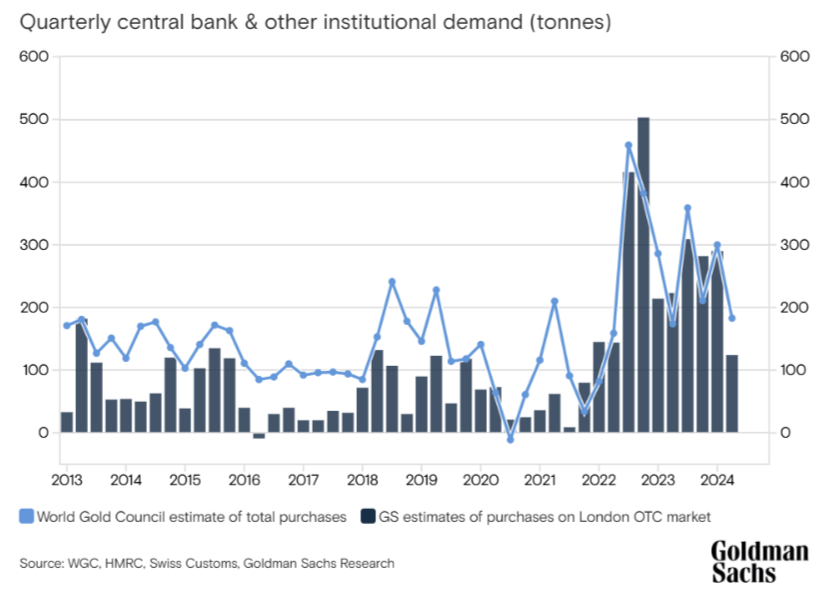

By 2024, the percentage of overall reserves held in gold by central banks had reached 10%, a significant climb from the 3% level recorded just 10 years earlier. Although we are still in an era where most reserve currencies are fiat (for example, paper with little intrinsic value), an increasing number of central banks seem to believe that holding gold adds an element of prudence to their reserve diversification strategy. Emerging economies, especially in Asia, are seeing their central banks take on an increasingly important role in the gold market. China (which now holds 5% of its reserves in gold), along with India, has emerged as one of the preeminent buyers of gold.

Moreover, the central banks of the emerging economies have, since 2022, stepped up their pace of gold buying. The catalyst for this last development was the unprecedented freezing of Russian assets, which prompted multiple nations to reconsider the makeup of their reserves.

Furthermore, the global shift towards a more sustainable economy, including investment in renewable energy and green technologies, is driving limited demand for certain commodities, such as precious metals that include gold. Gold plays an important role in clean energy technologies, including solar panels and electronics for energy-efficient systems. This increased demand for technological gold is exacerbated by growing concerns about the lack of resources necessary for the green transition.

Moreover, geopolitical tensions and economic uncertainty further underscore the attractiveness of gold as a safe asset, attracting investors seeking relief amid rapid changes in global markets. The Ukraine conflict, strained US-China relations, and unrest in the Middle East have sent investors scurrying to safe-haven assets. And when it comes to safe havens, gold is a time-tested destination. Its record of price stability in an unstable world at present stands in stark contrast to the behaviour of the stock market and other assets. An instance of this is China's recent accumulation of gold, which now makes up 5% of its foreign exchange reserves. This is yet another sign of a shift towards resilience in a global economy fraught with uncertainty.

Technical analysis: key levels to watch

According to the technical analysis, the asset's price is still in the uptrend, even on a high timeframe. The long-term bullish trend also hasn't changed for a bearish one. The $3,000 target, which aligns with the 4.236 Fibonacci extension level, is pretty real. However, this level may be too ambitious for the moment of publication.

Prospects for 2025 – factors shaping gold's future

According to the Chief Economists' Survey from the World Economic Forum, economists are uncertain about global economic stability. 54% of respondents forecast a steady outlook and 37% project further deterioration. Future fiscal policies targeting climate adaptation, a shifting demographic landscape, and ramped-up defence spending are set to push inflation upwards. All these look to gold as an inflation hedge; however, it's not just private investors: central banks are in on the gold thing, too. They are expected to keep topping up their gold reserves and, in the face of all these other demands, are likely to maintain long-term demand.

Will gold hit the $3,000-per-ounce price in 2025? The scenario seems very possible. However, for the asset's price to reach a rather ambitious target, favourable market conditions are required. They include both macroeconomic and geopolitical factors. For example, the re-election of Donald Trump introduces additional variables into the equation. Trump's geopolitical stance, particularly regarding global trade and conflict resolution, could influence investor sentiment and safe-haven demand. If his promises regarding the resolution of numerous conflicts are fulfilled, investors may partially abandon safe-haven assets for the riskier ones.

Octa is an international broker that has been providing online trading services worldwide since 2011. It offers commission-free access to financial markets and a variety of services used by clients from 180 countries who have opened more than 52 million trading accounts. To help its clients reach their investment goals, Octa offers free educational webinars, articles, and analytical tools.

The company is involved in a comprehensive network of charitable and humanitarian initiatives, including the improvement of educational infrastructure and short-notice relief projects supporting local communities.

Since its foundation, Octa has won more than 90 awards, including the 'Most Reliable Broker Global 2024' award from Global Forex Awards and the 'Best Mobile Trading Platform 2024' award from Global Brand Magazine.

This is a sponsored post. The opinions expressed in this article are those of the author and do not necessarily reflect the views of FXStreet. FXStreet has not verified the accuracy or basis-in-fact of any claim or statement made by any independent author. You should be aware of all the risks associated with trading and seek advice from an independent financial advisor if you have any doubts.

General Risk Warning for FX & CFD Trading. FX & CFDs are leveraged products. Trading in FX & CFDs related to foreign exchange, commodities, financial indices and other underlying variables, carry a high level of risk and can result in the loss of all of your investment. As such, FX & CFDs may not be appropriate for all investors. You should not invest money that you cannot afford to lose. Before deciding to trade, you should become aware of all the risks associated with FX & CFD trading, and seek advice from an independent and suitably licensed financial advisor. Under no circumstances shall we have any liability to any person or entity for (a) any loss or damage in whole or part caused by, resulting from, or relating to any transactions related to FX or CFDs or (b) any direct, indirect, special, consequential or incidental damages whatsoever.

Editors’ Picks

EUR/USD: Yes, the US economy is resilient – No, that won’t save the US Dollar Premium

Some impressive US data should have resulted in a much stronger USD. Well, it didn’t happen. The EUR/USD pair closed a third consecutive week little changed, a handful of pips above the 1.1800 mark.

Gold: Metals remain vulnerable to broad market mood Premium

Gold (XAU/USD) started the week on a bullish note and climbed above $5,000 before declining sharply and erasing its weekly gains on Thursday, only to recover heading into the weekend.

GBP/USD: Pound Sterling remains below 1.3700 ahead of UK inflation test Premium

The Pound Sterling (GBP) failed to resist at higher levels against the US Dollar (USD), but buyers held their ground amid a US data-busy blockbuster week.

Bitcoin: BTC bears aren’t done yet

Bitcoin (BTC) price slips below $67,000 at the time of writing on Friday, remaining under pressure and extending losses of nearly 5% so far this week.

US Dollar: Big in Japan Premium

The US Dollar (USD) resumed its yearly downtrend this week, slipping back to two-week troughs just to bounce back a tad in the second half of the week.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a Chief trader its second knowledge how to extract cash out of the market.

5 Forex News Events You Need To Know

In the fast moving world of currency markets where huge moves can seemingly come from nowhere, it is extremely important for new traders to learn about the various economic indicators and forex news events and releases that shape the markets. Indeed, quickly getting a handle on which data to look out for, what it means, and how to trade it can see new traders quickly become far more profitable and sets up the road to long term success.

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and selling pressure. Chart patterns have a proven track-record, and traders use them to identify continuation or reversal signals, to open positions and identify price targets.

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

The challenge: Timing the market and trader psychology

Successful trading often comes down to timing – entering and exiting trades at the right moments. Yet timing the market is notoriously difficult, largely because human psychology can derail even the best plans. Two powerful emotions in particular – fear and greed – tend to drive trading decisions off course.