Discover Financial Services provides digital banking and payment services, mainly in the United States. Its digital banking segment is quite regular, providing loans and credit cards to individuals. On the other hand, the payment services segment comprises ATMs, funds transfers, and settlement services, among other things. The company suffered a disastrous 2020 but still managed to stay profitable and seems to be recovering well, but is shrouded in uncertainty ahead.

When it rains, it pours

Discover was doing quite well before the pandemic, with revenues rising consistently. In FY17, the company reported revenues of around $9.9 billion, and they had gone up to about $11.4 billion by FY19. However, the company’s performance was primarily driven by the rise in revenues, as the net margin did not increase during the time (it fell slightly). As such, COVID-19 was a particularly devastating time for the company.

The vast majority of the company’s revenues come about due to its credit card business. In fact, 76% of the company’s revenue in FY19 was due to its credit cards. Credit card revenues fell sharply during the pandemic, as not only did people stop traveling (which accounted for a lot of the revenue), but they also stopped being extravagant with their finances. Americans, in general, took on less debt during the pandemic. Companies like Discover suffered the worst as a result.

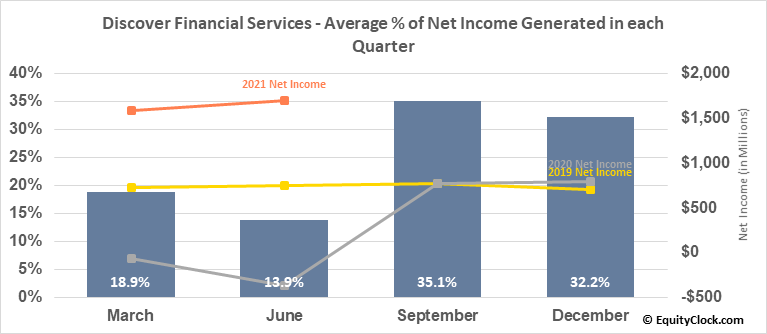

The company tends to generate most of its income in the final two quarters of the year, which means that FY21 could be the most profitable year for the company yet. Source: EquityClock

Fighting back

Q2 FY20 was a particularly devastating quarter for the company, as large credit losses meant that the company reported a $1.2 per share loss. However, the company announced in an earnings call at the end of Q1 that it had plans to cut costs by $400 million in 2020, and it is a strategy that has seemed to work.

Q2 FY20 was the last quarter in which the company reported a loss. While the turnaround can be largely attributed to the recovery of the economy in general, Discover has come through on its promises to reduce costs and streamline its operations.

The company’s net margin was 28.1% in the final quarter of FY20, and business has been booming in FY21 so far. While Americans were initially wary of the financial burden caused by COVID-19, the sentiment has now swung in the opposite direction. Over 40% of Americans have more credit card debt now than they did at the beginning of the pandemic.

While many of these debts are due to financial decisions during the pandemic, a lot of this is simply consumer debt, with people wanting to buy new things in the wake of rising asset prices.

Discovering value

Trying to value Discover is quite difficult right now. The company has performed exceptionally well in FY21, and the earnings per share have crossed $10 by the end of the second quarter. Just to put this into perspective, the company’s EPS for the entirety of FY19 was $9.08.

However, we are unsure if the company can sustain such a performance. For one, the outlook for the economy is not as great as it was at the beginning of FY21. With inflation on the rise, it is possible that the FED could cut interest rates. While it may not happen in 2021, it is inevitable at some point if inflation rates continue to stay high. That would mean people taking on less credit card debt and may even lead to higher defaults.

Still, while the long-term outlook for Discover is uncertain, we cannot argue that the company seems very enticing in the short term. Consensus estimates place the company’s earnings at $16.8 for FY21. The P/E ratio, currently at 8.15, is expected to fall to 7.70 by the end of the year. For FY22, the earnings are expected to fall to $12.5 per share, with the P/E ratio at 10.3.

This makes it challenging to recommend Discover as a long-term investment right now. Although it may be possible for you to time your entry and exit perfectly, we strongly advise against it. Many an investor has thought themselves to be smarter than the market and realized how wrong they were. Although the company has cut costs significantly during the pandemic, it is still massively exposed to its credit card business. As such, considerable deviations in the company’s performance are to be expected in the years ahead.

Opinions are on our own. The information is provided for information only and does not constitute, and should not be construed as, investment advice or a recommendation to buy, sell, or otherwise transact in any investment including any products or services or an invitation, offer or solicitation to engage in any investment activity.

Editors’ Picks

EUR/USD: US Dollar to remain pressured until uncertainty fog dissipates Premium

The EUR/USD pair lost additional ground in the first week of February, settling at around 1.1820. The reversal lost momentum after the pair peaked at 1.2082 in January, its highest since mid-2021.

Gold: Volatility persists in commodity space Premium

After losing more than 8% to end the previous week, Gold (XAU/USD) remained under heavy selling pressure on Monday and dropped toward $4,400. Although XAU/USD staged a decisive rebound afterward, it failed to stabilize above $5,000.

GBP/USD: Pound Sterling tests key support ahead of a big week Premium

The Pound Sterling (GBP) changed course against the US Dollar (USD), with GBP/USD giving up nearly 200 pips in a dramatic correction.

Bitcoin: The worst may be behind us

Bitcoin (BTC) price recovers slightly, trading at $65,000 at the time of writing on Friday, after reaching a low of $60,000 during the early Asian trading session. The Crypto King remained under pressure so far this week, posting three consecutive weeks of losses exceeding 30%.

Three scenarios for Japanese Yen ahead of snap election Premium

The latest polls point to a dominant win for the ruling bloc at the upcoming Japanese snap election. The larger Sanae Takaichi’s mandate, the more investors fear faster implementation of tax cuts and spending plans.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a Chief trader its second knowledge how to extract cash out of the market.

5 Forex News Events You Need To Know

In the fast moving world of currency markets where huge moves can seemingly come from nowhere, it is extremely important for new traders to learn about the various economic indicators and forex news events and releases that shape the markets. Indeed, quickly getting a handle on which data to look out for, what it means, and how to trade it can see new traders quickly become far more profitable and sets up the road to long term success.

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and selling pressure. Chart patterns have a proven track-record, and traders use them to identify continuation or reversal signals, to open positions and identify price targets.

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

The challenge: Timing the market and trader psychology

Successful trading often comes down to timing – entering and exiting trades at the right moments. Yet timing the market is notoriously difficult, largely because human psychology can derail even the best plans. Two powerful emotions in particular – fear and greed – tend to drive trading decisions off course.