In this article, I will show you step-by-step how to set up TradingView for the PowerX Strategy.

Let’s get started:

Here’s how to setup TradingView for the PowerX Strategy in 8 simple steps:

Step 1: Register for TradingView

It’s free, and if you don’t register, many of the features that I am showing you in this article won’t work.

You might even consider upgrading to the “Pro Version” for $14.95 per month. That’s the version that I have, and I think it’s well worth the price.

Step 2: Click on Full-Featured Chart

In order to add indicators to the chart and customize your layout, you need to click on Full-Featured Charts:

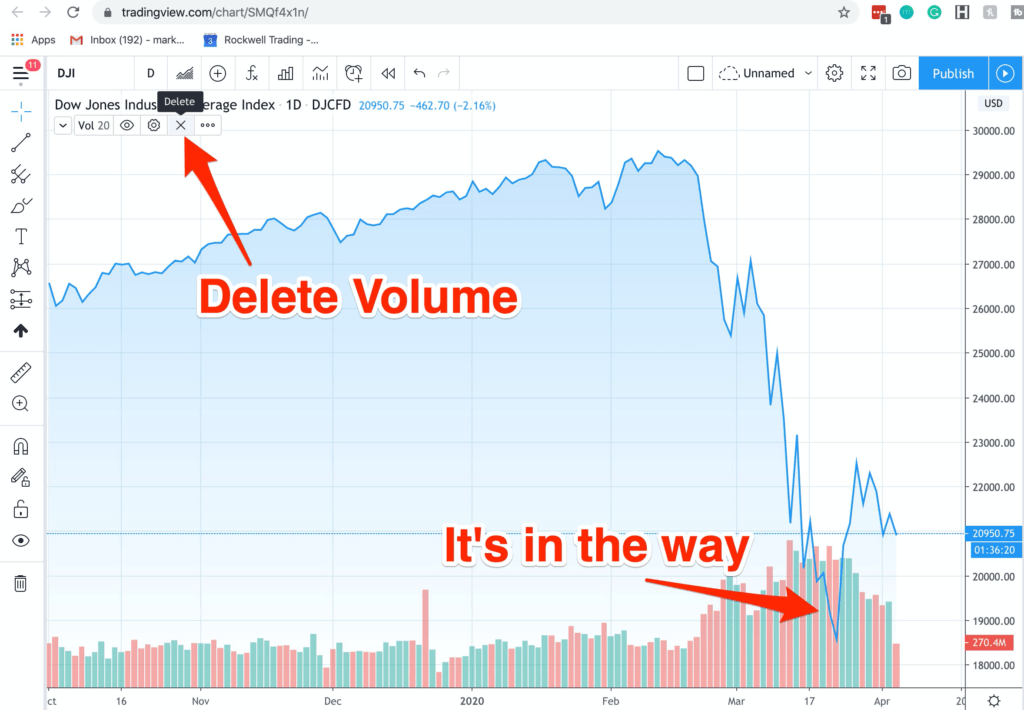

Step 3: Delete the Volume

I personally don’t use volume information, and it’s in the way. In order to have a clean chart, delete the volume:

Step 4: Add The RSI And Configure It

The next step is to add the indicators.

In order to add indicators…

- Click on the “F”

- Then enter “RSI” in the search field and

- Then select “Relative Strength Index”

Once the RSI Indicator is added to the charts, click on the gear icon to bring up the properties.

Now click on INPUT and change the LENGTH from 14 to 7.

And here’s how I select the STYLE of the indicator:

Changing the style is optional, but I like to change…

- The Upper Band to 100

- The Lower Band to 50 and

- The Background to GREEN with a 20% Opacity

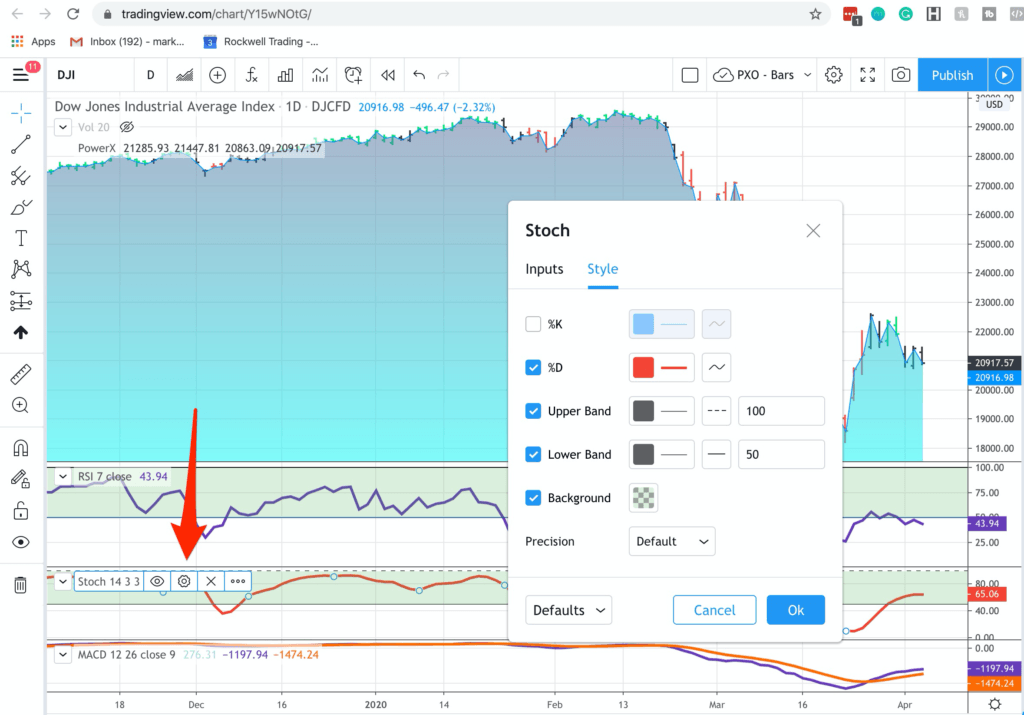

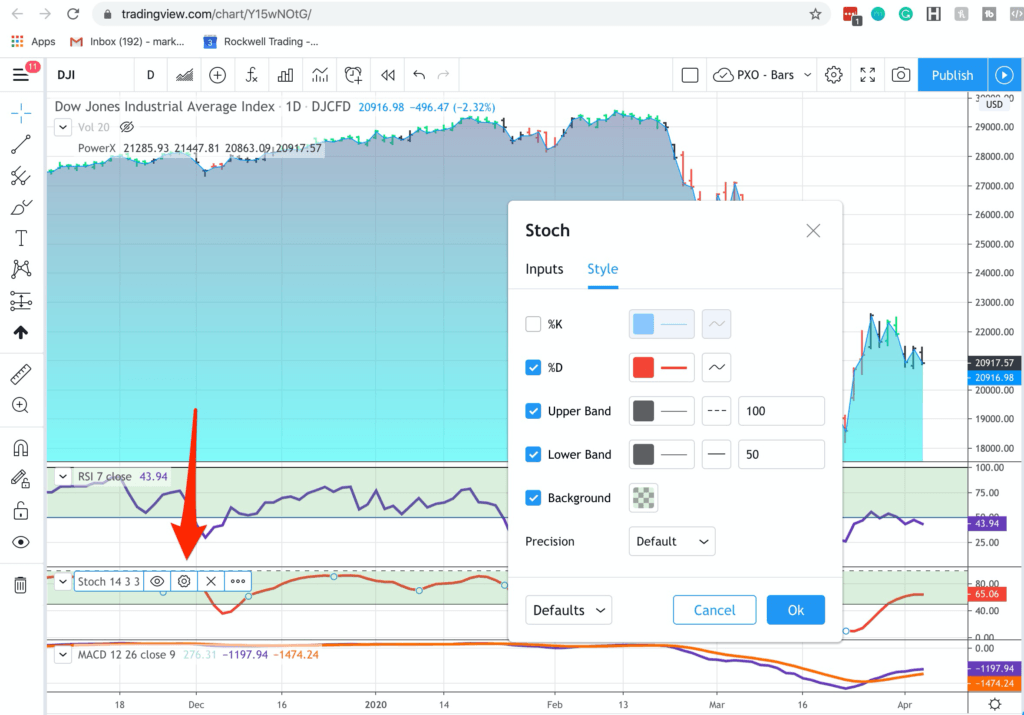

Step 5: Add the Stochastics

The next indicator is the Stochastics.

We can add the Stochastic in the same way as we added the RSI:

- Click on the “F”

- Then enter “Stochastic” in the search field and

- Then select “Stochastic”

Here’s how to configure the Stochastic:

- Under INPUT, select 14, 3 and 3

And I like to change my STYLE settings as following:

- Uncheck %K

- Set the “Upper Band” to 100

- Set the “Lower Band” to 50

- Use GREEN for the “Background” with a 20% opacity

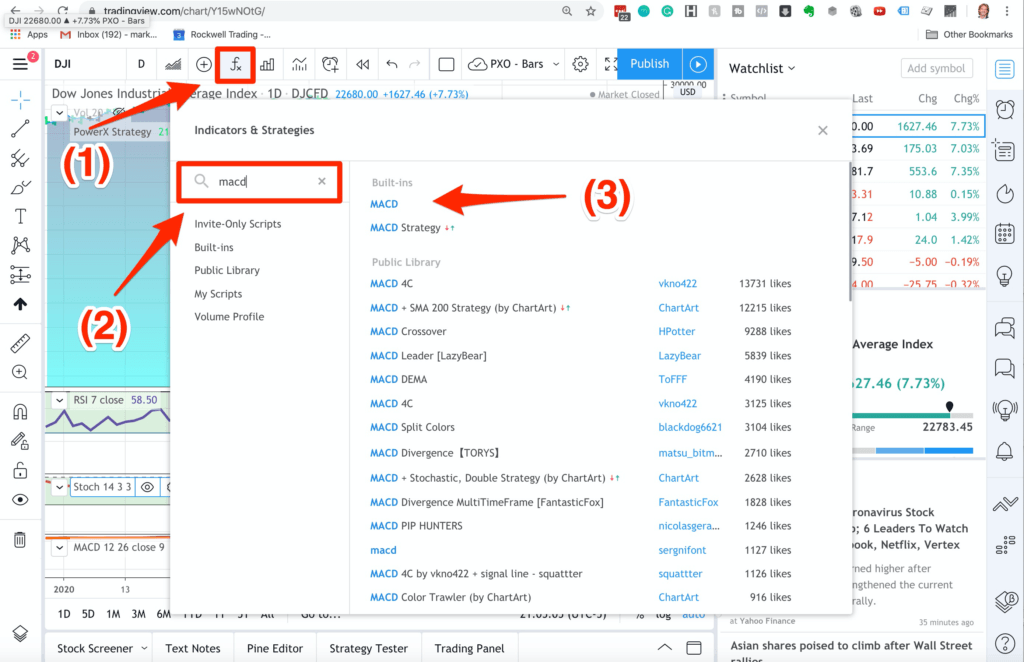

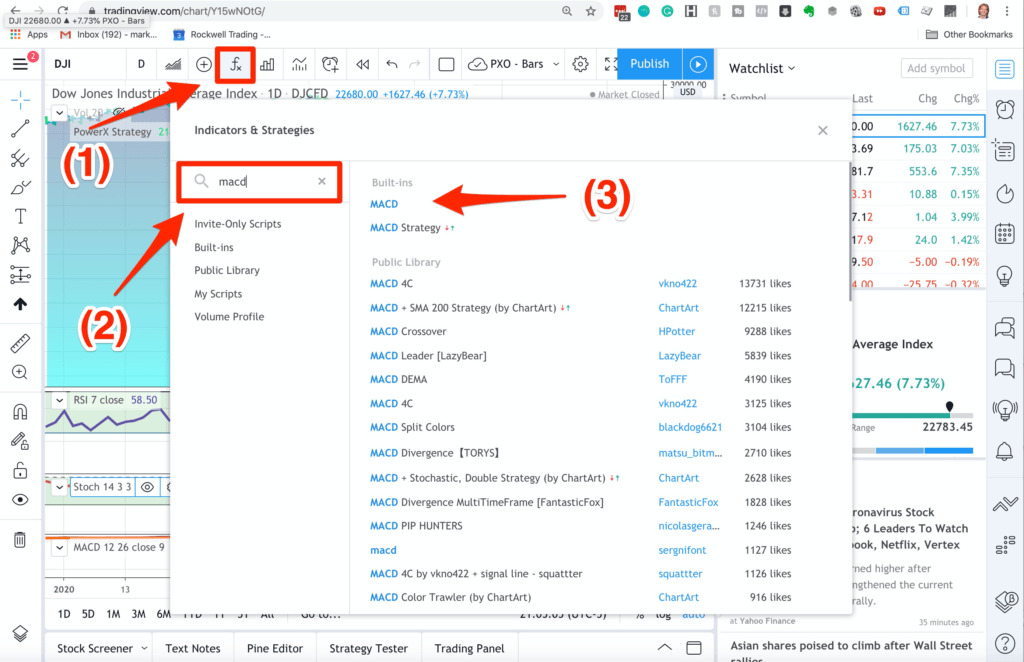

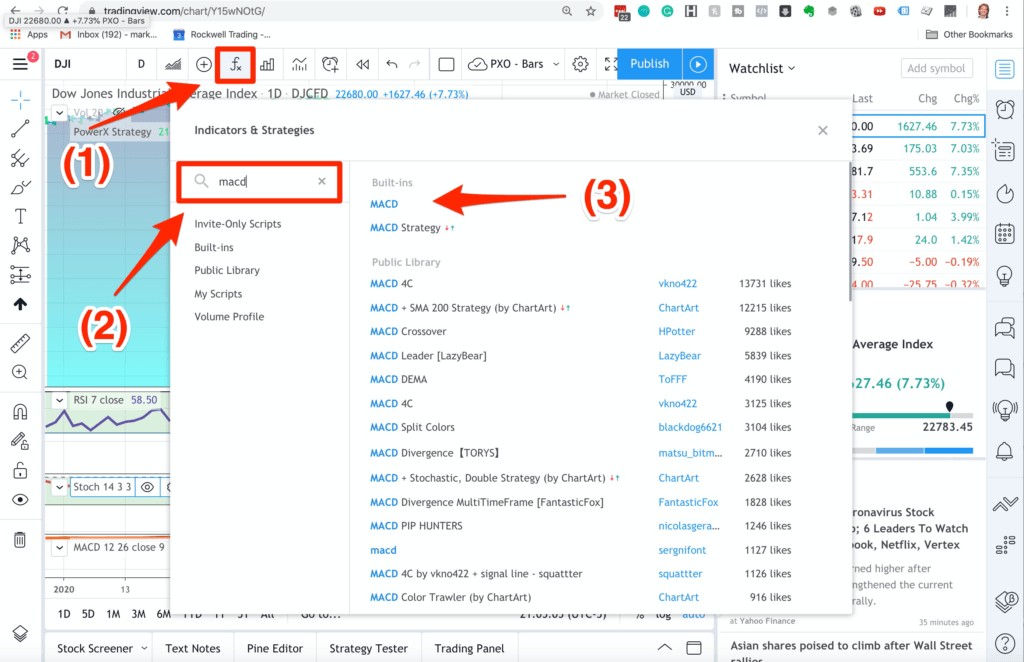

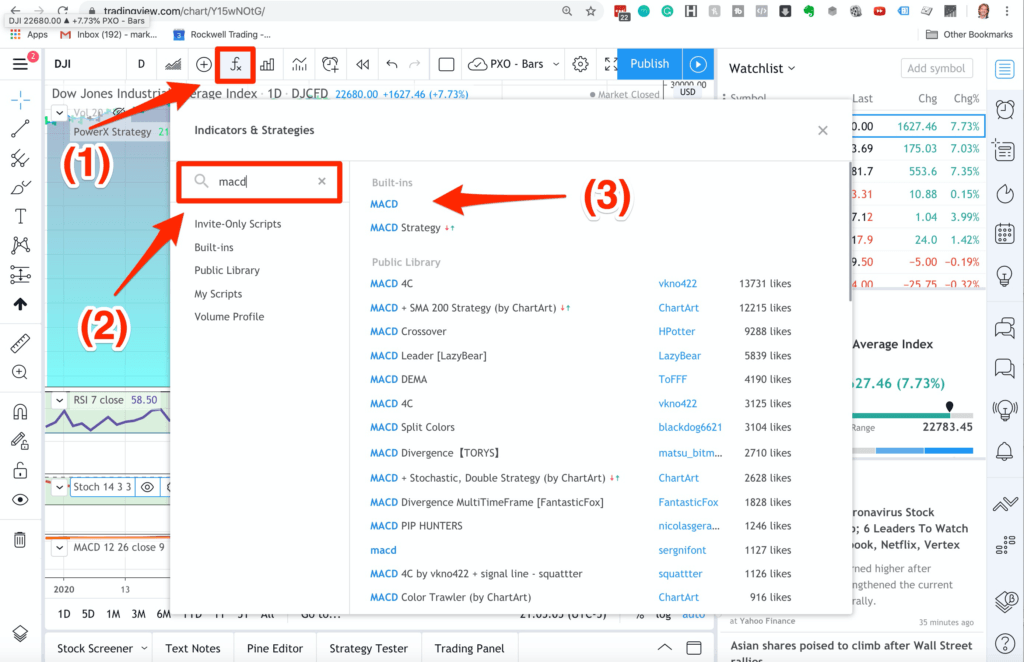

Step 6: Add the MACD

The next indicator is the MACD.

You can add it in the same way as we did before:

- Click on the “F”

- Then enter “MACD” in the search field and

- Then select “MACD”

Here’s how to configure the Stochastic:

- Under INPUT, select 12, 26 and 9

And I like to change my STYLE settings as following:

- Uncheck the “Histogram”

- Change the color of the “MACD” to purple

- Change the color of the “Signal” to orange

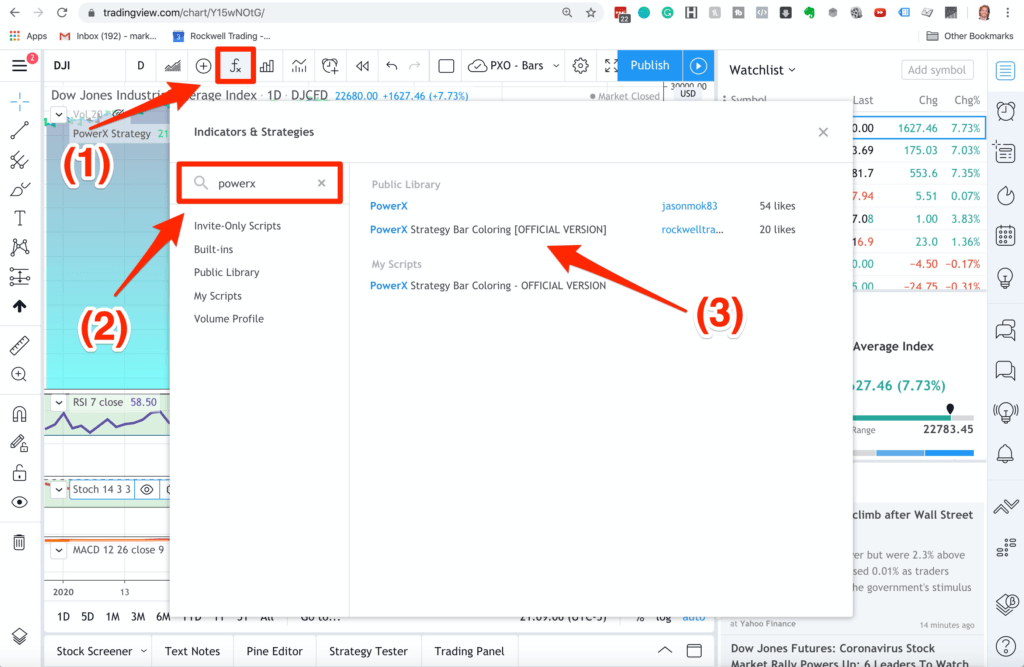

Step 7: Add Rockwell PowerX

The next step is to add the bar coloring so that the bars are GREEN and RED according to the PowerX Strategy:

- Click on the “F”

- Then enter “PowerX” in the search field and

- Then select “PowerX Strategy Bar Coloring [OFFICIAL VERSION]”

The good news: You don’t need to configure anything for this. :-)

Step 8: Save Your Chart Settings:

Your chart should now look like the chart below.

I highly recommend that you save your work:

- Click on the little ^ next to the GEAR icon

- Select a name and click on SAVE NOW

That’s it! You did it

Now you have setup TradingView for the PowerX Strategy, which — in my opinion — is the best TradingView Setup.

Hope this helps!

Trading Futures, options on futures and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. The lower the day trade margin, the higher the leverage and riskier the trade. Leverage can work for you as well as against you; it magnifies gains as well as losses. Past performance is not necessarily indicative of future results.

Editors’ Picks

EUR/USD: US Dollar comeback in the makes? Premium

The US Dollar (USD) stands victorious at the end of another week, with the EUR/USD pair trading near a four-week low of 1.1742, while the USD retains its strength despite some discouraging American data released at the end of the week.

Gold: Escalating geopolitical tensions help limit losses Premium

Gold (XAU/USD) struggled to make a decisive move in either direction this week as it quickly recovered above $5,000 after posting losses on Monday and Tuesday.

GBP/USD: Pound Sterling braces for more pain, as 200-day SMA tested Premium

The Pound Sterling (GBP) crashed to its lowest level in a month against the US Dollar (USD), as critical support levels were breached in a data-packed week.

Bitcoin: No recovery in sight

Bitcoin (BTC) price continues to trade within a range-bound zone, hovering around $67,000 at the time of writing on Friday, and falling slightly so far this week, with no signs of recovery.

US Dollar: Tariffed. Now What? Premium

The US Dollar (USD) reversed its previous week’s decline, managing to stage a meaningful rebound and retesting the area just above the 98.00 barrier when tracked by the US Dollar Index (DXY).

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a Chief trader its second knowledge how to extract cash out of the market.

5 Forex News Events You Need To Know

In the fast moving world of currency markets where huge moves can seemingly come from nowhere, it is extremely important for new traders to learn about the various economic indicators and forex news events and releases that shape the markets. Indeed, quickly getting a handle on which data to look out for, what it means, and how to trade it can see new traders quickly become far more profitable and sets up the road to long term success.

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and selling pressure. Chart patterns have a proven track-record, and traders use them to identify continuation or reversal signals, to open positions and identify price targets.

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

The challenge: Timing the market and trader psychology

Successful trading often comes down to timing – entering and exiting trades at the right moments. Yet timing the market is notoriously difficult, largely because human psychology can derail even the best plans. Two powerful emotions in particular – fear and greed – tend to drive trading decisions off course.