As cryptocurrency has become mainstream governments around the world have taken the first steps towards cryptocurrency regulations; Russia wants to create a robust tax regime, the UK and EU wants to force cryptocurrency to comply with Know your Customer (KYC) and Anti Money Laundering (AML) legislation and the Trump administration has voiced concerns that “Bitcoin is being used for illicit activity”. It seems that Cryptocurrency legislation is all but inevitable.

It should be no surprise that Governments around the World are looking at regulating the disruptive technology. There are fears that Bitcoin and its ilk are becoming safe havens for tax evaders, money launderers and criminals of all stripes. Governments are also concerned that unregulated Initial Coin Offerings (ICOs) are feeding an unsustainable bubble that could endanger the fragile economic recovery of the last decade.

This represents a dilemma for a community that has proven hostile to any Government intervention. Users and investors fear that politicians do not understand cryptocurrency and that any regulations will result in a de facto ban. This view manifests itself in the market via precipitous price drops whenever news of potential cryptocurrency legislation hits the headlines.

This disconnect between the Cryptocurrency community and World governments could have far-ranging consequences. The best way to understand what potential cryptocurrency legislation could look like and how it could affect the cryptocurrency market is to take a look at past attempts at regulation.

The Chinese ICO Ban Was Driven By Legitimate Fears About Unregulated Markets

Initial coin offerings, or ICOs, represent a new investment stream for small start-ups but represent a major problem for governments. An ICO allows a project to achieve funding through a “token sale”. They lower the barrier of entry for both investors and entrepreneurs and arguably democratize investment. The problem is that many investors are fairly inexperienced and unable to separate the good projects from the bad. Many new ICOs lack a proper whitepaper and amount to little more than a sales pitch peppered with buzzwords with no proven product anywhere in sight. This makes them a highly risky investment that is likely to fail.

This problem was particularly pronounced within China. In 2017 over $400 million was raised for Chinese based ICOs. The ICO market had clearly begun to overheat and If even a small proportion of ICOs began to fail then it could have a wide-ranging implications for the Chinese economy. In order to prevent the bubble from bursting the Chinese government took action.

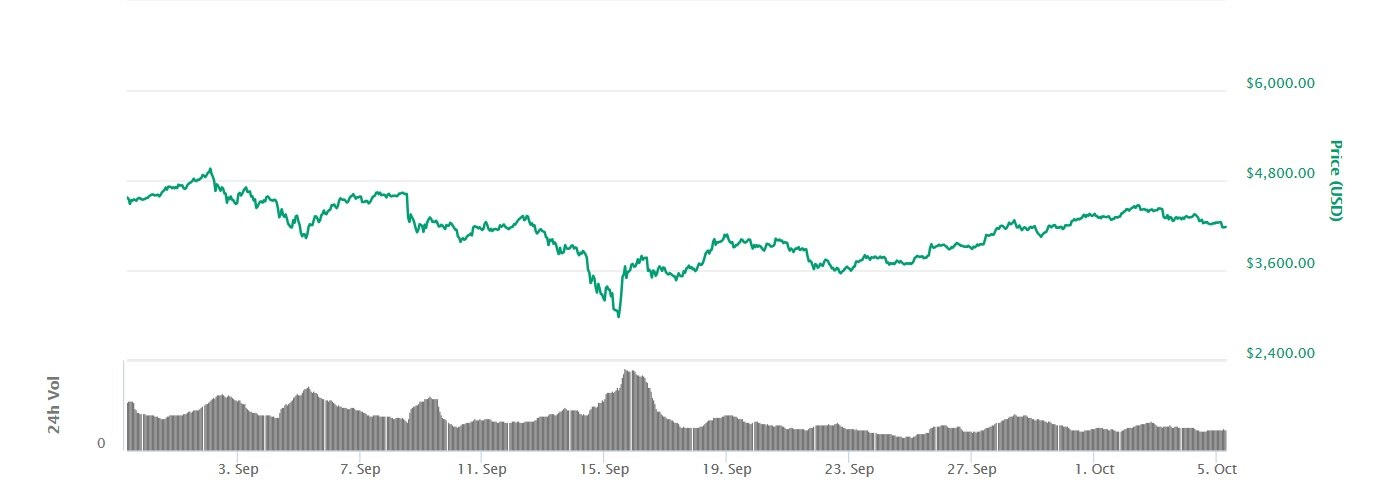

The market quickly bounced back from the Chinese ban (Via coinmarketcap)

In September 2017 the Chinese authorities issued a complete ban on ICOs and suspended fiat to cryptocurrency exchanges. The Chinese authorities justified the move by claiming that ICOs had “seriously disrupted the economic and financial order.” The regulations essentially banned cryptocurrency trading and the market experienced a brief downtown.

The blanket ban appears to have been a temporary measure to attempt to reassert control over the market. Yang Dong, director of the Center for Financial Technology, has stated that the government wishes to ensure that “Good ICO projects are allowed to develop in a legal and risk-controlled environment rather than simply adopting a one-size-fits-all approach.”.

In the Chinese environment, a blanket ban makes a great deal of sense. The Chinese government likes to be able to pick and chose the businesses it backs and ICOs represented an unacceptable loss of control. Furthermore, there were fears that cryptocurrency could undermine the yen and the Chinese authorities needed to take steps in order to prevent this from happening.

Even if China’s ICO ban is simply a short-term measure it still represents one of the most aggressive examples of cryptocurrency legislation today. In absence of a Global agreement many Chinese investors simply began to trade on foreign exchanges, rendering the whole exercise pointless. Cryptocurrency is essentially stateless and so any national ban will simply result in the money flowing elsewhere.

South Korean Regulation Was An Attempt To Cool Down An Overheated Market

One of the most popular digital destinations for disenfranchised Chinese investors was South Korea. Once the ban came into effect investors simply began flooding the Korean market with tokens that they would then illegally exchange for fiat currencies. South Korea was already one of the World’s largest cryptocurrency markets and their exchanges were particularly active. The influx of Chinese investors caused an already hot market to further overheat and Seoul felt compelled to take action.

In January 2018 the South Korean authorities announced that all foreigners and minors would be unable to trade on Korean exchanges. The Government cited concerns that cryptocurrency was being used to launder money. They also expressed concern that ICOs had become a vehicle for ponzi schemes and that the market was at risk of manipulation.

In order to enforce the ban, the government took steps to make ID verification mandatory. From the 30th of January, every South Korean cryptocurrency account was closed and Korean nationals were forced to open new accounts, foreigners and minors would be unable to open their accounts. Exchanges were also forced to share all transaction data with banks and any anonymous transactions were blocked by the Korean banks.

The announcement contributed to the BItcoin bear market (Via coinmarketcap)

The move contributed to the downturn that was already affecting the market and was met with disapproval from prominent members of South Korea’s burgeoning cryptocurrency industry. They were particularly concerned that the legislation would cause Korean businesses and talent to move to friendlier environments in Switzerland and Singapore and risked South Korea falling behind.

Russian cryptocurrency regulations represent a moderate approach

In January 2018 the Russian government drafted the federal law “On Digital Financial Assets“ that would regulate the creation, issuance, storage, and circulation of cryptocurrencies. The approach taken by the Russian authorities differed greatly from that of South Korea and China. The finance ministry recognized that too strict an approach risked forcing cryptocurrency into the black market and wanted to avoid that outcome.

Rather than an outright ban, the Russian law sought to define what cryptocurrency was and the parameters within which it was allowed to operate. This included legal definitions for various aspects of cryptocurrency.

| Asset | Russian legal definition |

| Cryptocurrency | a type of digital financial asset created and accounted for in the distributed registry of digital transactions by participants in this registry in accordance with the rules of maintaining the registry of digital transactions. |

| Token | a type of a digital financial asset that is issued by a legal entity or an individual entrepreneur (hereinafter referred to as an issue) in order to attract financing and is recorded in the registry of digital records |

| Mining |

An entrepreneurial activity aimed at creating a cryptocurrency and/or validation in order to receive compensation in the form of a cryptocurrency. |

A substantial proportion of Russia’s cryptocurrency legislation is devoted to ICOs. It specified that the issuer must release an investment memorandum that contains all information relating to the issuer themselves and the tokens at least 3 days prior to the sale. It also banned any advertising or offering tokens to potential investors prior to the sale. The draft law also prohibited unqualified investors from investing more than 50,000 rubles ($890) per ICO. Investors were also able to settle disputes through the Russian high courts in order to discourage fraudulent ICOs.

Russia’s new regulations also cover exchanges and wallets. Exchanges were required to register as Russian legal entities in order to operate inside Russia. They were also compelled to identify their users. This was to prevent exchanges from being used to evade taxes or launder money.

The most controversial aspect of the draft law was that it stated that exchanges were the only entities legally allowed to operate wallets. Exchanges have a very poor record of security and it is considered good practice for investors to only store their cryptocurrency in a private wallet. By forcing investors to keep their assets in an exchange wallet Russia is severely undermining their security and placing a great deal of trust in the exchanges.

Experts Believe Balanced Regulation Is The Key To The Long-Term Success Of Cryptocurrency

All three examples demonstrate the difficulties of adequately legislating for the cryptocurrency. In all three cases, regulators have failed to understand the technical and economic underpinnings of cryptocurrency and have drafted regulations that could well cause more harm than good.

Cryptocurrency is decentralized which makes it very difficult to legislate. Without global agreements users can simply start trading using foreign exchanges and trace users without undermining the security of the blockchain is challenging.

If cryptocurrency becomes a haven for tax evasion, fraud, and criminal activity then governments will inevitably respond by drafting draconian legislation. It is likely that this would drive cryptocurrency underground and blockchain technology would become the preserve of criminals. This scenario is an undesirable outcome for both the cryptocurrency community and governments.

There are already influential voices calling for Cryptocurrency developers and governments to work more closely together. The CEO of Ripple, Brad Garlinghouse, has previously voiced concerns that ICOs are too unregulated, arguing that “Heavily regulated markets are typically heavily regulated for a reason.”. Others have called for governments to more closely involve the cryptocurrency community in their legislative efforts.

“Instead of imposing a ban or heavily regulating the cryptocurrency trade, governments should cooperate with the community to maximize their tax collection efforts,” Vlad Sapozhnikov, co-founder and CEO of Deex Exchange

The community has already taken some steps towards cooperation with governments. A large number of exchanges already operate according to KYC and AML legislation as best practice. Furthermore, even privacy-centric cryptocurrencies like Monero have taken steps to allow their users to comply with the authorities by offering a key that provides a “window” into your assets. The problem is that heavy-handed legislation will scare the community away from cooperation and may even breed contempt.

The regulation doesn’t necessarily have to be bad a thing. There is a strong argument that KYC and LMA regulation may actually help to stabilize the volatile cryptocurrency market. Regulation of ICOs is also long overdue and the steps taken by Russia to hold entrepreneurs accountable should help to reduce the number of fraudulent token offerings.

Well crafted regulation could help to reassure investors that cryptocurrency is a legitimate financial innovation. Some experts within the cryptocurrency community also believe that regulatory interest in cryptocurrency shows that Governments have finally recognized the potential of the technology.

“What some will bill as censure, the cryptocurrency community will deem as a stamp of approval that finally recognizes the pivotal role that digital currencies will ultimately hold for the global economy.” - Nicholas Gregory, CEO of CommerceBlock

Regulation can Help you Predict Market Trends

For the short term news of regulation will likely continue to trigger market dips. Investors tend to react badly to news of cryptocurrency regulations because it generates uncertainty. There are concerns that governments often overreach and regulation is likely to be poorly-implemented and heavy-handed.

This lack of trust can lead to panic selling and regulation can make the market dip sharply. It is often a good strategy to buy on these dips. The market tends to recover as investors quickly realize that most legislative efforts are likely to prove ineffective. Shortly after the Chinese ICO ban, the market experienced a sharp dip that corrected itself a few days later. Savvy investors were able to use this market shift to make a profit.

The fear of regulation also makes privacy coins like Monero and Verge excellent hedging assets. In times of uncertainty cryptocurrency, investors tend to either withdraw their capital into fiat currencies or move it into anonymous currencies to protect it. This means that you will sometimes see privacy coins going against the trend and rising in value as investors shift their portfolios.

In the long term, this trend could begin to change as governments begin working more closely with the cryptocurrency community. Well-drafted legislation could begin to stabilize the cryptocurrency market. In particular, you should look for International agreements regarding ICOs and KYC/AML legislation. If these kinds of regulations are successfully implemented then the cryptocurrency market will theoretically become less volatile and investors will be less likely panic-sell their assets.

Conversely, poorly planned legislation has the potential to send the market into a downward spiral. If there are verified rumors of widespread bans on cryptocurrency exchanges then you should consider either selling a large portion of your assets, setting the stop at loss positions or transitioning your portfolio to privacy coins that can weather the storm.

Cryptocurrency legislation will remain an important part of the market for the foreseeable future. Successful investors will ensure that they keep informed about the latest changes and adjust their market position accordingly

Find out everything you need to know about cryptocurrency investing via our guides at Commodity.com

Investors should not rely solely on the information contained on our website or other publications when making investment decisions. Instead, investors should use the information provided by the profiled companies as a starting point for conducting additional research that will permit them to form their own opinions regarding the appropriateness of an investment in the profiled company’s securities.

Editors’ Picks

EUR/USD: US Dollar to remain pressured until uncertainty fog dissipates Premium

The EUR/USD pair lost additional ground in the first week of February, settling at around 1.1820. The reversal lost momentum after the pair peaked at 1.2082 in January, its highest since mid-2021.

Gold: Volatility persists in commodity space Premium

After losing more than 8% to end the previous week, Gold (XAU/USD) remained under heavy selling pressure on Monday and dropped toward $4,400. Although XAU/USD staged a decisive rebound afterward, it failed to stabilize above $5,000.

GBP/USD: Pound Sterling tests key support ahead of a big week Premium

The Pound Sterling (GBP) changed course against the US Dollar (USD), with GBP/USD giving up nearly 200 pips in a dramatic correction.

Bitcoin: The worst may be behind us

Bitcoin (BTC) price recovers slightly, trading at $65,000 at the time of writing on Friday, after reaching a low of $60,000 during the early Asian trading session. The Crypto King remained under pressure so far this week, posting three consecutive weeks of losses exceeding 30%.

Three scenarios for Japanese Yen ahead of snap election Premium

The latest polls point to a dominant win for the ruling bloc at the upcoming Japanese snap election. The larger Sanae Takaichi’s mandate, the more investors fear faster implementation of tax cuts and spending plans.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a Chief trader its second knowledge how to extract cash out of the market.

5 Forex News Events You Need To Know

In the fast moving world of currency markets where huge moves can seemingly come from nowhere, it is extremely important for new traders to learn about the various economic indicators and forex news events and releases that shape the markets. Indeed, quickly getting a handle on which data to look out for, what it means, and how to trade it can see new traders quickly become far more profitable and sets up the road to long term success.

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and selling pressure. Chart patterns have a proven track-record, and traders use them to identify continuation or reversal signals, to open positions and identify price targets.

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

The challenge: Timing the market and trader psychology

Successful trading often comes down to timing – entering and exiting trades at the right moments. Yet timing the market is notoriously difficult, largely because human psychology can derail even the best plans. Two powerful emotions in particular – fear and greed – tend to drive trading decisions off course.