Are you finding navigating the world of trading a challenging and overwhelming experience? Or perhaps you'd like practical guidance to overcome current obstacles? Either way, by outlining the problems each step solves, you have greater clarity on where you can make improvements in your trading.

Framework steps and the problems they solve

1. Specialise

Specialising in a market, much like the floor traders did, solves the following problems:

- Overwhemled by too many instruments to follow

- Stuck in analysis and not trading

- Not taking advantage of experience by focusing on a single market

- Lack of understanding leading to poor trading decisions

2. Playing Field

The application of a playing field creates order and structure in an otherwise erratic and chaotic trading environment. It solves the following problems:

- Unawareness of market maker and institutional trading

- Tactics that used to work no longer effective

- Constantly getting chopped up

- Adding to winners only to lose overall

- Exiting too soon and missing market continuation

- Giving back all profits while waiting for market to move further

3. Catalyst

Genuine moves in markets, unlike inconsequential noise, are created by an underlying reason. When you identify and trade based on an underlying catalyst, you remove the following problems:

- Taking "looks good" trades that ultimately lose more than they make

- Trading based on recommendations or opinions

- Losing due to lack of support from other traders

- Falling for simple trading traps set by larger traders

4. Playbook

An effective trading analysis includes having a catalogue of trades that have a proven positive edge and are based on multiple, unique, and easily distinguishable evidence characteristics. This catalogue of successful trades is commonly referred to as a "playbook" by traders. A playbook overcomes the following problems:

- Recency bias leading to false confidence

- Trading with the crowd

- Trading based on patterns with no edge

- Trading based on market movement without considering opportunity

- Unable to use tight risk management due to frequent stops

- Larger losers than winners due to poor risk management.

Applying the framework using real-time trading

Specialise part 1: A market easy to trade short or long with no borrowing cost for trading short. It can be helpful if it has flexible trading hours (e.g. trades for 23 hours each day).

Specialise part 2: Without thought, traders gravitate toward the most competitive trading instruments. If your objective is to make money, why compete in the most challenging pools on earth? Instead, you can focus on something with an extensive range of scenarios where you can exploit your lasting edge.

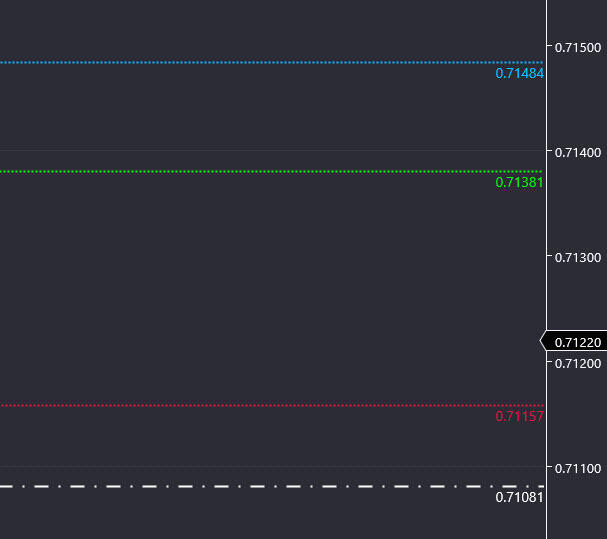

Playing Field: There's no chart below. Instead, the lines outline the playing field for the upcoming session. If price moves near any of the lines, the different colours make it easy to remember what to do.

The largest playing field lies between 0.7115 (red) and 0.7138 (green). You will see how this plays a role in a minute.

Catalyst:

Observations:

- AUD/USD increased after employment numbers

- HKE re-opens post-holidays

- Unknown to the crowd are long traders above 0.7138

- Short speculators covering in January

Thinking it through:

- Attempts to stop price increase will take time

- Speculators will cover shorts or enter long

- Market won't let offside long traders off the hook, watch for puking

- Market will make new shorts feel safe before taking them out

- HKE traders will provide liquidity

Putting it together:

- Trade confined within primary playing field

- Rotation day

- Short-side opportunities to develop/build

- Catch fast long trades - in and out quickly

- Rinse and repeat approach, no holding for big plays

Playbook: The following playbook trades relate to the catalyst and playing field described above.

Trade 1 is a playbook trade is based on a proprietary calculation (pink cirle).

Trade 2 is a scalp-at-transition playbook trade based on an instant cushion in your favour. And a quick exit if it doesn't open up further.

Trade 3 is what's known as the "Once-Bitten-Twice-Shy" playbook trade. While trade 4 is a premium under NDA playbook trade. the green ticks highlight the least challenging of all the executions.

Have you noticed the time gap between the first two trades and the last two trades? Although the price was fluctuating during that time, no trades were taken because the market conditions didn't match the criteria set in the playbook. This highlights that not all price movements are profitable trading opportunities.

The use of trading playbooks is a crucial aspect of successful professional trading. These playbooks are thoroughly researched and tested before being utilized in live trading. Once you've established a catalyst and identified a playing field, your task when trading is simply to wait for a trade that aligns with your playbook, and execute it.

Repeat this process every trading day. This strategy helps reduce the fear of missing out (FOMO), the fear of loss, and the stress and anxiety associated with trading. The four-step framework presented not only boosts your profits but also helps build and maintain your trading confidence and conviction.

Forex and derivatives trading is a highly competitive and often extremely fast-paced environment. It only rewards individuals who attain the required level of skill and expertise to compete. Past performance is not indicative of future results. There is a substantial risk of loss to unskilled and inexperienced players. The high degree of leverage can work against you as well as for you. Before deciding to trade any such leveraged products you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with trading on margin, and seek advice from an independent

Editors’ Picks

EUR/USD: US Dollar to remain pressured until uncertainty fog dissipates Premium

The EUR/USD pair lost additional ground in the first week of February, settling at around 1.1820. The reversal lost momentum after the pair peaked at 1.2082 in January, its highest since mid-2021.

Gold: Volatility persists in commodity space Premium

After losing more than 8% to end the previous week, Gold (XAU/USD) remained under heavy selling pressure on Monday and dropped toward $4,400. Although XAU/USD staged a decisive rebound afterward, it failed to stabilize above $5,000.

GBP/USD: Pound Sterling tests key support ahead of a big week Premium

The Pound Sterling (GBP) changed course against the US Dollar (USD), with GBP/USD giving up nearly 200 pips in a dramatic correction.

Bitcoin: The worst may be behind us

Bitcoin (BTC) price recovers slightly, trading at $65,000 at the time of writing on Friday, after reaching a low of $60,000 during the early Asian trading session. The Crypto King remained under pressure so far this week, posting three consecutive weeks of losses exceeding 30%.

Three scenarios for Japanese Yen ahead of snap election Premium

The latest polls point to a dominant win for the ruling bloc at the upcoming Japanese snap election. The larger Sanae Takaichi’s mandate, the more investors fear faster implementation of tax cuts and spending plans.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a Chief trader its second knowledge how to extract cash out of the market.

5 Forex News Events You Need To Know

In the fast moving world of currency markets where huge moves can seemingly come from nowhere, it is extremely important for new traders to learn about the various economic indicators and forex news events and releases that shape the markets. Indeed, quickly getting a handle on which data to look out for, what it means, and how to trade it can see new traders quickly become far more profitable and sets up the road to long term success.

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and selling pressure. Chart patterns have a proven track-record, and traders use them to identify continuation or reversal signals, to open positions and identify price targets.

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

The challenge: Timing the market and trader psychology

Successful trading often comes down to timing – entering and exiting trades at the right moments. Yet timing the market is notoriously difficult, largely because human psychology can derail even the best plans. Two powerful emotions in particular – fear and greed – tend to drive trading decisions off course.