This is a sponsored post. FXStreet has not verified the accuracy or basis-in-fact of any claim or statement made by the external author of the post. You should be aware of all the risks associated with trading. Cryptocurrency presales can be very risky investments as the assets have yet to be proven in the market. Some or all the tokens mentioned in the articles may be devalued or subject to scams, and investors may lose all capital as most of these assets lack proper due diligence. FXStreet is not responsible for any losses incurred from investments in crypto presales.

The crypto market has endured a broad selloff on Tuesday, with Bitcoin (BTC) sliding below $39,000 and Ethereum (ETH) dipping under $2,300.

However, for long-term investors, significant price drops like these may present suitable entry points to purchase quality assets at a discount.

This article explores five of the best coins to buy on the dip as the crypto market turns red.

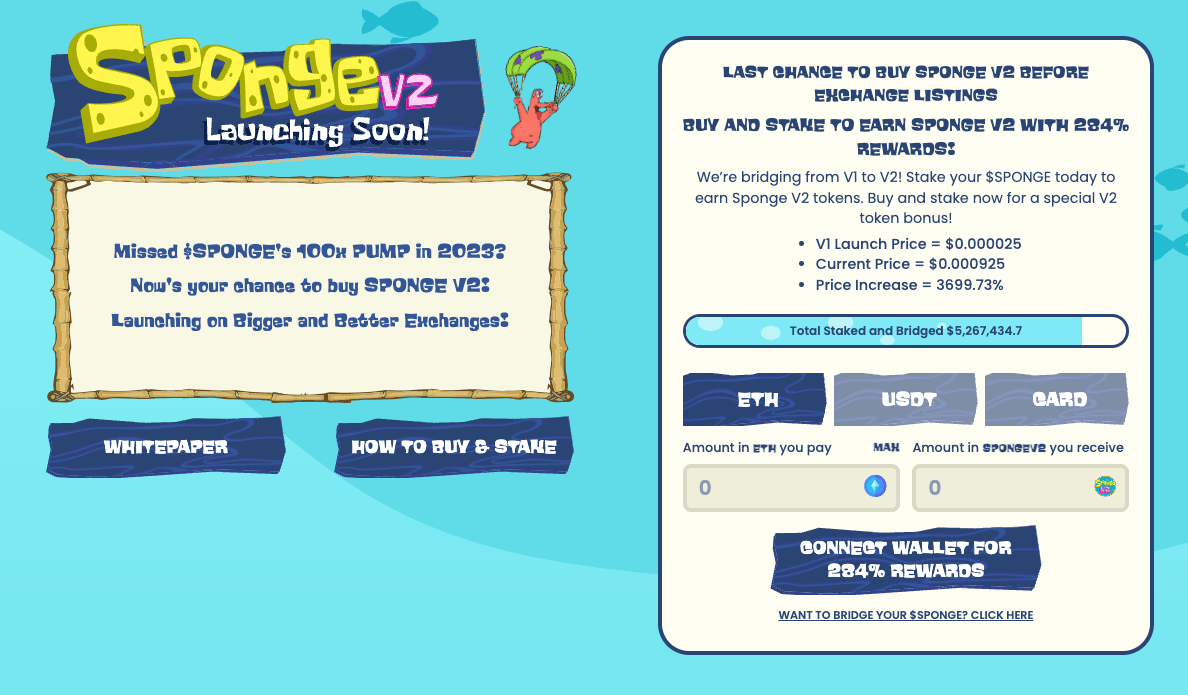

1. Sponge V2 (SPONGEV2)

Taking the number one spot on our list of best coins to buy on the dip is Sponge V2 (SPONGEV2).

In simple terms, Sponge V2 is an upcoming “evolution” of the popular Sponge (SPONGE) token, which rocketed back in May 2023.

This new token will feature play-to-earn (P2E) game integration and a novel Stake-to-Bridge mechanism – providing clear utility for holders.

Although not yet released, early investors can acquire SPONGEV2 tokens by staking SPONGE on the official Sponge website.

The reward rate is 284% annually, and more than $5 million worth of SPONGE has already been staked.

Given the incredible success of its predecessor, Sponge V2 is one of the most hotly anticipated meme coin launches of 2024 so far and could be worth watching as it gears up for exchange listings.

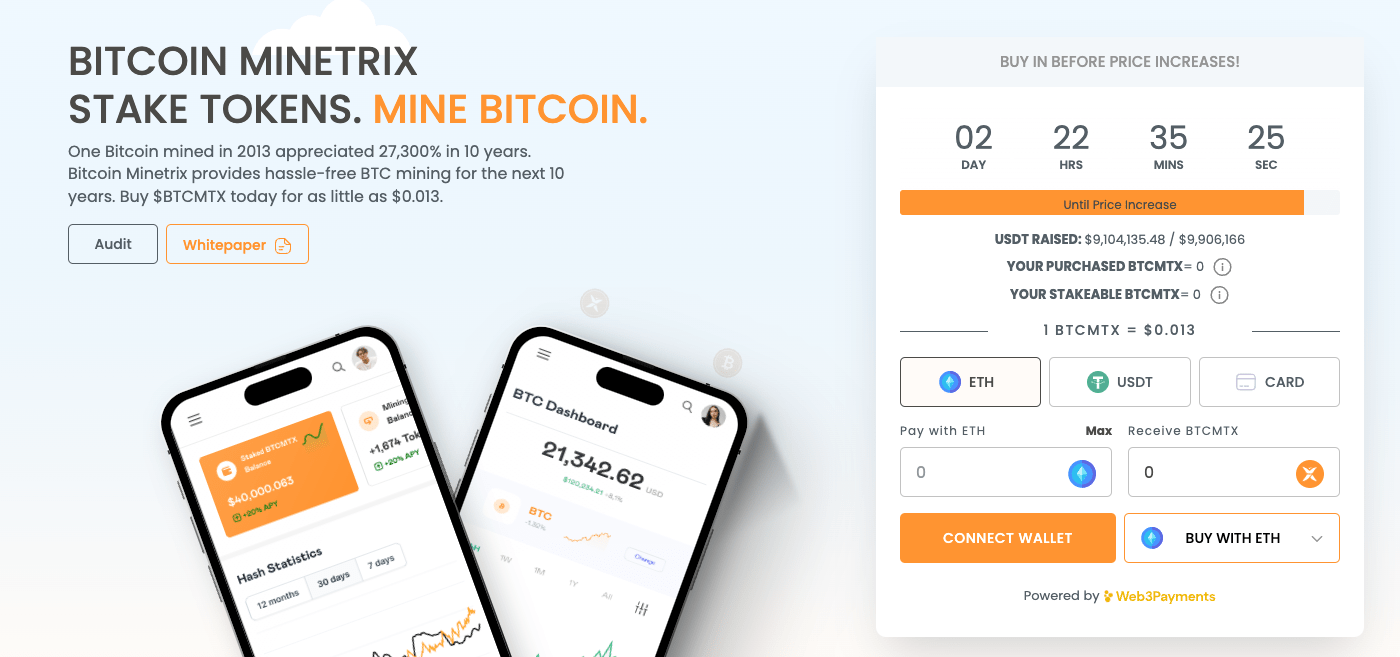

2. Bitcoin minetrix (BTCMTX)

Next up is Bitcoin Minetrix (BTCMTX), a first-of-its-kind Stake-to-Mine platform hosted on Ethereum.

Using Bitcoin Minetrix, everyday investors can mine Bitcoin simply by staking the native BTCMTX token.

This mining mechanism is complemented by a high-yield staking protocol for BTCMTX – creating two ways to earn passive income using Bitcoin Minetrix’s platform.

Over 577 million BTCMTX tokens have been staked already, even though the token isn’t yet publicly available.

The only way for investors to access BTCMTX before its open market debut is through the ongoing presale, which has raised over $9.1 million in funding.

With BTCMTX tokens available for just $0.013 during the current presale stage, this is another crypto that could be worth buying during the market dip.

Visit Bitcoin Minetrix Presale

3. Meme kombat (MK)

Much like Bitcoin Minetrix, Meme Kombat (MK) is a soon-to-be-released cryptocurrency in the midst of a successful presale phase.

This gaming-focused meme coin will feature a virtual battle arena where users can place bets on AI-animated fights using the native MK token.

Winners of these bets are rewarded with more MK tokens, similar to how P2E games offer prizes and incentives.

MK also has a staking protocol that offers yields of 128% per year.

The Meme Kombat project is led by experienced Web3 entrepreneur Matt Whiteman and has been fully audited by blockchain security firm Coinsult.

Given the recent successes of low-cap meme coins like Bonk (BONK), there’s a growing belief that MK could be a breakout star once the crypto market rebounds.

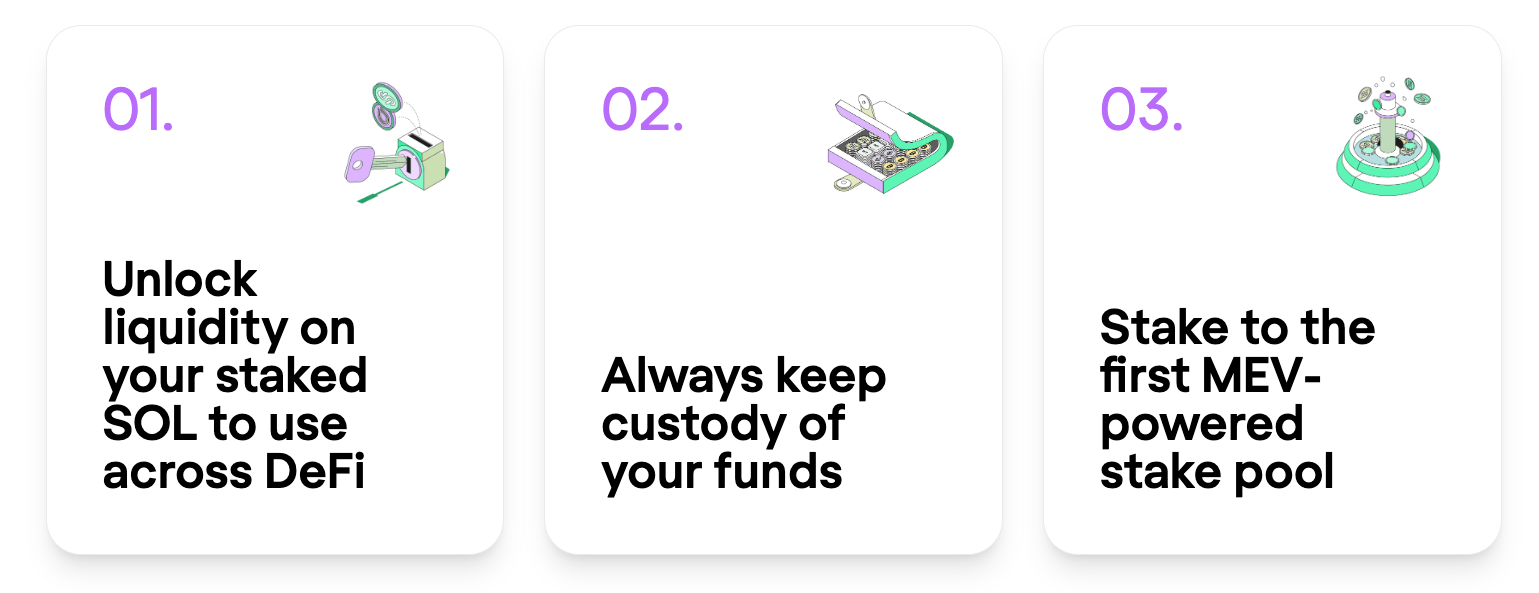

4. Jito (JTO)

Another crypto that continues to stand out during the market downturn is Jito (JTO).

Jito operates a liquid staking protocol that allows SOL holders to earn yields on derivative JitoSOL tokens while utilizing strategies to capture extra profits from Solana’s block production.

These features have quickly established Jito as a top DeFi project on Solana, with a total value locked (TVL) of over $680 million.

The native JTO token has dipped 8% in the past day, yet trading volumes have actually increased by 27%.

This suggests that savvy investors are using the downturn as a buying opportunity – which could prove lucrative if JTO surges once more.

5. Cartesi (CTSI)

Rounding off our list of the best coins to buy on the dip is Cartesi (CTSI), which aims to tackle blockchain scalability limitations by operating decentralized rollups.

This helps optimize side environments, enabling dApps to scale efficiently without congesting the main chain.

As a result, developers can build complex dApps with mainstream programming languages while leveraging the security of underlying chains like Ethereum.

With a use case like this, it’s no surprise that the native CTSI token is up 47% in the past month alone.

Moreover, with CTSI trading for just $0.24, there could be enormous room to run if the Cartesi protocol continues to gain traction.

This is a sponsored post. FXStreet has not verified the accuracy or basis-in-fact of any claim or statement made by the external author of the post. You should be aware of all the risks associated with trading. Cryptocurrency presales can be very risky investments as the assets have yet to be proven in the market. Some or all the tokens mentioned in the articles may be devalued or subject to scams, and investors may lose all capital as most of these assets lack proper due diligence. FXStreet is not responsible for any losses incurred from investments in crypto presales.

ETF News provides quality insights in the form of financial guides and video tutorials on buying and investing in stocks. We compare the top providers and provide detailed insight into their product offerings. We do not advise or recommend any provider but want to enable our readers to make informed decisions and trade on their own responsibility. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss for your capital. Up to 67 % of retail investor accounts lose money trading with the brokers compared on this website. Please make sure you fully understand the risks and seek independent advice. By continuing to use this website, you agree to our Privacy Policy.

Recommended Content

Editors’ Picks

Bitcoin Weekly Forecast: BTC nosedives below $95,000 as spot ETFs record highest daily outflow since launch

Bitcoin price continues to edge down, trading below $95,000 on Friday after declining more than 9% this week. Bitcoin US spot ETFs recorded the highest single-day outflow on Thursday since their launch in January.

Bitcoin crashes to $96,000, altcoins bleed: Top trades for sidelined buyers

Bitcoin (BTC) slipped under the $100,000 milestone and touched the $96,000 level briefly on Friday, a sharp decline that has also hit hard prices of other altcoins and particularly meme coins.

Solana Price Forecast: SOL’s technical outlook and on-chain metrics hint at a double-digit correction

Solana (SOL) price trades in red below $194 on Friday after declining more than 13% this week. The recent downturn has led to $38 million in total liquidations, with over $33 million coming from long positions.

SEC approves Hashdex and Franklin Templeton's combined Bitcoin and Ethereum crypto index ETFs

The SEC approved Hashdex's proposal for a crypto index ETF. The ETF currently features Bitcoin and Ethereum, with possible additions in the future. The agency also approved Franklin Templeton's amendment to its Cboe BZX for a crypto index ETF.

Bitcoin: 2025 outlook brightens on expectations of US pro-crypto policy

Bitcoin price has surged more than 140% in 2024, reaching the $100K milestone in early December. The rally was driven by the launch of Bitcoin Spot ETFs in January and the reduced supply following the fourth halving event in April.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.