This is a sponsored post. FXStreet has not verified the accuracy or basis-in-fact of any claim or statement made by the external author of the post. You should be aware of all the risks associated with trading. Cryptocurrency presales can be very risky investments as the assets have yet to be proven in the market. Some or all the tokens mentioned in the articles may be devalued or subject to scams, and investors may lose all capital as most of these assets lack proper due diligence. FXStreet is not responsible for any losses incurred from investments in crypto presales.

Bitcoin (BTC) has faced selling pressure recently, with one leading analyst forecasting further downside to around $38,000 if support levels can’t hold.

At the same time, some crypto pundits are touting the new Stake-to-Mine platform Bitcoin Minetrix (BTCMTX) as a viable alternative for investors seeking portfolio diversification while Bitcoin pulls back.

Bitcoin price faces additional downside, says 10x research analyst

Analyst Markus Thielen of 10x Research believes additional price drops could be ahead for Bitcoin.

In a recent client note, Thielen pointed to bearish RSI divergence on the daily BTC/USD chart.

Essentially, this means that even though Bitcoin hit a fresh two-year high above $49,000 last week, momentum indicators like the 14-day RSI failed to confirm this new high.

The RSI produced a lower peak than Bitcoin’s price peak, signaling waning upside momentum.

Additionally, the MACD histogram has crossed into negative territory – hinting that the bears are now in control.

Thielen believes the selling pressure could accelerate thanks to Grayscale’s popular Grayscale Bitcoin Trust (GBTC).

With GBTC shares now redeemable after a six-month lockup period, investors may rotate away from Grayscale’s 1.5% management fee into cheaper alternatives from competitors.

This potential exodus of assets could crush Bitcoin’s price in the near term.

If this occurs and the selloff gathers pace, Thielen sees the likeliest downside target being the support level at $38,000.

BTC sells off despite long-awaited spot ETF launches

As shown by Thielen’s technical analysis, Bitcoin has faced significant selling pressure this past week despite a monumental development in the coin’s maturity – the approval of spot BTC ETFs in the US.

Last week, the SEC greenlit the launch of 11 spot BTC ETFs, allowing investors to gain regulated exposure to Bitcoin’s price movements.

Many speculated this would propel Bitcoin’s price higher as the ETFs would provide easier access for mainstream investors.

Yet Bitcoin has slid over 13% since the debut of these spot ETFs, declining from $49,000 to $42,600 at the time of writing.

This “sell the news” type of price action is common across financial markets after major positive catalysts finally materialize.

The reality often fails to live up to the hype – prompting investors to take profits.

While disheartening to see Bitcoin sell-off, trading volumes have remained impressive and increased by 34% in the past day.

The Crypto Fear & Greed Index has dropped to Neutral, yet many believe this is a temporary blip before it rises again.

However, with Markus Thielen speculating that $38,000 is the likely destination, there could be more pain ahead for BTC holders.

Bitcoin Minetrix emerges as promising diversification play as presale raises $8.4m

As Bitcoin faces technical headwinds and profit-taking from spot ETF listings, the case for portfolio diversification into alternative crypto assets is strengthening.

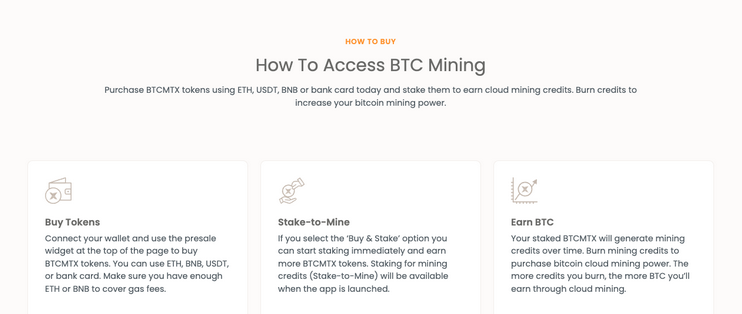

One emerging project catching the eye of investors is Bitcoin Minetrix (BTCMTX), which boasts a unique Stake-to-Mine model.

By staking the native BTCMTX token, users can earn non-transferable mining credits to redeem for BTC mining rewards.

This innovation aims to open Bitcoin mining to a wider audience by removing barriers like expensive hardware, complex setups, and advanced technical skills.

As such, Bitcoin Minetrix allows anyone to tap into Bitcoin’s block rewards just by staking tokens.

Moreover, as the Bitcoin Minetrix platform runs on Ethereum, it also brings transparency around mining pools, rewards distribution, and other metrics.

This contrasts with most cloud mining firms, which often operate with limited transparency, raising concerns about potential scams or hidden fees.

The ongoing Bitcoin Minetrix presale has already raised over $8.4 million as the project’s innovative setup and real-world utility begin to attract interest from retail investors.

Bitcoin Minetrix’s socials have also grown exponentially, and the official Twitter page now boasts over 17,600 followers.

With Bitcoin Minetrix’s team planning to launch BTCMTX on exchanges once the presale concludes, the project could see significant growth – and position itself as a high-potential alternative to Bitcoin.

Visit Bitcoin Minetrix Presale

This is a sponsored post. FXStreet has not verified the accuracy or basis-in-fact of any claim or statement made by the external author of the post. You should be aware of all the risks associated with trading. Cryptocurrency presales can be very risky investments as the assets have yet to be proven in the market. Some or all the tokens mentioned in the articles may be devalued or subject to scams, and investors may lose all capital as most of these assets lack proper due diligence. FXStreet is not responsible for any losses incurred from investments in crypto presales.

ETF News provides quality insights in the form of financial guides and video tutorials on buying and investing in stocks. We compare the top providers and provide detailed insight into their product offerings. We do not advise or recommend any provider but want to enable our readers to make informed decisions and trade on their own responsibility. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss for your capital. Up to 67 % of retail investor accounts lose money trading with the brokers compared on this website. Please make sure you fully understand the risks and seek independent advice. By continuing to use this website, you agree to our Privacy Policy.

Recommended Content

Editors’ Picks

Bitcoin Weekly Forecast: BTC nosedives below $95,000 as spot ETFs record highest daily outflow since launch

Bitcoin price continues to edge down, trading below $95,000 on Friday after declining more than 9% this week. Bitcoin US spot ETFs recorded the highest single-day outflow on Thursday since their launch in January.

Bitcoin crashes to $96,000, altcoins bleed: Top trades for sidelined buyers

Bitcoin (BTC) slipped under the $100,000 milestone and touched the $96,000 level briefly on Friday, a sharp decline that has also hit hard prices of other altcoins and particularly meme coins.

Solana Price Forecast: SOL’s technical outlook and on-chain metrics hint at a double-digit correction

Solana (SOL) price trades in red below $194 on Friday after declining more than 13% this week. The recent downturn has led to $38 million in total liquidations, with over $33 million coming from long positions.

SEC approves Hashdex and Franklin Templeton's combined Bitcoin and Ethereum crypto index ETFs

The SEC approved Hashdex's proposal for a crypto index ETF. The ETF currently features Bitcoin and Ethereum, with possible additions in the future. The agency also approved Franklin Templeton's amendment to its Cboe BZX for a crypto index ETF.

Bitcoin: 2025 outlook brightens on expectations of US pro-crypto policy

Bitcoin price has surged more than 140% in 2024, reaching the $100K milestone in early December. The rally was driven by the launch of Bitcoin Spot ETFs in January and the reduced supply following the fourth halving event in April.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.